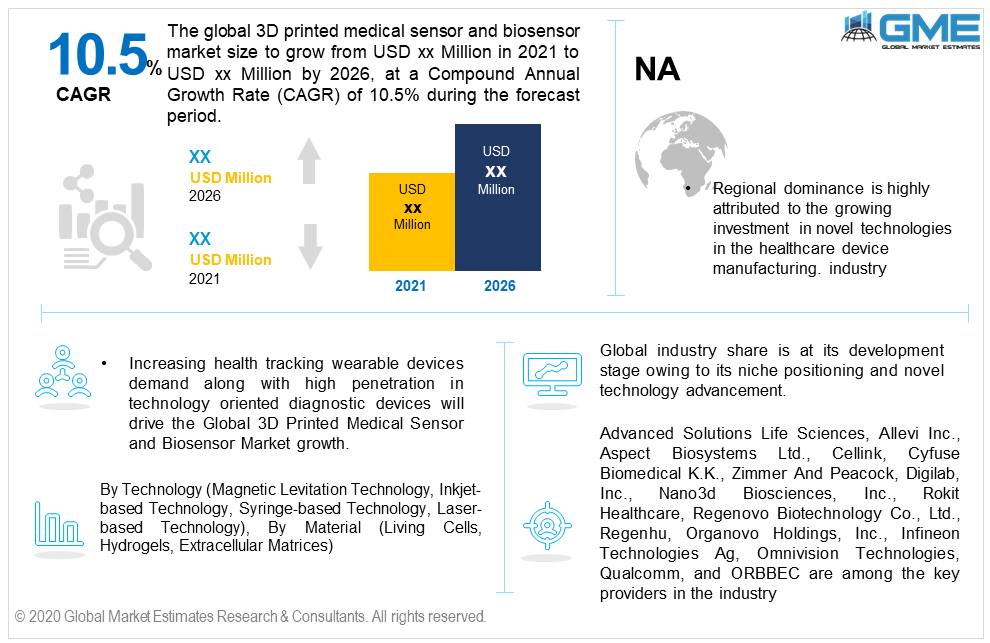

Global 3D Printed Medical Sensor & Biosensor Market Size, Trends & Analysis - Forecasts to 2026 By Technology (Magnetic Levitation Technology, Inkjet-based Technology, Syringe-based Technology, Laser-based Technology), By Material (Living Cells, Hydrogels, Extracellular Matrices), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Increasing health tracking wearable devices demand along with high penetration in technology oriented diagnostic devices will drive the Global 3D Printed Medical Sensor and Biosensor Market growth. Cost reduction, faster production rate, and product optimization are prime contributing factors to induce industry growth in the coming years.

The Global 3D Printed Medical Sensor and Biosensor Market size is intended to witness around 10.5% growth from 2021 to 2026, with North America leading the regional share. An increase in the number of rapid testing and wellness tracking solutions demand will support the global industry penetration. Better productivity, lesser resource wastage, and cost optimization are the major focus to invest in this technology.

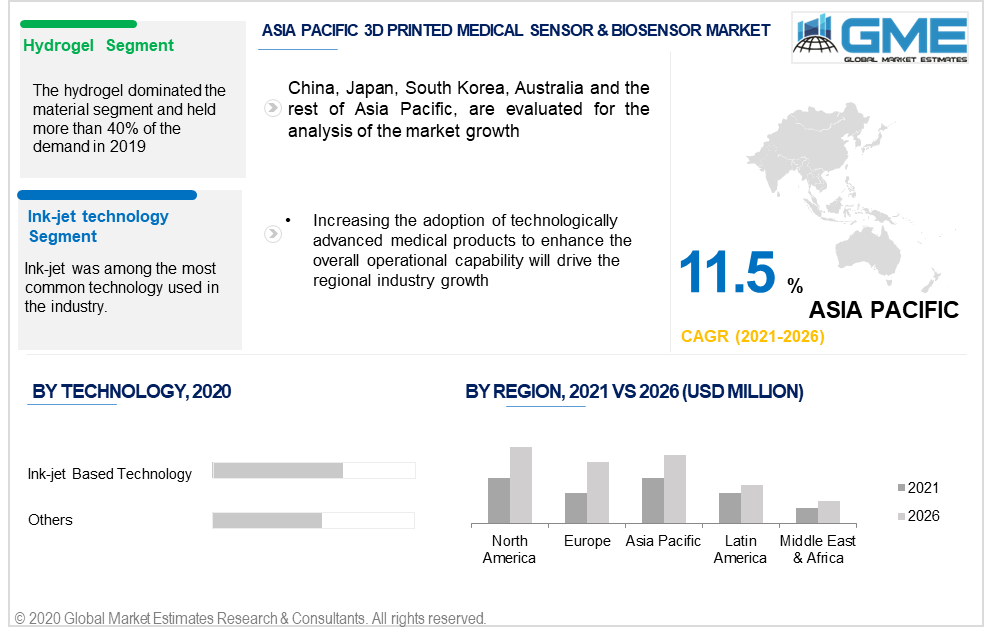

The technology segment is categorized into magnetic levitation technology, inkjet-based technology, syringe-based technology, and laser-based technology among others. The inkjet-based technology is anticipated to lead the segment demand and will account for more than 35% of the global share by 2026. Expertise in producing complex bio sensing and culture substrates along with high compatibility with tissue engineering and drug delivery systems will support the technology penetration.

The magnetic levitation technology is projected to observe the highest gains from 2021 to 2026. Cost efficiency, faster turnaround time, and minimal maintenance are among the key attributing factors to drive demand in this segment. High potential in solving the majority of the errors in bioprinting due to its high precision is another lucrative factor to invest in magnetic levitation technology.

Major material used in the industry includes but is not limited to living cells, hydrogels, and extracellular matrices among others. Hydrogels are an advanced and innovative material used in the production process. Improving overall bioprocessing and bio sensing are prime benefits offered by these materials. The hydrogel-based biosensors are highly efficient and useful for wearable applications. The rising adoption of health-tracking wearable devices will positively influence the usage and adoption of hydrogel material in the production process. Hydrogel-based wearable devices provide optimum mechanical properties which enable the ideal measuring and monitoring capabilities on the user. The material also helps in identifying the UV radiation exposure on the user.

Other key materials used in the industry are living cells and extracellular matrices. Living cells are projected to witness significant gains in the coming years. Enabling low-cost manufacturing, faster turnaround time, and sustainability are key attributing factors to drive demand for these materials in the industry.

North America dominated the global revenue share and accounted for more than 30% of the overall demand in 2019. Regional dominance is highly attributed to the growing investment in novel technologies and the healthcare industry expansion. The higher and faster rate of adaptability in terms of technically advanced healthcare products and solutions is another major factor to drive regional demand. Various healthcare organizations and institutes are investing in the development of 3-dimensional technology to upgrade the overall medical industry.

Asia Pacific is intended to observe more than 11.5% CAGR from 2021 to 2026. Increasing the adoption of technologically advanced medical products to enhance the overall operational capability will drive the regional industry growth. Sustainability and time management are prime focuses to build these production solutions in the healthcare industry. APAC holds an important foothold in global medical supplies. Therefore, production technology advancement is essential in the region to sustain the optimal resource supply. Medical devices shortage owing to the rising imbalance in the demand and supply triggered by the Covid-19 pandemic will induce product penetration in the region.

The European healthcare sector has noticed a significant adoption rate of these production technologies. The biosensor holds a prominent future in the region due to the on-going extensive research and adoption in multiple medical applications. Healthcare industry expansion along with heavy investment in advanced production techniques will support the regional industry growth.

Advanced Solutions Life Sciences, Allevi Inc., Aspect Biosystems Ltd., Cellink, Cyfuse Biomedical K.K., Zimmer And Peacock, Digilab, Inc., Nano3d Biosciences, Inc., Rokit Healthcare, Regenovo Biotechnology Co., Ltd., Regenhu, Organovo Holdings, Inc., Infineon Technologies Ag, Omnivision Technologies, Qualcomm, and ORBBEC are among the key providers in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Global industry share is at its development stage owing to its niche positioning and novel technology advancement. Production technology developments along with collaboration with the end-use companies are among the major strategies witnessed in the industry. Backward and forward integration to maximize profitability throughout the value chain is another tactic to be seen in the coming years.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 3D printed medical sensor and biosensor industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Material overview

2.1.3 Technology overview

2.1.4 Regional overview

Chapter 3 3D Printed Medical Sensor and Biosensor Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 3D Printed Medical Sensor and Biosensor Market, By Material

4.1 Material Outlook

4.2 Living Cells

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Hydrogels

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Extracellular Matrices

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Others

4.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 3D Printed Medical Sensor and Biosensor Market, By Technology

5.1 Technology Outlook

5.2 Magnetic Levitation Technology

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Inkjet-based Technology

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Syringe-based Technology

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Laser-based Technology

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Others

5.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 3D Printed Medical Sensor and Biosensor Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by material, 2019-2026 (USD Million)

6.2.3 Market size, by technology, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by material, 2019-2026 (USD Million)

6.2.4.2 Market size, by technology, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by material, 2019-2026 (USD Million)

6.2.5.2 Market size, by technology, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by material, 2019-2026 (USD Million)

6.3.3 Market size, by technology, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by material, 2019-2026 (USD Million)

6.2.4.2 Market size, by technology, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by material, 2019-2026 (USD Million)

6.3.5.2 Market size, by technology, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by material, 2019-2026 (USD Million)

6.3.6.2 Market size, by technology, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by material, 2019-2026 (USD Million)

6.3.7.2 Market size, by technology, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by material, 2019-2026 (USD Million)

6.3.8.2 Market size, by technology, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by material, 2019-2026 (USD Million)

6.3.9.2 Market size, by technology, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by material, 2019-2026 (USD Million)

6.4.3 Market size, by technology, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by material, 2019-2026 (USD Million)

6.4.4.2 Market size, by technology, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by material, 2019-2026 (USD Million)

6.4.5.2 Market size, by technology, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by material, 2019-2026 (USD Million)

6.4.6.2 Market size, by technology, 2019-2026 (USD Million)

6.4.7 India

6.4.7.1 Market size, by material, 2019-2026 (USD Million)

6.4.7.2 Market size, by technology, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by material, 2019-2026 (USD Million)

6.4.8.2 Market size, by technology, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by material, 2019-2026 (USD Million)

6.5.3 Market size, by technology, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by material, 2019-2026 (USD Million)

6.5.4.2 Market size, by technology, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by material, 2019-2026 (USD Million)

6.5.5.2 Market size, by technology, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by material, 2019-2026 (USD Million)

6.6.3 Market size, by technology, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by material, 2019-2026 (USD Million)

6.6.4.2 Market size, by technology, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by material, 2019-2026 (USD Million)

6.6.5.2 Market size, by technology, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 Advanced Solutions Life Sciences

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Allevi Inc.

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Aspect Biosystems Ltd.

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Cellink

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Cyfuse Biomedical K.K.

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Zimmer And Peacock

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Digilab, Inc.

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Nano3d Biosciences, Inc.

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 Rokit Healthcare

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Regenovo Biotechnology Co., Ltd.

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Regenhu

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Organovo Holdings, Inc.

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Infineon Technologies Ag

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Omnivision Technologies

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 Qualcomm

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 ORBBEC

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

The Global 3D Printed Medical Sensor & Biosensor Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the 3D Printed Medical Sensor & Biosensor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS