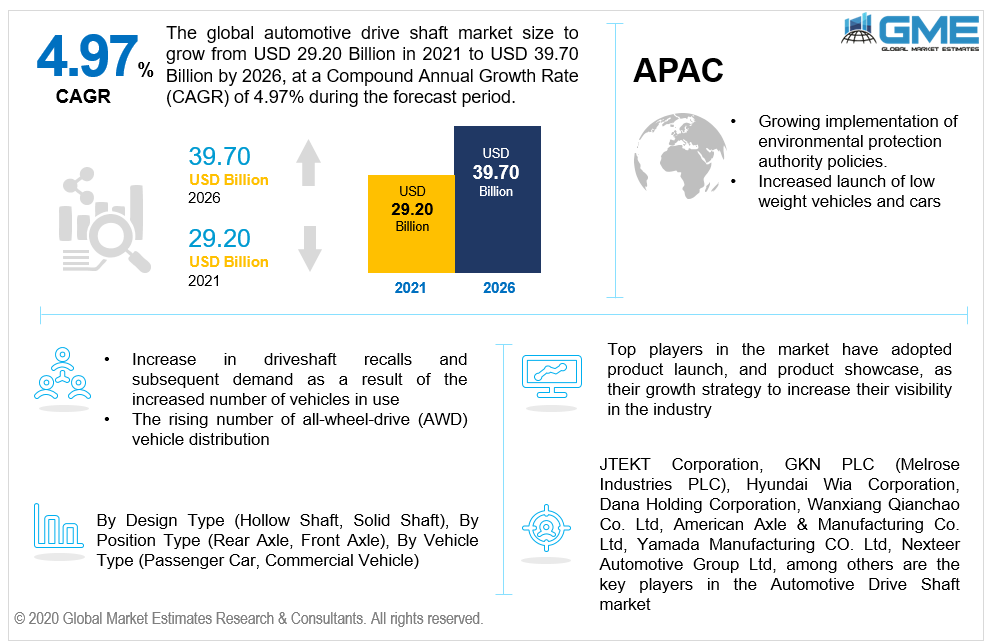

Global Automotive Drive Shaft Market Size, Trends & Analysis - Forecasts to 2026 By Design Type (Hollow Shaft, Solid Shaft), By Position Type (Rear Axle, Front Axle), By Vehicle Type (Passenger Car, Commercial Vehicle), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global automotive drive shaft market is projected to grow from USD 29.20 billion in 2021 to USD 39.70 billion by 2026 at a CAGR value of 4.97% from 2021 to 2026.

The market is rapidly growing owing to increasing driveshaft recalls and subsequent demand for lightweight vehicles. The market is also driven by increasing production sale of cars, SUVs, light weight vehicles and increasing costs for lightweight components.

During the forecast period of 2021 to 2026, automakers will intend to introduce more electric vehicle variants as compared to diesel based cars owing to rising air pollution levels across the globe. The preponderance of current and future electric vehicle models has all-wheel drives (AWD) or rear-wheel drives (RWD), which will fuel the demand for lightweight driveshaft in the market.

The rising concern for fuel efficiency, the implementation of strict norms by global pollution prevention authorities, and the advancement in drive shafts by producers without loss of performance and rigidity are expected to have a positive influence on the growth of this market from 2021 to 2026.

Industries are increasingly turning towards Distributed Control Systems (DCS) in order to reduce installation costs and to increase reliability with adequate remote monitoring capabilities.

The rising number of all-wheel-drive (AWD) vehicle distribution is one of the major drivers of the market.

The global COVID-19 outbreak disrupted the entire market supply chain, as supply-side (i.e., OEM) plants were shuttered, fresh auto sales were essentially non-existent during the imposed shutdown, and individuals were not authorized to move around to prevent the virus from spreading. However, as the economy progressively reopened, demand is returning to the market.

Furthermore, the market will benefit from increasing need for environment friendly vehicles for reducing air pollution levels, rising production volume for large passenger car sales, rapid urbanisation, quick economic boom, and increasing disposable income of developing countries.

However, the emergence of composite drive shafts, on the other hand, as well as the additional costs associated with drive shaft renewal, are projected to hinder the growth of the automotive drive shaft market.

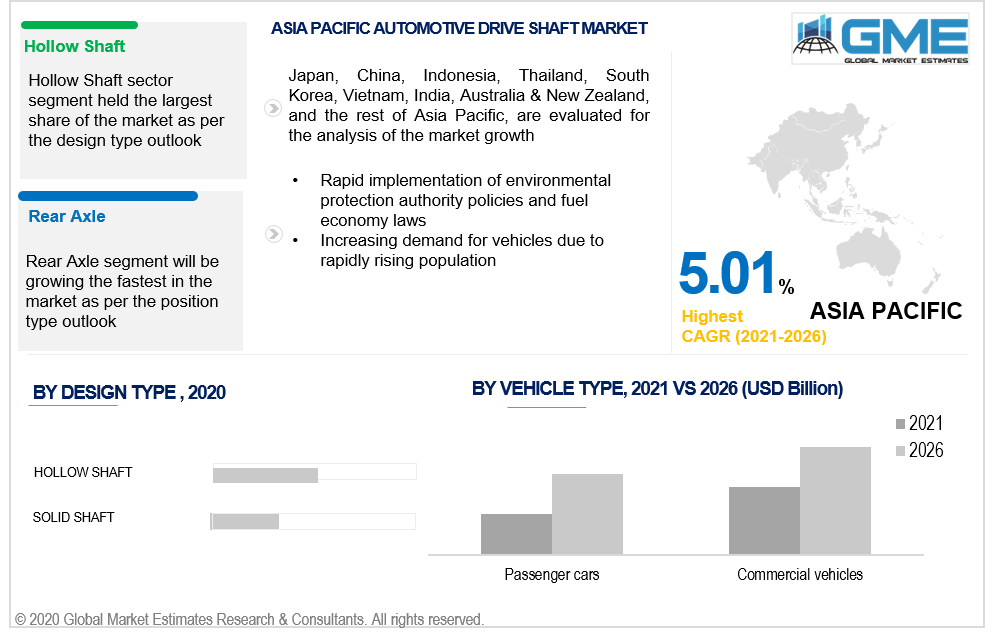

Based on the design type of automotive drive shaft, the market is segmented into hollow shaft and solid shaft. The hollow shaft’s segment held the lion’s share of the market. Due to the sheer advantages given by hollow shafts over solid drive shafts, the majority of passenger cars employ them as a drive shaft. A hollow drive shaft of the same volume as a solid drive shaft performs in the same way as a solid drive shaft without failing. As a result, the worldwide automotive drive shaft market is expected to develop.

Based on the position type, the market is segmented into rear axle and front axle. The demand for rear axle is on the rise and hence is estimated as the fastest growing segment.

Based on the vehicle type, the market is segmented into passenger car and commercial vehicle. Passenger vehicle sales fell during the COVID-19-induced economic lockdown. However, the post pandemic lockdown period has helped the automotive industry grow steadily.

Moreover, the utilization of commercial vehicles is projected to intensify. The growth is predicted to be driven by further infrastructural development, as well as the expansion of the construction and mining industries, which will necessitate the development of road infrastructure and increase the use of heavy vehicles. In addition, the rapid expansion of the e-commerce business is likely to boost desire for commercial vehicles.

Based on region, the market is segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and the Asia Pacific.

Owing to the implementation of environmental protection authority policies and fuel economy laws, clubbed with rising development in the auto industries for low-weight vehicles, rising demand for fuel efficient vehicles, the Asia-Pacific region is expected to dominate the automotive drive shaft market. Also, because of rising investments in the vehicle industry, markets of China and India are predicted to rise significantly high during the forecast period.

Apart from APAC, the market in the North American region is also increasing steadily. In addition to the high purchasing power of the population, the region is witnessing continuous infrastructural development. At the same time, government in North America are emphasising the need of having in-house car manufacturing facility which will further boost the market growth. Truck digitization, in accordance with the growing demand for connected vehicles, is likely to open up new economic prospects for major OEMs contributing to the regional market's growth during the forecast period.

JTEKT Corporation, GKN PLC (Melrose Industries PLC), Hyundai Wia Corporation, Dana Holding Corporation, Wanxiang Qianchao Co. Ltd, American Axle & Manufacturing Co. Ltd, Yamada Manufacturing CO. Ltd, Nexteer Automotive Group Ltd among others are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Automotive Drive Shaft Industry Overview, 2021-2026

2.1.1 Industry overview

2.1.2 Design Type overview

2.1.3 Position Type overview

2.1.4 Vehicle Type overview

2.1.5 Regional overview

Chapter 3 Trends

3.1 Market segmentation

3.2 Industry background, 2021-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company position overview, 2020

Chapter 4 Automotive Drive Shaft Market, By Design Type

4.1 Design Type Outlook

4.2 Hollow Shaft

4.2.1 Market size, by region, 2021-2026 (USD Billion)

4.3 Solid Shaft

4.3.1 Market size, by region, 2021-2026 (USD Billion)

Chapter 5 Automotive Drive Shaft Market, By Position Type

5.1 Position Type Outlook

5.2 Rear Axle

5.2.1 Market size, by region, 2021-2026 (USD Billion)

5.3 Front Axle

5.3.1 Market size, by region, 2021-2026 (USD Billion)

Chapter 6 Automotive Drive Shaft Market, By Vehicle Type

6.1 Vehicle Type Outlook

6.2 Passenger Car

6.2.1 Market size, by region, 2021-2026 (USD Billion)

6.3 Commercial Vehicle

6.3.1 Market size, by region, 2021-2026 (USD Billion)

Chapter 7 Automotive Drive Shaft Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by Country, 2021-2026 (USD Billion)

7.2.2 Market size, by Design Type, 2021-2026 (USD Billion)

7.2.3 Market size, by Position Type, 2021-2026 (USD Billion)

7.2.4 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.2.5.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.2.5.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.2.6.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.2.6.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.2.7 Mexico

7.2.7.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.2.7.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.2.7.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market size, by Country, 2021-2026 (USD Billion)

7.3.2 Market size, by Design Type, 2021-2026 (USD Billion)

7.3.3 Market size, by Position Type, 2021-2026 (USD Billion)

7.3.4 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.2.5.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.2.5.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.3.6 Spain

7.3.6.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.3.6.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.3.6.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.3.7.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.3.7.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.3.8.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.3.8.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market size, by Country, 2021-2026 (USD Billion)

7.4.2 Market size, by Design Type, 2021-2026 (USD Billion)

7.4.3 Market size, by Position Type, 2021-2026 (USD Billion)

7.4.4 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.4.5.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.4.5.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.4.6.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.4.6.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.4.7 Malaysia

7.4.7.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.4.7.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.4.7.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.4.8.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.4.8.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.4.9.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.4.9.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.5 Central & South America

7.5.1 Market size, by Country, 2021-2026 (USD Billion)

7.5.2 Market size, by Design Type, 2021-2026 (USD Billion)

7.5.3 Market size, by Position Type, 2021-2026 (USD Billion)

7.5.4 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.5.5.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.5.5.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.5.6.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.5.6.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market size, by Country, 2021-2026 (USD Billion)

7.6.2 Market size, by Design Type, 2021-2026 (USD Billion)

7.6.3 Market size, by Position Type, 2021-2026 (USD Billion)

7.6.4 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.6.5.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.6.5.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.6.6.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.6.6.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market size, by Design Type, 2021-2026 (USD Billion)

7.6.7.2 Market size, by Position Type, 2021-2026 (USD Billion)

7.6.7.3 Market size, by Vehicle Type, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 GKN PLC (Melrose Industries PLC)

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic Positioning

8.2.4 Infographic analysis

8.3 JTEKT Corporation

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic Positioning

8.3.4 Infographic analysis

8.4 Dana Holding Corporation

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic Positioning

8.4.4 Infographic analysis

8.5 Hyundai Wia Corporation

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic Positioning

8.5.4 Infographic analysis

8.6 Nexteer Automotive Group Ltd

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic Positioning

8.6.4 Infographic analysis

8.7 Showa Corporation

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic Positioning

8.7.4 Infographic analysis

8.8 Yamada Manufacturing CO. Ltd

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic Positioning

8.8.4 Infographic analysis

8.9 American Axle & Manufacturing Co. Ltd

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic Positioning

8.9.4 Infographic analysis

8.10 Wanxiang Qianchao Co. Ltd

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic Positioning

8.10.4 Infographic analysis

8.11 NTN Corporation

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic Positioning

8.11.4 Infographic analysis

8.12 Xuchang Yuangdong Driveshaft Co., Ltd

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic Positioning

8.12.4 Infographic analysis

8.13 Mohit Engineers Pvt. Ltd

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic Positioning

8.13.4 Infographic analysis

8.14 Neapco Holdings

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic Positioning

8.14.4 Infographic analysis

8.15 Trelleborg AB

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic Positioning

8.15.4 Infographic analysis

8.16 Other Companies

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic Positioning

8.16.4 Infographic analysis

The Global Automotive Drive Shaft Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Drive Shaft Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS