Global Antibacterial Drugs Market Size, Trends & Analysis - Forecasts to 2026 By Drug Class (Beta-Lactams, Quinolones, Macrolides, Tetracycline, Aminoglycoside, Sulfonamide, Phenicols, Others), By Route of Administration (Parenteral, Enteral, Oral), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies), By Region (North America, Europe, Asia Pacific, CSA, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

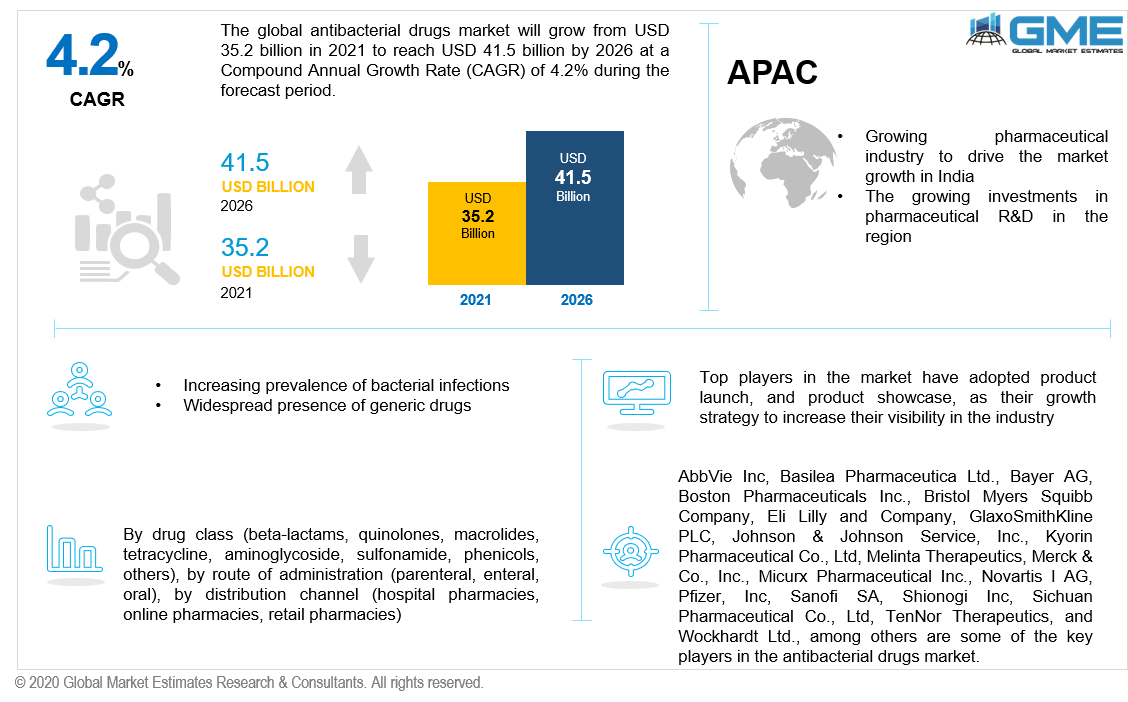

The global antibacterial drugs market will grow from USD 35.2 billion in 2021 to USD 41.5 billion in 2026 at a CAGR of 4.2%.

Antibacterial drugs destroy or inhibit the growth of microorganisms and bacteria. Antibiotics are antibacterial medications that are commonly utilized in the prevention and treatment of infectious diseases. Depending on the microorganism to be tested, different classes of these antibacterial drugs have been developed.

The increasing demand for efficient and inexpensive antibacterial drugs, and also the increasing number of multi-drug resistant bacterial strains, are some of the primary drivers driving the market growth. The other factors supporting the growth of the antibacterial drugs market are the increasing geriatric population, increasing R&D investments for the development of block buster and new drugs, and rising cases of bacterial infection such as pneumonia, tetanus, and tuberculosis across developed and developing regions.

Moreover, a rise in antibiotic resistance infection due to misuse or overdose of antibiotic drugs is likely to change prescription trends toward innovative medicines and target specific drugs to treat bacterial infections. As per the reports by CDC in 2021, it has been observed that there are more than 2.8 million antibiotic-resistant illnesses in the United States. On the contrary, advanced antibiotic development and the introduction of innovative combination medicines to treat antibiotic-resistant microbial illnesses are projected to open up new prospects for market players during the forecast period [2021-2026].

Furthermore, the market for antibacterial drugs will be growing rapidly owing to factors such as the rising number of cancer cases, common infections, tuberculosis, COVID-19, anaemia, etc., and rising geriatric patient pool especially in emerging regions, and the increasing launch of new antibacterial drugs.

The rising support from government organizations in the form of research funds to launch new antibiotic products and the increasing number of clinical trials is also helping the market grow rapidly.

Some of the most prominent players such as Bayer AG, GlaxoSmithKline PLC, Merck & Co., Inc, AstraZeneca PLC, and Pfizer, Inc, are ruling the market as they have a range of FDA-approved product line in the market. Moreover, rising organic and inorganic growth strategies to launch novel drugs is helping the market grow exponentially. For instance, the Global Antibiotic Research and Development Partnership (GARDP) established a public-private partnership with Evotec AG in March 2019 to manufacture first-in-class antibiotic drug for treating drug-resistant bacterial infections in the U.S.

However, a lack of awareness among the population about the dosage of antibiotic drugs and the side effects caused by the use of over the counter antibiotic drugs will restrict the growth of the market growth to some extent.

The coronavirus outbreak caused a major catastrophe in both the health and economic sectors as a result of regulations established by various regulatory bodies pertaining to global lockdown. Many manufacturing industrial operations were halted as a result of the strict lockdown measures, whereas the medicine industry was positively impacted by the outbreak. Antibacterial drugs was in high demand as the coronavirus caused a global health disaster, and there was a sudden rise in need for novel, target specific drugs and antibiotics in most of the parts of the world. Hence the growth of the antibacterial drug market was unharmed.

The antibacterial drugs market is categorized into beta-lactams, quinolones, macrolides, tetracycline, aminoglycoside, sulfonamide, phenicols, and others as per the drug class outlook. The Beta-lactams segment is expected to hold the lion’s share of the market during the forecast period. This is mainly because of the growing number of people suffering from various types of bacterial infections. β-lactams have strong antibacterial resistance and has worked very well on patients across the globe. Moreover, increasing usage of penicillin as the most commonly prescribed drug classes is the other prime factor supporting the growth of this segment.

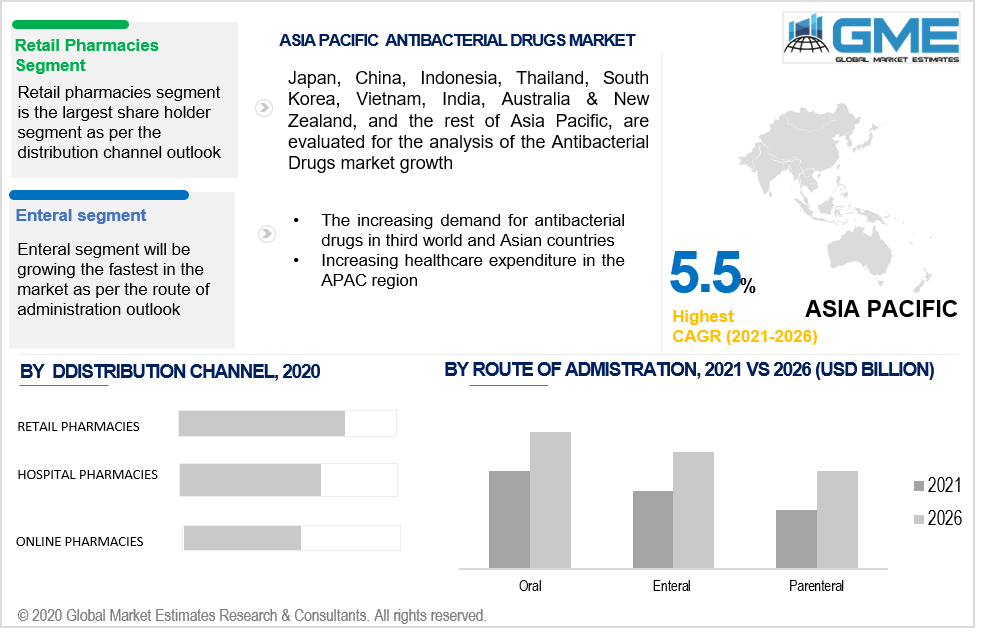

Based on the mode of administration, the market is segmented into parenteral, topical, oral, and others. The oral route of administration is favoured over all other forms of drug administration because it offers various benefits such as hygiene, ease of administration, no discomfort during administration, no need for hospital visit and adaptability to a wide range of treatments.

Based on the distribution channel, the market is segmented into hospital pharmacies, online pharmacies, and retail pharmacies. Retail pharmacies are expected to hold the largest share of the market owing to the increasing number of retail drugs stores and the growing availability of antibacterial drugs in regular retail pharmacies.

As per the geographical analysis, the antibacterial drugs market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The high share of this region is mainly due to the presence of key manufacturers in the United States market, increasing healthcare expenditure, the high availability of drugs through retail pharmacies, and increasing investments in R&D activities for novel antibiotic drug development in order to control the spread of infectious diseases.

However, on the contrary, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising chronic infections, COVID-19 cases, rare and genetic cancer diseases, cardiovascular diseases, and rising consumption of antibiotics will impact the APAC market positively. Moreover, the increase in sales of over-the-counter drugs and the increase in research & development activities in the pharmaceutical industry are some of the leading factors driving the APAC antibacterial drugs market growth.

AbbVie Inc, Basilea Pharmaceutica Ltd., Bayer AG, Boston Pharmaceuticals Inc., Bristol Myers Squibb Company, Debiopharm Group, Eli Lilly and Company, GlaxoSmithKline PLC, Iterum Therapeutics PLC, Johnson & Johnson Service, Inc., Kyorin Pharmaceutical Co., Ltd, Melinta Therapeutics, Merck & Co., Inc., Micurx Pharmaceutical Inc., Novartis International AG, Pfizer, Inc, R-Pharm Group, Sanofi SA, Shionogi Inc, Sichuan Pharmaceutical Co., Ltd, TenNor Therapeutics, Theravance Biopharma, Inc., VenatoRx Pharmaceuticals, Inc, and Wockhardt Ltd., among others are some of the key players in the antibacterial drugs market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2020, Pfizer, Inc. collaborated with Arixa Pharmaceuticals Inc. The company is engaged in developing next-generation oral antibiotics for drug-resistant Gram-negative infections.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Antibacterial Drugs Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Drug Class Overview

2.1.3 Route of Administration Overview

2.1.4 Distribution Channel Overview

2.1.5 Regional Overview

Chapter 3 Global Antibacterial Drugs Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for efficient antibacterial drugs

3.3.1.2 Increasing geriatric population

3.3.2 Industry Challenges

3.3.2.1 High R&D cost associated with novel and block buster drugs

3.4 Prospective Growth Scenario

3.4.1 Drug Class Growth Scenario

3.4.2 Route of Administration Growth Scenario

3.4.3 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Antibacterial Drugs Market, By Drug Class

4.1 Drug Class Outlook

4.2 Beta – lactams

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Quinolones

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Macrolides

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Tetracycline

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Aminoglycoside

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Sulfonamide

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Phenicols

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Others

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Antibacterial Drugs Market, By Route of Administration

5.1 Route of Administration Outlook

5.2 Oral

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Enteral

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Parenteral

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Antibacterial Drugs Market, By Distribution Channel

6.1 Distribution Channel Outlook

6.2 Hospital Pharmacies

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Retail Pharmacies

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Online Pharmacies

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Antibacterial Drugs Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.2.3 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.2.4 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.3 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.4 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Billion)

7.4.2 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.4.3 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.4.4 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Route of Administration, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.5.3 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.5.4 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.6.3 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.6.4 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Drug Class, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Route of Administration, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Distribution Channel, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Allergan, Plc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Novartis AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Bristol Myers Squibb Company

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Johnson and Johnson.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 AstraZeneca

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Merck & Company, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 GlaxoSmithKline Plc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Sanofi SA

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Pfizer Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 Hoffmann-La Roche AG

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Antibacterial Drugs Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Antibacterial Drugs Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS