Global Automotive Endpoint Authentication Market Size, Trends & Analysis - Forecasts to 2027 By Connectivity (Bluetooth, Wi-Fi, Cellular Network), By Authentication Type (Wearable, Smartphone Application, Biometric Access), By Vehicle Type (Passenger Cars, Electric Vehicles), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

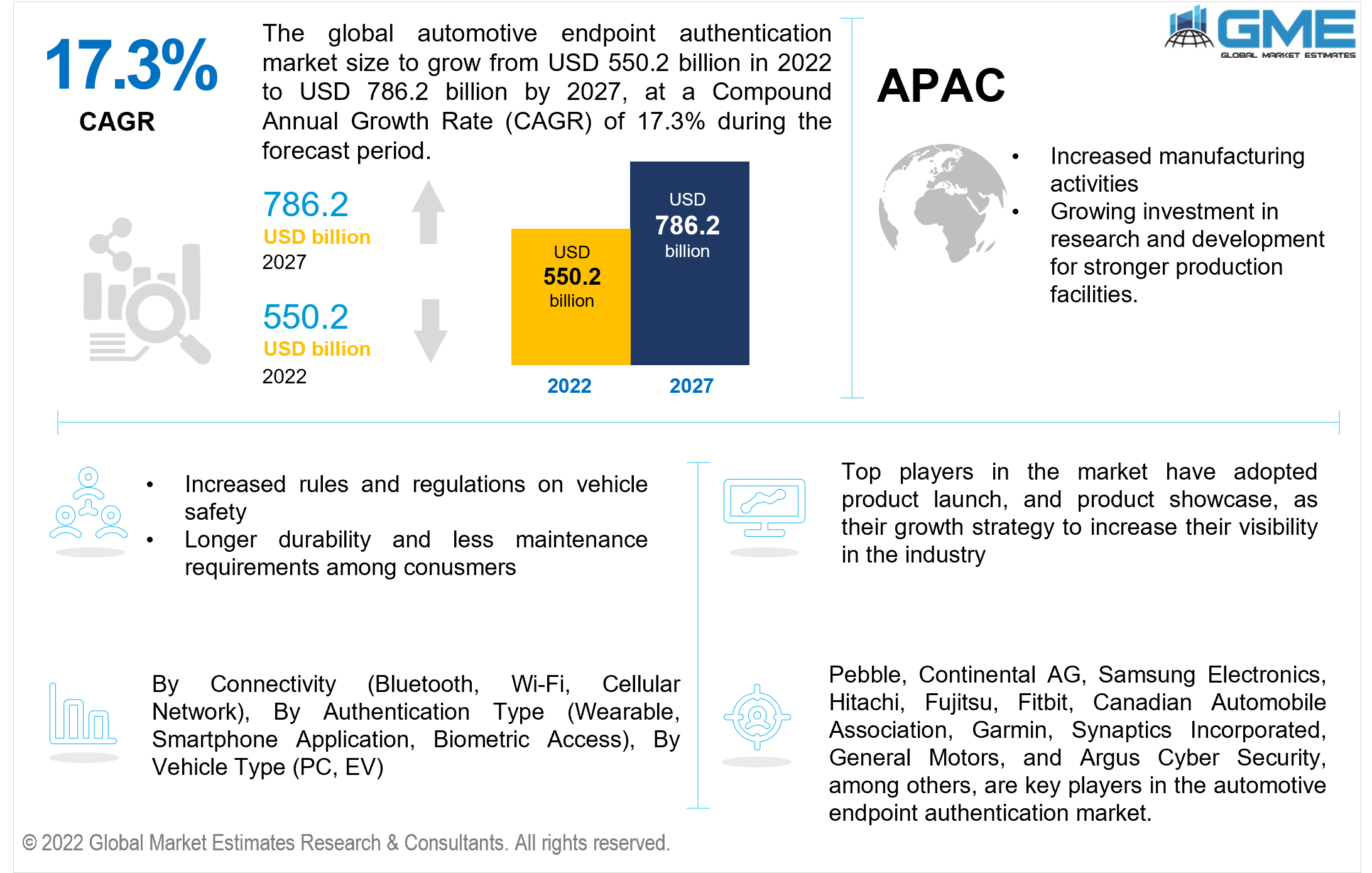

The Global Automotive Endpoint Authentication Market is projected to grow from USD 550.2 billion in 2022 to USD 786.2 billion in 2027 at a CAGR of 17.3%.

The automotive endpoint authentication market is expected to grow at a steady rate due to an increase in demand for vehicles and to protect smart components in vehicles from cyberattacks in the automobile industry. The adoption of ADAS technology has also boosted the market share during the forecast period. ADAS technology acts as assistance in driving and parking functions. This increases car functionality as well as road safety and helps to avoid accidents.

The major drivers in the automotive endpoint authentication market are the increase in disposable income of developing countries. Due to this the number of consumers buying vehicles has increased massively during the forecast period. The increase in automotive security is a major driver which boosts the market share during the forecast period. Security eases the consumer's experience and also provides safety for commercial and business vehicles.

The major restraints in the global automotive end-point authentication market are the rise in prices of raw materials, regulations surrounding safety standards, and the growing demand for energy-efficient and alternative fuel-based automobiles

The COVID-19 pandemic impacted the global automotive endpoint authentication market significantly. The global automotive endpoint authentication market had hit a stagnant stage during the initial days of the pandemic. This was because the global automobile market suffered huge losses during the pandemic. Fluctuations in the prices of raw materials, supply chain disruptions, and lack of availability of key automobile electronic components have impacted the endpoint authentication market directly. But as regional lockdowns were lifted, demand for vehicles increased and due to this, the global automotive endpoint authentication market saw substantial growth. The growing demand for the automotive endpoint authentication market will boost the market's revenue between 2022 and 2027.

The war between Russia and Ukraine had a substantial impact on the global automotive end-point authentication market. Ukraine and Russia are facing production delays, a rise in transportation costs, and low sales due to the ongoing war. This also affects the other regions in Europe. Russia and Ukraine produce key raw materials and components necessary for automobile industries across Europe. Disruptions in the functioning of factories in the two countries have had a widespread impact on the European region as a whole. Many countries trade with Russia and they are facing stockpiling and low demand due to increased prices. This impacts the political relations in the international market. Many companies are shutting down their business in Russia temporarily and this affects their other production plants as they have increased pressure of producing goods.

The biometric vehicle access segment is expected to witness the largest share in the global automotive endpoint authentication market during the forecast period of 2022-2027. This helps to identify the consumers and also helps in cross-checking the locking systems, especially for passenger vehicles and this helps reduce cyber-attacks. These advantages drive the market share during the forecast period.

The smartphone application segment is expected to grow the fastest from 2022 to 2027. There is an increase in demand for smartphones. Within an app, the consumer can find out about their personal and commercial vehicles. This has helped the automotive endpoint authentication market as it helps in reducing cyber-attacks.

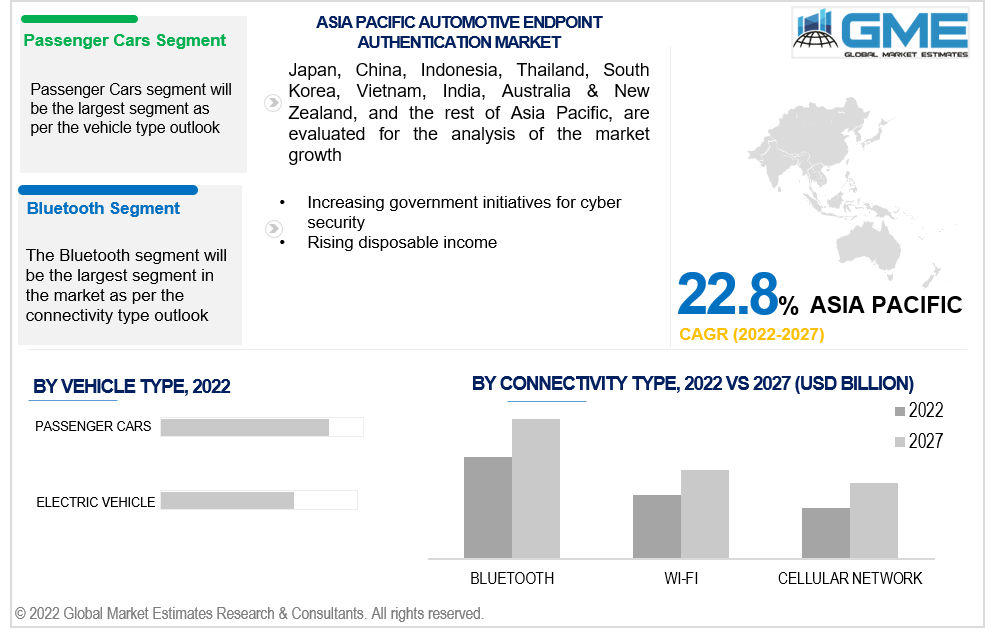

The passenger cars segment is expected to witness the largest share in the global automotive endpoint authentication market during the forecast period of 2022-2027. They are the most common type used for many years. Post covid, to avoid the spread of infection there was an increase in the purchase of private vehicles. Automotive endpoint authentication helps in locking systems which are extremely beneficial for families and also avoids attacks. They also help in location tracking and this is a major driver for the global automotive end-point authentication market. This will increase the market share for the global endpoint authentication market during the forecast period.

The electric vehicle segment is expected to grow the fastest from 2022 to 2027. Electric vehicles are environmentally friendly and consumers can charge the batteries at their convenience. EV is the new future in the vehicles segment as it works on batteries and not fuel. The increasing cost of fuel pushes consumers to purchase electric vehicles. Hence, considering these advantages the electric vehicle segment is expected to grow the fastest.

The Bluetooth segment is expected to witness the largest share in the global automotive endpoint authentication market during the forecast period of 2022-2027. Bluetooth enables a consumer to connect their smartphone devices which ease the consumer experience. It was introduced in early 2010 and this allowed the implementation of authentication systems.

The wi-fi segment is expected to grow the fastest between 2022 and 2027. Wi-Fi helps in tracking devices; it also allows GPS systems to be installed. It does not take up too much space and helps avoid cyber-attacks. Hence, considering these advantages the wi-fi segment is expected to grow the fastest.

The North America segment is expected to witness the largest share in the global automotive endpoint authentication market during the forecast period of 2022-2027. Due to the increase in disposable income of consumers and high demand in the automotive industry, the North America segment will dominate the global automotive end-point authentication market.

An increase in the standard of living, demand for electric vehicles, and awareness of energy-efficient vehicles drive the market in the United States. The automotive industry in the United States has been substantially strong for a few years and due to the increasing demand for vehicles, it is estimated to grow further during the forecast period.

Asia-Pacific is expected to grow the fastest from 2022 to 2027. Many regions are expanding the manufacturing sectors and hence there is a demand for more vehicles especially electric vehicles. Flue prices in Asia-Pacific are increasing rapidly and this is beneficial for the electric vehicles segment. Due to the rising disposable income of developing countries, strict rules and regulations by the government automotive endpoint authentication market have witnessed an increase in the market size.

The markets in India, China, and South Korea are developing new technologies and are also expanding businesses, this requires vehicles to transfer goods and services. A rise in infrastructural development increases demands for personal and commercial vehicles. Endpoint authentication helps in vehicle tracking and also in sustaining cyber-attacks. Hence, considering these advantages the global automotive endpoint authentication market is expected to grow.

The Middle East and Africa account for a significant market share. There is substantial growth due to investments in research and development, increased industrial activities, and businesses that are expanding in the global economy. The competitive landscape helps in the growth rate of the global automotive end-point authentication market.

The market share in Europe is extremely beneficial for the global automotive end-point authentication market. Germany, France & Spain are called hubs for producing automotive products. The product type is extremely innovative due to advanced technologies. Hence, considering these advantages the global automotive endpoint authentication market is estimated to grow during the forecast period.

Pebble, Continental AG, Samsung Electronics, Hitachi, Fujitsu, Fitbit, Canadian Automobile Association, Garmin, Synaptics Incorporated, General Motors, and Argus Cyber Security, among others, are some of the key players in the automotive endpoint authentication market.

Please note: This is not an exhaustive list of companies profiled in the report.

The global automotive endpoint authentication market has observed several strategic alliances between company profiles to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1 Global Market Outlook

2.2 By Vehicle Type Outlook

2.3 Connectivity Type Outlook

2.4 Authentication Outlook

2.5 Regional Outlook

Chapter 3 Global Automotive Endpoint Authentication Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Automotive Endpoint Authentication Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Automotive Endpoint Authentication Market: By Vehicle Type Trend Analysis

4.1 By Vehicle Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Passenger Cars

4.2.1 Market Estimates & Forecast Analysis of Passenger Cars Segment, By Region, 2019-2027 (USD Billion)

4.3 Electric Vehicles

4.3.1 Market Estimates & Forecast Analysis of Electric Vehicles Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Automotive Endpoint Authentication Market: By Authentication Trend Analysis

5.1 By Authentication: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Wearable

5.2.1 Market Estimates & Forecast Analysis of Wearable, By Region, 2019-2027 (USD Billion)

5.3 Smartphone Application

5.3.1 Market Estimates & Forecast Analysis of Smartphone Application Market Segment, By Region, 2019-2027 (USD Billion)

5.4 Biometric Access

5.4.1 Market Estimates & Forecast Analysis of Biometric Access Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Automotive Endpoint Authentication Market: Connectivity Type Trend Analysis

6.1 Connectivity Type: Historic Data vs. Forecast Data Analysis, 2022 vs. 2027

6.2 Bluetooth

6.2.1 Market Estimates & Forecast Analysis of Bluetooth Segment, By Region, 2019-2027 (USD Billion)

6.3 Wi-Fi

6.3.1 Market Estimates & Forecast Analysis of Wi-Fi Segment, By Region, 2019-2027 (USD Billion)

6.4 Cellular Network

6.3.1 Market Estimates & Forecast Analysis of Cellular Network Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Automotive Endpoint Authentication Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.5.7 Mexico

7.5.5.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Authentication, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By Connectivity Type, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Pebble

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Continental AG

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Samsung Electronics

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Hitachi

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Fujitsu

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Garmin

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Synaptics Incorporated

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 General Motors

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Argus Cyber Security

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Automotive Endpoint Authentication Market

2 Global Automotive Endpoint Authentication Market: Key Market Drivers

3 Global Automotive Endpoint Authentication Market: Key Market Challenges

4 Global Automotive Endpoint Authentication Market: Key Market Opportunities

5 Global Automotive Endpoint Authentication Market: Key Market Restraints

6 Global Automotive Endpoint Authentication Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

8 Passenger Cars: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

9 Electric Vehicles: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

10 Global Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

11 Wearable: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

12 Biometric Access: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

13 Smartphone Application: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

14 Global Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

15 Bluetooth: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

16 Wi-Fi: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

17 Cellular Network: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

18 Regional Analysis: Global Automotive Endpoint Authentication Market, By Region, 2019-2027 (USD Billion)

19 North America: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

20 North America: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

21 North America: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

22 North America: Automotive Endpoint Authentication Market, By Country, 2019-2027 (USD Billion)

23 U.S: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

24 U.S: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

25 U.S: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

26 Canada: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

27 Canada: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

28 Canada: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

29 Mexico: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

30 Mexico: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

31 Mexico: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

32 Europe: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

33 Europe: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

34 Europe: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

35 Europe: Automotive Endpoint Authentication Market, By Country, 2019-2027 (USD Billion)

36 Germany: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

37 Germany: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

38 Germany: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

39 UK: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

40 UK: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

41 UK: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

42 France: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

43 France: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

44 France: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

45 Italy: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

46 Italy: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

47 Italy: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

48 Spain: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

49 Spain: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

50 Spain: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

51 Rest Of Europe: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

52 Rest Of Europe: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

53 Rest Of Europe: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

54 Asia Pacific: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

55 Asia Pacific: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

56 Asia Pacific: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

57 Asia Pacific: Automotive Endpoint Authentication Market, By Country, 2019-2027 (USD Billion)

58 China: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

59 China: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

60 China: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

61 India: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

62 India: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

63 India: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

64 Japan: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

65 Japan: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

66 Japan: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

67 South Korea: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

68 South Korea: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

69 South Korea: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

70 Middle East & Africa: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

71 Middle East & Africa: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

72 Middle East & Africa: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

73 Middle East & Africa: Automotive Endpoint Authentication Market, By Country, 2019-2027 (USD Billion)

74 Saudi Arabia: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

75 Saudi Arabia: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

76 Saudi Arabia: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

77 UAE: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

78 UAE: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

79 UAE: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

80 Central & South America: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

81 Central & South America: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

82 Central & South America: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

83 Central & South America: Automotive Endpoint Authentication Market, By Country, 2019-2027 (USD Billion)

84 Brazil: Automotive Endpoint Authentication Market, By Vehicle Type, 2019-2027 (USD Billion)

85 Brazil: Automotive Endpoint Authentication Market, By Authentication, 2019-2027 (USD Billion)

86 Brazil: Automotive Endpoint Authentication Market, By Connectivity Type, 2019-2027 (USD Billion)

87 Pebble: By Vehicle Types Offered

88 Continental AG: By Vehicle Types Offered

89 Samsung Electronics: By Vehicle Types Offered

90 Hitachi: By Vehicle Types Offered

91 Fujitsu: By Vehicle Types Offered

92 Garmin: By Vehicle Types Offered

93 Argus Cyber Security: By Vehicle Types Offered

94 Synaptics Incorporated: By Vehicle Types Offered

95 General Motors: By Vehicle Types Offered

96 Other Companies: By Vehicle Types Offered

List of Figures

1. Global Automotive Endpoint Authentication Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Automotive Endpoint Authentication Market: Penetration & Growth Prospect Mapping

7. Global Automotive Endpoint Authentication Market: Value Chain Analysis

8. Global Automotive Endpoint Authentication Market Drivers

9. Global Automotive Endpoint Authentication Market Restraints

10. Global Automotive Endpoint Authentication Market Opportunities

11. Global Automotive Endpoint Authentication Market Challenges

12. Key Automotive Endpoint Authentication Market Manufacturer Analysis

13. Global Automotive Endpoint Authentication Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Pebble: Company Snapshot

16. Pebble: Swot Analysis

17. Continental AG: Company Snapshot

18. Continental AG: Swot Analysis

19. Samsung Electronics: Company Snapshot

20. Samsung Electronics: Swot Analysis

21. Hitachi: Company Snapshot

22. Hitachi: Swot Analysis

23. Fujitsu: Company Snapshot

24. Fujitsu: Swot Analysis

25. Argus Cyber Security: Company Snapshot

26. Argus Cyber Security: Swot Analysis

27. Synaptics Incorporated: Company Snapshot

28. Synaptics Incorporated: Swot Analysis

29. General Motors: Company Snapshot

30. General Motors: Swot Analysis

31. Garmin: Company Snapshot

32. Garmin: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Automotive Endpoint Authentication Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Endpoint Authentication Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS