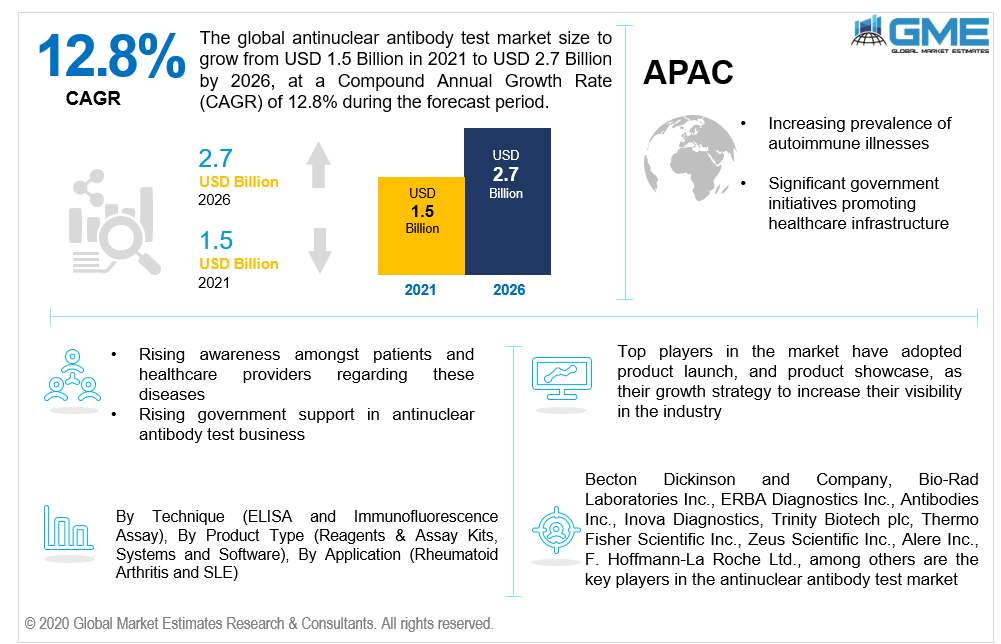

Global Antinuclear Antibody Test Market Size, Trends & Analysis- Forecasts to 2026 By Technique (ELISA and Immunofluorescence Assay), By Product Type (Reagents & Assay Kits, Systems and Software), By Application (Rheumatoid Arthritis and SLE), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global antinuclear antibody test market is projected to grow from USD 1.5 billion in 2021 to USD 2.7 billion by 2026 at a CAGR value of 12.8% from 2021 to 2026.

Antinuclear antibodies (ANAs, also known as antinuclear factor or ANF) are autoantibodies that bind to contents of the cell nucleus. In normal individuals, the immune system produces antibodies to foreign proteins (antigens) but not to human proteins (autoantigens). If anti-nuclear antibodies are found in a person's body, it could indicate that a person has an inflammatory illness. The market is expected to be driven by the increasing prevalence of autoimmune illnesses, as well as rising awareness amongst patients and healthcare providers regarding these diseases, during the forecast period.

The present spike in the need for ANA could be related to variables such as rising demand for early disease diagnosis amongst primary healthcare practitioners' and increasing number of healthcare institutes, hospitals, clinics and centers. Furthermore, the demand for ANA testing has risen because of rising R&D initiatives and developments in healthcare technology, particularly in developing economies such as Brazil and China, rising cases of autoimmune conditions such as inflammatory arthritis and autoimmune, as well as a rise in the usage of antinuclear antibodies tests across developing nations.

The growing prevalence of inflammatory illnesses like Sjogren's Syndrome, Acute Sensory Axonal Neuropathy, and others has boosted ANA testing popularity. As per a report by the Association for Peripheral Neuropathy, Guillain-Barre Syndrome (GBS) impacts 3,000-6,000 individuals in the United States each year. As a consequence, the need for earlier diagnosis for effective treatments is likely to propel the market growth. Infections caused by the Epstein–Barr virus, Campylobacter jejuni, and other viruses are also expected to drive the global ANA market during the forecast period of 2021 to 2026.

The Covid-19 pandemic had a positive impact on the anti-nuclear antibody testing market. The rising awareness regarding early disease diagnosis caused a jump in the number of individuals choosing antinuclear antibody tests which in turn was the key cause for the market's growth. Furthermore, the increased incidences of autoimmune illnesses due to COVID-19 complications, have also contributed to the market’s expansion.

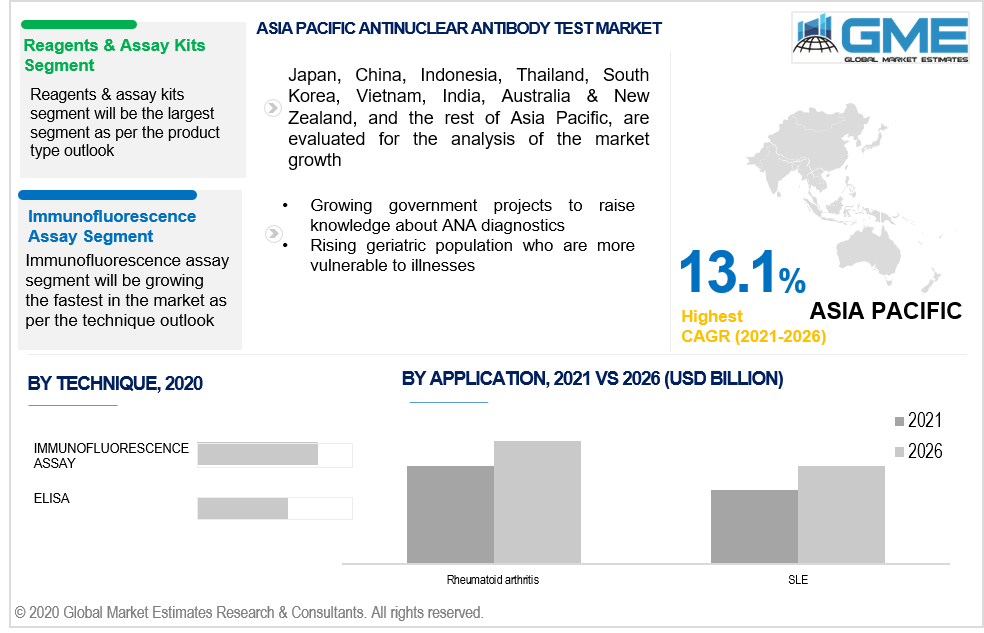

Based on various techniques, the market is segmented into ELISA and immunofluorescence assay. The immunofluorescence assay segment is expected to grow the fastest in the antinuclear antibody test market from 2021 to 2026. The immunofluorescence assay is the most widely used and standard method for ANA testing, as it provides greater sensitivity when compared to other techniques. This test aids in the identification of patterns such as nucleolar, scattered, and homogenous that are related to fundamental illnesses and autoimmunity.

Based on the product type, the market is segmented into reagents & assay kits, software, and systems. The reagents & assay kits segment are expected to grow the fastest in the antinuclear antibody test market from 2021 to 2026. The highest CAGR value is mostly due to a rise in the number of reagent rental partnership strategies and the frequency of autoimmune disorders that has led to increasing demand for reagents.

Based on the application, the market is segmented into rheumatoid arthritis and SLE. The rheumatoid arthritis segment is expected to grow the fastest in the antinuclear antibody test market from 2021 to 2026. The increasing prevalence of rheumatoid arthritis in emerging countries, where 25% of the population suffers from such a chronic rheumatoid arthritis, is the prime factor for the segment’s growth. Moreover, there is high prevalence of children above the age of 18 in the United States with doctor-diagnosed arthritis. Rheumatoid arthritis and osteoarthritis are the two most common disorders in the United States. As a result, the percentage of patients seeking therapy is on the rise.

As per the geographical analysis, the antinuclear antibody test market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the antinuclear antibody test market from 2021 to 2026. The dominance is due to major factor of increasing geriatric population. Geriatric population are more prone to infections due to decreased immunity and lead to high demand for earlier disease diagnosis and effective treatment. For instance, according to the report published by the Centers for Disease Control & Prevention (CDC) in December 2019, people of any age group can develop GBS, but the prevalence of GBS is at higher risk in the people aged over 65 years. This necessitates huge demand due to presence substantial geriatric population in the United States.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the antinuclear antibody test market during the forecast period. Rising prevalence of autoimmune disorders, unaddressed demands for autoimmune disease diagnostics in countries such as India are expected to enhance regional demand.

Becton Dickinson and Company, Bio-Rad Laboratories Inc., ERBA Diagnostics Inc., Antibodies Inc., Inova Diagnostics, Trinity Biotech plc, Thermo Fisher Scientific Inc., Zeus Scientific Inc., Alere Inc., F. Hoffmann-La Roche Ltd., among others are the key players in the antinuclear antibody test market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Antinuclear Antibody Test Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Technique Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Antinuclear Antibody Test Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The high prevalence of autoimmune illnesses

3.3.2 Technique Challenges

3.3.2.1 Lack of awareness regarding antinuclear antibody tests

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Technique Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Technique Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Antinuclear Antibody Test Market, By Product Type

4.1 Product Type Outlook

4.2 Reagents & Assay Kits

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Systems

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Software

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Antinuclear Antibody Test Market, By Technique,

5.1 Technique Outlook

5.2 ELISA

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Immunofluorescence Assay

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Antinuclear Antibody Test Market, By Application

6.1 Rheumatoid Arthritis

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 SLE

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Antinuclear Antibody Test Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Test Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Technique, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Test Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Technique, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Technique, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Technique, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Technique, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technique, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Becton Dickinson and Company

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Bio-Rad Laboratories Inc

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 ERBA Diagnostics Inc

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Antibodies Inc

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Inova Diagnostics

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Trinity Biotech plc

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Thermo Fisher Scientific Inc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Zeus Scientific Inc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Alere Inc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global Antinuclear Antibody Test Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Antinuclear Antibody Test Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS