Global AI in Biopharmaceutical Development Market Size, Trends & Analysis - Forecasts to 2027 By Type (Monoclonal Antibodies, Vaccines, Recombinant Proteins, and Others), By Application (Research & Discovery, Clinical Development, Manufacturing & Supply Chain, Others), By End-use (Biopharmaceutical Manufacturers, Contract Manufacturing Organizations/ Contract Research Organizations, and Academic & Government Research Institutes), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

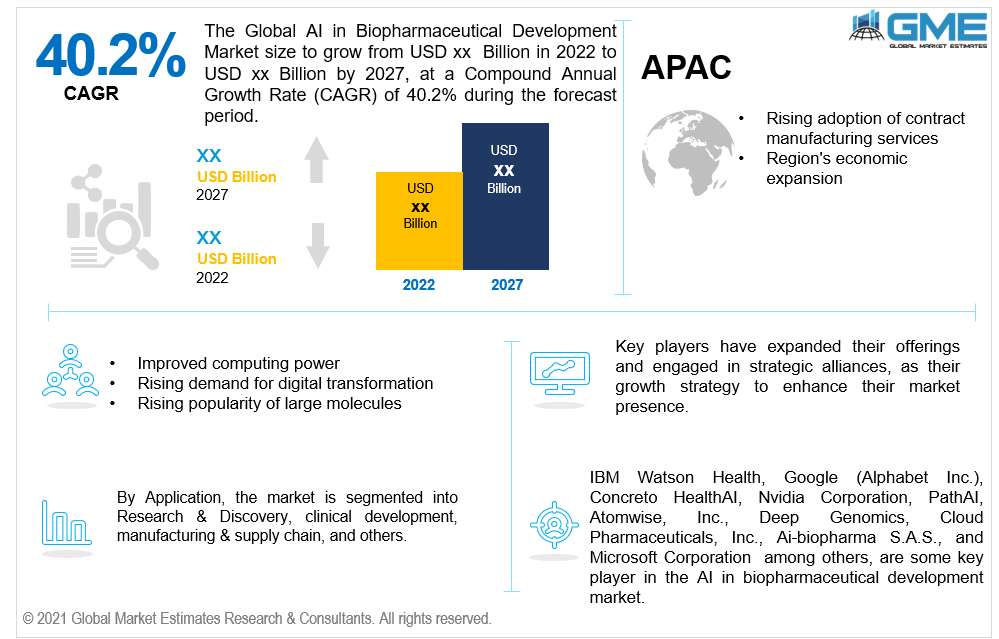

The global AI in the biopharmaceutical development market is projected to grow at a CAGR value of 40.2% from 2022 to 2027. Continuous medical and scientific innovation has transformed the biopharma sector. The increasing need for improved patient involvement and experience has driven the emergence of new business models. As a result, AI is becoming more prevalent in the biopharmaceutical industry, thereby driving market growth.

Despite the industry's high level of innovation, biopharma companies are witnessing a challenging environment as a result of rising competition, shorter time to market, expiring patents, diminishing peak sales, reimbursement pressure, and increasing regulatory scrutiny. These factors have contributed to an alarming drop in the expected return on investment from large biopharmaceutical companies' late-stage pipelines, affecting their long-term viability.

The advent of digital transformation is anticipated to help reverse this trend and advance biopharma R&D. Beyond R&D, companies are using digital transformation to boost operational performance, productivity, efficiency, and cost-effectiveness across the whole biopharma value chain. Thus, embracing digital transformation is expected to enable biopharma companies to advance their new product development, improve consumer engagement, and streamline biomanufacturing procedures.

Artificial intelligence (AI) is one of the key emerging technologies that provide a digital foundation and competitive advantage in data analytics, thus propelling the growth of digital transformation. As a result of the above-articulated factors, the worldwide AI market in biopharma is growing, and the opportunity for digital transformation is growing as well.

Research and development, sales, and clinical trials’ aspects of the biopharmaceutical industry have been negatively impacted by the COVID-19 pandemic. While many biopharmaceutical companies have reported a profit during the pandemic, several players observed to be substantially weaker, with fewer resources to invest in R&D and reported delays in future product introductions.

However, COVID-19 has created immense opportunities for the biomanufacturing sector owing to increasing investment in vaccine and therapy development against SARS-CoV-2 infection. Sanofi and GSK, for example, stated in February 2022 that they had submitted data from both their booster and Phase 3 effectiveness studies for regulatory approval of their COVID-19 vaccine. Such continuous investment has propelled the market revenue even during the COVID-19 pandemic.

The infrastructural failure of clinics and hospitals has adversely impacted healthcare systems and patient treatment, causing hospital employees to escape and leave hospitals. Furthermore, due to the costs of maintaining huge stockpiles and storage space constraints, hospitals have limited quantities of medicines and other consumables.

This has had an impact on not only hospital-based patient care but also therapeutic development initiatives. While therapeutic manufacturing facilities in Ukraine are being abandoned or even shelled, inflation and sanctions have impacted the Russian healthcare system over the border. As a result, the protracted conflict is expected to aggravate biopharmaceutical consumption for a time.

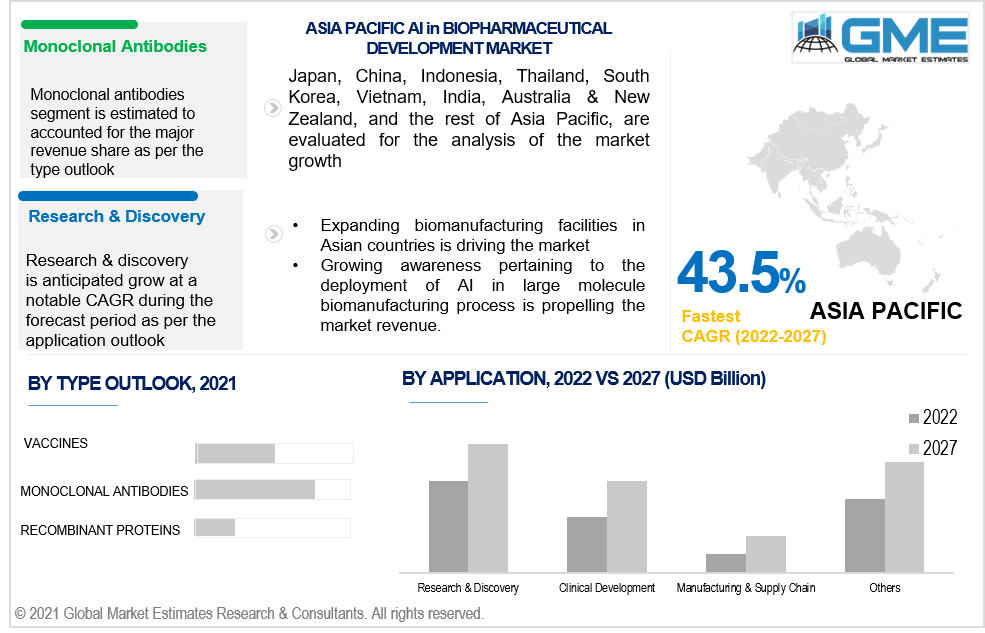

The monoclonal antibodies are estimated to capture the maximum share in 2020 owing to the successful application of monoclonal antibodies and antibody derivatives in medicines. Monoclonal antibodies have proven their therapeutic potential across multiple indications including rheumatoid arthritis, cancer, cardiovascular illnesses, and multiple sclerosis, among others.

Moreover, this therapy type finds its application in COVID-19 management, thus monoclonal antibodies targeting COVID-19 witnessed high demand for the management of COVID-19 patients. In July 2020, Biocon Ltd’s Itolizumab (ALZUMAb), an anti-CD6 IgG1 monoclonal antibody, received approval from the Drugs Controller General of India (DCGI) for the emergency treatment of cytokine release syndrome in COVID-19-infected patients with acute respiratory distress syndrome. These factors have spurred the segment growth in the 2021 market.

On the other hand, vaccines are growing at the fastest growth rate owing to enormous sums of investments in this segment. The majority of biopharmaceutical companies are making focused attempts to the development of vaccines against the SARS-CoV2 virus. Conventional vaccinations type, such as inactivated and attenuated vaccines, are available; however, sophisticated DNA, RNA, and protein subunit vaccines account for the vast majority of vaccine candidates now being developed. The vaccine segment is expected to grow at the fastest rate throughout the forecast period due to these factors.

Research & discovery segment is estimated to account for the major share in 2021. This can be attributed to the high usage of AI technologies for the discovery of new targets and testing of new components. Biopharma companies have been able to gain access to AI capabilities through software licensing deals or partnerships for implementation in their pipeline programs.

The clinical development aspect of biomanufacturing is anticipated to be the fastest growing segment of the AI-based biomanufacturing market during the forecast period. Third-party investment in AI-enabled new therapy development is expected to propel revenue growth through this segment.

Biopharmaceutical companies have dominated the 2021 market owing to their well-established presence and capability to invest heavily in new technologies. Some key biopharmaceutical companies that are exploring and implementing the use of AI in their development programs are Agilent Technologies, Gilead Sciences, Genentech, Biogen, Vertex Pharmaceuticals, Bayer AG, and Novartis AG among others.

On the other hand, contract service providers are expected to grow lucratively during the forecast period. Several contract service providers are expanding their production operations by adding innovation to their facilities. Moreover, recently, CMOS & CROs have reported increased demand for their services among therapy developments. This further propels them to implement novel technologies such as AI in their facility to keep pace with the growing demand.

North America (the United States, Canada, and Mexico) is estimated to account for the major revenue share of AI in the biopharmaceutical market. The presence of a substantial number of software and technology suppliers in the U.S. has resulted in the dominance of North America in the 2021 global market.

Furthermore, the biopharmaceuticals market in North America is being driven by the rising burden of chronic disease and increased expenditure on research and development activities in the U.S. The U.S. is recognized as the world's life sciences innovation capital, and the country is proactively involved in global capital investments by biopharmaceutical companies, thus resulting in their significant share.

On the other hand, Asia-Pacific is anticipated to register the fastest growth during the forecast period. Expansion of global market players in the Asian markets including China, India, and others is one of the key factors driving the market. Moreover, Asian countries are gaining traction as a hub for biomanufacturing of novel therapies owing to low manufacturing and operating cost in this region

China is estimated to dominate the Asia Pacific market to account for a significant share in the Asia Pacific AI in Biopharmaceutical Development Market. The growing popularity of large molecules over conventional therapies across multiple conditions is expected to propel revenue flow in this region.

IBM Watson Health, Google (Alphabet Inc.), Concreto HealthAI, Nvidia Corporation, PathAI, Atomwise, Inc., Deep Genomics, Cloud Pharmaceuticals, Inc., Ai-biopharma S.A.S., and Microsoft Corporation among others, are some key players operating in the AI in Biopharmaceutical Development Market.

Please note: This is not an exhaustive list of companies profiled in the report.

These key players are making focused attempts to enhance their market presence in the biopharmaceutical industry. New product development, merger, and acquisitions, and licensing deals are some of the key strategies undertaken by these companies to sustain the rising market competition.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model DetAIls

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Type Outlook

2.3 Application Outlook

2.4 End-use Outlook

2.5 Regional Outlook

Chapter 3 Global AI in Biopharmaceutical Development Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the AI in Biopharmaceutical Development Market

3.4 Metric Data on Complementary & Alternative Cancer Treatment Industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market RestrAInt Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 AI in Biopharmaceutical Development Market: Type Trend Analysis

4.1 Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Monoclonal Antibodies

4.2.1 Market Estimates & Forecast Analysis of Monoclonal Antibodies Segment, By Region, 2019-2027 (USD Billion)

4.3 Vaccines

4.3.1 Market Estimates & Forecast Analysis of Vaccines Segment, By Region, 2019-2027 (USD Billion)

4.4 Recombinant Proteins

4.4.1 Market Estimates & Forecast Analysis of Recombinant Proteins Segment, By Region, 2019-2027 (USD Billion)

4.5 Others

4.5.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 AI in Biopharmaceutical Development Market: Application Trend Analysis

5.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Research & Discovery

5.2.1 Market Estimates & Forecast Analysis of Research & Discovery Segment, By Region, 2019-2027 (USD Billion)

5.3 Clinical Development

5.3.1 Market Estimates & Forecast Analysis of Clinical Development Segment, By Region, 2019-2027 (USD Billion)

5.4 Manufacturing & Supply ChAIn

5.4.1 Market Estimates & Forecast Analysis of Manufacturing & Supply ChAIn Segment, By Region, 2019-2027 (USD Billion)

5.5 Others

5.5.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 AI in Biopharmaceutical Development Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.2.5 U.S.

6.2.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.5.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.2.6 Canada

6.2.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.6.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.2.7 Mexico

6.2.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.7.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By End-use 2019-2026 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.3.3 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3.5 Germany

6.3.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.5.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3.6 UK

6.3.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.6.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3.7 France

6.3.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3.8 Italy

6.3.8.1 Market Estimates & Forecast Analysis, By Type, 2018-2026 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2026 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3.9 Spain

6.3.9.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.3.10 Rest of Europe

6.3.10.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By End-use 2019-2026 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.4.3 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.4.5 China

6.4.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.5.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.4.6 India

6.4.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2025 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Billion)

6.4.6.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.4.7 Japan

6.4.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.7.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Estimates & Forecast Analysis, By Type, 2018-2026 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2026 (USD Billion)

6.4.8.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.4.9 Rest of Asia Pacific

6.4.9.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.4.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.9.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By End-use 2019-2026 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.5.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.5.5 Brazil

6.5.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.5.5.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.5.6 Rest of Central & South America

6.5.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.5.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.5.6.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By End-use 2019-2026 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.6.5 Saudi Arabia

6.6.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.5.3 Market Estimates & Forecast Analysis, By Country, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.6.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.6.7 Rest of Middle East & Africa

6.6.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2026 (USD Billion)

6.6.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.7.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 End-User Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 IBM Watson Health

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Service/Software Benchmarking

8.2 Google (Alphabet Inc.)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Service/Software Benchmarking

8.3 Concreto HealthAI

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Service/Software Benchmarking

8.4 Nvidia Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Service/Software Benchmarking

8.5 PathAI

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Service/Software Benchmarking

8.6 Atomwise, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Service/Software Benchmarking

8.7 Deep Genomics

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Service/Software Benchmarking

8.8 Cloud Pharmaceuticals, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Service/Software Benchmarking

8.9 Microsoft Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Initiatives

8.9.4 Service/Software Benchmarking

8.10 Ai-biopharma S.A.S.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Service/Software Benchmarking

List of Tables

1 Technological advancements in AI in biopharmaceutical development market

2 Global AI in biopharmaceutical development market: key market drivers

3 Global AI in biopharmaceutical development market: key market challenges

4 Global AI in biopharmaceutical development market: key market opportunities

5 Global AI in biopharmaceutical development market: key market restraints

6 Global AI in biopharmaceutical development market estimates & forecast analysis, 2019-2027 (USD billion)

7 Global AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

8 Monoclonal antibodies: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

9 Vaccines: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

10 Recombinant proteins: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

11 Others: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

12 Global AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

13 Research & discovery: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

14 Clinical development: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

15 Manufacturing & supply chain: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

16 Others: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

17 Global AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

18 Biopharmaceutical manufacturers: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

19 Contract manufacturing organizations/ contract research organizations: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

20 Academic & government research institutes: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

21 Regional analysis: Global AI in biopharmaceutical development market, by region, 2019-2027 (USD billion)

22 North America: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

23 North America: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

24 North America: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

25 North America: AI in biopharmaceutical development market, by country, 2019-2027 (USD billion)

26 U.S.: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

27 U.S.: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

28 U.S.: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

29 Canada: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

30 Canada: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

31 Canada: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

32 Mexico: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

33 Mexico: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

34 Mexico: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

35 Europe: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

36 Europe: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

37 Europe: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

38 Europe: AI in biopharmaceutical development market, by country, 2019-2027 (USD billion)

39 Germany: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

40 Germany: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

41 Germany: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

42 UK: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

43 UK: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

44 UK: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

45 France: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

46 France: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

47 France: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

48 Italy: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

49 Italy: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

50 Italy: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

51 Spain: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

52 Spain: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

53 Spain: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

54 Rest of Europe: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

55 Rest of Europe: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

56 Rest of Europe: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

57 Asia Pacific: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

58 Asia Pacific: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

59 Asia Pacific: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

60 Asia Pacific: AI in biopharmaceutical development market, by country, 2019-2027 (USD billion)

61 China: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

62 China: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

63 China: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

64 India: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

65 India: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

66 India: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

67 Japan: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

68 Japan: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

69 Japan: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

70 South Korea: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

71 South Korea: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

72 South Korea: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

73 Middle East & Africa: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

74 Middle East & Africa: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

75 Middle East & Africa: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

76 Middle East & Africa: AI in biopharmaceutical development market, by country, 2019-2027 (USD billion)

77 Saudi Arabia: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

78 Saudi Arabia: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

79 Saudi Arabia: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

80 South Africa: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

81 South Africa: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

82 South Africa: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

83 Central & South America: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

84 Central & South America: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

85 Central & South America: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

86 Central & South America: AI in biopharmaceutical development market, by country, 2019-2027 (USD billion)

87 Brazil: AI in biopharmaceutical development market, by type, 2019-2027 (USD billion)

88 Brazil: AI in biopharmaceutical development market, by application, 2019-2027 (USD billion)

89 Brazil: AI in biopharmaceutical development market, by end-use, 2019-2027 (USD billion)

90 IBM Watson Health: Products offered

91 Google (Alphabet Inc.): Products offered

92 Concreto HealthAI: Products offered

93 Nvidia Corporation: Products offered

94 PathAI: Products offered

95 Atomwise, Inc.: Products offered

96 Deep Genomics: Products offered

97 Cloud Pharmaceuticals, Inc.: Products offered

98 Microsoft Corporation: Products offered

99 Ai-Biopharma S.A.S.: Products offered

List of Figures

1. Global AI in biopharmaceutical development market segmentation & research scope

2. Primary research partners and local informers

3. Primary research process

4. Primary research approaches

5. Primary research responses

6. Global AI in biopharmaceutical development market: penetration & growth prospect mapping

7. Global AI in biopharmaceutical development market: value chAIn analysis

8. Global AI in biopharmaceutical development market drivers

9. Global AI in biopharmaceutical development market restraints

10. Global AI in biopharmaceutical development market opportunities

11. Global AI in biopharmaceutical development market challenges

12. Key AI in biopharmaceutical development market manufacturer analysis

13. Global AI in biopharmaceutical development market: porter’s five forces analysis

14. Pestle analysis & impact analysis

15. IBM Watson Health: Company snapshot

16. IBM Watson Health: Swot analysis

17. Google (Alphabet Inc.): Company snapshot

18. Google (Alphabet Inc.): Swot analysis

19. Concreto HealthAI: Company snapshot

20. Concreto HealthAI: Swot analysis

21. Nvidia Corporation: Company snapshot

22. Nvidia Corporation: Swot analysis

23. PathAI: Company snapshot

24. PathAI: Swot analysis

25. Atomwise, Inc.: Company snapshot

26. Atomwise, Inc.: Swot analysis

27. Deep Genomics: Company snapshot

28. Deep Genomics: Swot analysis

29. Cloud Pharmaceuticals, Inc.: Company snapshot

30. Cloud Pharmaceuticals, Inc.: Swot analysis

31. Microsoft Corporation: Company snapshot

32. Microsoft Corporation: Swot analysis

33. Ai-biopharma S.A.S.: Company snapshot

34. Ai-biopharma S.A.S.: Swot analysis

The Global AI in Biopharmaceutical Development Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the AI in Biopharmaceutical Development Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS