Global Alternative Fuel and Hybrid Vehicle Market Size, Trends & Analysis - Forecasts to 2027 By Fuel Type (Hybrid Vehicles, Plugin Hybrid Vehicles, Battery Electric Vehicles and Others [Gaseous Fuels, Biofuels]), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Vehicle Class (Economical Vehicles, Mid-priced Vehicles, and Luxury Vehicles), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Share Analysis, and Competitor Analysis

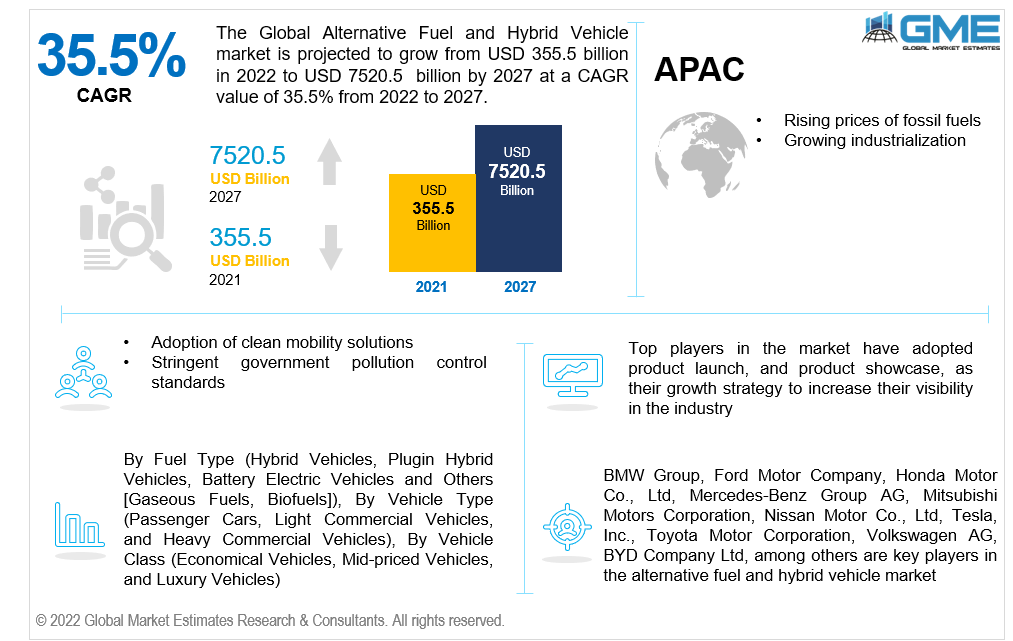

The global alternative fuel and hybrid vehicle market are projected to grow from USD 355.5 Billion in 2022 to USD 7520.5 Billion in 2027 at a CAGR value of 35.5% from 2022 to 2027.

With emissions from mobility expanding at a faster rate than those from other sectors, and with an anticipated tripling of these emissions by 2050, the transportation sector is critical in mitigating climate change. Due to various escalating concerns about the environment and pollution issues, as well as greater subsidies and restrictions from local, state, and federal governments that encourage their usage, the use of this alternative fuel and hybrid vehicles has expanded in recent years.

The decline in global oil reserves, the rise in fossil fuel prices, the adoption of clean mobility solutions, stringent government pollution control standards, and the expansion of supportive policies to encourage the implementation of alternative fuel vehicles are all factors driving the market's growth.

According to studies, their use can reduce hazardous pollutants and greenhouse gas emissions, lower tailpipe emissions of fine particulates and poisonous gases and improve air quality in urban areas, all of which are factors driving market expansion throughout the forecast period.

Biofuels' capacity to comply with federal air quality rules in non-attainment or maintenance zones, as well as achieve regional objectives like promoting the usage of fuels produced from domestic sources, is propelling the market growth.

Furthermore, recent oil price hikes, reduced dependence on foreign oil, and industrial associations campaigning for specific biofuels are all driving market expansion upward.

Since the carbon dioxide emitted from biodiesel burning is compensated by carbon dioxide collected from producing soybeans and other feedstocks used to produce the fuel, using this reduces life cycle emissions. Alternative fuels lower carbon dioxide emissions by 74% when compared to petroleum diesel, as per a life cycle analysis conducted by Argonne National Laboratory. Improved fuel lubricity, an increase in the cetane number, and a safer fuel than petroleum diesel owing to its less-flammable nature are also expected to drive market expansion throughout the forecast period.

HEVs are more fuel-efficient and cost less to operate than comparable conventional vehicles. For instance, the 2012 Honda Civic Hybrid has a combined city-highway gas mileage estimate of 44 miles per gallon, whereas the conventional 2012 Civic has a combined city-highway fuel economy estimate of 32 miles per gallon.

Other benefits of HEVs include less dependency on imported petroleum, improved power independence, and greater residual value, as HEVs are becoming more popular, and because of their favourable technology, HEVs can typically have a higher perceived value.

However, increased capital costs of electric and hybrid vehicles and related infrastructure, higher operating costs, such as maintenance and fuel expenses, reliability and quality considerations, restricted alternative fuel accessibility, and the threat of fuel delivery disruptions are some of the factors that hinder the market growth.

The COVID-19 pandemic caused supply-chain disruptions, resulting in a halt in vehicle production and poor passenger car sales around the world. Furthermore, during the COVID-19 period, government-imposed lockdowns resulted in a halt in manufacturing and a fall in demand for alternate vehicles. The elimination of lockdown restrictions, on the other hand, has increased electric car sales. This increase in electric car sales is likely to help the alternative fuel and hybrid vehicle markets flourish.

The alternative fuel and hybrid vehicle market are segmented into hybrid vehicles, plugin hybrid vehicles, battery electric vehicles, and others (gaseous fuels, biofuels) based on fuel type.

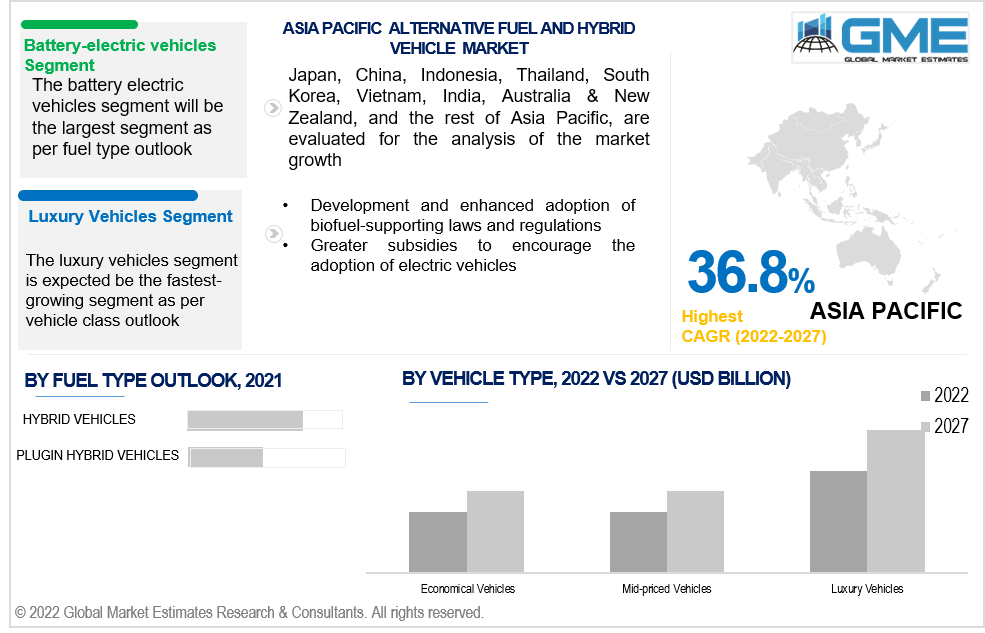

The battery-electric vehicles segment is expected to grow the fastest in the alternative fuel and hybrid vehicle market from 2022 to 2027. Increasing adoption of battery electric vehicles due to advantages such as low carbon footprint, lower running costs, free parking in a few countries, convenience to charge the vehicle at home, and reduced noise pollution are some of the factors driving the segment growth.

The alternative fuel and hybrid vehicle market are segmented as passenger cars, light commercial vehicles, and heavy commercial vehicles based on vehicle type. The passenger cars segment is expected to grow the fastest in the alternative fuel and hybrid vehicle market from 2022 to 2027. The burgeoning population along with rising disposable income, and the ease with which credit and funding can be obtained. Furthermore, the market is expected to see increased demand for passenger vehicles as the logistics and passenger transportation sectors grow.

Based on vehicle class, the alternative fuel and hybrid vehicle market is segmented into economical vehicles, mid-priced vehicles, and luxury vehicles. The luxury vehicles segment is expected to hold a larger share as compared to other segments. Luxury cars give a high degree of safe and comfortable amenities, demand for luxury cars is being fuelled by the increasing movement of electric luxury vehicles around the world.

Also, with growing environmental issues and rising gasoline prices, major luxury car companies are launching electrified variants of their vehicles, which is also likely to drive the expansion of the luxury car market.

As per the geographical analysis, the global alternative fuel and hybrid vehicle market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) region is expected to be the dominant force in the market during the forecasted period. The presence of a considerable amount of feedstock for biofuel production, as well as supporting infrastructure and government incentives for the use of renewable fuels in the region, will lead to market expansion in the region.

The Canadian government has been focusing on yearly reductions of 30 Mt in Gas (GHG) emissions by 2030, as part of the nation's broader goal of a 30.0 percent reduction in GHG emissions by 2030.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the global alternative fuel and hybrid vehicle market during the forecast period. Regional expansion is being fuelled by the development and enhanced adoption of biofuel-supporting laws and regulations, as well as greater subsidies to encourage the adoption of electric vehicles. Other factors expected to boost the market in this area during the forecast period include growing industrialization, increasing disposable income, and significant research and development (R&D) initiatives.

BMW Group, Ford Motor Company, Honda Motor Co., Ltd, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Nissan Motor Co., Ltd, Tesla, Inc., Toyota Motor Corporation, Volkswagen AG, BYD Company Ltd, among others are key players in the alternative fuel and hybrid vehicle market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Alternative Fuel and Hybrid Vehicle Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Fuel Type Overview

2.1.3 Vehicle Type Overview

2.1.4 Vehicle Class Overview

2.1.6 Regional Overview

Chapter 3 Alternative Fuel and Hybrid Vehicle Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Adoption of Clean Mobility Solutions

3.3.1.2 Supportive government policies to encourage the use of alternative fuel vehicles

3.3.2 Industry Challenges

3.3.2.1 The increased capital costs of electric and hybrid vehicles and related infrastructure

3.4 Prospective Growth Scenario

3.4.1 Fuel Type Growth Scenario

3.4.2 Vehicle Type Growth Scenario

3.4.3 Vehicle Class Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-user Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Alternative Fuel and Hybrid Vehicle Market, By Fuel Type

4.1 Fuel Type Outlook

4.2 Hybrid Vehicles

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Plugin Hybrid Vehicles

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Battery Electric Vehicles

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Alternative Fuel and Hybrid Vehicle Market, By Vehicle Type

5.1 Vehicle Type Outlook

5.2 Passenger Cars

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Light Commercial Vehicles

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Heavy Commercial Vehicles

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Alternative Fuel and Hybrid Vehicle Market, By Vehicle Class

6.1 Economical Vehicles

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Mid-priced Vehicles

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Luxury Vehicles

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Alternative Fuel and Hybrid Vehicle Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.2.3 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.2.4 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.3 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.4 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.4.3 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.4.4 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.4.9.2 Market size, By Vehicle Type, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.5.3 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.5.4 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.6.3 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.6.4 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Fuel Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Vehicle Type, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Vehicle Class, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 BMW Group

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Ford Motor Company

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Honda Motor Co., Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Mercedes-Benz Group AG

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Mitsubishi Motors Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Nissan Motor Co., Ltd

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8. Tesla, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Toyota Motor Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Volkswagen AG

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Alternative Fuel and Hybrid Vehicle Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Alternative Fuel and Hybrid Vehicle Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS