Global Liquid Biopsy Market Size, Trends & Analysis - Forecasts to 2029 By Biomarker Type (Circulating Tumour Cells, Circulating Tumour Nucleic Acids, and Exosomes), By Application Type (Lung Cancer, Gastrointestinal Cancer, Prostate Cancer, Breast Cancer, Colorectal Cancer, Leukemia, and Others), By Sample Type (Blood, Urine, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

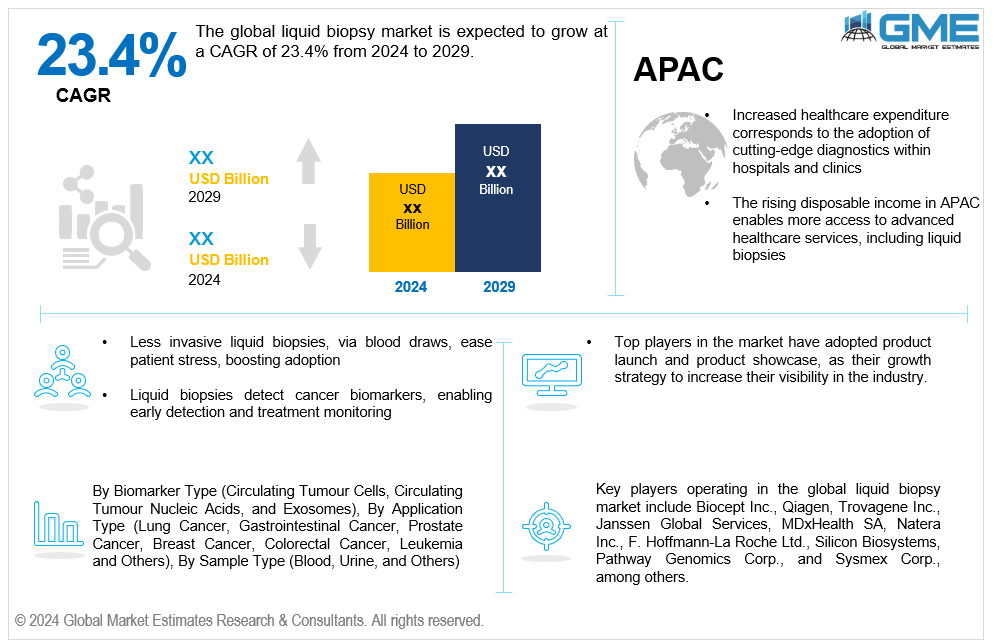

The global liquid biopsy market is expected to exhibit a CAGR of 23.4% from 2024 to 2029. A liquid biopsy is a cutting-edge diagnostic technique used to detect and analyze biomarkers, such as circulating tumour cells, cell-free DNA, or other molecules found in bodily fluids like blood or urine. Unlike conventional biopsies, which need invasive techniques to obtain tissue samples, liquid biopsies provide a minimally invasive option for monitoring and detecting many illnesses, particularly malignancies, by evaluating genetic mutations or molecular alterations. This approach holds immense promise in personalized medicine, aiding in early detection, treatment selection, and tracking treatment response, revolutionizing the field of oncology and potentially extending to other diseases where biomarkers play a crucial role in diagnosis and management.

Many factors drive the growth of the global liquid biopsy market. The rising incidence of cancer worldwide has intensified the demand for less invasive diagnostic methods, driving the adoption of liquid biopsies for early detection and monitoring. Continuous technological advancements in isolating and analyzing biomarkers from liquid samples have enhanced the accuracy and reliability of these tests, making them more appealing to clinicians and patients. Moreover, the shift towards personalized medicine, coupled with rising investments in research and development, has broadened the clinical utility of liquid biopsies across various diseases beyond oncology, further fuelling market growth. Regulatory support and approvals have also played a pivotal role in ensuring the credibility and safety of these innovative diagnostic tools, contributing to their widespread acceptance and market expansion.

Despite the promising growth prospects, the global liquid biopsy market faces certain restraints that hinder its growth. One significant challenge is the need for further validation and standardization of liquid biopsy tests to ensure their reliability and consistency across different platforms and settings. Cost concerns related to the adoption of these technologies also pose a hurdle, especially in regions with limited healthcare budgets. Additionally, while liquid biopsies offer a less invasive option, their sensitivity and specificity in detecting early-stage cancers or other diseases might still require refinement to match or exceed the accuracy of traditional tissue biopsies. Regulatory complexities and the need for robust clinical evidence to support widespread adoption further slowdown market penetration, hindering the rapid expansion of liquid biopsy technologies.

Based on the biomarker type, the market is segmented into circulating tumour cells, circulating tumour nucleic acids, and exosomes. The circulating tumour nucleic acids (ctDNA) segment is expected to be the largest segment during the forecast period. ctDNA's discovery as a biomarker offers a non-invasive alternative to invasive procedures, allowing researchers to identify tumour-specific mutations from liquid samples. This development enables tumour DNA molecular profiling, aiding early cancer detection and therapy monitoring. Its potential for detecting aberrant ctDNA from cancer cells opens doors for precise diagnosis and surveillance, driving significant demand and market dominance within liquid biopsy applications.

The exosomes segment is expected to be the fastest growing segment in the global liquid biopsy market during the forecast period. Their stability, encapsulated by lipid bilayers, ensures intactness during transportation, enhancing the reliability of biomarker detection. Exosomes' role as key mediators in intercellular communication amplifies their significance, especially in cancer progression and metastasis. Their involvement in complex signaling pathways within the tumour microenvironment presents a rich source of information crucial for understanding and tracking cancer development at all stages, driving rapid advancements and interest in exosome-based liquid biopsy technologies.

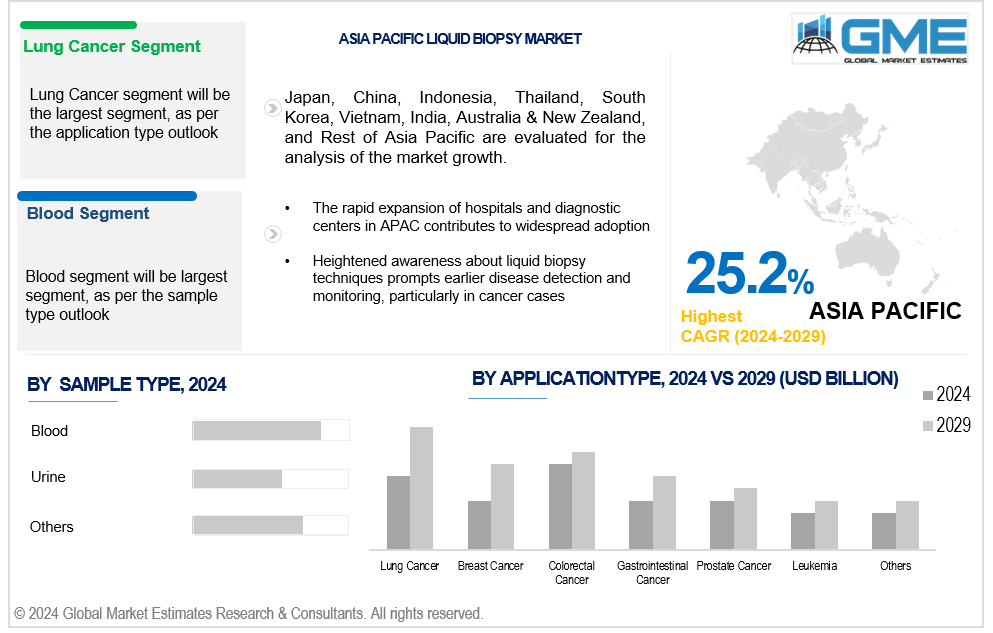

On the basis of application type, the market is segmented into lung cancer, gastrointestinal cancer, prostate cancer, breast cancer, colorectal cancer, leukemia, and others. The lung cancer is expected to be the largest segment during the forecast period. Lung cancer ranks among the most prevalent and fatal cancers globally, necessitating frequent monitoring for treatment efficacy and disease progression. Liquid biopsies offer a minimally invasive method for detecting genetic mutations and biomarkers, aiding in early diagnosis, treatment selection, and monitoring. The high demand for non-invasive diagnostics in lung cancer, coupled with the advancements in liquid biopsy technologies targeting lung-specific mutations like EGFR, has propelled its prominence in this market.

The breast cancer is expected to be the fastest-growing segment in the global liquid biopsy market during the forecast period. Breast cancer is prevalent worldwide, spurring demand for non-invasive, efficient diagnostic tools. Liquid biopsies offer a minimally invasive alternative, facilitating early detection, treatment monitoring, and recurrence surveillance in breast cancer patients. Continuous advancements in liquid biopsy technologies, focusing on detecting circulating tumour cells and cell-free DNA specific to breast cancer, further propel its rapid adoption, driving growth within this segment.

Based on sample type, the market is segmented into blood, urine, and others. The blood segment is expected to be the largest and the fastest-growing segment during the forecast period. Blood contains a high concentration of circulating tumour cells (CTCs), cell-free DNA (cfDNA), and other indicators, enabling a thorough examination of many malignancies and disorders. Its accessibility and routine collection in clinical settings make blood-based liquid biopsies more practical and widely applicable. Moreover, the established protocols for blood sample collection and processing streamline the integration of liquid biopsy tests into existing diagnostic workflows, contributing to its dominant position in the market.

North America is analysed to account for the largest share of the global liquid biopsy market during the forecast period. The regional market growth is primarily attributed to the increased adoption of innovative diagnostic methods such as liquid biopsy, notably in the diagnosis of cancer. The region, led by a substantial market like the U.S., has witnessed a surge in cancer cases, with around 1.8 million new cases estimated in 2020 by the American Cancer Society. This prevalence drives demand for efficient, non-invasive diagnostic tools like liquid biopsies, propelling the region's leadership in advancing and embracing these technologies for early cancer detection, monitoring, and personalized treatment strategies.

Asia Pacific is expected to be the fastest-growing region across the global liquid biopsy market. The region's increasing disposable income and healthcare expenditure facilitate greater accessibility to advanced medical technologies, driving the adoption of liquid biopsy techniques in hospitals, clinics, and diagnostic laboratories. Rising awareness regarding these innovative diagnostic methods has further spurred demand. Moreover, the expanding network of hospitals and diagnostic centres across the APAC region enhances the availability and utilization of liquid biopsy tests, contributing significantly to the segment's rapid growth in the forecast period.

Key players operating in the global liquid biopsy market include Biocept Inc., Qiagen, Trovagene Inc., Janssen Global Services, MDxHealth SA, Natera Inc., F. Hoffmann-La Roche Ltd., Silicon Biosystems, Pathway Genomics Corp., and Sysmex Corp., among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2022, Thermo Fisher Scientific introduced over 50 dPCR liquid biopsy assays for its Applied Biosystems Absolute Q dPCR system, designed to provide results within 90 minutes with minimal hands-on time. The assays are predesigned for identifying genetic mutations and simplifying liquid biopsy workflows. The company's Digital PCR Custom Assay Design tool enables quick dPCR assay generation.

In June 2021, Biocept partnered with Quest Diagnostics to offer its Target Selector next-generation sequencing (NGS)-based liquid biopsy targeted lung cancer panel. This less invasive assay performs genomic profiling in advanced NSCLC patients, facilitating targeted treatments and analyzing therapy effectiveness. Nearly 70% of the biomarkers analysed are as per National Comprehensive Cancer Center guidance and U.S. Food and Drug Administration-approved treatments.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LIQUID BIOPSY MARKET, BY BIOMARKER TYPE

4.1 Introduction

4.2 Liquid Biopsy Market: Biomarker Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Circulating Tumour Cells

4.4.1 Circulating Tumour Cells Market Estimates and Forecast, 2021-2029 (USD Billion)

4.5 Circulating Tumor Nucleic Acids

4.5.1 Circulating Tumor Nucleic Acids Market Estimates and Forecast, 2021-2029 (USD Billion)

4.6 Exosomes

4.6.1 Exosomes Market Estimates and Forecast, 2021-2029 (USD Billion)

5 GLOBAL LIQUID BIOPSY MARKET, BY SAMPLE TYPE

5.1 Introduction

5.2 Liquid Biopsy Market: Sample Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Blood

5.4.1 Blood Market Estimates and Forecast, 2021-2029 (USD Billion)

5.5 Urine

5.5.1 Urine Market Estimates and Forecast, 2021-2029 (USD Billion)

5.6 Other Samples

5.6.1 Other Samples Market Estimates and Forecast, 2021-2029 (USD Billion)

6 GLOBAL LIQUID BIOPSY MARKET, BY APPLICATION TYPE

6.1 Introduction

6.2 Liquid Biopsy Market: Application Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Lung Cancer

6.4.1 Lung Cancer Market Estimates and Forecast, 2021-2029 (USD Billion)

6.5 Gastrointestinal Cancer

6.5.1 Gastrointestinal Cancer Market Estimates and Forecast, 2021-2029 (USD Billion)

6.6 Prostate Cancer

6.6.1 Prostate Cancer Market Estimates and Forecast, 2021-2029 (USD Billion)

6.7 Breast Cancer

6.7.1 Breast Cancer Market Estimates and Forecast, 2021-2029 (USD Billion)

6.8 Colorectal Cancer

6.8.1 Colorectal Cancer Market Estimates and Forecast, 2021-2029 (USD Billion)

6.9 Leukemia

6.9.1 Leukemia Market Estimates and Forecast, 2021-2029 (USD Billion)

6.10 Other Applications

6.10.1 Other Applications Market Estimates and Forecast, 2021-2029 (USD Billion)

7 GLOBAL LIQUID BIOPSY MARKET, BY REGION

7.1 Introduction

7.2 North America Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.1 By Biomarker Type

7.2.2 By Sample Type

7.2.3 By Application Type

7.2.4 By Country

7.2.4.1 U.S. Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.1.1 By Biomarker Type

7.2.4.1.2 By Sample Type

7.2.4.1.3 By Application Type

7.2.4.2 Canada Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.2.1 By Biomarker Type

7.2.4.2.2 By Sample Type

7.2.4.2.3 By Application Type

7.2.4.3 Mexico Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.3.1 By Biomarker Type

7.2.4.3.2 By Sample Type

7.2.4.3.3 By Application Type

7.3 Europe Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.1 By Biomarker Type

7.3.2 By Sample Type

7.3.3 By Application Type

7.3.4 By Country

7.3.4.1 Germany Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.1.1 By Biomarker Type

7.3.4.1.2 By Sample Type

7.3.4.1.3 By Application Type

7.3.4.2 U.K. Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.2.1 By Biomarker Type

7.3.4.2.2 By Sample Type

7.3.4.2.3 By Application Type

7.3.4.3 France Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.3.1 By Biomarker Type

7.3.4.3.2 By Sample Type

7.3.4.3.3 By Application Type

7.3.4.4 Italy Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.4.1 By Biomarker Type

7.3.4.4.2 By Sample Type

7.2.4.4.3 By Application Type

7.3.4.5 Spain Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.5.1 By Biomarker Type

7.3.4.5.2 By Sample Type

7.2.4.5.3 By Application Type

7.3.4.6 Netherlands Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.7.1 By Biomarker Type

7.3.4.7.2 By Sample Type

7.2.4.7.3 By Application Type

7.3.4.7 Rest of Europe Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.7.1 By Biomarker Type

7.3.4.7.2 By Sample Type

7.2.4.7.3 By Application Type

7.4 Asia Pacific Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.1 By Biomarker Type

7.4.2 By Sample Type

7.4.3 By Application Type

7.4.4 By Country

7.4.4.1 China Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.1.1 By Biomarker Type

7.4.4.1.2 By Sample Type

7.4.4.1.3 By Application Type

7.4.4.2 Japan Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.2.1 By Biomarker Type

7.4.4.2.2 By Sample Type

7.4.4.2.3 By Application Type

7.4.4.3 India Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.3.1 By Biomarker Type

7.4.4.3.2 By Sample Type

7.4.4.3.3 By Application Type

7.4.4.4 South Korea Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.4.1 By Biomarker Type

7.4.4.4.2 By Sample Type

7.4.4.4.3 By Application Type

7.4.4.5 Singapore Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.5.1 By Biomarker Type

7.4.4.5.2 By Sample Type

7.4.4.5.3 By Application Type

7.4.4.6 Malaysia Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.7.1 By Biomarker Type

7.4.4.7.2 By Sample Type

7.4.4.7.3 By Application Type

7.4.4.7 Thailand Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.7.1 By Biomarker Type

7.4.4.7.2 By Sample Type

7.4.4.7.3 By Application Type

7.4.4.8 Indonesia Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.8.1 By Biomarker Type

7.4.4.8.2 By Sample Type

7.4.4.8.3 By Application Type

7.4.4.9 Vietnam Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.9.1 By Biomarker Type

7.4.4.9.2 By Sample Type

7.4.4.9.3 By Application Type

7.4.4.10 Taiwan Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.10.1 By Biomarker Type

7.4.4.10.2 By Sample Type

7.4.4.10.3 By Application Type

7.4.4.11 Rest of Asia Pacific Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.11.1 By Biomarker Type

7.4.4.11.2 By Sample Type

7.4.4.11.3 By Application Type

7.5 Middle East and Africa Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.1 By Biomarker Type

7.5.2 By Sample Type

7.5.3 By Application Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.1.1 By Biomarker Type

7.5.4.1.2 By Sample Type

7.5.4.1.3 By Application Type

7.5.4.2 U.A.E. Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.2.1 By Biomarker Type

7.5.4.2.2 By Sample Type

7.5.4.2.3 By Application Type

7.5.4.3 Israel Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.3.1 By Biomarker Type

7.5.4.3.2 By Sample Type

7.5.4.3.3 By Application Type

7.5.4.4 South Africa Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.4.1 By Biomarker Type

7.5.4.4.2 By Sample Type

7.5.4.4.3 By Application Type

7.5.4.5 Rest of Middle East and Africa Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.5.1 By Biomarker Type

7.5.4.5.2 By Sample Type

7.5.4.5.2 By Application Type

7.6 Central and South America Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.1 By Biomarker Type

7.7.2 By Sample Type

7.7.3 By Application Type

7.7.4 By Country

7.7.4.1 Brazil Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.1.1 By Biomarker Type

7.7.4.1.2 By Sample Type

7.7.4.1.3 By Application Type

7.7.4.2 Argentina Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.2.1 By Biomarker Type

7.7.4.2.2 By Sample Type

7.7.4.2.3 By Application Type

7.7.4.3 Chile Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.3.1 By Biomarker Type

7.7.4.3.2 By Sample Type

7.7.4.3.3 By Application Type

7.7.4.4 Rest of Central and South America Liquid Biopsy Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.4.1 By Biomarker Type

7.7.4.4.2 By Sample Type

7.7.4.4.3 By Application Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Biocept Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Qiagen

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Trovagene Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Janssen Global Services

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 MDxHealth SA

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Natera Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 F. Hoffmann-La Roche Ltd.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Silicon Biosystems

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Pathway Genomics Corp.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Sysmex Corp.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH OFFERINGOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

2 Circulating Tumour Cells Market, By Region, 2021-2029 (USD Billion)

3 Circulating Tumor Nucleic Acids Market, By Region, 2021-2029 (USD Billion)

4 Exosomes Market, By Region, 2021-2029 (USD Billion)

5 Global Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

6 Blood Market, By Region, 2021-2029 (USD Billion)

7 Urine Market, By Region, 2021-2029 (USD Billion)

8 Other Samples Market, By Region, 2021-2029 (USD Billion)

9 Global Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

10 Lung Cancer Market, By Region, 2021-2029 (USD Billion)

11 Gastrointestinal Cancer Market, By Region, 2021-2029 (USD Billion)

12 Prostate Cancer Market, By Region, 2021-2029 (USD Billion)

13 Breast Cancer Market, By Region, 2021-2029 (USD Billion)

14 Colorectal Cancer Market, By Region, 2021-2029 (USD Billion)

15 Leukemia Market, By Region, 2021-2029 (USD Billion)

16 Other Applications Market, By Region, 2021-2029 (USD Billion)

17 Regional Analysis, 2021-2029 (USD Billion)

18 North America Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

19 North America Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

20 North America Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

21 North America Liquid Biopsy Market, By Country, 2021-2029 (USD Billion)

22 U.S. Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

23 U.S. Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

24 U.S. Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

25 Canada Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

26 Canada Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

27 Canada Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

28 Mexico Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

29 Mexico Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

30 Mexico Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

31 Europe Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

32 Europe Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

33 Europe Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

34 EUROPE Liquid Biopsy Market, By Country, 2021-2029 (USD Billion)

35 Germany Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

36 Germany Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

37 Germany Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

38 U.K. Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

39 U.K. Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

40 U.K. Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

41 France Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

42 France Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

43 France Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

44 Italy Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

45 Italy Liquid Biopsy Market, By Sample Type Type, 2021-2029 (USD Billion)

46 Italy Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

47 Spain Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

48 Spain Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

49 Spain Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

50 Netherland Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

51 Netherland Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

52 Netherland Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

53 Rest Of Europe Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

54 Rest Of Europe Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

55 Rest of Europe Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

56 Asia Pacific Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

57 Asia Pacific Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

58 Asia Pacific Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

59 Asia Pacific Liquid Biopsy Market, By Country, 2021-2029 (USD Billion)

60 China Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

61 China Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

62 China Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

63 India Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

64 India Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

65 India Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

66 Japan Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

67 Japan Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

68 Japan Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

69 South Korea Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

70 South Korea Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

71 South Korea Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

72 Australia Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

73 Australia Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

74 Australia Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

75 Thailand Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

76 Thailand Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

77 Thailand Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

78 Vietnam Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

79 Vietnam Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

80 Vietnam Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

81 indonesia Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

82 indonesia Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

83 indonesia Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

84 Malaysia Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

85 Malaysia Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

86 Malaysia Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

87 Philippines Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

88 Philippines Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

89 Philippines Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

90 Singapore Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

91 Singapore Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

92 Singapore Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

93 Rest of APAC Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

94 Rest of APAC Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

95 Rest of APAC Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

96 Middle East and Africa Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

97 Middle East and Africa Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

98 Middle East and Africa Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

99 Middle East and Africa Liquid Biopsy Market, By Country, 2021-2029 (USD Billion)

100 Saudi Arabia Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

101 Saudi Arabia Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

102 Saudi Arabia Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

103 UAE Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

104 UAE Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

105 UAE Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

106 South Africa Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

107 South Africa Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

108 South Africa Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

109 Israel Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

110 Israel Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

111 Israel Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

112 Rest of Middle East and Africa Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

113 Rest of Middle East and Africa Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

114 Rest of Middle East and Africa Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

115 Central and South America Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

116 Central and South America Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

117 Central and South America Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

118 Central and South America Liquid Biopsy Market, By Country, 2021-2029 (USD Billion)

119 Brazil Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

120 Brazil Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

121 Brazil Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

122 Argentina Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

123 Argentina Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

124 Argentina Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

125 Chile Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

126 Chile Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

127 Chile Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

128 Rest of Central and South America Liquid Biopsy Market, By Biomarker Type, 2021-2029 (USD Billion)

129 Rest of Central and South America Liquid Biopsy Market, By Sample Type, 2021-2029 (USD Billion)

130 Rest of Central and South America Liquid Biopsy Market, By Application Type, 2021-2029 (USD Billion)

131 BIOCEPT INC.: Products & Services Offering

132 QIAGEN : Products & Services Offering

133 Trovagene Inc.: Products & Services Offering

134 Janssen Global Services: Products & Services Offering

135 MDxHealth SA: Products & Services Offering

136 NATERA INC.: Products & Services Offering

137 F. Hoffmann-La Roche Ltd. : Products & Services Offering

138 Silicon Biosystems: Products & Services Offering

139 Pathway Genomics Corp.: Products & Services Offering

140 Sysmex Corp.: Products & Services Offering

141 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Liquid Biopsy Market Overview

2 Global Liquid Biopsy Market Value From 2021-2029 (USD Billion)

3 Global Liquid Biopsy Market Share, By Biomarker Type (2023)

4 Global Liquid Biopsy Market Share, By Sample Type (2023)

5 Global Liquid Biopsy Market Share, By Application Type (2023)

6 Global Liquid Biopsy Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Liquid Biopsy Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Liquid Biopsy Market

11 Impact Of Challenges On The Global Liquid Biopsy Market

12 Porter’s Five Forces Analysis

13 Global Liquid Biopsy Market: By Biomarker Type Scope Key Takeaways

14 Global Liquid Biopsy Market, By Biomarker Type Segment: Revenue Growth Analysis

15 Circulating Tumour Cells Market, By Region, 2021-2029 (USD Billion)

16 Circulating Tumor Nucleic Acids Market, By Region, 2021-2029 (USD Billion)

17 Other Market, By Region, 2021-2029 (USD Billion)

18 Other Offerings Market, By Region, 2021-2029 (USD Billion)

19 Global Liquid Biopsy Market: By Sample Type Scope Key Takeaways

20 Global Liquid Biopsy Market, By Sample Type Segment: Revenue Growth Analysis

21 Blood Market, By Region, 2021-2029 (USD Billion)

22 Urine Market, By Region, 2021-2029 (USD Billion)

23 Other Samples Market, By Region, 2021-2029 (USD Billion)

24 Global Liquid Biopsy Market: By Application Type Scope Key Takeaways

25 Global Liquid Biopsy Market, By Application Type Segment: Revenue Growth Analysis

26 Lung Cancer Market, By Region, 2021-2029 (USD Billion)

27 Gastrointestinal Cancer Market, By Region, 2021-2029 (USD Billion)

28 Prostate Cancer Market, By Region, 2021-2029 (USD Billion)

29 Breast Cancer Market, By Region, 2021-2029 (USD Billion)

30 Colorectal Cancer Market, By Region, 2021-2029 (USD Billion)

31 Leukemia Market, By Region, 2021-2029 (USD Billion)

32 Other Applications Market, By Region, 2021-2029 (USD Billion)

33 Regional Segment: Revenue Growth Analysis

34 Global Liquid Biopsy Market: Regional Analysis

35 North America Liquid Biopsy Market Overview

36 North America Liquid Biopsy Market, By Biomarker Type

37 North America Liquid Biopsy Market, By Sample Type

38 North America Liquid Biopsy Market, By Application Type

39 North America Liquid Biopsy Market, By Country

40 U.S. Liquid Biopsy Market, By Biomarker Type

41 U.S. Liquid Biopsy Market, By Sample Type

42 U.S. Liquid Biopsy Market, By Application Type

43 Canada Liquid Biopsy Market, By Biomarker Type

44 Canada Liquid Biopsy Market, By Sample Type

45 Canada Liquid Biopsy Market, By Application Type

46 Mexico Liquid Biopsy Market, By Biomarker Type

47 Mexico Liquid Biopsy Market, By Sample Type

48 Mexico Liquid Biopsy Market, By Application Type

49 Four Quadrant Positioning Matrix

50 Company Market Share Analysis

51 Biocept Inc.: Company Snapshot

52 Biocept Inc.: SWOT Analysis

53 Biocept Inc.: Geographic Presence

54 Qiagen : Company Snapshot

55 Qiagen : SWOT Analysis

56 Qiagen : Geographic Presence

57 Trovagene Inc.: Company Snapshot

58 Trovagene Inc.: SWOT Analysis

59 Trovagene Inc.: Geographic Presence

60 Janssen Global Services: Company Snapshot

61 Janssen Global Services: Swot Analysis

62 Janssen Global Services: Geographic Presence

63 MDxHealth SA: Company Snapshot

64 MDxHealth SA: SWOT Analysis

65 MDxHealth SA: Geographic Presence

66 Natera Inc.: Company Snapshot

67 Natera Inc.: SWOT Analysis

68 Natera Inc.: Geographic Presence

69 F. Hoffmann-La Roche Ltd. : Company Snapshot

70 F. Hoffmann-La Roche Ltd. : SWOT Analysis

71 F. Hoffmann-La Roche Ltd. : Geographic Presence

72 Silicon Biosystems: Company Snapshot

73 Silicon Biosystems: SWOT Analysis

74 Silicon Biosystems: Geographic Presence

75 Pathway Genomics Corp.: Company Snapshot

76 Pathway Genomics Corp.: SWOT Analysis

77 Pathway Genomics Corp.: Geographic Presence

78 Sysmex Corp.: Company Snapshot

79 Sysmex Corp.: SWOT Analysis

80 Sysmex Corp.: Geographic Presence

81 Other Companies: Company Snapshot

82 Other Companies: SWOT Analysis

83 Other Companies: Geographic Presence

The Global Liquid Biopsy Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Liquid Biopsy Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS