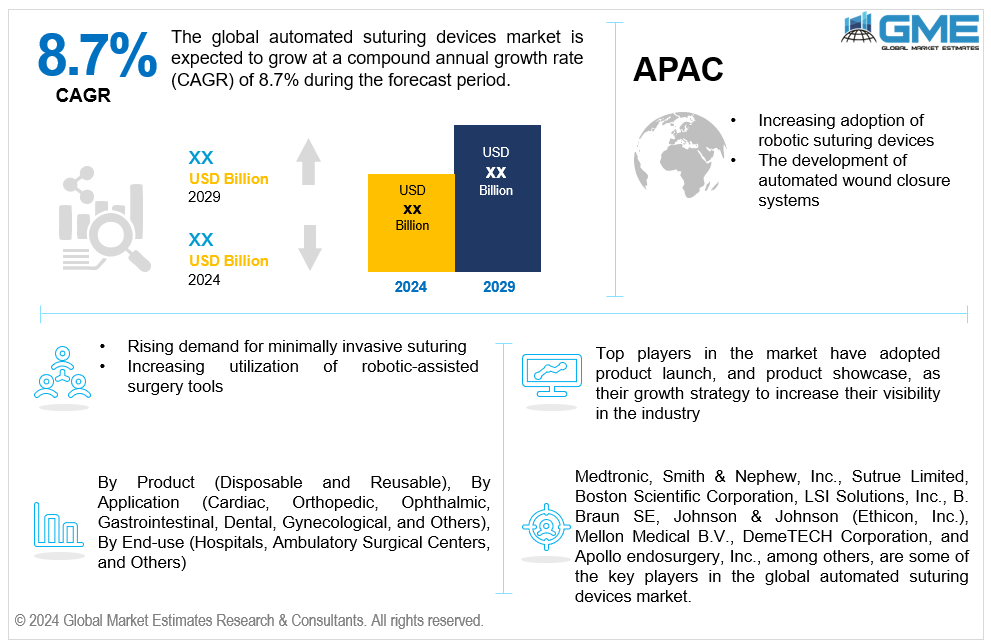

Global Automated Suturing Devices Market Size, Trends & Analysis - Forecasts to 2029 By Product (Disposable and Reusable), By Application (Cardiac, Orthopedic, Ophthalmic, Gastrointestinal, Dental, Gynecological, and Others), By End-use (Hospitals, Ambulatory Surgical Centers, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global automated suturing devices market is estimated to exhibit a CAGR of 8.7% from 2024 to 2029.

The primary factors propelling the market growth are the increasing adoption of robotic suturing devices and the development of automated wound closure systems. Advancements in automated surgical sutures improve accuracy and lower the possibility of human mistakes, resulting in quicker healing and better patient outcomes. The integration of suture placement devices and laparoscopic suturing instruments into surgical procedures offers minimally invasive solutions, further promoting market growth. These advancements align with the broader expansion of the surgical robotics market, emphasizing the importance of automation and robotics in modern healthcare. Enhanced efficiency, consistency, and safety provided by these automated systems are pivotal factors boosting their adoption in various surgical settings. Sophisticated automated suturing techniques are in high demand as healthcare practitioners look to improve patient care and surgical operations. This emphasizes the importance of these technologies in the rapidly changing surgical innovation environment. For instance, researchers at the University of New South Wales Medical Robotics Lab created smart sutures in December 2021 to accelerate wound healing. These sutures autonomously close the wound opening without the need for human involvement.

The rising demand for minimally invasive suturing and the increasing utilization of robotic-assisted surgery tools are expected to support the market growth. Endoscopic suturing devices and automated suture systems are at the forefront of the minimally invasive suturing trend, providing surgeons with the tools needed to perform precise and efficient suturing through small incisions. This technology aligns perfectly with the growing preference for laparoscopic surgery equipment, which offers patients reduced recovery times and fewer complications compared to traditional open surgery. Additionally, the increased utilization of minimally invasive surgery devices highlights the healthcare industry's shift towards techniques that minimize patient trauma while ensuring effective treatment outcomes. The adoption of these advanced suturing devices is driven by their ability to enhance surgical precision, reduce operating times, and improve overall patient safety.

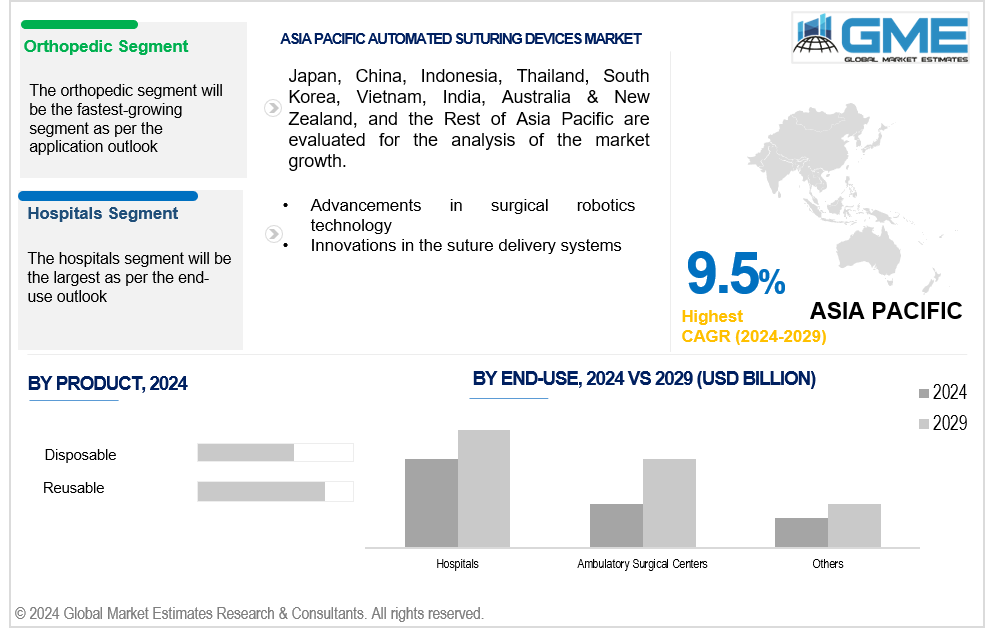

Advancements in surgical robotics technology coupled with innovations in the suture delivery systems propel market growth. The integration of surgical stapling devices with robotic systems enhances precision and efficiency in suturing, minimizing human error, and improving patient outcomes. The surgical robotics industry is rapidly evolving, with continuous innovations leading to more sophisticated and reliable robotic surgical instruments. These advancements are critical in procedures requiring high dexterity and accuracy, boosting the demand for automated suturing solutions. Hospitals and surgical centers are using robotic-assisted procedures more often as a result of surgical robotics advancements that make them more accessible and efficient.

Artificial intelligence (AI) and machine learning's integration with automated suturing devices provide a substantial opportunity for suturing device manufacturers to improve surgical operations' accuracy and efficiency. Additionally, significant growth opportunities exist in developing next-generation suturing devices with enhanced precision, efficiency, and minimally invasive capabilities.

However, the complexity and steep learning curve of automated suturing devices and the high cost of these devices may impede market growth during the forecast period.

The reusable segment is expected to hold the largest share of the market over the forecast period. Even though they cost more upfront, reusable suturing devices are typically more economical in the long run. Hospitals and surgical facilities can reuse these instruments several times, lowering the overall cost per surgery.

The disposable segment is expected to be the fastest-growing segment in the market from 2024 to 2029. In many healthcare settings, single-use medical equipment is preferred due to the rising emphasis on infection control and patient safety. Disposable suturing device demand is being driven by this trend.

The cardiac segment is expected to hold the largest share of the market over the forecast period. Due to the fragile nature of heart tissues and the intricacy of the operations involved, complicated suturing techniques are frequently needed during cardiac surgeries. Automated suturing machines make suturing with accuracy and consistency possible, which is essential for getting the best results possible from cardiac surgeries.

The orthopedic segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The precision and effectiveness of orthopedic treatments have been improved by developments in robotic-assisted surgery and image-guided navigation systems, among other orthopedic surgical methods and technology. The growth of automated suturing devices in orthopedic surgery is fueled by the greater control and uniformity that these technologies provide throughout the suturing process.

The hospitals segment is expected to hold the largest share of the market over the forecast period. Hospitals perform many different disciplines of surgery, including general surgery, orthopedics, cardiology, neurology, and more. The vast number of procedures performed in hospitals drives the need for automated suturing devices.

The ambulatory surgical centers segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Specialized in minimally invasive operations, Ambulatory surgical centers provide various benefits over typical open surgeries, such as shortened recovery periods, shorter hospital stays, and cheaper medical expenses. These minimally invasive treatments are made possible by automated suturing devices, which allow for accurate and effective soft tissue closure.

North America is expected to be the largest region in the global market. Its well-established healthcare system consists of a vast network of specialist clinics, ambulatory surgical centers, and hospitals. These institutions drive the use of automated suturing devices by investing in cutting-edge medical technologies to uphold high standards of patient care.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The Asia Pacific region's economy is expanding quickly, driving up healthcare costs and infrastructural development. Advanced medical technology, such as automated suturing devices, is becoming increasingly in demand as healthcare facilities develop and modernize.

Medtronic, Smith & Nephew, Inc., Sutrue Limited, Boston Scientific Corporation, LSI Solutions, Inc., B. Braun SE, Johnson & Johnson (Ethicon, Inc.), Mellon Medical B.V., DemeTECH Corporation, and Apollo endosurgery, Inc., among others, are some of the key players in the global automated suturing devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2024, Sutrue's ground-breaking, 3D-manufactured automatic suturing devices launched at London's The Design Museum. The 3D printing industry players attended the event to learn more about how additive manufacturing is changing the medical field moving forward.

In January 2023, Valkyrie Looped Sternotomy Sutures were launched by Able Medical Devices. The stainless-steel looped wire sutures can be used to close a patient’s chest after open heart surgery.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL AUTOMATED SUTURING DEVICES MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AUTOMATED SUTURING DEVICES MARKET, BY PRODUCT

4.1 Introduction

4.2 Automated Suturing Devices Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Disposable

4.4.1 Disposable Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Reusable

4.5.1 Reusable Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL AUTOMATED SUTURING DEVICES MARKET, BY APPLICATION

5.1 Introduction

5.2 Automated Suturing Devices Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Cardiac

5.4.1 Cardiac Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Orthopedic

5.5.1 Orthopedic Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Ophthalmic

5.6.1 Ophthalmic Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Gastrointestinal

5.7.1 Gastrointestinal Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Dental

5.8.1 Dental Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Gynecological

5.9.1 Gynecological Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Others

5.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL AUTOMATED SUTURING DEVICES MARKET, BY END-USE

6.1 Introduction

6.2 Automated Suturing Devices Market: End-use Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Hospitals

6.4.1 Hospitals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Ambulatory Surgical Centers

6.5.1 Ambulatory Surgical Centers Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Others

6.6.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL AUTOMATED SUTURING DEVICES MARKET, BY REGION

7.1 Introduction

7.2 North America Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Product

7.2.2 By Application

7.2.3 By End-use

7.2.4 By Country

7.2.4.1 U.S. Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Product

7.2.4.1.2 By Application

7.2.4.1.3 By End-use

7.2.4.2 Canada Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Product

7.2.4.2.2 By Application

7.2.4.2.3 By End-use

7.2.4.3 Mexico Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Product

7.2.4.3.2 By Application

7.2.4.3.3 By End-use

7.3 Europe Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Product

7.3.2 By Application

7.3.3 By End-use

7.3.4 By Country

7.3.4.1 Germany Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Product

7.3.4.1.2 By Application

7.3.4.1.3 By End-use

7.3.4.2 U.K. Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Product

7.3.4.2.2 By Application

7.3.4.2.3 By End-use

7.3.4.3 France Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Product

7.3.4.3.2 By Application

7.3.4.3.3 By End-use

7.3.4.4 Italy Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Product

7.3.4.4.2 By Application

7.2.4.4.3 By End-use

7.3.4.5 Spain Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Product

7.3.4.5.2 By Application

7.2.4.5.3 By End-use

7.3.4.6 Netherlands Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Product

7.3.4.6.2 By Application

7.2.4.6.3 By End-use

7.3.4.7 Rest of Europe Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Product

7.3.4.7.2 By Application

7.2.4.7.3 By End-use

7.4 Asia Pacific Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Product

7.4.2 By Application

7.4.3 By End-use

7.4.4 By Country

7.4.4.1 China Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Product

7.4.4.1.2 By Application

7.4.4.1.3 By End-use

7.4.4.2 Japan Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Product

7.4.4.2.2 By Application

7.4.4.2.3 By End-use

7.4.4.3 India Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Product

7.4.4.3.2 By Application

7.4.4.3.3 By End-use

7.4.4.4 South Korea Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Product

7.4.4.4.2 By Application

7.4.4.4.3 By End-use

7.4.4.5 Singapore Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Product

7.4.4.5.2 By Application

7.4.4.5.3 By End-use

7.4.4.6 Malaysia Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Product

7.4.4.6.2 By Application

7.4.4.6.3 By End-use

7.4.4.7 Thailand Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Product

7.4.4.7.2 By Application

7.4.4.7.3 By End-use

7.4.4.8 Indonesia Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Product

7.4.4.8.2 By Application

7.4.4.8.3 By End-use

7.4.4.9 Vietnam Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Product

7.4.4.9.2 By Application

7.4.4.9.3 By End-use

7.4.4.10 Taiwan Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Product

7.4.4.10.2 By Application

7.4.4.10.3 By End-use

7.4.4.11 Rest of Asia Pacific Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Product

7.4.4.11.2 By Application

7.4.4.11.3 By End-use

7.5 Middle East and Africa Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Product

7.5.2 By Application

7.5.3 By End-use

7.5.4 By Country

7.5.4.1 Saudi Arabia Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Product

7.5.4.1.2 By Application

7.5.4.1.3 By End-use

7.5.4.2 U.A.E. Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Product

7.5.4.2.2 By Application

7.5.4.2.3 By End-use

7.5.4.3 Israel Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Product

7.5.4.3.2 By Application

7.5.4.3.3 By End-use

7.5.4.4 South Africa Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Product

7.5.4.4.2 By Application

7.5.4.4.3 By End-use

7.5.4.5 Rest of Middle East and Africa Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Product

7.5.4.5.2 By Application

7.5.4.5.2 By End-use

7.6 Central and South America Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Product

7.6.2 By Application

7.6.3 By End-use

7.6.4 By Country

7.6.4.1 Brazil Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Product

7.6.4.1.2 By Application

7.6.4.1.3 By End-use

7.6.4.2 Argentina Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Product

7.6.4.2.2 By Application

7.6.4.2.3 By End-use

7.6.4.3 Chile Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Product

7.6.4.3.2 By Application

7.6.4.3.3 By End-use

7.6.4.4 Rest of Central and South America Automated Suturing Devices Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Product

7.6.4.4.2 By Application

7.6.4.4.3 By End-use

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Medtronic

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Smith & Nephew, Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Sutrue Limited

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Boston Scientific Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 LSI Solutions, Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 B. BRAUN SE

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Johnson & Johnson (Ethicon, Inc.)

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Mellon Medical B.V.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 DemeTECH Corporation

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Apollo endosurgery, Inc.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Automated Suturing Devices Market, By Product, 2021-2029 (USD Mllion)

2 Disposable Market, By Region, 2021-2029 (USD Mllion)

3 Reusable Market, By Region, 2021-2029 (USD Mllion)

4 Global Automated Suturing Devices Market, By Application, 2021-2029 (USD Mllion)

5 Cardiac Market, By Region, 2021-2029 (USD Mllion)

6 Orthopedic Market, By Region, 2021-2029 (USD Mllion)

7 Ophthalmic Market, By Region, 2021-2029 (USD Mllion)

8 Gastrointestinal Market, By Region, 2021-2029 (USD Mllion)

9 Dental Market, By Region, 2021-2029 (USD Mllion)

10 Gynecological Market, By Region, 2021-2029 (USD Mllion)

11 Others Market, By Region, 2021-2029 (USD Mllion)

12 Global Automated Suturing Devices Market, By End-use, 2021-2029 (USD Mllion)

13 Hospitals Market, By Region, 2021-2029 (USD Mllion)

14 Ambulatory Surgical Centers Market, By Region, 2021-2029 (USD Mllion)

15 Others Market, By Region, 2021-2029 (USD Mllion)

16 Regional Analysis, 2021-2029 (USD Mllion)

17 North America Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

18 North America Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

19 North America Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

20 North America Automated Suturing Devices Market, By Country, 2021-2029 (USD Million)

21 U.S. Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

22 U.S. Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

23 U.S. Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

24 Canada Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

25 Canada Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

26 Canada Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

27 Mexico Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

28 Mexico Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

29 Mexico Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

30 Europe Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

31 Europe Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

32 Europe Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

33 Europe Automated Suturing Devices Market, By Country 2021-2029 (USD Million)

34 Germany Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

35 Germany Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

36 Germany Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

37 U.K. Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

38 U.K. Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

39 U.K. Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

40 France Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

41 France Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

42 France Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

43 Italy Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

44 Italy Automated Suturing Devices Market, By application, 2021-2029 (USD Million)

45 Italy Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

46 Spain Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

47 Spain Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

48 Spain Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

49 Netherlands Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

50 Netherlands Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

51 Netherlands Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

52 Rest Of Europe Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

53 Rest Of Europe Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

54 Rest of Europe Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

55 Asia Pacific Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

56 Asia Pacific Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

57 Asia Pacific Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

58 Asia Pacific Automated Suturing Devices Market, By Country, 2021-2029 (USD Million)

59 China Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

60 China Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

61 China Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

62 India Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

63 India Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

64 India Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

65 Japan Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

66 Japan Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

67 Japan Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

68 South Korea Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

69 South Korea Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

70 South Korea Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

71 malaysia Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

72 malaysia Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

73 malaysia Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

74 Thailand Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

75 Thailand Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

76 Thailand Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

77 Indonesia Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

78 Indonesia Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

79 Indonesia Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

80 Vietnam Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

81 Vietnam Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

82 Vietnam Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

83 Taiwan Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

84 Taiwan Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

85 Taiwan Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

86 Rest of Asia Pacific Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

87 Rest of Asia Pacific Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

88 Rest of Asia Pacific Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

89 Middle East and Africa Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

90 Middle East and Africa Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

91 Middle East and Africa Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

92 Middle East and Africa Automated Suturing Devices Market, By Country, 2021-2029 (USD Million)

93 Saudi Arabia Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

94 Saudi Arabia Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

95 Saudi Arabia Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

96 UAE Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

97 UAE Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

98 UAE Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

99 Israel Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

100 Israel Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

101 Israel Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

102 South Africa Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

103 South Africa Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

104 South Africa Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

107 Rest of Middle East and Africa Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

108 Central and South America Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

109 Central and South America Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

110 Central and South America Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

111 Central and South America Automated Suturing Devices Market, By Country, 2021-2029 (USD Million)

112 Brazil Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

113 Brazil Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

114 Brazil Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

115 Argentina Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

116 Argentina Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

117 Argentina Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

118 Chile Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

119 Chile Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

120 Chile Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

121 Rest of Central and South America Automated Suturing Devices Market, By Product, 2021-2029 (USD Million)

122 Rest of Central and South America Automated Suturing Devices Market, By Application, 2021-2029 (USD Million)

123 Rest of Central and South America Automated Suturing Devices Market, By End-use, 2021-2029 (USD Million)

124 Medtronic: Products & Services Offering

125 Smith & Nephew, Inc.: Products & Services Offering

126 Sutrue Limited: Products & Services Offering

127 Boston Scientific Corporation: Products & Services Offering

128 LSI Solutions, Inc.: Products & Services Offering

129 B. BRAUN SE: Products & Services Offering

130 Johnson & Johnson (Ethicon, Inc.) : Products & Services Offering

131 Mellon Medical B.V.: Products & Services Offering

132 DemeTECH Corporation, Inc: Products & Services Offering

133 Apollo endosurgery, Inc.: Products & Services Offering

134 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Automated Suturing Devices Market Overview

2 Global Automated Suturing Devices Market Value From 2021-2029 (USD Mllion)

3 Global Automated Suturing Devices Market Share, By Product (2023)

4 Global Automated Suturing Devices Market Share, By Application (2023)

5 Global Automated Suturing Devices Market Share, By End-use (2023)

6 Global Automated Suturing Devices Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Automated Suturing Devices Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Automated Suturing Devices Market

11 Impact Of Challenges On The Global Automated Suturing Devices Market

12 Porter’s Five Forces Analysis

13 Global Automated Suturing Devices Market: By Product Scope Key Takeaways

14 Global Automated Suturing Devices Market, By Product Segment: Revenue Growth Analysis

15 Disposable Market, By Region, 2021-2029 (USD Mllion)

16 Reusable Market, By Region, 2021-2029 (USD Mllion)

17 Global Automated Suturing Devices Market: By Application Scope Key Takeaways

18 Global Automated Suturing Devices Market, By Application Segment: Revenue Growth Analysis

19 Cardiac Market, By Region, 2021-2029 (USD Mllion)

20 Orthopedic Market, By Region, 2021-2029 (USD Mllion)

21 Ophthalmic Market, By Region, 2021-2029 (USD Mllion)

22 Gastrointestinal Market, By Region, 2021-2029 (USD Mllion)

23 Dental Market, By Region, 2021-2029 (USD Mllion)

24 Gynecological Market, By Region, 2021-2029 (USD Mllion)

25 Others Market, By Region, 2021-2029 (USD Mllion)

26 Global Automated Suturing Devices Market: By End-use Scope Key Takeaways

27 Global Automated Suturing Devices Market, By End-use Segment: Revenue Growth Analysis

28 Hospitals Market, By Region, 2021-2029 (USD Mllion)

29 Ambulatory Surgical Centers Market, By Region, 2021-2029 (USD Mllion)

30 Others Market, By Region, 2021-2029 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global Automated Suturing Devices Market: Regional Analysis

33 North America Automated Suturing Devices Market Overview

34 North America Automated Suturing Devices Market, By Product

35 North America Automated Suturing Devices Market, By Application

36 North America Automated Suturing Devices Market, By End-use

37 North America Automated Suturing Devices Market, By Country

38 U.S. Automated Suturing Devices Market, By Product

39 U.S. Automated Suturing Devices Market, By Application

40 U.S. Automated Suturing Devices Market, By End-use

41 Canada Automated Suturing Devices Market, By Product

42 Canada Automated Suturing Devices Market, By Application

43 Canada Automated Suturing Devices Market, By End-use

44 Mexico Automated Suturing Devices Market, By Product

45 Mexico Automated Suturing Devices Market, By Application

46 Mexico Automated Suturing Devices Market, By End-use

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 Medtronic: Company Snapshot

50 Medtronic: SWOT Analysis

51 Medtronic: Geographic Presence

52 Smith & Nephew, Inc.: Company Snapshot

53 Smith & Nephew, Inc.: SWOT Analysis

54 Smith & Nephew, Inc.: Geographic Presence

55 Sutrue Limited: Company Snapshot

56 Sutrue Limited: SWOT Analysis

57 Sutrue Limited: Geographic Presence

58 Boston Scientific Corporation: Company Snapshot

59 Boston Scientific Corporation: Swot Analysis

60 Boston Scientific Corporation: Geographic Presence

61 LSI Solutions, Inc.: Company Snapshot

62 LSI Solutions, Inc.: SWOT Analysis

63 LSI Solutions, Inc.: Geographic Presence

64 B. BRAUN SE: Company Snapshot

65 B. BRAUN SE: SWOT Analysis

66 B. BRAUN SE: Geographic Presence

67 Johnson & Johnson (Ethicon, Inc.) : Company Snapshot

68 Johnson & Johnson (Ethicon, Inc.) : SWOT Analysis

69 Johnson & Johnson (Ethicon, Inc.) : Geographic Presence

70 Mellon Medical B.V.: Company Snapshot

71 Mellon Medical B.V.: SWOT Analysis

72 Mellon Medical B.V.: Geographic Presence

73 DemeTECH Corporation, Inc.: Company Snapshot

74 DemeTECH Corporation, Inc.: SWOT Analysis

75 DemeTECH Corporation, Inc.: Geographic Presence

76 Apollo endosurgery, Inc.: Company Snapshot

77 Apollo endosurgery, Inc.: SWOT Analysis

78 Apollo endosurgery, Inc.: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global Automated Suturing Devices Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automated Suturing Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS