Global Adhesives & Sealants Market Size, Trends & Analysis - Forecasts to 2029 By Adhesive Resin (Polyurethane, Epoxy, Acrylic, Silicone, Cyanoacrylate, VAE/EVA, and Other), By Adhesives Technology (Solvent-borne, Reactive, Hot Melt, UV-cured Adhesives, and Water-borne), By Sealant Resin (Silicone, Polyurethane, Acrylic, Epoxy, and Other), By End-use Industry (Aerospace, Automotive, Building and Construction, Footwear and Leather, Healthcare, Paper & Packaging, Woodwork and Joinery, and Other), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

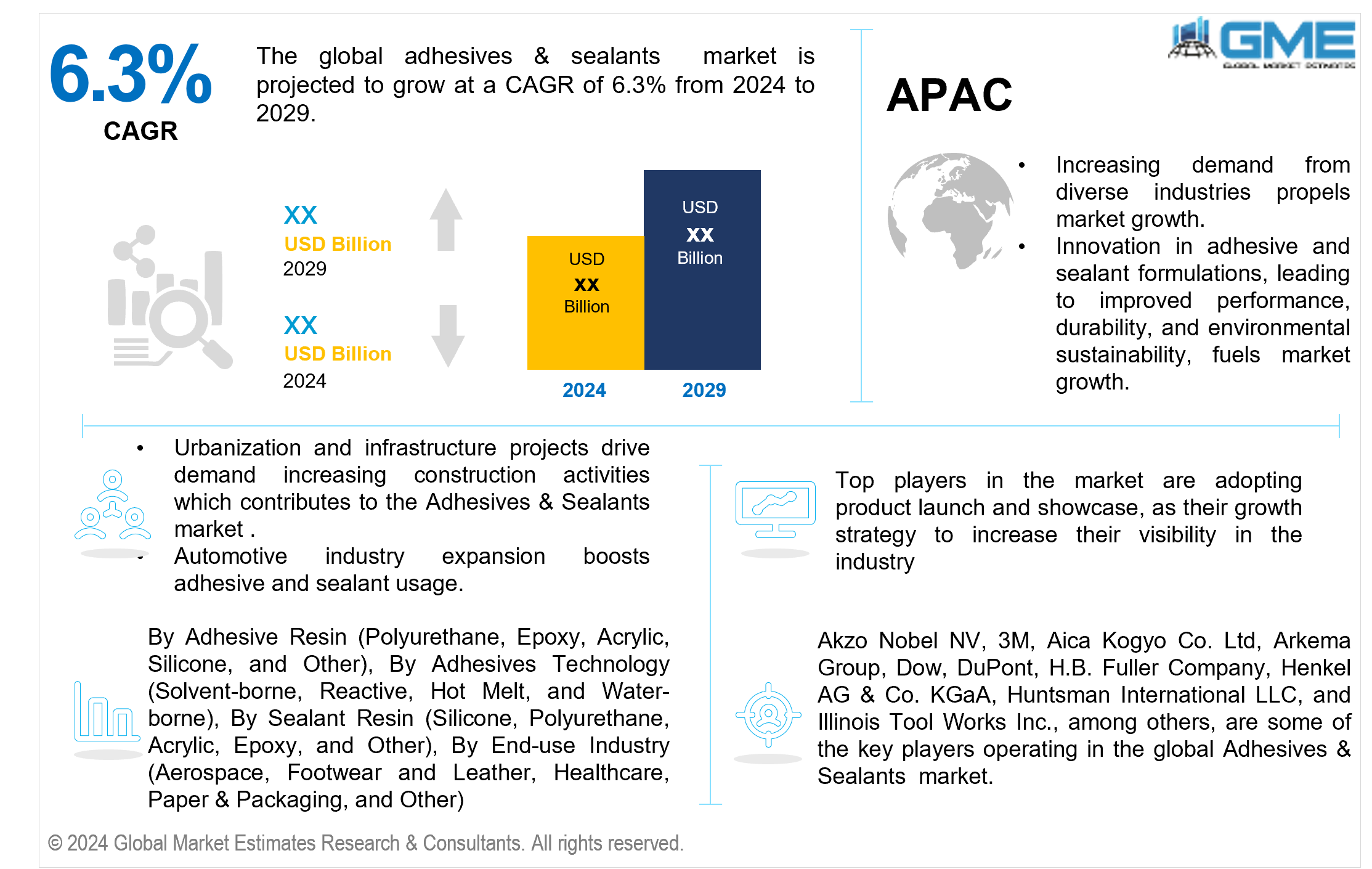

The global adhesives & sealants market is projected to grow at a CAGR of 6.3% from 2024 to 2029.

Changes in material consumption patterns, notably the shift from traditional materials such as metal, aluminum, and paper to more lasting alternatives, influence the packaging industry's demand for adhesives and sealants. The demand for better product protection, longer shelf life, and greater sustainability drives this transformation. As firms switch to materials like plastics, composites, and laminates that are more resistant to external variables and assure product integrity, the demand for adhesives and sealants to link these materials together grows.

The adhesives and sealants industry is growing rapidly, owing to constant formulation innovation. Manufacturers concentrate on creating environmentally friendly and high-performance products to fulfill changing consumer and regulatory needs. They invest in R&D to introduce adhesives and sealants with improved features such as increased adhesion, durability, flexibility, and resilience to extreme environmental conditions. These innovations not only meet different business needs, but they also correspond with sustainability aims, resulting in market expansion. Prioritizing the development of novel solutions allows producers to remain competitive in a dynamic market landscape, promoting a cycle of innovation and growth in the adhesives and sealants sector.

The need for adhesives and sealants is driven by the requirement for maintenance, repair, and restoration activities in various sectors such as construction, automotive, and infrastructure. These compounds repair, bond, and seal existing structures and components, increasing their useful life.

In North America and Europe, stringent environmental regulations oversee chemical production, impacting manufacturers' production capacities. Regulatory bodies such as ERC and EC monitor solvent-based product manufacturing. Compliance with regulations like COSHH, REACH, GHS, and EPA requires manufacturers to prioritize eco-friendly adhesive and sealant development. However, meeting evolving standards and regulations pose constraints on manufacturers due to additional compliance burdens and costs.

The acrylic segment is expected to hold the largest share of the market. The segment growth is attributed to its adaptability, high bonding strength, and resistance to external variables. Acrylic adhesives offer a wide range of substrates, including metals, plastics, and composites, making them appropriate for various applications in the automotive, construction, electronics, and packing industries.

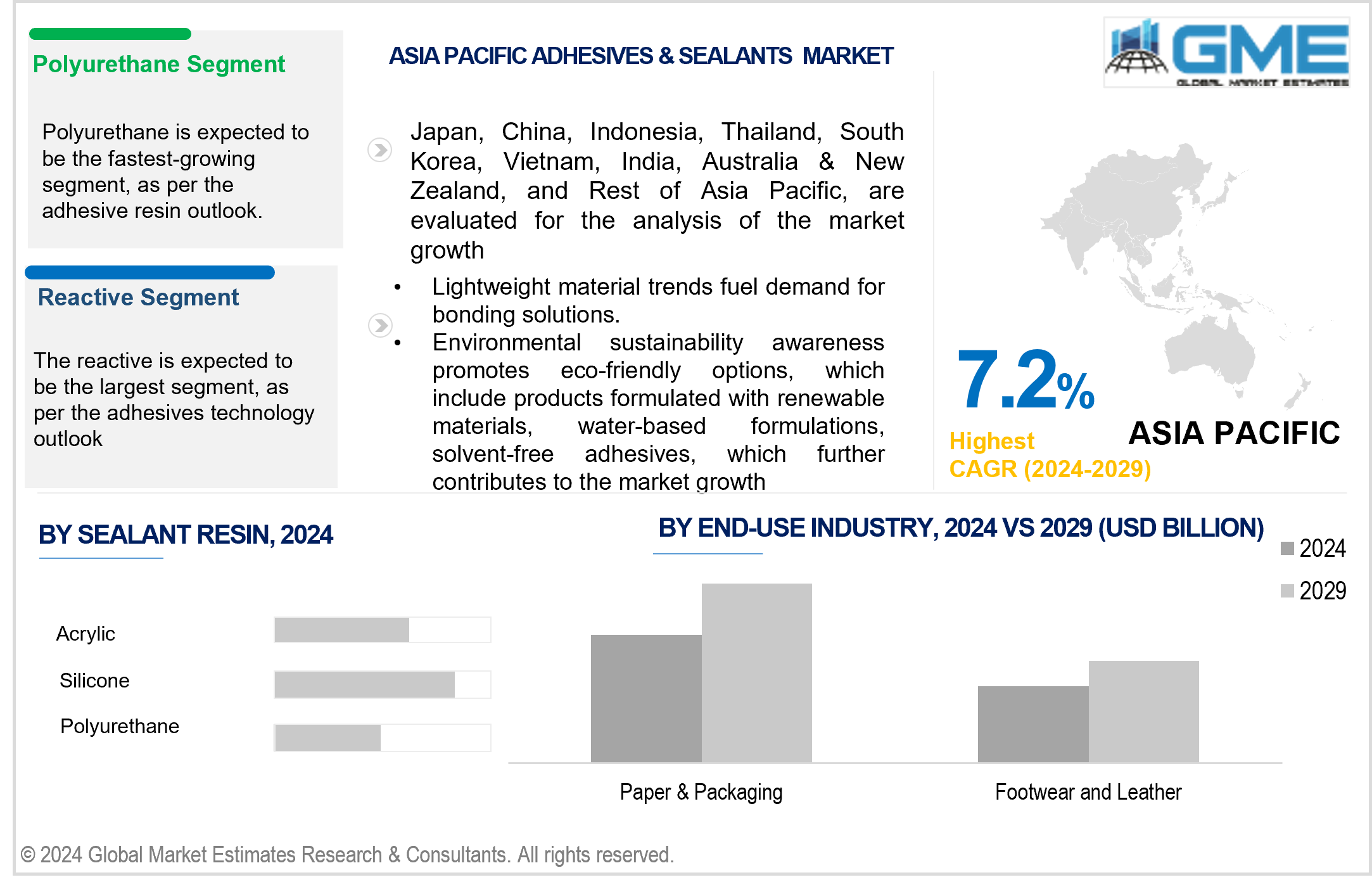

The polyurethane segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is due to its exceptional strength, flexibility, and durability are the reasons for its growth. Polyurethane adhesives are ideal for high-demand applications in industries like construction, automotive, and aerospace because they have excellent adherence to a range of surfaces and are resistant to adverse weather.

The hot melt segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is due to its easy application procedure, quick curing time, and adaptability. Hot melt adhesives provide rapid bonding without the need for solvent-based chemicals or water, making them eco-friendly. Their ability to bond diverse substrates in industries such as packaging, woodworking, and automotive drives the segment's rapid growth.

The reactive segment is expected to hold the largest share of the market. The segment growth is due to its widespread use in bonding applications that require high strength and endurance. When heat, pressure, or moisture are applied to reactive adhesives, they polymerize and establish strong connections. These adhesives work well in complex settings, making them ideal for essential applications in aerospace, automotive, and electronics industries.

The polyurethane segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The anticipated growth is due to its features, such as high flexibility, stickiness, and durability. Polyurethane sealants are highly weather-resistant and chemically stable, making them ideal for various sealing applications in the construction, automotive, and industrial sectors.

The silicone segment is expected to hold the largest share of the market. This is due to its flexibility, durability, and weather resistance. Silicone sealants are used in various automotive, construction, and electronics applications to provide long-lasting, waterproof seals. Their ability to endure harsh temperatures, UV exposure, and environmental conditions makes them the preferred choice for sealing applications, resulting in the largest market share.

The footwear and leather segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The growth is due to rising demand for adhesives and sealants in the production of footwear, leather items, and accessories. Adhesives are necessary for bonding diverse materials in shoe production, ensuring durability and flexibility. With rising disposable incomes, fashion trends, and urbanization driving demand for footwear and leather products, this segment is expected to grow significantly.

The paper & packaging segment is expected to hold the largest share of the market over the forecast period. The growth is due to the widespread use of adhesives and sealants in packaging materials such as cartons, boxes, labels, and flexible packaging. Adhesives are essential for bonding and sealing these materials to maintain product integrity, protection, and appearance. With the continued expansion of the e-commerce sector and the demand for packaged goods, the paper and packaging industry continues to contribute to the market growth.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include established automotive, construction, and electronics industries, all of which use adhesives and sealants extensively. Furthermore, stringent regulatory criteria in the region encourage the use of environmentally friendly and high-performance adhesive solutions. Additionally, increasing investment in the region's infrastructure sector contributes to the market's growth. For instance, in November 2021, the U.S. government revealed plans to allocate USD 35 billion to Texas for infrastructure development.

Asia Pacific is predicted to witness rapid growth during the forecast period. The region's growing urbanization, population, and industrialization fuel demand for adhesives and sealants in various industries, including construction, automotive, electronics, and packaging. Increasing infrastructure investments, disposable incomes, and changing consumer lifestyles contribute to market expansion. As construction projects increase and consumer demand diversifies, the demand for these products grows, indicating a symbiotic relationship between economic development and consumer behaviour in driving the growth of the market.

Akzo Nobel NV, 3M, Aica Kogyo Co. Ltd, Arkema Group, Dow, DuPont, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC, and Illinois Tool Works Inc., among others, are some of the key players operating in the global adhesive & sealants market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2023, Henkel Adhesives Technologies inaugurated its Technology Center in Bridgewater, New Jersey, USA. This facility will serve as a hub for showcasing Henkel's entire technology portfolio, including sealants, adhesives, coatings, and specialty materials. The center aims to foster collaboration across the value chain and facilitate co-innovation with partners and customers across various industries, such as packaging, electronics, and construction.

In February 2023, 3M launched a ground-breaking medical adhesive capable of adhering to the skin for up to 28 days, doubling the previous standard wear time of 14 days. This innovative adhesive is designed for various health monitors, sensors, and long-term medical wearables, offering extended wear time benefits. The 3M Medical Tape 4578 adhesive also features liner-free stability, providing device makers with greater design flexibility. This advancement underscores 3M's commitment to advancing healthcare through cutting-edge materials science.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Adhesives Technologys

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ADHESIVES & SEALANTS MARKET, BY ADHESIVES TECHNOLOGY

4.1 Introduction

4.2 Adhesives & Sealants Market: Adhesives Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Solvent-borne

4.4.1 Solvent-borne Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Reactive

4.5.1 Reactive Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Hot Melt

4.6.1 Hot Melt Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 UV-cured Adhesives

4.7.1 UV-cured Adhesives Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Water-borne

4.8.1 Water-borne Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ADHESIVES & SEALANTS MARKET, BY END-USE INDUSTRY

5.1 Introduction

5.2 Adhesives & Sealants Market: End-use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Aerospace

5.4.1 Aerospace Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Automotive

5.5.1 Automotive Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Building and Construction

5.6.1 Building and Construction Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Footwear and Leather

5.7.1 Footwear and Leather Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Healthcare

5.8.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Paper & Packaging

5.9.1 Paper & Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Woodwork and Joinery

5.10.1 Woodwork and Joinery Market Estimates and Forecast, 2021-2029 (USD Million)

5.11 Other

5.11.1 Other Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL ADHESIVES & SEALANTS MARKET, BY ADHESIVE RESIN

6.1 Introduction

6.2 Adhesives & Sealants Market: Adhesive Resin Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Polyurethane

6.4.1 Polyurethane Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Epoxy

6.5.1 Epoxy Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Acrylict

6.6.1 Acrylict Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Silicone

6.7.1 Silicone Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Cyanoacrylate

6.8.1 Cyanoacrylate Market Estimates and Forecast, 2021-2029 (USD Million)

6.9 VAE/EVA

6.9.1 VAE/EVA Market Estimates and Forecast, 2021-2029 (USD Million)

6.10 Others

6.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL ADHESIVES & SEALANTS MARKET, BY SEALANT RESIN

7.1 Introduction

7.2 Adhesives & Sealants Market: Sealant Resin Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Silicone

7.4.1 Silicone Market Estimates and Forecast, 2021-2029 (USD Million)

7.5 Polyurethane

7.5.1 Polyurethane Market Estimates and Forecast, 2021-2029 (USD Million)

7.6 Acrylic

7.6.1 Acrylic Market Estimates and Forecast, 2021-2029 (USD Million)

7.7 Epoxy

7.7.1 Epoxy Market Estimates and Forecast, 2021-2029 (USD Million)

7.8 Other

7.8.1 Other Market Estimates and Forecast, 2021-2029 (USD Million)

8 GLOBAL ADHESIVES & SEALANTS MARKET, BY REGION

8.1 Introduction

8.2 North America Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.1 By Adhesives Technology

8.2.2 By End-use Industry

8.2.3 By Adhesive Resin

8.2.4 By Sealant Resin

8.2.5 By Country

8.2.5.1 U.S. Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.5.1.1 By Adhesives Technology

8.2.5.1.2 By End-use Industry

8.2.5.1.3 By Adhesive Resin

8.2.5.1.4 By Sealant Resin

8.2.5.2 Canada Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.5.2.1 By Adhesives Technology

8.2.5.2.2 By End-use Industry

8.2.5.2.3 By Adhesive Resin

8.2.5.2.4 By Sealant Resin

8.2.5.3 Mexico Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.5.3.1 By Adhesives Technology

8.2.5.3.2 By End-use Industry

8.2.5.3.3 By Adhesive Resin

8.2.5.3.4 By Sealant Resin

8.3 Europe Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.1 By Adhesives Technology

8.3.2 By End-use Industry

8.3.3 By Adhesive Resin

8.3.4 By Sealant Resin

8.3.5 By Country

8.3.5.1 Germany Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.1.1 By Adhesives Technology

8.3.5.1.2 By End-use Industry

8.3.5.1.3 By Adhesive Resin

8.3.5.1.4 By Sealant Resin

8.3.5.2 U.K. Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.2.1 By Adhesives Technology

8.3.5.2.2 By End-use Industry

8.3.5.2.3 By Adhesive Resin

8.3.5.2.4 By Sealant Resin

8.3.5.3 France Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.3.1 By Adhesives Technology

8.3.5.3.2 By End-use Industry

8.3.5.3.3 By Adhesive Resin

8.3.5.3.4 By Sealant Resin

8.3.5.4 Italy Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.4.1 By Adhesives Technology

8.3.5.4.2 By End-use Industry

8.3.5.4.3 By Adhesive Resin

8.3.5.4.4 By Sealant Resin

8.3.5.5 Spain Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.5.1 By Adhesives Technology

8.3.5.5.2 By End-use Industry

8.3.5.5.3 By Adhesive Resin

8.3.5.5.4 By Sealant Resin

8.3.5.6 Netherlands Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.6.1 By Adhesives Technology

8.3.5.6.2 By End-use Industry

8.3.5.6.3 By Adhesive Resin

8.3.5.6.4 By Sealant Resin

8.3.5.7 Rest of Europe Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.7.1 By Adhesives Technology

8.3.5.7.2 By End-use Industry

8.3.5.7.3 By Adhesive Resin

8.3.5.7.4 By Sealant Resin

8.4 Asia Pacific Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.1 By Adhesives Technology

8.4.2 By End-use Industry

8.4.3 By Adhesive Resin

8.4.4 By Sealant Resin

8.4.5 By Country

8.4.5.1 China Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.1.1 By Adhesives Technology

8.4.5.1.2 By End-use Industry

8.4.5.1.3 By Adhesive Resin

8.4.5.1.4 By Sealant Resin

8.4.5.2 Japan Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.2.1 By Adhesives Technology

8.4.5.2.2 By End-use Industry

8.4.5.2.3 By Adhesive Resin

8.4.5.2.4 By Sealant Resin

8.4.5.3 India Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.3.1 By Adhesives Technology

8.4.5.3.2 By End-use Industry

8.4.5.3.3 By Adhesive Resin

8.4.5.3.4 By Sealant Resin

8.4.5.4 South Korea Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.4.1 By Adhesives Technology

8.4.5.4.2 By End-use Industry

8.4.5.4.3 By Adhesive Resin

8.4.5.4.4 By Sealant Resin

8.4.5.5 Singapore Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.5.1 By Adhesives Technology

8.4.5.5.2 By End-use Industry

8.4.5.5.3 By Adhesive Resin

8.4.5.5.4 By Sealant Resin

8.4.5.6 Malaysia Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.6.1 By Adhesives Technology

8.4.5.6.2 By End-use Industry

8.4.5.6.3 By Adhesive Resin

8.4.5.6.4 By Sealant Resin

8.4.5.7 Thailand Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.7.1 By Adhesives Technology

8.4.5.7.2 By End-use Industry

8.4.5.7.3 By Adhesive Resin

8.4.5.7.4 By Sealant Resin

8.4.5.8 Indonesia Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.8.1 By Adhesives Technology

8.4.5.8.2 By End-use Industry

8.4.5.8.3 By Adhesive Resin

8.4.5.8.4 By Sealant Resin

8.4.5.9 Vietnam Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.9.1 By Adhesives Technology

8.4.5.9.2 By End-use Industry

8.4.5.9.3 By Adhesive Resin

8.4.5.9.4 By Sealant Resin

8.4.5.10 Taiwan Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.10.1 By Adhesives Technology

8.4.5.10.2 By End-use Industry

8.4.5.10.3 By Adhesive Resin

8.4.5.10.4 By Sealant Resin

8.4.5.11 Rest of Asia Pacific Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.11.1 By Adhesives Technology

8.4.5.11.2 By End-use Industry

8.4.5.11.3 By Adhesive Resin

8.4.5.11.4 By Sealant Resin

8.5 Middle East and Africa Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.1 By Adhesives Technology

8.5.2 By End-use Industry

8.5.3 By Adhesive Resin

8.5.4 By Sealant Resin

8.5.5 By Country

8.5.5.1 Saudi Arabia Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.1.1 By Adhesives Technology

8.5.5.1.2 By End-use Industry

8.5.5.1.3 By Adhesive Resin

8.5.5.1.4 By Sealant Resin

8.5.5.2 U.A.E. Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.2.1 By Adhesives Technology

8.5.5.2.2 By End-use Industry

8.5.5.2.3 By Adhesive Resin

8.5.5.2.4 By Sealant Resin

8.5.5.3 Israel Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.4.3.1 By Adhesives Technology

8.5.4.3.2 By End-use Industry

8.5.4.3.3 By Adhesive Resin

8.5.5.3.4 By Sealant Resin

8.5.5.4 South Africa Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.4.1 By Adhesives Technology

8.5.5.4.2 By End-use Industry

8.5.5.4.3 By Adhesive Resin

8.5.5.4.4 By Sealant Resin

8.5.5.5 Rest of Middle East and Africa Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.5.1 By Adhesives Technology

8.5.5.5.2 By End-use Industry

8.5.5.5.2 By Adhesive Resin

8.5.5.5.4 By Sealant Resin

8.6 Central and South America Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.1 By Adhesives Technology

8.6.2 By End-use Industry

8.6.3 By Adhesive Resin

8.6.4 By Sealant Resin

8.6.5 By Country

8.6.5.1 Brazil Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.1.1 By Adhesives Technology

8.6.5.1.2 By End-use Industry

8.6.5.1.3 By Adhesive Resin

8.6.5.1.4 By Sealant Resin

8.6.5.2 Argentina Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.2.1 By Adhesives Technology

8.6.5.2.2 By End-use Industry

8.6.5.2.3 By Adhesive Resin

8.6.5.2.4 By Sealant Resin

8.6.5.3 Chile Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.3.1 By Adhesives Technology

8.6.5.3.2 By End-use Industry

8.6.5.3.3 By Adhesive Resin

8.6.5.5.4 By Sealant Resin

8.6.5.4 Rest of Central and South America Adhesives & Sealants Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.4.1 By Adhesives Technology

8.6.5.4.2 By End-use Industry

8.6.5.4.3 By Adhesive Resin

8.6.5.4.4 By Sealant Resin

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Akzo Nobel NV

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Aica Kogyo Co. Ltd

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Arkema Group

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Dow

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 DuPont

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 H.B. Fuller Company

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Henkel AG & Co. KGaA

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Huntsman International LLC

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Illinois Tool Works Inc.

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 3M

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Mllion)

2 Solvent-borne Market, By Region, 2021-2029 (USD Mllion)

3 Reactive Market, By Region, 2021-2029 (USD Mllion)

4 Hot Melt Market, By Region, 2021-2029 (USD Mllion)

5 UV-cured Adhesives Market, By Region, 2021-2029 (USD Mllion)

6 Water-borne Market, By Region, 2021-2029 (USD Mllion)

7 Global Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Mllion)

8 Aerospace Market, By Region, 2021-2029 (USD Mllion)

9 Automotive Market, By Region, 2021-2029 (USD Mllion)

10 Building and Construction Market, By Region, 2021-2029 (USD Mllion)

11 Footwear and Leather Market, By Region, 2021-2029 (USD Mllion)

12 Healthcare Market, By Region, 2021-2029 (USD Mllion)

13 Paper & Packaging Market, By Region, 2021-2029 (USD Mllion)

14 Woodwork and Joinery Market, By Region, 2021-2029 (USD Mllion)

15 Other Market, By Region, 2021-2029 (USD Mllion)

16 Global Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Mllion)

17 Polyurethane Market, By Region, 2021-2029 (USD Mllion)

18 Epoxy Market, By Region, 2021-2029 (USD Mllion)

19 Acrylict Market, By Region, 2021-2029 (USD Mllion)

20 Silicone Market, By Region, 2021-2029 (USD Mllion)

21 Cyanoacrylate Market, By Region, 2021-2029 (USD Mllion)

22 VAE/EVA Market, By Region, 2021-2029 (USD Mllion)

23 Others Market, By Region, 2021-2029 (USD Mllion)

24 Global Adhesives & Sealants Market, By SEALANT RESIN, 2021-2029 (USD Mllion)

25 Silicone Market, By Region, 2021-2029 (USD Mllion)

26 Polyurethane Market, By Region, 2021-2029 (USD Mllion)

27 Acrylic Market, By Region, 2021-2029 (USD Mllion)

28 Epoxy Market, By Region, 2021-2029 (USD Mllion)

29 Other Resins Market, By Region, 2021-2029 (USD Mllion)

30 Regional Analysis, 2021-2029 (USD Mllion)

31 North America Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

32 North America Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

33 North America Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

34 North America Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

35 North America Adhesives & Sealants Market, By Country, 2021-2029 (USD Million)

36 U.S Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

37 U.S Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

38 U.S Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

39 U.S Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

40 Canada Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

41 Canada Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

42 Canada Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

43 CANADA Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

44 Mexico Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

45 Mexico Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

46 Mexico Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

47 mexico Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

48 Europe Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

49 Europe Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

50 Europe Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

51 europe Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

52 europe Adhesives & Sealants Market, By country, 2021-2029 (USD Million)

53 Germany Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

54 Germany Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

55 Germany Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

56 germany Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

57 U.K Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

58 U.K Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

59 U.K Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

60 U.kAdhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

61 France Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

62 France Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

63 France Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

64 france Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

65 Italy Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

66 Italy Adhesives & Sealants Market, By T End-use Industry Type, 2021-2029 (USD Million)

67 Italy Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

68 italy Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

69 Spain Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

70 Spain Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

71 Spain Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

72 spain Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

73 Rest Of Europe Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

74 Rest Of Europe Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

75 Rest of Europe Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

76 REST OF EUROPE Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

77 Asia Pacific Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

78 Asia Pacific Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

79 Asia Pacific Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

80 asia Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

81 Asia Pacific Adhesives & Sealants Market, By Country, 2021-2029 (USD Million)

82 China Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

83 China Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

84 China Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

85 china Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

86 India Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

87 India Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

88 India Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

89 india Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

90 Japan Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

91 Japan Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

92 Japan Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

93 japan Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

94 South Korea Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

95 South Korea Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

96 South Korea Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

97 south korea Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

98 rest of Asia Pacific Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

99 rest of Asia Pacific Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

100 rest of Asia Pacific Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

101 rest of asia Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

102 Middle East and Africa Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

103 Middle East and Africa Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

104 Middle East and Africa Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

105 MIDDLE EAST and AFRICA Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

106 Middle East and Africa Adhesives & Sealants Market, By Country, 2021-2029 (USD Million)

107 Saudi Arabia Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

108 Saudi Arabia Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

109 Saudi Arabia Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

110 saudi arabia Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

111 UAE Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

112 UAE Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

113 UAE Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

114 uae Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

115 rest of Middle East and Africa Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

116 rest of Middle East and Africa Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

117 rest of Middle East and Africa Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

118 rest of MIDDLE EAST and AFRICA Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

119 Central and South America Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

120 Central and South America Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

121 Central and South America Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

122 CENTRAL and SOUTH AMERICA Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

123 Central and South America Adhesives & Sealants Market, By Country, 2021-2029 (USD Million)

124 Brazil Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

125 Brazil Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

126 Brazil Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

127 brazil Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

128 rest of Central and South America Adhesives & Sealants Market, By Adhesives Technology, 2021-2029 (USD Million)

129 rest of Central and South America Adhesives & Sealants Market, By End-use Industry, 2021-2029 (USD Million)

130 rest of Central and South America Adhesives & Sealants Market, By Adhesive Resin, 2021-2029 (USD Million)

131 rest of CENTRAL and SOUTH AMERICA Adhesives & Sealants Market, By Sealant Resin, 2021-2029 (USD Million)

132 Akzo Nobel NV: Products & Services Offering

133 Aica Kogyo Co. Ltd: Products & Services Offering

134 Arkema Group: Products & Services Offering

135 Dow: Products & Services Offering

136 DuPont: Products & Services Offering

137 H.B. FULLER COMPANY: Products & Services Offering

138 Henkel AG & Co. KGaA : Products & Services Offering

139 Huntsman International LLC: Products & Services Offering

140 Illinois Tool Works Inc., Inc: Products & Services Offering

141 3M: Products & Services Offering

142 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Adhesives & Sealants Market Overview

2 Global Adhesives & Sealants Market Value From 2021-2029 (USD Mllion)

3 Global Adhesives & Sealants Market Share, By Adhesives Technology (2023)

4 Global Adhesives & Sealants Market Share, By End-use Industry (2023)

5 Global Adhesives & Sealants Market Share, By Adhesive Resin (2023)

6 Global Adhesives & Sealants Market Share, By Sealant Resin (2023)

7 Global Adhesives & Sealants Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Adhesives & Sealants Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Adhesives & Sealants Market

12 Impact Of Challenges On The Global Adhesives & Sealants Market

13 Porter’s Five Forces Analysis

14 Global Adhesives & Sealants Market: By Adhesives Technology Scope Key Takeaways

15 Global Adhesives & Sealants Market, By Adhesives Technology Segment: Revenue Growth Analysis

16 Solvent-borne Market, By Region, 2021-2029 (USD Mllion)

17 Reactive Market, By Region, 2021-2029 (USD Mllion)

18 Hot Melt Market, By Region, 2021-2029 (USD Mllion)

19 UV-cured Adhesives Market, By Region, 2021-2029 (USD Mllion)

20 Water-borne Market, By Region, 2021-2029 (USD Mllion)

21 Global Adhesives & Sealants Market: By End-use Industry Scope Key Takeaways

22 Global Adhesives & Sealants Market, By End-use Industry Segment: Revenue Growth Analysis

23 Aerospace Market, By Region, 2021-2029 (USD Mllion)

24 Automotive Market, By Region, 2021-2029 (USD Mllion)

25 Building and Construction Market, By Region, 2021-2029 (USD Mllion)

26 Footwear and Leather Market, By Region, 2021-2029 (USD Mllion)

27 Healthcare Market, By Region, 2021-2029 (USD Mllion)

28 Paper & Packaging Market, By Region, 2021-2029 (USD Mllion)

29 Woodwork and Joinery Market, By Region, 2021-2029 (USD Mllion)

30 Other Market, By Region, 2021-2029 (USD Mllion)

31 Global Adhesives & Sealants Market: By Adhesive Resin Scope Key Takeaways

32 Global Adhesives & Sealants Market, By Adhesive Resin Segment: Revenue Growth Analysis

33 Polyurethane Market, By Region, 2021-2029 (USD Mllion)

34 Epoxy Market, By Region, 2021-2029 (USD Mllion)

35 Acrylict Market, By Region, 2021-2029 (USD Mllion)

36 Silicone Market, By Region, 2021-2029 (USD Mllion)

37 Cyanoacrylate Market, By Region, 2021-2029 (USD Mllion)

38 VAE/EVA Market, By Region, 2021-2029 (USD Mllion)

39 Others Market, By Region, 2021-2029 (USD Mllion)

40 Global Adhesives & Sealants Market: By Sealant Resin Scope Key Takeaways

41 Global Adhesives & Sealants Market, By Sealant Resin Segment: Revenue Growth Analysis

42 Silicone Market, By Region, 2021-2029 (USD Mllion)

43 Polyurethane Market, By Region, 2021-2029 (USD Mllion)

44 Acrylic Market, By Region, 2021-2029 (USD Mllion)

45 Epoxy Market, By Region, 2021-2029 (USD Mllion)

46 Other Resins Market, By Region, 2021-2029 (USD Mllion)

47 Regional Segment: Revenue Growth Analysis

48 Global Adhesives & Sealants Market: Regional Analysis

49 North America Adhesives & Sealants Market Overview

50 North America Adhesives & Sealants Market, By Adhesives Technology

51 North America Adhesives & Sealants Market, By End-use Industry

52 North America Adhesives & Sealants Market, By Adhesive Resin

53 North America Adhesives & Sealants Market, By Sealant Resin

54 North America Adhesives & Sealants Market, By Country

55 U.S. Adhesives & Sealants Market, By Adhesives Technology

56 U.S. Adhesives & Sealants Market, By End-use Industry

57 U.S. Adhesives & Sealants Market, By Adhesive Resin

58 U.S. Adhesives & Sealants Market, By Sealant Resin

59 Canada Adhesives & Sealants Market, By Adhesives Technology

60 Canada Adhesives & Sealants Market, By End-use Industry

61 Canada Adhesives & Sealants Market, By Adhesive Resin

62 Canada Adhesives & Sealants Market, By Sealant Resin

63 Mexico Adhesives & Sealants Market, By Adhesives Technology

64 Mexico Adhesives & Sealants Market, By End-use Industry

65 Mexico Adhesives & Sealants Market, By Adhesive Resin

66 Mexico Adhesives & Sealants Market, By Sealant Resin

67 Four Quadrant Positioning Matrix

68 Company Market Share Analysis

69 Akzo Nobel NV: Company Snapshot

70 Akzo Nobel NV: SWOT Analysis

71 Akzo Nobel NV: Geographic Presence

72 Aica Kogyo Co. Ltd: Company Snapshot

73 Aica Kogyo Co. Ltd: SWOT Analysis

74 Aica Kogyo Co. Ltd: Geographic Presence

75 Arkema Group: Company Snapshot

76 Arkema Group: SWOT Analysis

77 Arkema Group: Geographic Presence

78 Dow: Company Snapshot

79 Dow: Swot Analysis

80 Dow: Geographic Presence

81 DuPont: Company Snapshot

82 DuPont: SWOT Analysis

83 DuPont: Geographic Presence

84 H.B. Fuller Company: Company Snapshot

85 H.B. Fuller Company: SWOT Analysis

86 H.B. Fuller Company: Geographic Presence

87 Henkel AG & Co. KGaA : Company Snapshot

88 Henkel AG & Co. KGaA : SWOT Analysis

89 Henkel AG & Co. KGaA : Geographic Presence

90 Huntsman International LLC: Company Snapshot

91 Huntsman International LLC: SWOT Analysis

92 Huntsman International LLC: Geographic Presence

93 Illinois Tool Works Inc., Inc.: Company Snapshot

94 Illinois Tool Works Inc., Inc.: SWOT Analysis

95 Illinois Tool Works Inc., Inc.: Geographic Presence

96 3M: Company Snapshot

97 3M: SWOT Analysis

98 3M: Geographic Presence

99 Other Companies: Company Snapshot

100 Other Companies: SWOT Analysis

101 Other Companies: Geographic Presence

The Global Adhesives & Sealants Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Adhesives & Sealants Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS