Global Aircraft Electrification Market Size, Trends & Analysis - Forecasts to 2027 By Component (Batteries, Fuel Cells, Solar Cells, Electric Actuators, Electric Pumps, Generators, Motors, Power Electronics, Distribution Devices), By Technology (More Electric, Hybrid Electric, Fully Electric), By Application (Power Generation, Power Distribution, Power Conversion, Energy Storage), By Platform (Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles (UAVs), Advanced Air Mobility), By System (Propulsion System, Environmental Control System, Landing Gear System, Ice Protection System, Flight Control System, Thrust Reverser System), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

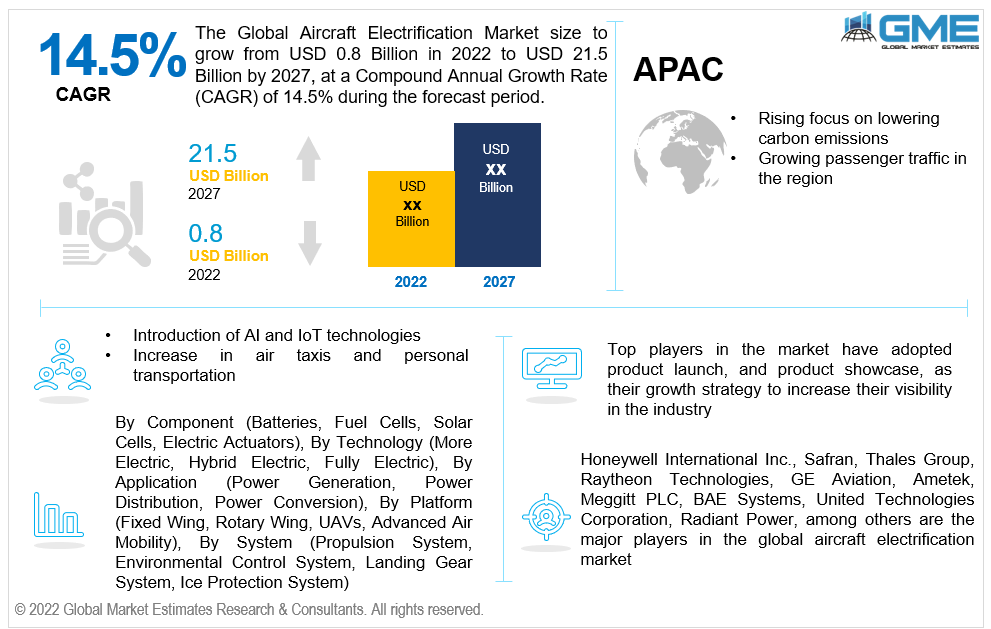

The Global Aircraft Electrification Market is projected to grow from USD 0.8 billion in 2022 to USD 21.5 billion by 2027 at a CAGR value of 14.5% from 2022 to 2027.

In 2019, aircraft accounted for about 9% of total transportation energy used in the United States. Though it is a tiny fraction, the US Energy Information Administration (EIA) estimated in 2019 that air will be the only mode of transportation to see a persistent rise in energy usage, reaching 14% by 2050. Some of the major factors driving the growth of the global aircraft electrification market are an increase in global government concerns about environmental pollution, stringent rules concerning carbon emissions via aeroplanes by the aircraft industry to reduce noise exposure, and low operating costs.

Between 2019 and 2050, the EIA predicts a 60 per cent rise in commercial air travel seat miles, with a 38 per cent increase in energy use and a 12 per cent increase in fuel efficiency in seat miles per gallon. During the forecast period, market growth will be fueled by the supply of commercial jet gas mileage, rising adoption of sustainable and environmentally friendly aircraft, and advancements in advanced air manoeuvrability.

The increased requirement for aerial surveys is driving market expansion and assessments for agricultural and emergency relief, rising military planning and monitoring usage, increasing need for training flights and recreation and distributing high-value cargo such as vital medical supplies.

Factors such as passenger-related applications include urban air mobility, rural passenger accessibility providing remote area movement as well as accessibility for business trips, and large-scale commercial air service fuel market expansion during the forecast period.

The introduction of AI and IoT technologies increased air taxis and personal transportation, and rising demand for eVTOL aircrafts. Furthermore, anticipated operating cost reductions and decreased long-term financial benefits are the most compelling reasons for aircraft operators and manufacturers to electrify their fleets. Ampaire, for instance, claims that its 15-passenger aircraft will cut fuel expenditures by 90% and cost of maintenance by 50%, resulting in market growth.

Electric hybrid planes are predicted to expand fastest in regional markets, defined as markets with journeys of fewer than 500 kilometres (310 miles). According to the NASA Regional Air Mobility report, only 30 (0.6%) of the 5,050 public airports in the United States support 70% of domestic air travel.

Furthermore, a mix of technologies incorporating drop-in replacement fuels such as SAF, an affordable and clean alternative that reduces time and expenses while spurring economic development by reaching neglected areas, drives market expansion.

The prevailing air travel disruption, with spectacular reductions in flights due to the COVID-19 pandemic and a shift towards lower-occupancy passenger vehicle alternatives, may create opportunities for small, low-cost, low-emission aircraft by reducing passenger loads while lowering carbon emissions per mile travelled and increasing the frequency of air travel arrivals and departures that better correspond with traveller requirements.

The poor energy density of batteries, the shortage of experienced people managing these products and services, and the limited selection and capacities of electric aircraft are limiting the market growth for electric aircraft producers.

The market is segmented into batteries, fuel cells, solar cells, electric actuators, electric pumps, generators, motors, power electronics, and distribution devices based on the component. The batteries segment is expected to grow the fastest in the aircraft electrification market from 2022 to 2027.

The capability of Li-S batteries to collect and release the energy allows for the creation of batteries that can hold up to five times the capacity of lithium for the same size and weight. Lithium titanate, also known as lithium titanium oxide, is a rechargeable battery with a reduced energy density than conventional lithium-ion batteries.

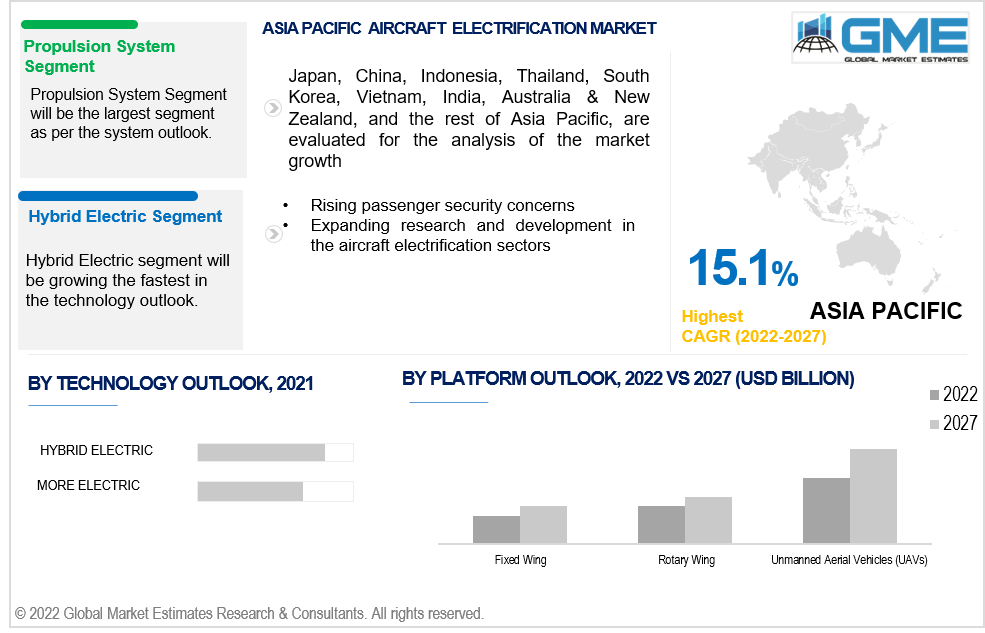

The market is segmented into more electric, hybrid electric, and fully electric based on the technology. The hybrid-electric segment is expected to grow the fastest in the aircraft electrification market from 2022 to 2027. One of the most significant advantages of a hybrid vehicle over a gasoline-powered car is that it is cleaner to drive and has greater gas efficiency, making it more ecologically friendly.

Based on the application, the market is segmented into power generation, power distribution, power conversion, and energy storage. The power generation segment is expected to grow the fastest in the aircraft electrification market from 2022 to 2027.

Traditional aeroplanes use physical hydraulic or pneumatic technology to generate energy, whereas advanced aircraft employ an electric generator. In wide-body and enormous aircraft, key airline companies favour integrated drive units over variable speed generators because these engines are more accurate and effective.

Fixed-wing, rotary-wing, unmanned aerial vehicles (UAVs), and advanced air mobility are segmented based on application. The unmanned aerial vehicles (UAVs) segment is expected to grow the fastest in the aircraft electrification market from 2022 to 2027. UAVs have a more comprehensive range of motion than human aircraft. They can fly deeper and, in more orientations, making it easier to traverse historically difficult-to-reach regions.

The market is segmented into propulsion systems, environmental control systems, landing gear systems, ice protection systems, flight control systems, and thrust reverser systems based on the system. The propulsion system segment is expected to grow the fastest in the aircraft electrification market from 2022 to 2027. They offer increased manoeuvrability and significant redundancy and improved payload due to the ability to move equipment components around.

As per the geographical analysis, the aircraft electrification market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the aircraft electrification market from 2022 to 2027. The growing percentage of future developments and the presence of various enterprises promoting the electrification of the aviation sector are some of the factors contributing to the growth of the North American aircraft electrification market.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the aircraft electrification market during the forecast period. The focus on lowering carbon emissions and aviation noise is becoming more intense and boosting the market growth. Also, growing passenger traffic in the region, rising passenger security concerns and expanding research and development in the aircraft electrification sectors are driving market expansion.

Honeywell International Inc., Safran, Thales Group, Raytheon Technologies, GE Aviation, Ametek, Meggitt PLC, BAE Systems, United Technologies Corporation, Radiant Power, among others, are the major players in the global aircraft electrification market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aircraft Electrification Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.5 Platform Overview

2.1.6 System Overview

2.1.7 Regional Overview

Chapter 3 Aircraft Electrification Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rising need for safer, cleaner aircraft with lower emissions

3.3.1.2 The growing emergence of more electrified aircraft

3.3.2 Industry Challenges

3.3.2.1 The poor energy density of batteries

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Platform Growth Scenario

3.4.5 System Scenario

3.4.6 Regional Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Aircraft Electrification Market, By Component

4.1 Component Outlook

4.2 Batteries

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Fuel Cells

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Solar Cells

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Electric Actuators

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Electric Pumps

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

4.7 Generators

4.7.1 Market Size, By Region, 2022-2027 (USD Billion)

4.8 Motors

4.8.1 Market Size, By Region, 2022-2027 (USD Billion)

4.9 Power Electronics

4.9.1 Market Size, By Region, 2022-2027 (USD Billion)

4.10 Distribution Devices

4.10.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Aircraft Electrification Market, By Technology

5.1 Technology Outlook

5.2 More Electric

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Hybrid Electric

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Fully Electric

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Aircraft Electrification Market, By Application

6.1 Power Generation

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Power Distribution

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Power Conversion

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Energy Storage

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Aircraft Electrification Market, By Platform

7.1 Fixed Wing

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Rotary Wing

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Unmanned Aerial Vehicles (UAVs)

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

7.4 Advanced Air Mobility

7.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Aircraft Electrification Market, By System

8.1 Propulsion System

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Environmental Control System

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.3 Landing Gear System

8.3.1 Market Size, By Region, 2022-2027 (USD Billion)

8.4 Ice Protection System

8.4.1 Market Size, By Region, 2022-2027 (USD Billion)

8.5 Flight Control System

8.5.1 Market Size, By Region, 2022-2027 (USD Billion)

8.6 Thrust Reverser System

8.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 Aircraft Electrification Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2022-2027 (USD Billion)

9.2.2 Market Size, By Component, 2022-2027 (USD Billion)

9.2.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.4 Market Size, By Application, 2022-2027 (USD Billion)

9.2.5 Market Size, By Platform, 2022-2027 (USD Billion)

9.2.6 Market Size, By System, 2022-2027 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.2.7.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.2.7.5 Market Size, By System, 2022-2027 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.2.8.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.2.8.5 Market Size, By System, 2022-2027 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.2.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.2.9.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.2.9.5 Market Size, By System, 2022-2027 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2022-2027 (USD Billion)

9.3.2 Market Size, By Component, 2022-2027 (USD Billion)

9.3.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.4 Market Size, By Application 2022-2027 (USD Billion)

9.3.5 Market Size, By Platform, 2022-2027 (USD Billion)

9.3.6 Market Size, By System, 2022-2027 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.7.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.3.7.5 Market Size, By System, 2022-2027 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.8.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.3.8.5 Market Size, By System, 2022-2027 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.9.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.3.9.5 Market Size, By System, 2022-2027 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.10.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.3.10.3 Market Size, By Application, 2022-2027 (USD Billion)

9.3.10.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.3.10.5 Market Size, By System, 2022-2027 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2022-2027 (USD Billion)

9.4.2 Market Size, By Component, 2022-2027 (USD Billion)

9.4.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.4 Market Size, By Application, 2022-2027 (USD Billion)

9.4.5 Market Size, By Platform, 2022-2027 (USD Billion)

9.4.6 Market Size, By System, 2022-2027 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.4.7.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.4.7.5 Market Size, By System, 2022-2027 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.4.8.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.4.8.5 Market Size, By System, 2022-2027 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.4.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.4.9.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.4.9.5 Market Size, By System, 2022-2027 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2022-2027 (USD Billion)

9.5.2 Market Size, By Component, 2022-2027 (USD Billion)

9.5.3 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.4 Market Size, By Application, 2022-2027 (USD Billion)

9.5.5 Market Size, By Platform, 2022-2027 (USD Billion)

9.5.6 Market Size, By System, 2022-2027 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.7.3 Market Size, By Application, 2022-2027 (USD Billion)

9.5.7.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.5.7.5 Market Size, By System, 2022-2027 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.8.3 Market Size, By Application, 2022-2027 (USD Billion)

9.5.8.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.5.8.5 Market Size, By System, 2022-2027 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

9.5.9.3 Market Size, By Application, 2022-2027 (USD Billion)

9.5.9.4 Market Size, By Platform, 2022-2027 (USD Billion)

9.5.9.5 Market Size, By System, 2022-2027 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2022

10.2 Honeywell International Inc.

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Infographic Analysis

10.3 Safran

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Infographic Analysis

10.4 Thales Group

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Infographic Analysis

10.5 Raytheon Technologies

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Infographic Analysis

10.6 GE Aviation

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Infographic Analysis

10.7 Ametek

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Infographic Analysis

10.8 Meggitt PLC

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Infographic Analysis

10.11 BAE Systems

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Infographic Analysis

10.10 United Technologies Corporation

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Infographic Analysis

10.11 Radiant Power Corporation

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Infographic Analysis

10.12 Other Companies

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Infographic Analysis

The Global Aircraft Electrification Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aircraft Electrification Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS