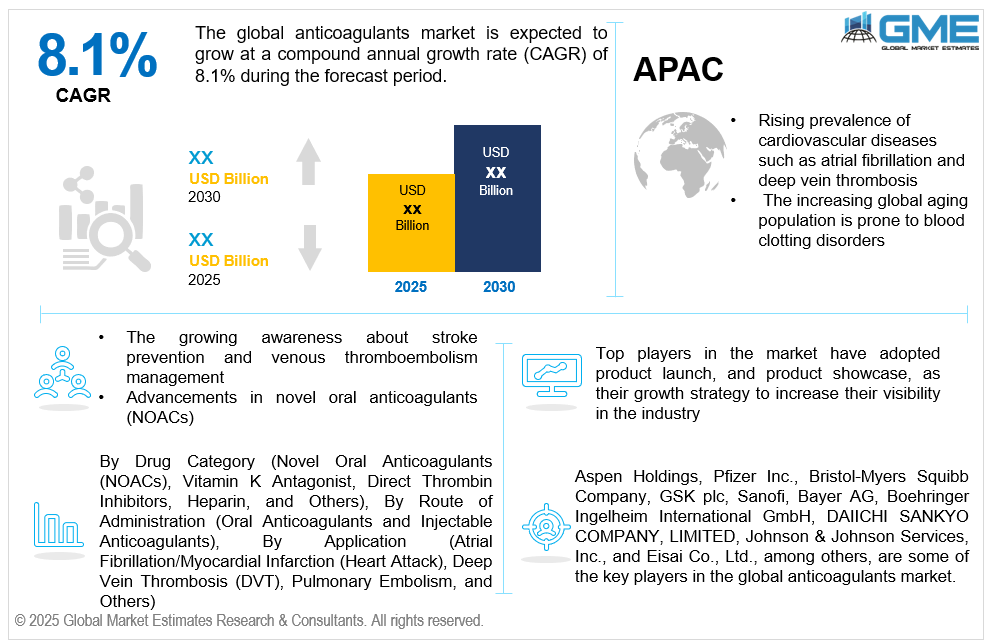

Global Anticoagulants Market Size, Trends & Analysis - Forecasts to 2030 By Drug Category (Novel Oral Anticoagulants (NOACs) [Eliquis, Xarelto, Savaysa & lixiana, and Pradaxa], Vitamin K Antagonist, Direct Thrombin Inhibitors, Heparin, and Others), By Route of Administration (Oral Anticoagulants and Injectable Anticoagulants), By Application (Atrial Fibrillation/Myocardial Infarction (Heart Attack), Deep Vein Thrombosis (DVT), Pulmonary Embolism, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global anticoagulants market is estimated to exhibit a CAGR of 8.1% from 2025 to 2030.

The primary factors propelling the market growth are the rising prevalence of cardiovascular diseases such as atrial fibrillation and deep vein thrombosis, and the increasing global aging population prone to blood clotting disorders. The abnormal heart rhythms of atrial fibrillation greatly raise the danger of blood clots, which can result in stroke and other serious consequences. Similarly, DVT, where blood clots form in deep veins (often in the legs), can result in life-threatening conditions like pulmonary embolism if untreated. With growing sedentary lifestyles, aging populations, and the surge in obesity and hypertension rates worldwide, the incidence of these conditions is escalating. As a result, the demand for effective anticoagulant therapies to prevent and manage clot-related complications is increasing. Healthcare providers are increasingly prescribing anticoagulants such as warfarin, heparin, and novel oral anticoagulants (NOACs) to reduce clotting risks. This trend, coupled with heightened patient awareness and the need for long-term treatment solutions, continues to fuel steady growth in the anticoagulants market globally.

The growing awareness about stroke prevention and venous thromboembolism management, along with the advancements in novel oral anticoagulants (NOACs), are expected to support the market growth. Public health campaigns, educational initiatives by healthcare organizations, and increased physician emphasis on preventive care have led to greater recognition of the risks associated with untreated blood clots. As individuals become more informed about conditions like deep vein thrombosis, pulmonary embolism, and stroke, there is a rising demand for early diagnosis and proactive treatment approaches. Anticoagulants play a crucial role in preventing the formation of dangerous clots, especially in high-risk populations such as the elderly, post-surgical patients, and individuals with atrial fibrillation. Moreover, the accessibility of advanced diagnostic tools has improved the detection rates of clotting disorders, further boosting the need for anticoagulant therapies.

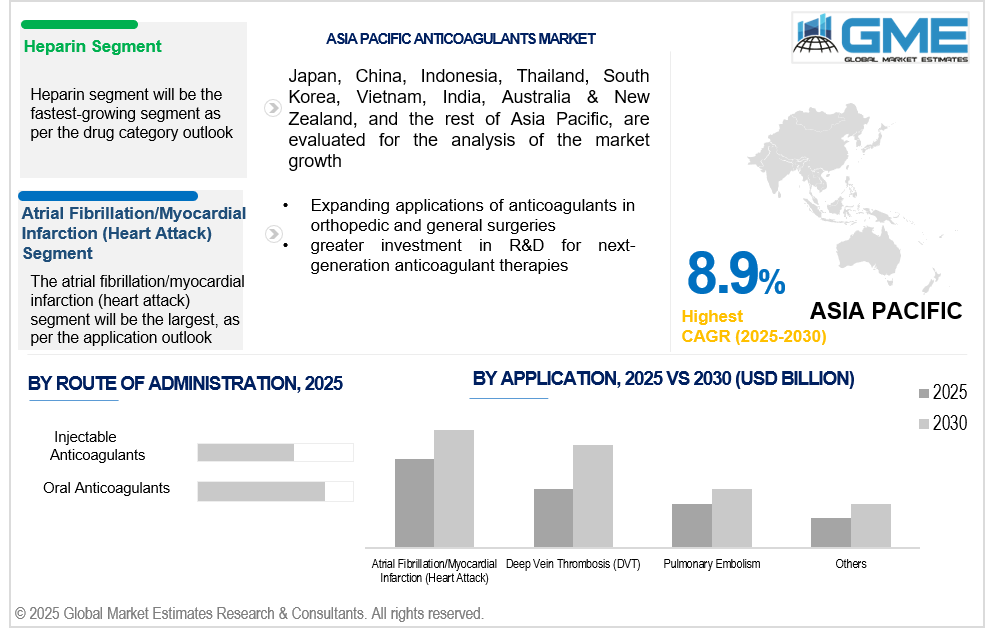

Expanding applications of anticoagulants in orthopedic and general surgeries, coupled with the greater investment in R&D for next-generation anticoagulant therapies, propel market growth. Research organizations and pharmaceutical corporations are investing a lot of money in creating anticoagulants that are safer, more effective, have fewer side effects, are easier to take, and enhance patient adherence. Innovations such as targeted anticoagulants that minimize bleeding risks and therapies with longer half-lives requiring less frequent dosing are gaining momentum. The drawbacks of conventional therapies like warfarin, which need frequent monitoring and dosage modifications, are being addressed by these developments. Additionally, the introduction of novel oral anticoagulants (NOACs) has revolutionized stroke prevention and VTE management, offering more convenient and predictable treatment options. As clinical trials continue to explore new molecules and combination therapies, the pipeline for anticoagulant drugs remains strong.

The rising need for anticoagulant reversal agents during emergencies like major bleeding events presents a crucial opportunity for companies to develop adjunct therapies, creating new revenue streams and improving the safety profile of anticoagulant use. Additionally, the growing trend toward home healthcare creates an opportunity for anticoagulant monitoring devices that allow patients to manage their therapy at home, reducing hospital visits, lowering healthcare costs, and increasing treatment convenience. However, stringent regulatory approval processes and the risk of drug interactions impede market growth.

The novel oral anticoagulants (NOACs) segment is expected to hold the largest share of the market over the forecast period. NOACs act rapidly upon administration and their effects wear off quickly, providing better control during surgical interventions and emergencies. This pharmacological advantage makes NOACs highly suitable for a wide range of clinical applications, increasing their market dominance.

The heparin segment is expected to be the fastest-growing segment in the market from 2025 to 2030. Heparin is a critical anticoagulant used in dialysis treatments and intensive care units (ICUs) to prevent clot formation in extracorporeal circuits, positioning it for strong growth alongside the expansion of global dialysis centers and critical care infrastructure.

The oral anticoagulants segment is expected to hold the largest share of the market over the forecast period. The increasing use of novel oral anticoagulants (NOACs), such as rivaroxaban and apixaban, due to their superior safety profiles and fixed dosing advantages, is driving significant growth and solidifying the oral segment’s leadership position.

The injectable anticoagulants segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. As dialysis and extracorporeal membrane oxygenation (ECMO) treatments expand globally, the use of injectable anticoagulants in maintaining circuit patency is rising sharply, driving faster growth in this route of administration segment within the anticoagulants market.

The atrial fibrillation/myocardial infarction (Heart Attack) segment is expected to hold the largest share of the market over the forecast period. With the rising incidence of myocardial infarction (heart attacks) due to lifestyle factors like poor diet, lack of exercise, and increasing obesity rates, there is a sustained need for anticoagulants to prevent clot formation and reduce complications, enhancing market growth.

The deep vein thrombosis (DVT) segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. DVT is a dangerous illness that can result in complications such the high-mortality pulmonary embolism (PE). As healthcare systems focus on reducing these risks, the use of anticoagulants for DVT treatment continues to increase.

North America is expected to be the largest region in the global market. North America boasts an advanced healthcare infrastructure, with cutting-edge hospitals, specialized clinics, and well-established healthcare systems. This facilitates widespread access to anticoagulant therapies, enabling rapid adoption and solidifying the region’s position as the largest consumer of anticoagulants.

Asia Pacific is anticipated to witness rapid growth during the forecast period. There is a growing emphasis on preventive healthcare across the Asia Pacific region, with patients seeking ways to avoid stroke, heart attack, and other thromboembolic conditions. This rising focus on prevention is leading to increased use of anticoagulants for long-term management.

Aspen Holdings, Pfizer Inc., Bristol-Myers Squibb Company, GSK plc, Sanofi, Bayer AG, Boehringer Ingelheim International GmbH, DAIICHI SANKYO COMPANY, LIMITED, Johnson & Johnson Services, Inc., and Eisai Co., Ltd., among others, are some of the key players in the global anticoagulants market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2024, Novo Nordisk reported that the FDA in the United States had approved its Alhemo (concizumab-mtci) injection. It is anticipated that the approval will expand its portfolio and deepen its dedication to providing treatments for uncommon bleeding disorders.

In October 2024, Pfizer Inc. declared that its HYMPAVZI (marstacimab-hncq), which was created to treat hemophilia A or B without the use of inhibitors, had been approved by the US FDA. It is a preventive subcutaneous therapy administered once a week.

REPORT CONTENT

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL ANTICOAGULANTS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ANTICOAGULANTS MARKET, BY DRUG CATEGORY

4.1 Introduction

4.2 Anticoagulants Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Novel Oral Anticoagulants (NOACs) [Eliquis, Xarelto, Savaysa & lixiana, and Pradaxa]

4.4.1 Novel Oral Anticoagulants (NOACs) [Eliquis, Xarelto, Savaysa & lixiana, and Pradaxa] Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Vitamin K Antagonist

4.5.1 Vitamin K Antagonist Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Direct Thrombin Inhibitors

4.6.1 Direct Thrombin Inhibitors Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Heparin

4.7.1 Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ANTICOAGULANTS MARKET, BY APPLICATION

5.1 Introduction

5.2 Anticoagulants Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Atrial Fibrillation/Myocardial Infarction (Heart Attack)

5.4.1 Atrial Fibrillation/Myocardial Infarction (Heart Attack) Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Deep Vein Thrombosis (DVT)

5.5.1 Deep Vein Thrombosis (DVT) Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Pulmonary Embolism

5.6.1 Pulmonary Embolism Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL ANTICOAGULANTS MARKET, BY ROUTE OF ADMINISTRATION

6.1 Introduction

6.2 Anticoagulants Market: Route of Administration Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Oral Anticoagulants

6.4.1 Oral Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Injectable Anticoagulants

6.5.1 Injectable Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL ANTICOAGULANTS MARKET, BY REGION

7.1 Introduction

7.2 North America Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Drug Category

7.2.2 By Application

7.2.3 By Route of Administration

7.2.4 By Country

7.2.4.1 U.S. Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Drug Category

7.2.4.1.2 By Application

7.2.4.1.3 By Route of Administration

7.2.4.2 Canada Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Drug Category

7.2.4.2.2 By Application

7.2.4.2.3 By Route of Administration

7.2.4.3 Mexico Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Drug Category

7.2.4.3.2 By Application

7.2.4.3.3 By Route of Administration

7.3 Europe Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Drug Category

7.3.2 By Application

7.3.3 By Route of Administration

7.3.4 By Country

7.3.4.1 Germany Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Drug Category

7.3.4.1.2 By Application

7.3.4.1.3 By Route of Administration

7.3.4.2 U.K. Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Drug Category

7.3.4.2.2 By Application

7.3.4.2.3 By Route of Administration

7.3.4.3 France Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Drug Category

7.3.4.3.2 By Application

7.3.4.3.3 By Route of Administration

7.3.4.4 Italy Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Drug Category

7.3.4.4.2 By Application

7.2.4.4.3 By Route of Administration

7.3.4.5 Spain Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Drug Category

7.3.4.5.2 By Application

7.2.4.5.3 By Route of Administration

7.3.4.6 Netherlands Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Drug Category

7.3.4.6.2 By Application

7.2.4.6.3 By Route of Administration

7.3.4.7 Rest of Europe Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Drug Category

7.3.4.7.2 By Application

7.2.4.7.3 By Route of Administration

7.4 Asia Pacific Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Drug Category

7.4.2 By Application

7.4.3 By Route of Administration

7.4.4 By Country

7.4.4.1 China Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Drug Category

7.4.4.1.2 By Application

7.4.4.1.3 By Route of Administration

7.4.4.2 Japan Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Drug Category

7.4.4.2.2 By Application

7.4.4.2.3 By Route of Administration

7.4.4.3 India Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Drug Category

7.4.4.3.2 By Application

7.4.4.3.3 By Route of Administration

7.4.4.4 South Korea Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Drug Category

7.4.4.4.2 By Application

7.4.4.4.3 By Route of Administration

7.4.4.5 Singapore Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Drug Category

7.4.4.5.2 By Application

7.4.4.5.3 By Route of Administration

7.4.4.6 Malaysia Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Drug Category

7.4.4.6.2 By Application

7.4.4.6.3 By Route of Administration

7.4.4.7 Thailand Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Drug Category

7.4.4.7.2 By Application

7.4.4.7.3 By Route of Administration

7.4.4.8 Indonesia Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Drug Category

7.4.4.8.2 By Application

7.4.4.8.3 By Route of Administration

7.4.4.9 Vietnam Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Drug Category

7.4.4.9.2 By Application

7.4.4.9.3 By Route of Administration

7.4.4.10 Taiwan Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Drug Category

7.4.4.10.2 By Application

7.4.4.10.3 By Route of Administration

7.4.4.11 Rest of Asia Pacific Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Drug Category

7.4.4.11.2 By Application

7.4.4.11.3 By Route of Administration

7.5 Middle East and Africa Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Drug Category

7.5.2 By Application

7.5.3 By Route of Administration

7.5.4 By Country

7.5.4.1 Saudi Arabia Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Drug Category

7.5.4.1.2 By Application

7.5.4.1.3 By Route of Administration

7.5.4.2 U.A.E. Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Drug Category

7.5.4.2.2 By Application

7.5.4.2.3 By Route of Administration

7.5.4.3 Israel Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Drug Category

7.5.4.3.2 By Application

7.5.4.3.3 By Route of Administration

7.5.4.4 South Africa Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Drug Category

7.5.4.4.2 By Application

7.5.4.4.3 By Route of Administration

7.5.4.5 Rest of Middle East and Africa Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Drug Category

7.5.4.5.2 By Application

7.5.4.5.2 By Route of Administration

7.6 Central and South America Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Drug Category

7.6.2 By Application

7.6.3 By Route of Administration

7.6.4 By Country

7.6.4.1 Brazil Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Drug Category

7.6.4.1.2 By Application

7.6.4.1.3 By Route of Administration

7.6.4.2 Argentina Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Drug Category

7.6.4.2.2 By Application

7.6.4.2.3 By Route of Administration

7.6.4.3 Chile Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Drug Category

7.6.4.3.2 By Application

7.6.4.3.3 By Route of Administration

7.6.4.4 Rest of Central and South America Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Drug Category

7.6.4.4.2 By Application

7.6.4.4.3 By Route of Administration

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Aspen Holdings

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Pfizer Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Bristol-Myers Squibb Company

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 GSK plc

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Sanofi

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 BAYER AG

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Boehringer Ingelheim International GmbH

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 DAIICHI SANKYO COMPANY LIMITED

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Johnson & Johnson Services, Inc.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Eisai Co., Ltd.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

2 Novel Oral Anticoagulants (NOACs) [Eliquis, Xarelto, Savaysa & lixiana, and Pradaxa] Market, By Region, 2021-2029 (USD Million)

3 Vitamin K Antagonist Market, By Region, 2021-2029 (USD Million)

4 Direct Thrombin Inhibitors Market, By Region, 2021-2029 (USD Million)

5 Heparin Market, By Region, 2021-2029 (USD Million)

6 Others Market, By Region, 2021-2029 (USD Million)

7 Global Anticoagulants Market, By Application, 2021-2029 (USD Million)

8 Atrial Fibrillation/Myocardial Infarction (Heart Attack) Market, By Region, 2021-2029 (USD Million)

9 Deep Vein Thrombosis (DVT) Market, By Region, 2021-2029 (USD Million)

10 Pulmonary Embolism Market, By Region, 2021-2029 (USD Million)

11 Others Market, By Region, 2021-2029 (USD Million)

12 Global Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

13 Oral Anticoagulants Market, By Region, 2021-2029 (USD Million)

14 Injectable Anticoagulants Market, By Region, 2021-2029 (USD Million)

15 Regional Analysis, 2021-2029 (USD Million)

16 North America Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

17 North America Anticoagulants Market, By Application, 2021-2029 (USD Million)

18 North America Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

19 North America Anticoagulants Market, By Country, 2021-2029 (USD Million)

20 U.S Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

21 U.S Anticoagulants Market, By Application, 2021-2029 (USD Million)

22 U.S Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

23 Canada Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

24 Canada Anticoagulants Market, By Application, 2021-2029 (USD Million)

25 Canada Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

26 Mexico Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

27 Mexico Anticoagulants Market, By Application, 2021-2029 (USD Million)

28 Mexico Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

29 Europe Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

30 Europe Anticoagulants Market, By Application, 2021-2029 (USD Million)

31 Europe Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

32 Europe Anticoagulants Market, By Country 2021-2029 (USD Million)

33 Germany Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

34 Germany Anticoagulants Market, By Application, 2021-2029 (USD Million)

35 Germany Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

36 U.K Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

37 U.K Anticoagulants Market, By Application, 2021-2029 (USD Million)

38 U.K Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

39 France Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

40 France Anticoagulants Market, By Application, 2021-2029 (USD Million)

41 France Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

42 Italy Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

43 Italy Anticoagulants Market, By application, 2021-2029 (USD Million)

44 Italy Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

45 Spain Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

46 Spain Anticoagulants Market, By Application, 2021-2029 (USD Million)

47 Spain Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

48 Netherlands Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

49 Netherlands Anticoagulants Market, By Application, 2021-2029 (USD Million)

50 Netherlands Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

51 Rest Of Europe Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

52 Rest Of Europe Anticoagulants Market, By Application, 2021-2029 (USD Million)

53 Rest of Europe Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

54 Asia Pacific Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

55 Asia Pacific Anticoagulants Market, By Application, 2021-2029 (USD Million)

56 Asia Pacific Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

57 Asia Pacific Anticoagulants Market, By Country, 2021-2029 (USD Million)

58 China Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

59 China Anticoagulants Market, By Application, 2021-2029 (USD Million)

60 China Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

61 India Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

62 India Anticoagulants Market, By Application, 2021-2029 (USD Million)

63 India Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

64 Japan Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

65 Japan Anticoagulants Market, By Application, 2021-2029 (USD Million)

66 Japan Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

67 South Korea Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

68 South Korea Anticoagulants Market, By Application, 2021-2029 (USD Million)

69 South Korea Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

70 malaysia Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

71 malaysia Anticoagulants Market, By Application, 2021-2029 (USD Million)

72 malaysia Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

73 Thailand Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

74 Thailand Anticoagulants Market, By Application, 2021-2029 (USD Million)

75 Thailand Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

76 Indonesia Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

77 Indonesia Anticoagulants Market, By Application, 2021-2029 (USD Million)

78 Indonesia Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

79 Vietnam Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

80 Vietnam Anticoagulants Market, By Application, 2021-2029 (USD Million)

81 Vietnam Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

82 Taiwan Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

83 Taiwan Anticoagulants Market, By Application, 2021-2029 (USD Million)

84 Taiwan Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

85 Rest of Asia Pacific Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

86 Rest of Asia Pacific Anticoagulants Market, By Application, 2021-2029 (USD Million)

87 Rest of Asia Pacific Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

88 Middle East and Africa Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

89 Middle East and Africa Anticoagulants Market, By Application, 2021-2029 (USD Million)

90 Middle East and Africa Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

91 Middle East and Africa Anticoagulants Market, By Country, 2021-2029 (USD Million)

92 Saudi Arabia Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

93 Saudi Arabia Anticoagulants Market, By Application, 2021-2029 (USD Million)

94 Saudi Arabia Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

95 UAE Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

96 UAE Anticoagulants Market, By Application, 2021-2029 (USD Million)

97 UAE Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

98 Israel Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

99 Israel Anticoagulants Market, By Application, 2021-2029 (USD Million)

100 Israel Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

101 South Africa Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

102 South Africa Anticoagulants Market, By Application, 2021-2029 (USD Million)

103 South Africa Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Anticoagulants Market, By Application, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

107 Central and South America Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

108 Central and South America Anticoagulants Market, By Application, 2021-2029 (USD Million)

109 Central and South America Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

110 Central and South America Anticoagulants Market, By Country, 2021-2029 (USD Million)

111 Brazil Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

112 Brazil Anticoagulants Market, By Application, 2021-2029 (USD Million)

113 Brazil Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

114 Argentina Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

115 Argentina Anticoagulants Market, By Application, 2021-2029 (USD Million)

116 Argentina Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

117 Chile Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

118 Chile Anticoagulants Market, By Application, 2021-2029 (USD Million)

119 Chile Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

120 Rest of Central and South America Anticoagulants Market, By Drug Category, 2021-2029 (USD Million)

121 Rest of Central and South America Anticoagulants Market, By Application, 2021-2029 (USD Million)

122 Rest of Central and South America Anticoagulants Market, By Route of Administration, 2021-2029 (USD Million)

123 Aspen Holdings: Products & Services Offering

124 Pfizer Inc.: Products & Services Offering

125 Bristol-Myers Squibb Company: Products & Services Offering

126 GSK plc: Products & Services Offering

127 Sanofi: Products & Services Offering

128 BAYER AG: Products & Services Offering

129 Boehringer Ingelheim International GmbH: Products & Services Offering

130 DAIICHI SANKYO COMPANY LIMITED: Products & Services Offering

131 Johnson & Johnson Services, Inc., Inc: Products & Services Offering

132 Eisai Co., Ltd.: Products & Services Offering

133 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Anticoagulants Market Overview

2 Global Anticoagulants Market Value From 2021-2029 (USD Million)

3 Global Anticoagulants Market Share, By Drug Category (2023)

4 Global Anticoagulants Market Share, By Application (2023)

5 Global Anticoagulants Market Share, By Route of Administration (2023)

6 Global Anticoagulants Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Anticoagulants Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Anticoagulants Market

11 Impact Of Challenges On The Global Anticoagulants Market

12 Porter’s Five Forces Analysis

13 Global Anticoagulants Market: By Drug Category Scope Key Takeaways

14 Global Anticoagulants Market, By Drug Category Segment: Revenue Growth Analysis

15 Novel Oral Anticoagulants (NOACs) [Eliquis, Xarelto, Savaysa & lixiana, and Pradaxa] Market, By Region, 2021-2029 (USD Million)

16 Vitamin K Antagonist Market, By Region, 2021-2029 (USD Million)

17 Direct Thrombin Inhibitors Market, By Region, 2021-2029 (USD Million)

18 Heparin Market, By Region, 2021-2029 (USD Million)

19 Others Market, By Region, 2021-2029 (USD Million)

20 Global Anticoagulants Market: By Application Scope Key Takeaways

21 Global Anticoagulants Market, By Application Segment: Revenue Growth Analysis

22 Atrial Fibrillation/Myocardial Infarction (Heart Attack) Market, By Region, 2021-2029 (USD Million)

23 Deep Vein Thrombosis (DVT) Market, By Region, 2021-2029 (USD Million)

24 Pulmonary Embolism Market, By Region, 2021-2029 (USD Million)

25 Others Market, By Region, 2021-2029 (USD Million)

26 Global Anticoagulants Market: By Route of Administration Scope Key Takeaways

27 Global Anticoagulants Market, By Route of Administration Segment: Revenue Growth Analysis

28 Oral Anticoagulants Market, By Region, 2021-2029 (USD Million)

29 Injectable Anticoagulants Market, By Region, 2021-2029 (USD Million)

30 Regional Segment: Revenue Growth Analysis

31 Global Anticoagulants Market: Regional Analysis

32 North America Anticoagulants Market Overview

33 North America Anticoagulants Market, By Drug Category

34 North America Anticoagulants Market, By Application

35 North America Anticoagulants Market, By Route of Administration

36 North America Anticoagulants Market, By Country

37 U.S. Anticoagulants Market, By Drug Category

38 U.S. Anticoagulants Market, By Application

39 U.S. Anticoagulants Market, By Route of Administration

40 Canada Anticoagulants Market, By Drug Category

41 Canada Anticoagulants Market, By Application

42 Canada Anticoagulants Market, By Route of Administration

43 Mexico Anticoagulants Market, By Drug Category

44 Mexico Anticoagulants Market, By Application

45 Mexico Anticoagulants Market, By Route of Administration

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 Aspen Holdings: Company Snapshot

49 Aspen Holdings: SWOT Analysis

50 Aspen Holdings: Geographic Presence

51 Pfizer Inc.: Company Snapshot

52 Pfizer Inc.: SWOT Analysis

53 Pfizer Inc.: Geographic Presence

54 Bristol-Myers Squibb Company: Company Snapshot

55 Bristol-Myers Squibb Company: SWOT Analysis

56 Bristol-Myers Squibb Company: Geographic Presence

57 GSK plc: Company Snapshot

58 GSK plc: Swot Analysis

59 GSK plc: Geographic Presence

60 Sanofi: Company Snapshot

61 Sanofi: SWOT Analysis

62 Sanofi: Geographic Presence

63 BAYER AG: Company Snapshot

64 BAYER AG: SWOT Analysis

65 BAYER AG: Geographic Presence

66 Boehringer Ingelheim International GmbH : Company Snapshot

67 Boehringer Ingelheim International GmbH : SWOT Analysis

68 Boehringer Ingelheim International GmbH : Geographic Presence

69 DAIICHI SANKYO COMPANY LIMITED: Company Snapshot

70 DAIICHI SANKYO COMPANY LIMITED: SWOT Analysis

71 DAIICHI SANKYO COMPANY LIMITED: Geographic Presence

72 Johnson & Johnson Services, Inc., Inc.: Company Snapshot

73 Johnson & Johnson Services, Inc., Inc.: SWOT Analysis

74 Johnson & Johnson Services, Inc., Inc.: Geographic Presence

75 Eisai Co., Ltd.: Company Snapshot

76 Eisai Co., Ltd.: SWOT Analysis

77 Eisai Co., Ltd.: Geographic Presence

78 Other Companies: Company Snapshot

79 Other Companies: SWOT Analysis

80 Other Companies: Geographic Presence

The Global Anticoagulants Market has been studied from the year 2019 till 2030. However, the CAGR provided in the report is from the year 2025 to 2030. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Anticoagulants Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS