Global Healthcare IT Market Size, Trends & Analysis - Forecasts to 2027 By Application (Electronic Health Records, Computerized Provider Order Entry Systems, Electronic Prescribing Systems, Tele-Healthcare, Clinical Information Systems, PACs, Laboratory Information Systems, Others), By Region (Asia Pacific, Asia Pacific, Central, and South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

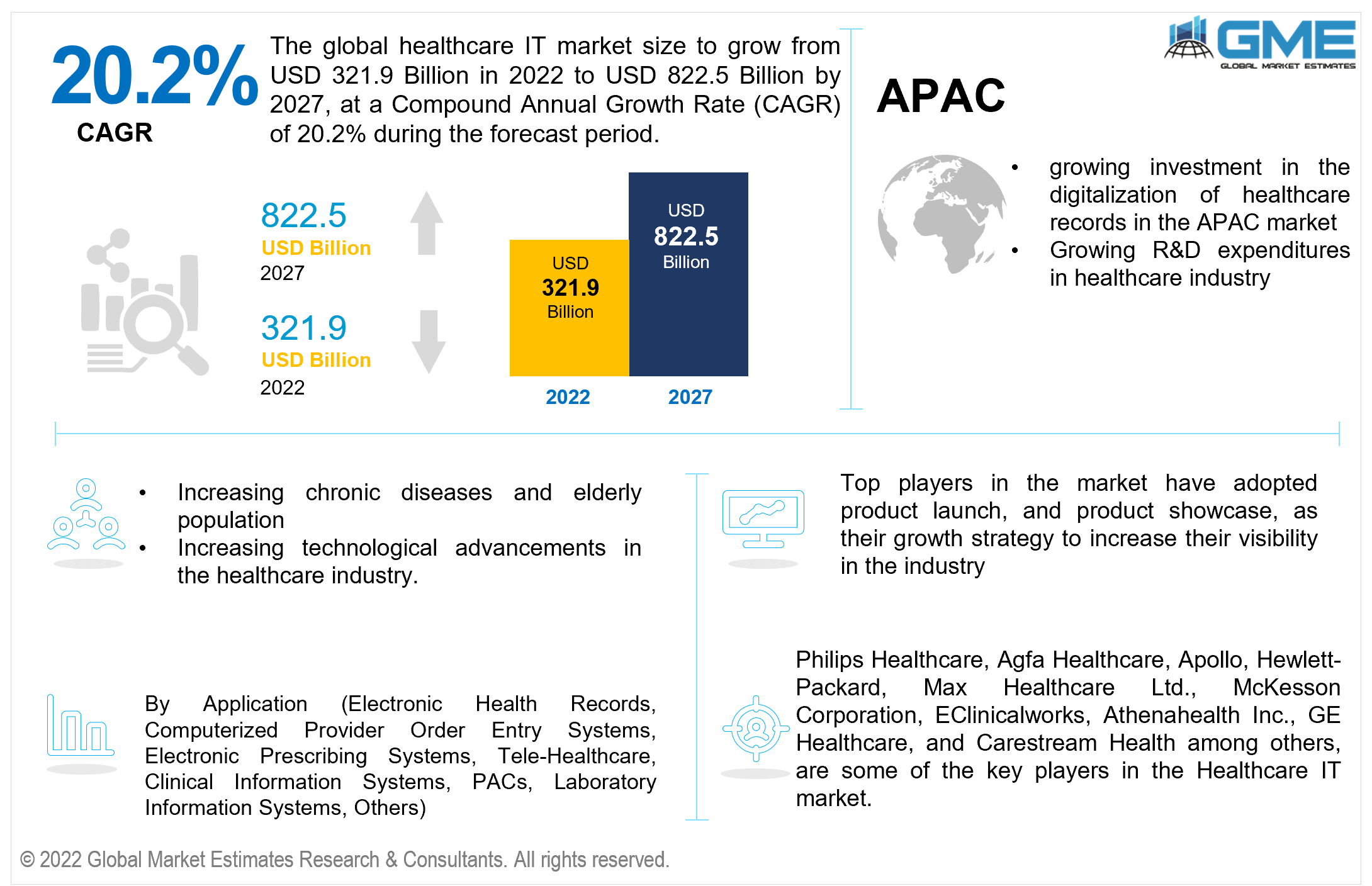

The global healthcare IT market is projected to grow from USD 321.9 Billion in 2022 to USD 822.5 Billion in 2027 at a CAGR value of 20.2% from 2022 to 2027.

The market is driven by the growing investment in the digitalization of healthcare records, improving communication between departments, facility management solutions, telehealth solutions, a growing number of healthcare IT solution vendors, and growing investment in modernizing healthcare facilities.

Information technology (IT) has the potential to transform the medical industry into an evidence-based endeavor. Healthcare IT provides enhanced analysis tools and data integration for better results through software-powered analysis of novel observations, and optimized treatment procedures through the invention of personalized plans that combine targeted therapies focused on personal attributes, thereby improving the overall healthcare market globally.

The healthcare IT market is gaining traction as a result of improvements in network connectivity, network infrastructure improvement, and rising healthcare IT investment. With the aid of a broadening IT infrastructure, key healthcare players are concentrating on creative product development tactics and making significant advances. Big data, the Internet of Things, artificial intelligence, and machine learning algorithms are being incorporated by market participants into their current initiatives to improve health and medical procedures, which is driving the industry's expansion.

The growing popularity of mobile health and telehealth services, the rising demand for improving the quality of care and safety provided to patients, and the heavy investment in government programs to boost healthcare IT adoption all contribute to the growth of the global healthcare IT market. Securing patient information is a difficult task for healthcare organizations because of the growth in worries about patient data safety and security, which are key bottlenecks in the healthcare IT sector. The Asia-Pacific area has tremendous commercial viability and provides excellent development prospects for the healthcare IT industry.

Adoption of medical information technology means developing, adopting, and maintaining a wide range of IT systems for the healthcare industry. Over the past few years, there has been a steady shift in the market in favor of a value-based therapeutic process. Through patient involvement, adherence to legal requirements, and individualized customer service, this method seeks to improve treatment quality. When striving to build interoperability across healthcare providers, data gathering, risk, and clinical services must also be taken into consideration.

The market is progressing toward improving outpatient care with IT solutions to minimize the cost of care in response to the increasing pressures on health systems to lower healthcare costs. Another significant element influencing the growth of ambulatory care is accessibility. The growing application of IT solutions in outpatient facilities to improve workflow and increase satisfaction among users will rise along with the number of outpatient clinics and the volume of patients.

The COVID-19 outbreak had placed healthcare providers both big and small under a significant amount of stress as healthcare institutions all across the world are being overburdened by the massive number of people suffering from COVID who were flocking to them for treatment every day. In many nations throughout the world, the growing incidence of coronavirus illness has increased the demand for precise diagnostic and treatment tools.

The COVID-19 epidemic has also raised the requirement for social distance between medical professionals and their patients, which has created a demand for telehealth and remote patient monitoring solutions in the healthcare industry as well as for the prompt transmission of patient health information. Healthcare IT is a useful tool in this area since it offers a secure framework for transmitting, sharing, and retrieving data on patient health history digitally.

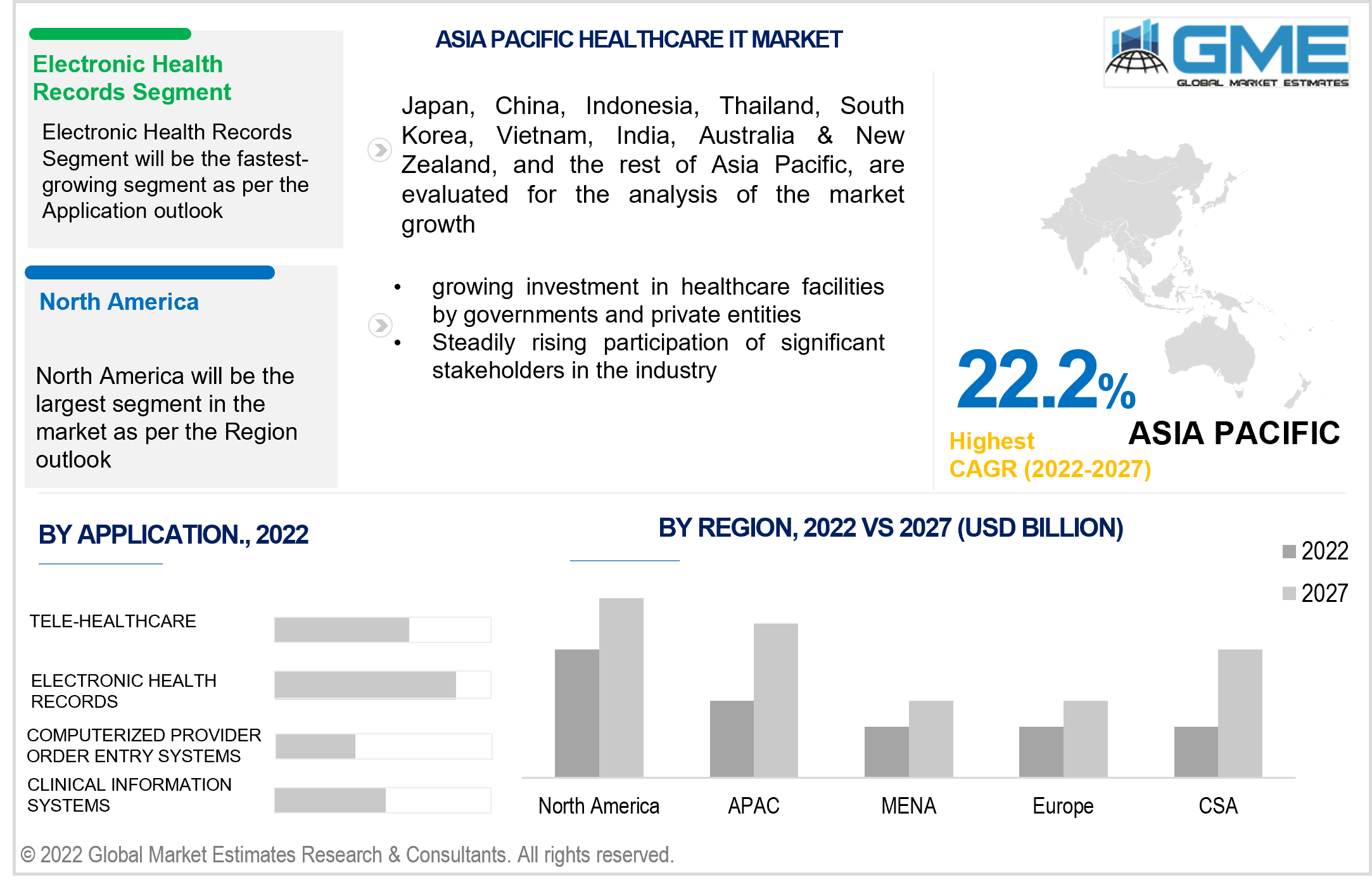

The electronic health records solutions segment is expected to be the largest segment in the market from 2022 to 2027. The growing demand for healthcare IT solutions in hospitals and clinics as they look to optimize workflow is the major driver of the healthcare provider solutions segment. The growing number of government compliance and regulations have also played a crucial role in the growing adoption of IT solutions.

The telehealth segment is expected to register the fastest growth during the forecast period. The growing demand for remote monitoring solutions, the growing demand for patient consultations from the comfort of one’s home, and COVID-related restrictions are the main drivers of the telehealth segment.

The North American region will have a dominant share in the healthcare IT market from 2022 to 2027. The market is expanding due to factors such as rising smartphone adoption, better internet access, rising healthcare IT investment, infrastructure improvements, rising levels of digital literacy, and the presence of major companies. The North American healthcare IT market is expanding as a result of the industry's quick adoption and implementation of its services to enhance patient care while concurrently bringing down medical expenses.

The adoption of cutting-edge solutions is being boosted by an increase in the number of medical institutions, universities, dedicated research institutes, and other healthcare research facilities. Furthermore, the existence of famous care institutions plays a significant role in this region's development.

The APAC region is anticipated to grow at the fastest growth rate during the forecast period. The growing number of telehealth solutions providers and their increasing popularity in the APAC region is expected to drive the market during the forecast period. The region’s growing investment in healthcare facilities by governments and private entities is also expected to play a positive role in the growing development of the healthcare IT market.

Philips Healthcare, Agfa Healthcare, Apollo, Hewlett-Packard, Max Healthcare Ltd., McKesson Corporation, EClinicalworks, Athenahealth Inc., GE Healthcare, and Carestream Health among others, are some of the key players in the healthcare IT market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Health Organization, USFDA, National Cancer Institute, American Cancer Society, CDC, WCRF, and the Global Cancer Observatory, among others

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Application Outlook

2.3 Regional Outlook

Chapter 3 Global Healthcare IT Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Healthcare IT Market

3.4 Metric Data on Cash Transactions

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Healthcare IT Market: Application Trend Analysis

4.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Electronic Health Records

4.2.1 Market Estimates & Forecast Analysis of Electronic Health Records Segment, By Region, 2019-2027 (USD Billion)

4.3 Computerized Provider Order Entry Systems

4.3.1 Market Estimates & Forecast Analysis of Computerized Provider Order Entry Systems Segment, By Region, 2019-2027 (USD Billion)

4.4 Electronic Prescribing Systems

4.4.1 Market Estimates & Forecast Analysis of Electronic Prescribing Systems Segment, By Region, 2019-2027 (USD Billion)

4.5 Tele-Healthcare

4.5.1 Market Estimates & Forecast Analysis of Tele-Healthcare Segment, By Region, 2019-2027 (USD Billion)

4.6 Clinical Information Systems

4.6.1 Market Estimates & Forecast Analysis of Clinical Information Systems Segment, By Region, 2019-2027 (USD Billion)

4.7 PACs

4.7.1 Market Estimates & Forecast Analysis PACs Segment, By Region, 2019-2027 (USD Billion)

4.8 Laboratory Information Systems

4.8.1 Market Estimates & Forecast Analysis Laboratory Information Systems Segment, By Region, 2019-2027 (USD Billion)

4.9 Others

4.9.1 Market Estimates & Forecast Analysis Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Healthcare IT Market, By Region

5.1 Regional Outlook

5.2 North America

5.2.1 Market Estimates & Forecast Analysis, By Country 2019-2025 (USD Billion)

5.2.2 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Billion)

5.2.3 U.S.

5.2.3.1 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Billion)

5.2.4 Canada

5.2.4.1 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Billion)

5.2.5 Mexico

5.2.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3 Europe

5.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.3.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.3 Germany

5.3.3.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.4 UK

5.3.4.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.5 France

5.3.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.6 Netherlands

5.3.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.7 Italy

5.3.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.8 Spain

5.3.8.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.3.9 Rest of Europe

5.3.9.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4 Asia Pacific

5.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.3 China

5.4.3.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.4 India

5.4.4.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.5 Japan

5.4.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.6 Indonesia

5.4.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.7 South Korea

5.4.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.6 Thailand

5.4.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.7 Vietnam

5.4.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.8 Singapore

5.4.8.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.9 Malaysia

5.4.9.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.4.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.5 Central & South America

5.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.5.3 Brazil

5.5.3.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.5.4 Argentina

5.5.4.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.5.5 Chile

5.5.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.5.6 Rest of Central & South America

5.5.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.6 Middle East & Africa

5.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.6.3 Saudi Arabia

5.6.3.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.6.4 United Arab Emirates

5.6.4.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.6.5 Israel

5.6.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.6.6 South Africa

5.6.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

5.6.7 Rest of Middle East & Africa

5.6.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Philips Healthcare

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Agfa Healthcare

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Apollo

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Hewlett-Packard

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Max Healthcare Ltd.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 McKesson Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 EClinicalworks

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Athenahealth Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.9 Other Companies

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

List of Tables

1 Technological Advancements In Healthcare IT Market

2 Global Healthcare IT Market: Key Market Drivers

3 Global Healthcare IT Market: Key Market Challenges

4 Global Healthcare IT Market: Key Market Opportunities

5 Global Healthcare IT Market: Key Market Restraints

6 Global Healthcare IT Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Healthcare IT Market, By Application, 2019-2027 (USD Billion)

8 Electronic Health Records: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

9 Computerized Provider Order Entry Systems: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

10 Electronic Prescribing Systems: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

11 Tele-Healthcare: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

12 Clinical Information Systems: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

13 Laboratory Information Systems: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

14 Others: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

15 PACs: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

16 Regional Analysis: Global Healthcare IT Market, By Region, 2019-2027 (USD Billion)

17 North America: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

18 North America: Healthcare IT Market, By Country, 2019-2027 (USD Billion)

19 U.S: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

20 Canada: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

21 Mexico: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

22 Europe: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

23 Europe: Healthcare IT Market, By Country, 2019-2027 (USD Billion)

24 Germany: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

25 UK: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

26 France: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

27 Italy: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

28 Spain: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

29 Rest Of Europe: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

30 Asia Pacific: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

31 Asia Pacific: Healthcare IT Market, By Country, 2019-2027 (USD Billion)

32 China: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

33 India: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

34 Japan: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

35 South Korea: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

36 Thailand: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

37 Vietnam: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

38 Indonesia: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

39 Singapore: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

40 Malaysia: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

41 Rest Of APAC: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

42 Middle East & Africa: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

43 Middle East & Africa: Healthcare IT Market, By Country, 2019-2027 (USD Billion)

44 Saudi Arabia: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

45 UAE: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

46 Israel: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

47 South Africa: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

48 Rest Of Middle East & Africa: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

49 Central & South America: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

50 Central & South America: Healthcare IT Market, By Country, 2019-2027 (USD Billion)

51 Brazil: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

52 Argentina: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

53 Chile: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

54 Rest Of Central & South America: Healthcare IT Market, By Application, 2019-2027 (USD Billion)

55 Philips Healthcare: Products Offered

56 Agfa Healthcare: Products Offered

57 Apollo: Products Offered

58 Hewlett-Packard: Products Offered

59 Max Healthcare Ltd.: Products Offered

60 McKesson Corporation: Products Offered

61 EClinicalworks: Products Offered

62 Athenahealth Inc.: Products Offered

63 Other Companies: Products Offered

List of Figures

1. Global Healthcare IT Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Healthcare IT Market: Penetration & Growth Prospect Mapping

7. Global Healthcare IT Market: Value Chain Analysis

8. Global Healthcare IT Market Drivers

9. Global Healthcare IT Market Restraints

10. Global Healthcare IT Market Opportunities

11. Global Healthcare IT Market Challenges

12. Key Healthcare IT Market Manufacturer Analysis

13. Global Healthcare IT Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Philips Healthcare: Company Snapshot

16. Philips Healthcare: Swot Analysis

17. Agfa Healthcare: Company Snapshot

18. Agfa Healthcare: Swot Analysis

19. Apollo: Company Snapshot

20. Apollo: Swot Analysis

21. Hewlett-Packard: Company Snapshot

22. Hewlett-Packard: Swot Analysis

23. Max Healthcare Ltd.: Company Snapshot

24. Max Healthcare Ltd.: Swot Analysis

25. McKesson Corporation: Company Snapshot

26. McKesson Corporation: Swot Analysis

27. EClinicalworks: Company Snapshot

28. EClinicalworks: Swot Analysis

29. Athenahealth Inc.: Company Snapshot

30. Athenahealth Inc.: Swot Analysis

31. Other Companies: Company Snapshot

32. Other Companies: Swot Analysis

The Global Healthcare IT Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Healthcare IT Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS