Global Pipeline Integrity Management Market Size, Trends & Analysis - Forecasts to 2028 By Sector (Crude Oil and Natural Gas), By Location of Deployment (Onshore and Offshore), By Service Type (Inspection Services, Cleaning Services, and Repair and Refurbishment Services), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

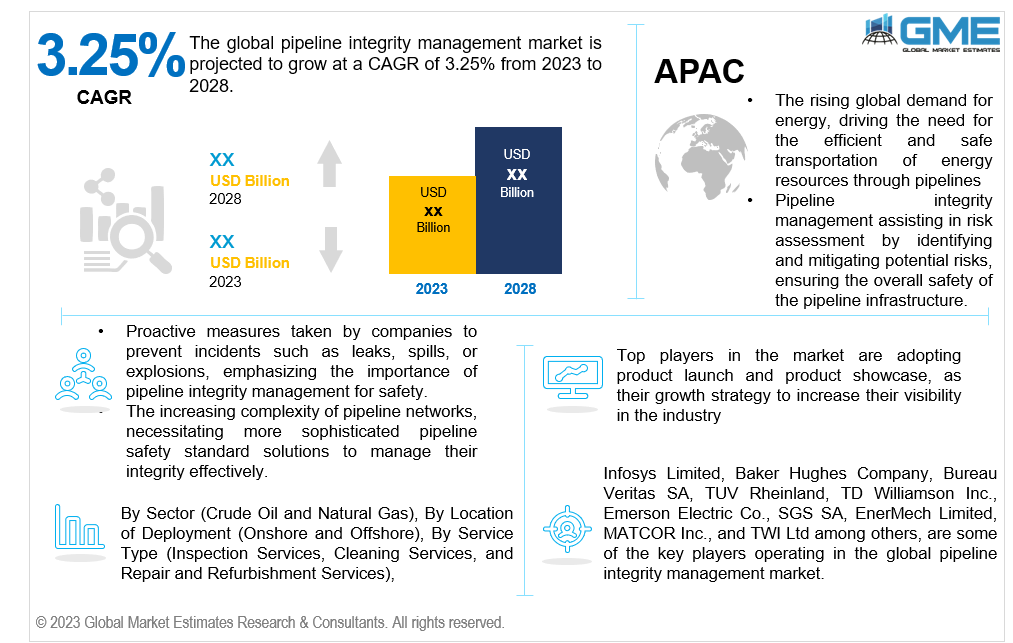

The global pipeline integrity management market is projected to grow at a CAGR of 3.25% from 2023 to 2028.

Pipelines are crucial in transporting various substances, such as oil, gas, and chemicals. Preventing incidents such as leaks, spills, or explosions is critical for protecting the environment and communities. Pipeline integrity management plays a crucial role in assessing and managing pipeline risks by identifying and addressing potential threats.

The development of advanced pipeline inspection technologies, such as sensors, monitoring systems, and data analytics, plays a significant role in future pipeline integrity management. Technologies facilitate ongoing surveillance, early identification of irregularities, and predictive maintenance. In 2021, T.D. Williamson (TDW), a global provider of pipeline solutions, enhanced their multiple dataset gouge versus metal loss (GvML) classifiers, marking a notable advancement in the industry's ability to assess pipeline integrity. This innovation represents the first published performance specification for identifying and depth sizing gouges within a dent. The Multiple Datasets (MDS) platform, a comprehensive mechanical damage assessment tool, integrates various technologies on a single inspection platform, allowing for the correlation of data to identify potential threats.

The expansion of this market is attributed to substantial investments by various governments in developing pipeline infrastructure. For instance, in December 2020, the Indian government unveiled a plan to invest USD 60 billion in gas pipeline infrastructure development. This initiative involves extending Compressed Natural Gas pipeline networks (CGD) across 232 geographical regions nationwide by 2024.

Growing environmental awareness and concerns about pipeline integrity's ecological impact, which are pipeline incidents on ecosystems and local communities, contribute to the emphasis on pipeline integrity management trends. Companies are motivated to adopt pipeline integrity solutions that prevent environmental damage.

As the pipeline networks become more extensive and complex, managing their integrity becomes more challenging. This complexity drives the need for sophisticated pipeline safety standard solutions. Additionally, implementing robust pipeline integrity management systems involves significant upfront costs for technology adoption, inspection tools, and monitoring equipment. This could pose pipeline integrity challenges, particularly for smaller operators or companies operating within constrained financial constraints. Thus, these factors, as mentioned above, may hinder the market growth over the forecast period.

Natural gas segment is expected to hold the largest share of the market during the forecast period. This growth is attributed to the growing demand for natural gas pipeline infrastructure, which can provide secure, cost-effective, and reliable pipeline network connections. Moreover, there is a surge in demand for liquefied natural gas (LNG) and shale gas, and pipelines represent the most cost-effective means of transportation for transporting natural gas, crude oil, and petroleum products over long distances. For instance, according to the International Energy Agency's Medium-Term Gas Report, there will be 4% increase in natural gas demand in India by the end of 2023.

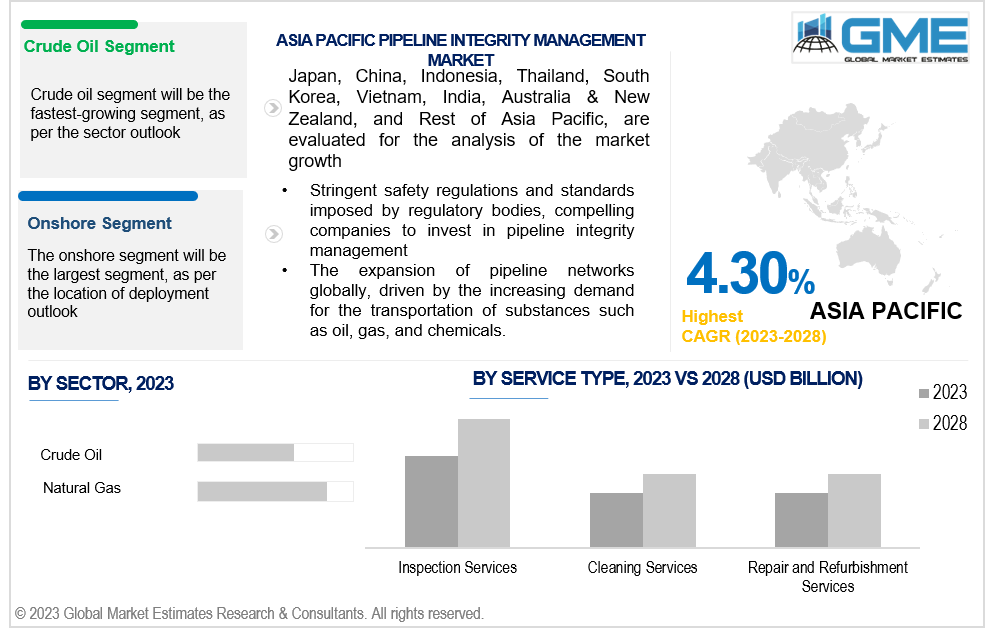

Crude oil segment is expected to be the fastest-growing segment in the market from 2023-2028. As global energy demands continue to rise, this growing demand underscores the need to prioritize the integrity of crude oil pipelines. Crude oil is a vital commodity in the energy sector, and disruptions in its transportation can have significant economic and environmental consequences. Maintaining stability and efficiency of the energy supply chain relies heavily on assuring the integrity of crude oil pipelines.

Onshore segment is expected to hold the largest market share and is also anticipated to be the fastest-growing segment from 2023-2028. The growth is attributed to the rising demand for oil and gas, coupled with escalating environmental apprehensions associated with their transportation. This segment involves diverse evaluations, including metal loss/corrosion assessments, geometry deformation, and crack and pipeline leak detection. Notably, metal loss/corrosion detection constitutes the most significant share of applications in onshore pipelines.

The inspection services segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Pipeline inspection services are instrumental in identifying early signs of damage or conditions like rusting. Regularly scheduled cleaning services are typically part of routine pipeline maintenance strategies to prevent breakdowns and enhance overall pipeline integrity services.

The repair and refurbishment services segment is anticipated to hold the largest share of the market. The growth is primarily due to the nature of these activities, involving the replacement of equipment or components within the pipeline or pipeline monitoring system. Typically, incurring higher costs than inspection or cleaning, repair and refurbishment play a crucial role in preventing damage, particularly in sectors such as chemicals, oil, and gas. Consequently, there is a growing willingness among end users to invest in the repair and refurbishment of pipelines to ensure their continued safe and reliable operation.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include increasing usage of crude oil and natural gas. According to TC Energy, a pipeline company, the United States and Canada are significant markets in the pipeline transportation sector. In the United States, 66% of crude oil and processed products are transported through pipelines, along with almost all types of natural gas. Similarly, 97% of the oil and natural gas are delivered through pipelines in Canada.

Asia Pacific is predicted to witness rapid growth during the forecast period. The growth is attributed to the increasing trade of natural gas in the region. There has been a consistent upward trend in natural gas imports in China, averaged 10.5 billion cubic feet per day (Bcf/d), a 19% increase in 2021 compared with 2020, effectively meeting the growing domestic demand. Initiatives by the Indian and Chinese governments, such as investments in gas pipeline infrastructure, CNG pipeline networks, and LNG regasification terminals, also play a significant role in fostering the growth of the pipeline integrity management market in Asia Pacific.

Infosys Limited, Baker Hughes Company, Bureau Veritas SA, TUV Rheinland, TD Williamson Inc., Emerson Electric Co., SGS SA, EnerMech Limited, MATCOR Inc., and TWI Ltd, among others, are some of the key players operating in the global pipeline integrity management market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2021, Schneider Electric and Prisma Photonics, a company specializing in advanced fiber sensing for intelligent infrastructure, entered into a collaboration aimed at assisting oil and gas oil and gas pipeline integrity management owners and operators in averting unintentional and intentional incidents. The collaboration focuses on delivering real-time insights and accurate monitoring of oil and gas infrastructure to enhance security and prevent potential threats.

In August 2022, Baker Hughes announced an agreement to acquire Quest Integrity, a subsidiary of Team, Inc., known globally for its technology-centric solutions in asset inspection and reliability management. Quest Integrity operates across diverse sectors, such as pipelines, refining, petrochemicals, and power generation.

REPORT CONTENT

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL PIPELINE INTEGRITY MANAGEMENT MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PIPELINE INTEGRITY MANAGEMENT MARKET, BY SECTOR

4.1 Introduction

4.2 Pipeline Integrity Management Market: Sector Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Crude Oil

4.4.1 Crude Oil Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Natural Gas

4.5.1 Natural Gas Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL PIPELINE INTEGRITY MANAGEMENT MARKET, BY LOCATION OF DEPLOYMENT

5.1 Introduction

5.2 Pipeline Integrity Management Market: Location of Deployment Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Onshore

5.4.1 Onshore Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Offshore

5.5.1 Offshore Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL PIPELINE INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE

6.1 Introduction

6.2 Pipeline Integrity Management Market: Service Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Inspection Services

6.4.1 Inspection Services Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Cleaning Services

6.5.1 Cleaning Services Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Repair and Refurbishment Services

6.6.1 Repair and Refurbishment Services Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL PIPELINE INTEGRITY MANAGEMENT MARKET, BY REGION

7.1 Introduction

7.2 North America Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Sector

7.2.2 By Location of Deployment

7.2.3 By Service Type

7.2.4 By Country

7.2.4.1 U.S. Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Sector

7.2.4.1.2 By Location of Deployment

7.2.4.1.3 By Service Type

7.2.4.2 Canada Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Sector

7.2.4.2.2 By Location of Deployment

7.2.4.2.3 By Service Type

7.2.4.3 Mexico Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Sector

7.2.4.3.2 By Location of Deployment

7.2.4.3.3 By Service Type

7.3 Europe Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Sector

7.3.2 By Location of Deployment

7.3.3 By Service Type

7.3.4 By Country

7.3.4.1 Germany Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Sector

7.3.4.1.2 By Location of Deployment

7.3.4.1.3 By Service Type

7.3.4.2 U.K. Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Sector

7.3.4.2.2 By Location of Deployment

7.3.4.2.3 By Service Type

7.3.4.3 France Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Sector

7.3.4.3.2 By Location of Deployment

7.3.4.3.3 By Service Type

7.3.4.4 Italy Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Sector

7.3.4.4.2 By Location of Deployment

7.2.4.4.3 By Service Type

7.3.4.5 Spain Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Sector

7.3.4.5.2 By Location of Deployment

7.2.4.5.3 By Service Type

7.3.4.6 Netherlands Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6.1 By Sector

7.3.4.6.2 By Location of Deployment

7.2.4.6.3 By Service Type

7.3.4.7 Rest of Europe Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Sector

7.3.4.7.2 By Location of Deployment

7.2.4.7.3 By Service Type

7.4 Asia Pacific Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Sector

7.4.2 By Location of Deployment

7.4.3 By Service Type

7.4.4 By Country

7.4.4.1 China Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Sector

7.4.4.1.2 By Location of Deployment

7.4.4.1.3 By Service Type

7.4.4.2 Japan Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Sector

7.4.4.2.2 By Location of Deployment

7.4.4.2.3 By Service Type

7.4.4.3 India Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Sector

7.4.4.3.2 By Location of Deployment

7.4.4.3.3 By Service Type

7.4.4.4 South Korea Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Sector

7.4.4.4.2 By Location of Deployment

7.4.4.4.3 By Service Type

7.4.4.5 Singapore Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Sector

7.4.4.5.2 By Location of Deployment

7.4.4.5.3 By Service Type

7.4.4.6 Malaysia Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6.1 By Sector

7.4.4.6.2 By Location of Deployment

7.4.4.6.3 By Service Type

7.4.4.7 Thailand Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Sector

7.4.4.7.2 By Location of Deployment

7.4.4.7.3 By Service Type

7.4.4.8 Indonesia Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Sector

7.4.4.8.2 By Location of Deployment

7.4.4.8.3 By Service Type

7.4.4.9 Vietnam Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Sector

7.4.4.9.2 By Location of Deployment

7.4.4.9.3 By Service Type

7.4.4.10 Taiwan Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Sector

7.4.4.10.2 By Location of Deployment

7.4.4.10.3 By Service Type

7.4.4.11 Rest of Asia Pacific Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Sector

7.4.4.11.2 By Location of Deployment

7.4.4.11.3 By Service Type

7.5 Middle East and Africa Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Sector

7.5.2 By Location of Deployment

7.5.3 By Service Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Sector

7.5.4.1.2 By Location of Deployment

7.5.4.1.3 By Service Type

7.5.4.2 U.A.E. Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Sector

7.5.4.2.2 By Location of Deployment

7.5.4.2.3 By Service Type

7.5.4.3 Israel Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Sector

7.5.4.3.2 By Location of Deployment

7.5.4.3.3 By Service Type

7.5.4.4 South Africa Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Sector

7.5.4.4.2 By Location of Deployment

7.5.4.4.3 By Service Type

7.5.4.5 Rest of Middle East and Africa Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Sector

7.5.4.5.2 By Location of Deployment

7.5.4.5.2 By Service Type

7.6 Central and South America Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.1 By Sector

7.6.2 By Location of Deployment

7.6.3 By Service Type

7.6.4 By Country

7.6.4.1 Brazil Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1.1 By Sector

7.6.4.1.2 By Location of Deployment

7.6.4.1.3 By Service Type

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2.1 By Sector

7.6.4.2.2 By Location of Deployment

7.6.4.2.3 By Service Type

7.6.4.3 Chile Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3.1 By Sector

7.6.4.3.2 By Location of Deployment

7.6.4.3.3 By Service Type

7.6.4.4 Rest of Central & South America Pipeline Integrity Management Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.4.1 By Sector

7.6.4.4.2 By Location of Deployment

7.6.4.4.3 By Service Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Infosys Limited

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Baker Hughes Company

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Bureau Veritas SA

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 TUV Rheinland

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 TD Williamson Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Emerson Electric Co.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 SGS SA

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 EnerMech Limited

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 MATCOR Inc.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 TWI Ltd

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Mllion)

2 Crude Oil Market, By Region, 2020-2028 (USD Mllion)

3 Natural Gas Market, By Region, 2020-2028 (USD Mllion)

4 Global Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Mllion)

5 Onshore Market, By Region, 2020-2028 (USD Mllion)

6 Offshore Market, By Region, 2020-2028 (USD Mllion)

7 Global Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Mllion)

8 Inspection Services Market, By Region, 2020-2028 (USD Mllion)

9 Cleaning Services Market, By Region, 2020-2028 (USD Mllion)

10 Repair and Refurbishment Services Market, By Region, 2020-2028 (USD Mllion)

11 Regional Analysis, 2020-2028 (USD Mllion)

12 North America Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

13 North America Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

14 North America Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

15 North America Pipeline Integrity Management Market, By Country, 2020-2028 (USD Million)

16 U.S Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

17 U.S Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

18 U.S Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

19 Canada Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

20 Canada Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

21 Canada Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

22 Mexico Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

23 Mexico Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

24 Mexico Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

25 Europe Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

26 Europe Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

27 Europe Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

28 Germany Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

29 Germany Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

30 Germany Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

31 U.K Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

32 U.K Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

33 U.K Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

34 France Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

35 France Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

36 France Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

37 Italy Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

38 Italy Pipeline Integrity Management Market, By End Use , 2020-2028 (USD Million)

39 Italy Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

40 Spain Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

41 Spain Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

42 Spain Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

43 Rest Of Europe Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

44 Rest Of Europe Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

45 Rest of Europe Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

46 Asia Pacific Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

47 Asia Pacific Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

48 Asia Pacific Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

49 Asia Pacific Pipeline Integrity Management Market, By Country, 2020-2028 (USD Million)

50 China Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

51 China Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

52 China Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

53 India Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

54 India Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

55 India Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

56 Japan Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

57 Japan Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

58 Japan Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

59 South Korea Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

60 South Korea Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

61 South Korea Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

62 Middle East and Africa Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

63 Middle East and Africa Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

64 Middle East and Africa Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

65 Middle East and Africa Pipeline Integrity Management Market, By Country, 2020-2028 (USD Million)

66 Saudi Arabia Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

67 Saudi Arabia Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

68 Saudi Arabia Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

69 UAE Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

70 UAE Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

71 UAE Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

72 Central and South America Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

73 Central and South America Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

74 Central and South America Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

75 Central and South America Pipeline Integrity Management Market, By Country, 2020-2028 (USD Million)

76 Brazil Pipeline Integrity Management Market, By Sector, 2020-2028 (USD Million)

77 Brazil Pipeline Integrity Management Market, By Location of Deployment, 2020-2028 (USD Million)

78 Brazil Pipeline Integrity Management Market, By Service Type, 2020-2028 (USD Million)

79 Infosys Limited: Products & Services Offering

80 Baker Hughes Company: Products & Services Offering

81 Bureau Veritas SA: Products & Services Offering

82 TUV Rheinland: Products & Services Offering

83 TD Williamson Inc.: Products & Services Offering

84 EMERSON ELECTRIC CO.: Products & Services Offering

85 SGS SA : Products & Services Offering

86 EnerMech Limited: Products & Services Offering

87 MATCOR Inc., Inc: Products & Services Offering

88 TWI Ltd: Products & Services Offering

89 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Pipeline Integrity Management Market Overview

2 Global Pipeline Integrity Management Market Value From 2020-2028 (USD Mllion)

3 Global Pipeline Integrity Management Market Share, By Sector (2022)

4 Global Pipeline Integrity Management Market Share, By Location of Deployment (2022)

5 Global Pipeline Integrity Management Market Share, By Service Type (2022)

6 Global Pipeline Integrity Management Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Pipeline Integrity Management Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Pipeline Integrity Management Market

11 Impact Of Challenges On The Global Pipeline Integrity Management Market

12 Porter’s Five Forces Analysis

13 Global Pipeline Integrity Management Market: By Sector Scope Key Takeaways

14 Global Pipeline Integrity Management Market, By Sector Segment: Revenue Growth Analysis

15 Crude Oil Market, By Region, 2020-2028 (USD Mllion)

16 Natural Gas Market, By Region, 2020-2028 (USD Mllion)

17 Global Pipeline Integrity Management Market: By Location of Deployment Scope Key Takeaways

18 Global Pipeline Integrity Management Market, By Location of Deployment Segment: Revenue Growth Analysis

19 Onshore Market, By Region, 2020-2028 (USD Mllion)

20 Offshore Market, By Region, 2020-2028 (USD Mllion)

21 Global Pipeline Integrity Management Market: By Service Type Scope Key Takeaways

22 Global Pipeline Integrity Management Market, By Service Type Segment: Revenue Growth Analysis

23 Inspection Services Market, By Region, 2020-2028 (USD Mllion)

24 Cleaning Services Market, By Region, 2020-2028 (USD Mllion)

25 Above to 50 GHz Market, By Region, 2020-2028 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Pipeline Integrity Management Market: Regional Analysis

28 North America Pipeline Integrity Management Market Overview

29 North America Pipeline Integrity Management Market, By Sector

30 North America Pipeline Integrity Management Market, By Location of Deployment

31 North America Pipeline Integrity Management Market, By Service Type

32 North America Pipeline Integrity Management Market, By Country

33 U.S. Pipeline Integrity Management Market, By Sector

34 U.S. Pipeline Integrity Management Market, By Location of Deployment

35 U.S. Pipeline Integrity Management Market, By Service Type

36 Canada Pipeline Integrity Management Market, By Sector

37 Canada Pipeline Integrity Management Market, By Location of Deployment

38 Canada Pipeline Integrity Management Market, By Service Type

39 Mexico Pipeline Integrity Management Market, By Sector

40 Mexico Pipeline Integrity Management Market, By Location of Deployment

41 Mexico Pipeline Integrity Management Market, By Service Type

42 Four Quadrant Positioning Matrix

43 Company Market Share Analysis

44 Infosys Limited: Company Snapshot

45 Infosys Limited: SWOT Analysis

46 Infosys Limited: Geographic Presence

47 Baker Hughes Company: Company Snapshot

48 Baker Hughes Company: SWOT Analysis

49 Baker Hughes Company: Geographic Presence

50 Bureau Veritas SA: Company Snapshot

51 Bureau Veritas SA: SWOT Analysis

52 Bureau Veritas SA: Geographic Presence

53 TUV Rheinland: Company Snapshot

54 TUV Rheinland: Swot Analysis

55 TUV Rheinland: Geographic Presence

56 TD Williamson Inc.: Company Snapshot

57 TD Williamson Inc.: SWOT Analysis

58 TD Williamson Inc.: Geographic Presence

59 Emerson Electric Co.: Company Snapshot

60 Emerson Electric Co.: SWOT Analysis

61 Emerson Electric Co.: Geographic Presence

62 SGS SA : Company Snapshot

63 SGS SA : SWOT Analysis

64 SGS SA : Geographic Presence

65 EnerMech Limited: Company Snapshot

66 EnerMech Limited: SWOT Analysis

67 EnerMech Limited: Geographic Presence

68 MATCOR Inc., Inc.: Company Snapshot

69 MATCOR Inc., Inc.: SWOT Analysis

70 MATCOR Inc., Inc.: Geographic Presence

71 TWI Ltd: Company Snapshot

72 TWI Ltd: SWOT Analysis

73 TWI Ltd: Geographic Presence

74 Other Companies: Company Snapshot

75 Other Companies: SWOT Analysis

76 Other Companies: Geographic Presence

The Global Pipeline Integrity Management Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pipeline Integrity Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS