Global Acidity Regulators Market Size, Trends & Analysis - Forecasts to 2026 By Product (Citric Acids, Acetic Acids, Phosphoric Acid, Malic Acid, Lactic Acid), By Application (Beverages, Proceeded Food, Bakery & Confectionery, Sauces, Condiments & Dressing, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

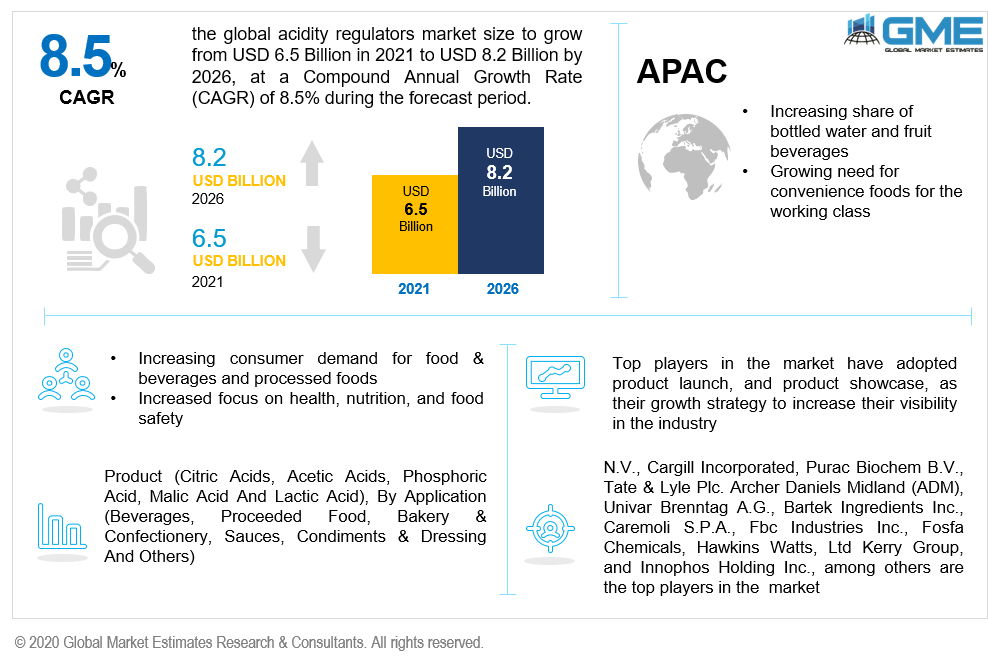

The global acidity regulators market is projected to grow from USD 6.5 billion in 2021 to USD 8.2 billion by 2026 at a CAGR value of 8.5% from 2021 to 2026. The acidity regulators market is projected to be driven by rising awareness of effective microbial action on food quality, as well as growing concerns about extending the shelf life of food and beverage items. Furthermore, the acidity regulators market is likely to be driven by the flourishing food industry, rising population and consumer demand, increasing research activities in the field of acidity regulators and launch of enhancement strategies for food safety.

The product's extensive application scope as gelling agents, flavourings, and taste modifiers in the food and beverage sector is likely to drive growth in the global market. Growing demand for processed foods such as wafers, tofu, and noodles is likely to promote the use of acidity regulators in the market.

The current trends in food acidity regulator consumption reflect the global population's growing demand, product penetration and purchasing power in emerging economies, as well as the rising trend towards exotic and innovative flavours in affluent countries. The acidity regulator market has grown tremendously as a result of the wide application scope of regulators in packaged food and bakery items. Acidity regulators are used in canned foods, dried foods, and frozen foods to improve flavour and shelf life. Previously, natural sources were employed to extract acids; however, new technological breakthroughs have resulted in the production of synthetic acids, which has encouraged global market growth.

Acidity regulators are pH control chemicals used as food additives to manage the acidity or basicity of the food item. Mineral or organic acids, neutralizing agents, bases, or buffering agents are examples of acidity regulators. Acidity regulators are essential in the food and beverage sector and are widely utilized in a variety of applications including drinks, condiments, bakery goods, and dressings, among others. They maintain and stabilize the pH balance of the food product and function as preservatives to extend its shelf life.

They are also employed as flavour enhancers, frequently adding a strong taste to the food product, and as gelling agents. Many fruits and vegetables, including lemons, oranges, mangos, tomatoes, strawberries, and apples, contain natural acids. Acidity regulators can be derived from natural sources or synthesized synthetically. Food acidity regulators are essential components of the global food additives business since they supply an acidic medium as well as taste to food and beverage goods.

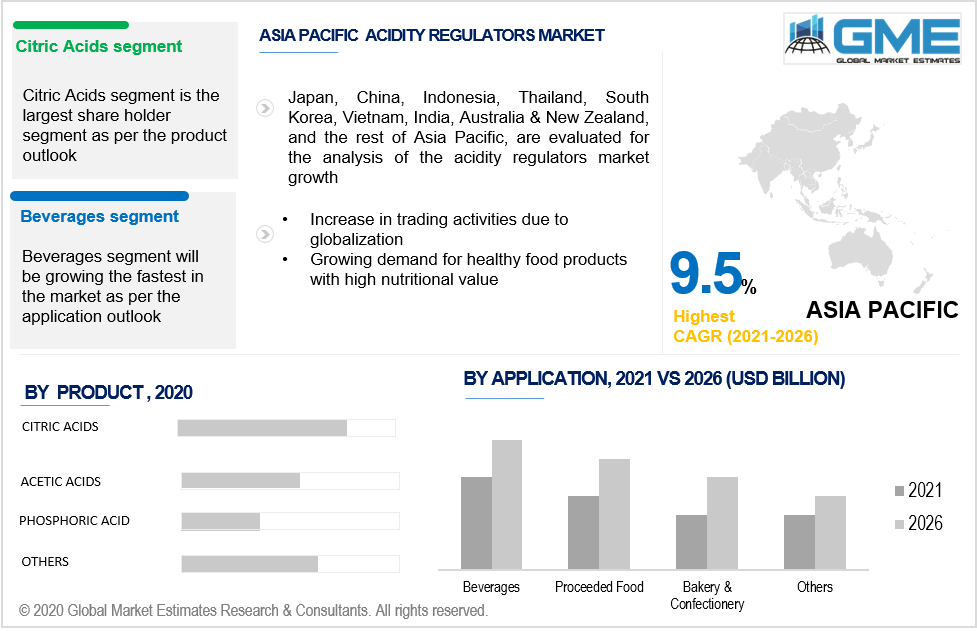

Based on the products the acidity regulators market is segregated into citric acids, acetic acids, phosphoric acid, malic acid, and lactic acid. Because of expanding usage in sectors such as food and beverages, pharmaceuticals, and others, the citric acid sector accounted for the largest shares in the acidity regulator market. Citric acid is highly sought after due to its pleasant flavour, pH characteristics, and good solubility. Furthermore, extremely good citric acid sequestering abilities fill out the features of these goods and qualify them for a variety of applications such as food and beverage, medicines, and personal care. With its broad use as a preservative, enhancer, and flavour enhancer, the acid control market is likely to rise during the forecast period of 2021 to 2026.

Based on the type of applications the acidity regulators market is divided into beverages, proceeded food, bakery & confectionery, and sauces, condiments & dressing. As of 2020, the beverage category accounted for the largest share of the market in terms of revenue and volume sales. The rising non-alcoholic beverage business, on the other hand, is predicted to drive acidity regulators' market demand.

Furthermore, rising lactic acid utilisation in the manufacturing stage of dairy products such as yoghurt, cheese, buttermilk, and other dairy products, especially for fermentation purposes, is propelling the market growth. Growth in the non-alcoholic beverage sector in India and China are predicted to drive demand for acidity regulators in the market. Because of its application in adding a sour flavour to fruit and vegetable juices, malic acid is predicted to be the fastest-growing product sector.

As per the geographical analysis, the acidity regulators market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America.

North America is estimated to be the largest market for acidity regulators during the forecast period of 2021 and 2026, whereas Asia Pacific will be the fastest-growing segment in the market. Large investments are made in the manufacturing industries for food safety procedures. Hence, this factor will drive the market in North America. Moreover, The NA acidity regulators market is predicted to expand as fruit beverage consumption will rise. The Asia Pacific region will grow with the highest CAGR value, as the expansion of the food and beverage industries in China and India is flourishing coupled with rising strong demand for processed goods.

N.V., Cargill Incorporated, Purac Biochem B.V., Tate & Lyle Plc. Archer Daniels Midland (ADM), Univar Brenntag A.G., Bartek Ingredients Inc., Caremoli S.P.A., Fbc Industries Inc., Fosfa Chemicals, Hawkins Watts, Ltd Kerry Group, and Innophos Holding Inc., among others the major players in the acidity regulators market players.

Please note: This is not an exhaustive list of companies profiled in the report.

These players are working on various marketing strategies, including R&D activities, partnership and collaborations, awareness programs, technological progress, geographical expansion product launch strategies. These organic and inorganic strategies have been adopted in order to increase their individual market share.

In January 2018, ADM established its innovation center in Singapore to strengthen its Southeast Asian presence. This helped the company expand its business and foot print in the market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Acidity Regulators Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Acidity Regulators Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing focus on health, nutrition, and food safety

3.3.1.2 Increasing consumer demand for food & beverages and processed foods

3.3.2 Industry challenges

3.3.2.1 Low-cost suppliers flooding in the market

3.4 Prospective Growth Scenario

3.4.1 Product Overview

3.4.2 Application Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Acidity Regulators Market, By Application

4.1 Application Outlook

4.2 Proceeded Food

4.2.1 Market Size, By Region, 2016-2026 (USD Billion)

4.3 Bakery & Confectionery

4.3.1 Market Size, By Region, 2016-2026 (USD Billion)

4.4 Condiments & Dressing

4.4.1 Market Size, By Region, 2016-2026 (USD Billion)

4.5 Beverages

4.5.1 Market Size, By Region, 2016-2026 (USD Billion)

4.6 Sauces

4.6.1 Market Size, By Region, 2016-2026 (USD Billion)

4.7 Others

4.7.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 5 Global Acidity Regulators Market, By Product

5.1 Product Outlook

5.2 Citric Acids

5.2.1 Market Size, By Region, 2016-2026 (USD Billion)

5.3 Acetic Acids

5.3.1 Market Size, By Region, 2016-2026 (USD Billion)

5.4 Phosphoric Acid

5.4.1 Market Size, By Region, 2016-2026 (USD Billion)

5.5 Malic Acid

5.5.1 Market Size, By Region, 2016-2026 (USD Billion)

5.6 Lactic Acid

5.6.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 6 Global Acidity Regulators Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Billion)

6.2.2 Market Size, By Application, 2016-2026 (USD Billion)

6.2.3 Market Size, By Product, 2016-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2016-2026 (USD Billion)

6.2.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2016-2026 (USD Billion)

6.2.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Billion)

6.3.2 Market Size, By Application, 2016-2026 (USD Billion)

6.3.3 Market Size, By Product, 2016-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2016-2026 (USD Billion)

6.3.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2016-2026 (USD Billion)

6.3.5.2 Market Si/ze, By Product, 2016-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Application, 2016-2026 (USD Billion)

6.3.6.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2016-2026 (USD Billion)

6.3.7.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2016-2026 (USD Billion)

6.3.8.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2016-2026 (USD Billion)

6.3.9.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Billion)

6.4.2 Market Size, By Application, 2016-2026 (USD Billion)

6.4.3 Market Size, By Product, 2016-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Application, 2016-2026 (USD Billion)

6.4.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Application, 2016-2026 (USD Billion)

6.4.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2016-2026 (USD Billion)

6.4.6.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2016-2026 (USD Billion)

6.4.7.2 Market size, By Product, 2016-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2016-2026 (USD Billion)

6.4.8.2 Market Size, By Product, 2016-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Billion)

6.5.2 Market Size, By Application, 2016-2026 (USD Billion)

6.5.3 Market Size, By Product, 2016-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2016-2026 (USD Billion)

6.5.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2016-2026 (USD Billion)

6.5.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2016-2026 (USD Billion)

6.5.6.2 Market Size, By Product, 2016-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Billion)

6.6.2 Market Size, By Application, 2016-2026 (USD Billion)

6.6.3 Market Size, By Product, 2016-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2016-2026 (USD Billion)

6.6.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2016-2026 (USD Billion)

6.6.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2016-2026 (USD Billion)

6.6.6.2 Market Size, By Product, 2016-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Caremoli S.P.A.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 Cargill Incorporated

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Archer Daniels Midland Co.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Hawkins Watts Ltd

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Bartek Ingredients Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 Johnson & Johnson

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Merz Pharma

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 Chemelco International B.V.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Fuerst Day Lawson Ltd

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Celrich Products

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Prinova Group L.L.C

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

7.13 Other Companies

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info-Graphic Analysis

The Global Acidity Regulators Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Acidity Regulators Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS