Global Airborne Optronics Market Size, Trends & Analysis - Forecasts to 2027 By System (Targeting system, Reconnaissance system, Search & track system, Surveillance system, Warning/detection system, Countermeasure system, Navigation & guidance system, Special mission system), By Technology (Multispectral, Hyperspectral), By Application (Commercial, Military, Space), By Aircraft Type (Fixed Wing, Rotary Wing, Urban Air Mobility, Unmanned Aerial Vehicles), By End-Use (OEM, Aftermarket), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

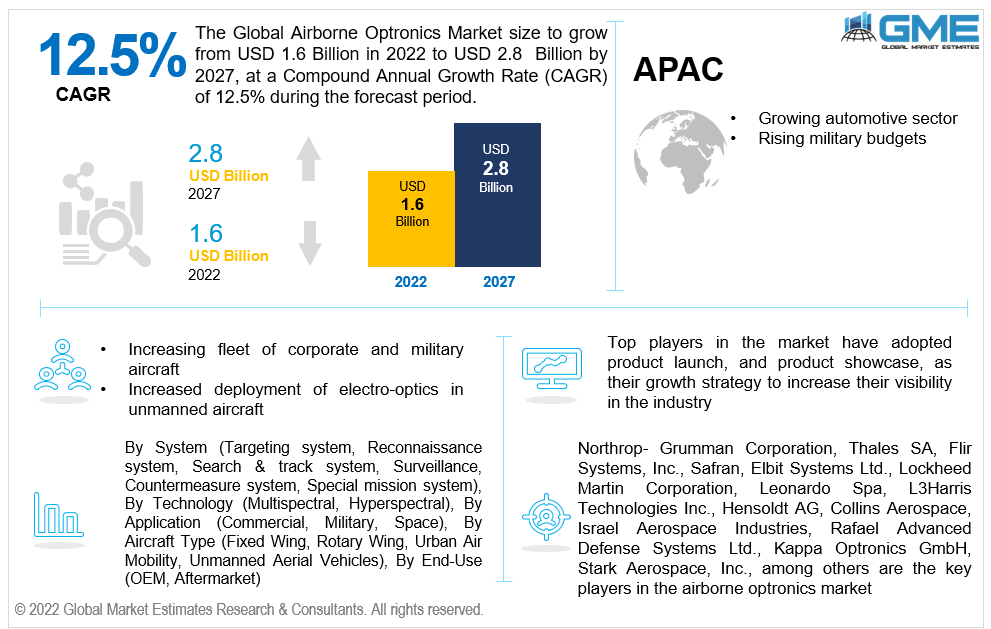

The Global Airborne Optronics Market is projected to grow from USD 1.6 billion in 2022 to USD 2.8 billion by 2027 at a CAGR value of 12.5% from 2022 to 2027.

Innovative approaches in the mission administration of present and next-generation ground attack aircraft have resulted from technological advances in the field of optronics. Most military forces across the world deploy tactical systems like laser range finders (LRFs), laser radars (LADARs), and laser target designators (LTDs), and new promising laser technologies are being researched. An increasing fleet of corporate and military aircraft, as well as increased deployment of electro-optics in unmanned aircraft, are driving the industry during the forecast period.

Market expansion is being driven by quickly developing technology to address new protection and stability challenges, good range identification and high-resolution imaging characterization, and the growing requirement for enhanced accuracy along with real-time surveillance systems in military and aeronautics; are propelling the market growth during the forecast period.

Furthermore, advantages such as immediate imagery description of the operation aiding in speedier decision making as well as improvements in surveillance technology for end-use industries like aerospace, defense, and many others, are also boosting the market growth. However, there is a huge cost incurred in procuring devices, and the over sensitivity of the devices are major restraint on the global airborne optronics market.

Airborne optronics aids in the simplification and transmission of data acquired to the vessel or UAV operators, as well as improving the operator's or pilot's spatial awareness by providing specific and timely data on the battlefields driving demand. The occurrence of advanced features for sensing the potential danger of weapon systems and their power to destroy them has resulted in a rising demand for airborne optronics by the naval forces of many countries. In addition, a rise in demand for airborne optronics has emerged from increased demand for simpler mechanisms in aerial warfare.

COVID-19 has impeded the growth of the airborne optronics business and has resulted in the suspension of operations of various aircrafts, including commercial, military, and spacecraft. Key industry participants have seen a significant drop in airborne optronics sales, which has had a negative influence on the market.

Based on the system, the market is segmented into a targeting system, reconnaissance system, search & track system, surveillance system, warning or detection system, countermeasure system, navigation & guidance system, and special mission system.

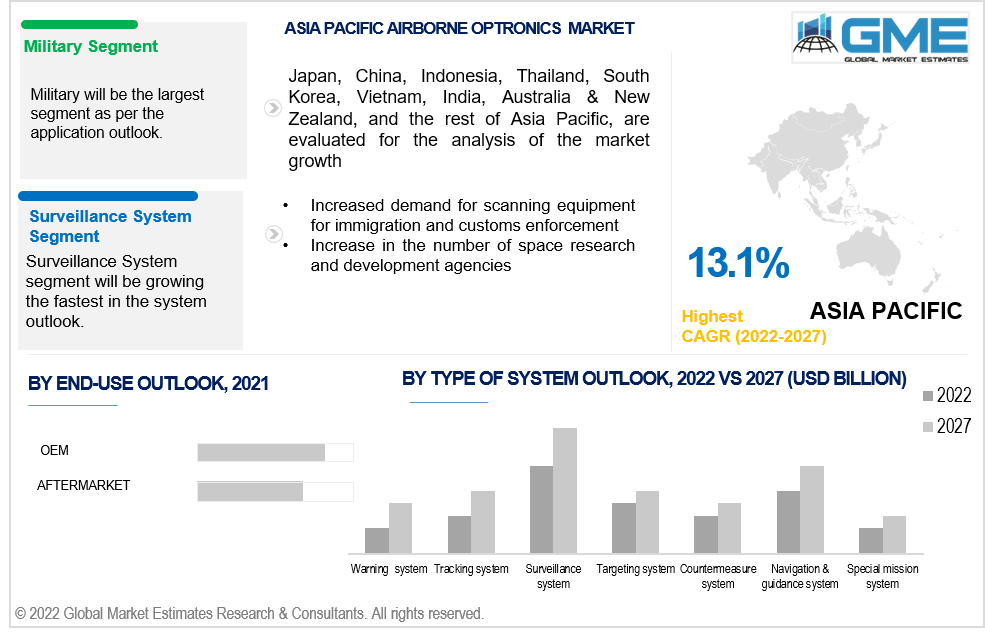

The surveillance system segment is expected to grow the fastest in the airborne optronics market from 2022 to 2027. The rising demand and need for security and protection among all the market sectors, increasing demand for advanced tracking and surveillance systems and devices, and managing complexities of security process smoothly by defense operations are contributing to segment growth.

The market is segmented into multispectral and hyperspectral based on technology. The multispectral segment is expected to grow the fastest in the airborne optronics market from 2022 to 2027. Multispectral imaging technology overcomes the limits of human sight by capturing significant information across the photonic spectrum with spectral imaging. It may also be used to distinguish land surface characteristics and landscape formations, as well as identify and characterize materials, thereby driving the market growth.

The market is divided into commercial, military, and space, based on the application. The military sector segment is expected to hold a larger share as compared to other segments. The rising geopolitical issues around the world, increasing cases of terrorist attacks in the countries, and growing demand from military and pilots to have hands-on airborne optronics system is driving the market growth globally.

The market is segmented into fixed-wing, rotary-wing, urban air mobility, and unmanned aerial vehicles based on aircraft type. The unarmed aerial vehicles (UAVs) segment is expected to grow the fastest in the airborne optronics market from 2022 to 2027. The growth can be owing to the economic cost of most variations, drones have become more accessible to a wider range of users. In addition, UAVs have a more comprehensive range of motion than human aircraft. They can fly deeper and, in more orientations, making it easier to traverse historically difficult-to-reach regions.

The market is segmented into OEM, and aftermarket based on end-use. The OEM segment is expected to grow the fastest in the airborne optronics market from 2022 to 2027. The biggest advantage of OEM equipment is its affordability. OEM solutions have a lower production cost due to the economy of scale. Furthermore, shorter lead periods, cheaper pricing, quicker solicitation replies, and better customer service are all aiding segment growth.

As per the geographical analysis, the airborne optronics market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the airborne optronics market from 2022 to 2027. The growing demand for advanced optronics devices, the prevalence of most prominent players in the market, the rise in commercial aircraft orders and supplies along with increasing investment in R&D activities by the firms in the market are contributing to regional growth.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the airborne optronics market during the forecast period. The region's growing automotive sector, rising military budgets, increased demand for scanning equipment for immigration and customs enforcement, and an increase in the number of space research and development agencies are all driving market growth.

Northrop- Grumman Corporation, Thales SA, Flir Systems, Inc., Safran, Elbit Systems Ltd., Lockheed Martin Corporation, Leonardo Spa, L3Harris Technologies Inc., Hensoldt AG, Collins Aerospace, Israel Aerospace Industries, Rafael Advanced Defense Systems Ltd., Kappa Optronics GmbH, Stark Aerospace, Inc., among others are the key players in the global airborne optronics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Airborne Optronics Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 System Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.5 Aircraft Type Overview

2.1.6 End-Use Overview

2.1.7 Regional Overview

Chapter 3 Airborne Optronics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for airborne optronics among all sectors

3.3.1.2 Increasing need for advanced transparent and accurate surveillance systems

3.3.2 Industry Challenges

3.3.2.1 The over sensitivity of the devices

3.4 Prospective Growth Scenario

3.4.1 System Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 WRITE Growth Scenario

3.4.4 Aircraft Type Growth Scenario

3.4.5 End-Use Scenario

3.4.6 Regional Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Airborne Optronics Market, By System

4.1 System Outlook

4.2 Reconnaissance system

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Targeting system

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Search and track system

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Surveillance system

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Warning/detection system

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

4.7 Countermeasure system

4.7.1 Market Size, By Region, 2022-2027 (USD Billion)

4.8 Navigation and guidance system

4.8.1 Market Size, By Region, 2022-2027 (USD Billion)

4.9 Special mission system

4.9.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Airborne Optronics Market, By Technology

5.1 Technology Outlook

5.2 Multispectral

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Hyperspectral

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Airborne Optronics Market, By WRITE

6.1 Commercial

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Military

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Space

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Airborne Optronics Market, By Aircraft Type

7.1 Fixed Wing

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Rotary Wing

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Urban Air Mobility

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

7.4 Unmanned Aerial Vehicles

7.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Airborne Optronics Market, By End-Use

8.1 OEM

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Aftermarket

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 Airborne Optronics Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2022-2027 (USD Billion)

9.2.2 Market Size, By System, 2022-2027 (USD Billion)

9.2.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.4 Market Size, By Application, 2022-2027 (USD Billion)

9.2.5 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.2.6 Market Size, By End-Use, 2022-2027 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By System, 2022-2027 (USD Billion)

9.2.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.2.7.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.2.7.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By System, 2022-2027 (USD Billion)

9.2.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.2.8.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.2.8.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By System, 2022-2027 (USD Billion)

9.2.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.2.9.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.2.9.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2022-2027 (USD Billion)

9.3.2 Market Size, By System, 2022-2027 (USD Billion)

9.3.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.4 Market Size, By Application, 2022-2027 (USD Billion)

9.3.5 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.3.6 Market Size, By End-Use, 2022-2027 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By System, 2022-2027 (USD Billion)

9.3.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.7.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.3.7.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By System, 2022-2027 (USD Billion)

9.3.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.8.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.3.8.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By System, 2022-2027 (USD Billion)

9.3.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.9.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.3.9.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By System, 2022-2027 (USD Billion)

9.3.10.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.10.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.10.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.3.10.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2022-2027 (USD Billion)

9.4.2 Market Size, By System, 2022-2027 (USD Billion)

9.4.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.4 Market Size, By Application, 2022-2027 (USD Billion)

9.4.5 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.4.6 Market Size, By End-Use, 2022-2027 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By System, 2022-2027 (USD Billion)

9.4.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.4.7.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.4.7.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By System, 2022-2027 (USD Billion)

9.4.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.4.8.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.4.8.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By System, 2022-2027 (USD Billion)

9.4.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.4.9.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.4.9.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2022-2027 (USD Billion)

9.5.2 Market Size, By System, 2022-2027 (USD Billion)

9.5.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.4 Market Size, By Application, 2022-2027 (USD Billion)

9.5.5 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.5.6 Market Size, By End-Use, 2022-2027 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By System, 2022-2027 (USD Billion)

9.5.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.5.7.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.5.7.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By System, 2022-2027 (USD Billion)

9.5.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.5.8.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.5.8.5 Market Size, By End-Use, 2022-2027 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By System, 2022-2027 (USD Billion)

9.5.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.5.9.4 Market Size, By Aircraft Type, 2022-2027 (USD Billion)

9.5.9.5 Market Size, By End-Use, 2022-2027 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2022

10.2 Northrop Grumman Corporation

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Infographic Analysis

10.3 Thales SA

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Infographic Analysis

10.4 Flir Systems, Inc.

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Infographic Analysis

10.5 Safran

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Infographic Analysis

10.6 Elbit Systems Ltd.

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Infographic Analysis

10.7 Lockheed Martin Corporation

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Infographic Analysis

10.8 Leonardo Spa

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Strategic Positioning

10.8.4 Infographic Analysis

10.9 L3Harris Technologies Inc.

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Infographic Analysis

10.10 Collins Aerospace

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Infographic Analysis

10.11 Israel Aerospace Industries

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Infographic Analysis

10.12 Rafael Advanced Defense Systems Ltd.

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Infographic Analysis

10.13 Kappa Optronics GmbH

10.13.1 Company Overview

10.13.2 Financial Analysis

10.13.3 Strategic Positioning

10.13.4 Infographic Analysis

10.14 Stark Aerospace, Inc.

10.14.1 Company Overview

10.14.2 Financial Analysis

10.14.3 Strategic Positioning

10.14.4 Infographic Analysis

10.15 Excelitas Technologies Corporation

10.15.1 Company Overview

10.15.2 Financial Analysis

10.15.3 Strategic Positioning

10.15.4 Infographic Analysis

10.16 Osi Optoelectronics, Inc.

10.16.1 Company Overview

10.16.2 Financial Analysis

10.16.3 Strategic Positioning

10.16.4 Infographic Analysis

10.17 Leidos Holdings, Inc.

10.17.1 Company Overview

10.17.2 Financial Analysis

10.17.3 Strategic Positioning

10.17.4 Infographic Analysis

10.18 Ii-Vi, Inc.

10.18.1 Company Overview

10.18.2 Financial Analysis

10.18.3 Strategic Positioning

10.18.4 Infographic Analysis

10.19 Bae Systems plc

10.19.1 Company Overview

10.19.2 Financial Analysis

10.19.3 Strategic Positioning

10.19.4 Infographic Analysis

10.20 Aselsan A.a.

10.20.1 Company Overview

10.20.2 Financial Analysis

10.20.3 Strategic Positioning

10.20.4 Infographic Analysis

10.21 Intevac, Inc.

10.21.1 Company Overview

10.21.2 Financial Analysis

10.21.3 Strategic Positioning

10.21.4 Infographic Analysis

10.22 Ximea GmbH

10.22.1 Company Overview

10.22.2 Financial Analysis

10.22.3 Strategic Positioning

10.22.4 Infographic Analysis

10.23 Headwall Photonics, Inc.

10.23.1 Company Overview

10.23.2 Financial Analysis

10.23.3 Strategic Positioning

10.23.4 Infographic Analysis

10.24 Cubert GmbH

10.24.1 Company Overview

10.24.2 Financial Analysis

10.24.3 Strategic Positioning

10.24.4 InfoGraphic Analysis

10.25 Other Companies

10.25.1 Company Overview

10.25.2 Financial Analysis

10.25.3 Strategic Positioning

10.25.4 Infographic Analysis

The Global Airborne Optronics Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Airborne Optronics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS