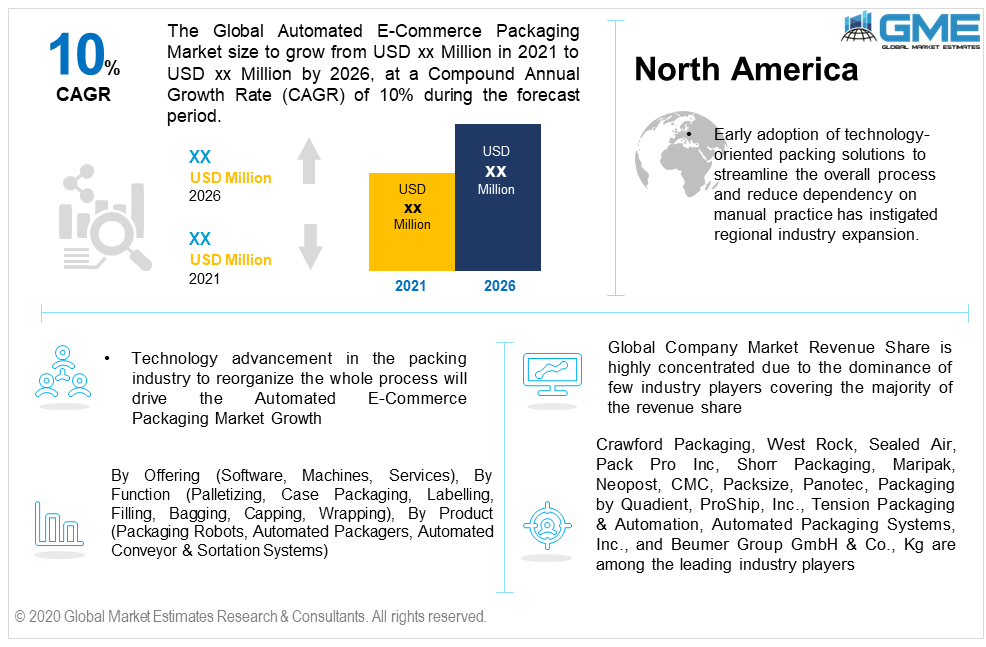

Global Automated E-Commerce Packaging Market Size, Trends & Analysis - Forecasts to 2026 By Offering (Software, Machines, Services), By Function (Palletizing, Case Packaging, Labelling, Filling, Bagging, Capping, Wrapping), By Product (Packaging Robots, Automated Packagers, Automated Conveyor & Sortation Systems), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The Global Automated E-Commerce Packaging Market is set to witness more than 10% CAGR from 2021 to 2026, with North America dominating the market. Technology advancement in the packing industry to reorganize the whole process will drive the Automated E-Commerce Packaging Market Growth. Minimizing labor costs, improved efficiency, and faster turnaround time are the basic advantages offered in the industry. E-commerce industry expansion is among the major reason for companies to highly invest in the automation programs. As per the UN conference on trade and development held in 2017, the global e-commerce industry generated more than USD 29 Trillion in revenue.

Heavy load on manual workforce due to increase rush of packing diversified products may lead to unavoidable errors and mistakes. Thus, the adoption and deployment of various small-scale and large-scale types of machinery will help companies to attain their goals and tasks more efficiently. These packing solutions are an ideal concept for companies facing labor shortages due to the covid-19 pandemic.

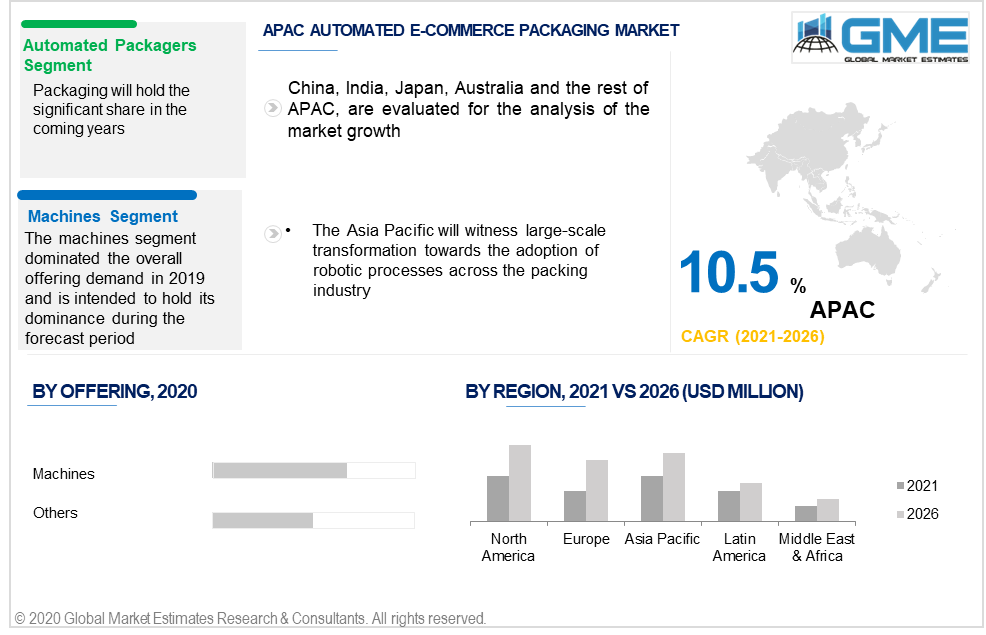

By offering, the industry is divided into software, machines, and services. The machine or equipment segment leads the global offering segment and is anticipated to dominate throughout the forecast period. Streamlining the overall process in terms of packing size, shape, design, and thickness along with uniformity in the quality are positive impacting factors to stimulate demand. Also, the wide availability of a variety of machines and equipment to target diversified business groups will benefit the overall market expansion.

Softwares are set to foresee the highest CAGR in the offering segment from 2021 to 2026. Packing customization, personalization, and process standardization are the key assistances provided by the software programs.

Case packaging, palletizing, labeling, filling, bagging, capping, and wrapping among others are the key identified functions offered in the industry. Case packaging and labeling are among the highly contributing function in the market. Precision, wastage reduction, elimination of excessive void fill, and right-sizing are prime factors to drive penetration in these functions.

Due to the covid-19 pandemic, the majority of the sales are shifted to the online platform. Thus, attaining maximum profitability and reduce dependency on the manual workforce will result in the large-scale adoption of automation packaging solutions.

Manual packing processes are monotonous and prone to face numerous errors related to labeling, carton sizing, filling, and wrapping. Also, the task is monotonous which may result in boredom and mistakes during the process. Therefore, the automation process proved to provide more efficiency in terms of cost, material usage, time management, and overall output.

By product, the industry is divided into automated packagers, packaging robots, and automated conveyor & sortation systems. The automated packagers accounted for a significant market share in 2019. Faster turnaround time, cost minimization, and reduced wastage are the major attributing factors to drive the adoption of these packing solutions.

Another product that is gaining high penetration is the packaging robots. Higher efficiency, product safety, and workflow enhancement by eliminating redundant tasks are key benefits offered by these products. The segment is anticipated to grow at the fastest pace during the forecast period.

The North American region, predominated by the U.S. and Canada is intended to lead the overall revenue share from 2021 to 2026. The region will account for more than 32% of the revenue by the end of 2026. Early adoption of technology-oriented packing solutions to streamline the overall process and reduce dependency on manual practice has instigated regional industry expansion.

The Asia Pacific will witness large-scale transformation towards the adoption of robotic processes across the packing industry. Thus, the region is likely to foresee the fastest gains during the forecast period. High penetration in online sales channels accompanied by increasing inclination towards equipment transformation to save cost and time will induce regional industry growth.

The European market is highly influenced by the technology-oriented process across the supply chain. The region will witness steady gains in the coming years. The presence of a large number of companies offering diversified packing machines to suit different business needs will support the regional industry growth.

Global Company Market Revenue Share is highly concentrated due to the dominance of few industry players covering the majority of the revenue share. Innovation & technology advancement to streamline the overall packing process are among the prime strategies seen in the industry. Also, collaboration with the end-use companies is observed to attain packing solutions customization for diversified business needs.

Crawford Packaging, West Rock, Sealed Air, Pack Pro Inc, Shorr Packaging, Maripak, Neopost, CMC, Packsize, Panotec, Packaging by Quadient, ProShip, Inc., Tension Packaging & Automation, Automated Packaging Systems, Inc., and Beumer Group GmbH & Co., Kg are among the leading industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Currently, the market is consolidated as only a limited number of manufacturers have attained the maximum share. However, rapid advancement in technology-oriented packing solutions will result in high penetration of new market entrants in the coming years. Also, long-term contracts with the vendors across the value chain will be the key strategy in the coming years.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Automated e-commerce packaging industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Product overview

2.1.3 Function overview

2.1.4 Offering overview

2.1.5 Regional overview

Chapter 3 Automated E-Commerce Packaging Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Automated E-Commerce Packaging Market, By Product

4.1 Product Outlook

4.2 Packaging Robots

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Automated Packagers

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Automated Conveyor & Sortation Systems

4.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Automated E-Commerce Packaging Market, By Offering

5.1 Offering Outlook

5.2 Software

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Machines

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Services

5.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Automated E-Commerce Packaging Market, By Function

6.1 Function Outlook

6.2 Palletizing

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Case Packaging

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Labeling

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Filling

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.6 Bagging

6.6.1 Market size, by region, 2019-2026 (USD Million)

6.7 Capping

6.7.1 Market size, by region, 2019-2026 (USD Million)

6.8 Wrapping

6.8.1 Market size, by region, 2019-2026 (USD Million)

6.9 Others

6.9.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Automated E-Commerce Packaging Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by product, 2019-2026 (USD Million)

7.2.3 Market size, by function, 2019-2026 (USD Million)

7.2.4 Market size, by offering, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by product, 2019-2026 (USD Million)

7.2.5.2 Market size, by function, 2019-2026 (USD Million)

7.2.5.3 Market size, by offering, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by product, 2019-2026 (USD Million)

7.2.6.2 Market size, by function, 2019-2026 (USD Million)

7.2.6.3 Market size, by offering, 2019-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market size, by product, 2019-2026 (USD Million)

7.2.7.2 Market size, by function, 2019-2026 (USD Million)

7.2.7.3 Market size, by offering, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by product, 2019-2026 (USD Million)

7.3.3 Market size, by function, 2019-2026 (USD Million)

7.3.4 Market size, by offering, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by product, 2019-2026 (USD Million)

7.2.5.2 Market size, by function, 2019-2026 (USD Million)

7.2.5.3 Market size, by offering, 2019-2026 (USD Million)

7.3.6 Spain

7.3.6.1 Market size, by product, 2019-2026 (USD Million)

7.3.6.2 Market size, by function, 2019-2026 (USD Million)

7.3.6.3 Market size, by offering, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by product, 2019-2026 (USD Million)

7.3.7.2 Market size, by function, 2019-2026 (USD Million)

7.3.7.3 Market size, by offering, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by product, 2019-2026 (USD Million)

7.3.8.2 Market size, by function, 2019-2026 (USD Million)

7.3.8.3 Market size, by offering, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by product, 2019-2026 (USD Million)

7.4.3 Market size, by function, 2019-2026 (USD Million)

7.4.4 Market size, by offering, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by product, 2019-2026 (USD Million)

7.4.5.2 Market size, by function, 2019-2026 (USD Million)

7.4.5.3 Market size, by offering, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by product, 2019-2026 (USD Million)

7.4.6.2 Market size, by function, 2019-2026 (USD Million)

7.4.6.3 Market size, by offering, 2019-2026 (USD Million)

7.4.7 Malaysia

7.4.7.1 Market size, by product, 2019-2026 (USD Million)

7.4.7.2 Market size, by function, 2019-2026 (USD Million)

7.4.7.3 Market size, by offering, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by product, 2019-2026 (USD Million)

7.4.8.2 Market size, by function, 2019-2026 (USD Million)

7.4.8.3 Market size, by offering, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by product, 2019-2026 (USD Million)

7.4.9.2 Market size, by function, 2019-2026 (USD Million)

7.4.9.3 Market size, by offering, 2019-2026 (USD Million)

7.5 Central & South America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by product, 2019-2026 (USD Million)

7.5.3 Market size, by function, 2019-2026 (USD Million)

7.5.4 Market size, by offering, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by product, 2019-2026 (USD Million)

7.5.5.2 Market size, by function, 2019-2026 (USD Million)

7.5.5.3 Market size, by offering, 2019-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market size, by product, 2019-2026 (USD Million)

7.5.6.2 Market size, by function, 2019-2026 (USD Million)

7.5.6.3 Market size, by offering, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by product, 2019-2026 (USD Million)

7.6.3 Market size, by function, 2019-2026 (USD Million)

7.6.4 Market size, by offering, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by product, 2019-2026 (USD Million)

7.6.5.2 Market size, by function, 2019-2026 (USD Million)

7.6.5.3 Market size, by offering, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by product, 2019-2026 (USD Million)

7.6.6.2 Market size, by function, 2019-2026 (USD Million)

7.6.6.3 Market size, by offering, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by product, 2019-2026 (USD Million)

7.6.7.2 Market size, by function, 2019-2026 (USD Million)

7.6.7.3 Market size, by offering, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Crawford Packaging

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 West Rock

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Sealed Air

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Pack Pro Inc

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Shorr Packaging

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Maripak

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Neopost

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 CMC

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Packsize

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Panotec

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Packaging by Quadient

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 ProShip, Inc.

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Tension Packaging & Automation

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Automated Packaging Systems, Inc.

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Beumer Group GmbH & Co., Kg

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

The Global Automated E-Commerce Packaging Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automated E-Commerce Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS