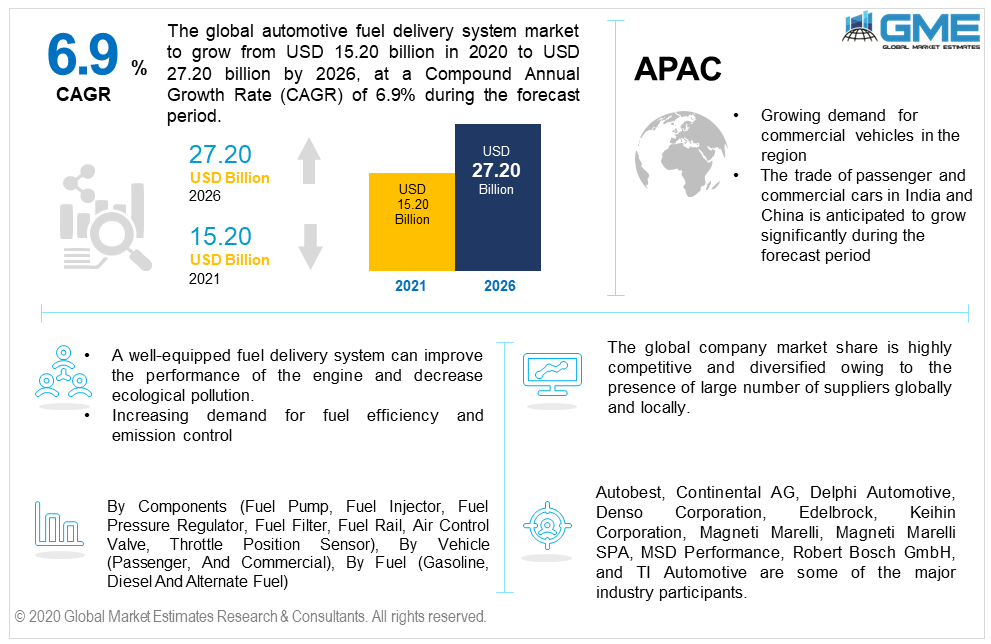

Global Automotive Fuel Delivery System Market Size, Trends & Analysis – Forecasts to 2026 By Component (Fuel Pump, Fuel Injector, Fuel Pressure Regulator, Fuel Filter, Fuel Rail, Air Control Valve, Throttle Position Sensor), By Vehicle (Passenger and Commercial), By Fuel (Gasoline, Diesel, and Alternate Fuel), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); Company Market Share Analysis, and Competitor Analysis

The global automotive fuel delivery system market is valued at USD 15.20 billion in 2020 and is anticipated to surpass USD 27.20 billion by 2026 expanding at a CAGR of 6.9%.

There are multiple market drivers nudging the growth of the business like the growth of the automotive industry, altering lifestyle, and growing inclination of comfortable rides. Further, carrier production and booming demand for high-efficiency engines are escalating the sales of automobiles and are anticipated to encourage the extension of the market in the future as well. Moreover, fast progress in transport base including improving lifestyles of customers is one of the prime reasons for expanding the creation of new vehicles.

In todays’ era, vehicles are ever-present and enhance the market for automotive replacement components. Moreover, the global automotive market is swelling in view of demarcated urbanization and improving per capita disposable earnings. Furthermore, many important aspects stimulating the growth of the market range from the execution of severe emission control standards, particularly for commercial transport, sound mitigation, improved fuel performance, etc. Also, compressed natural gas and liquified petroleum gas vehicles have got attention concerning the reduction in emanations from diesel carriers.

However, the introduction and rising preference of electric carriers in the transportation realm are anticipated to hamper the development of the business. Further, certain impediments like high cost owing to more effective and organized fuel delivery systems act as a restraint in the growth of the market.

COVID-19 fastened the industries across the globe by disturbing the supply value chains and impacting the overall market delivery systems. However, the market is rapidly impending at the pre-COVID mark, also a healthy growth rate is foreseen amidst the forecast period, kindled by economic recovery in most of the emerging nations. The usual discontinuation of public transport operations, accompanied by the virus's extremely contagious character, raised the market for tourist carriers, leading towards progressive alternatives.

Based on component, the market is segmented into fuel injector, fuel rail, fuel pump, fuel filter, fuel pressure regulator, throttle position sensor, and air control valve.

The fuel injectors segment would register the most substantial share during the forecast timeline. A fuel injector is an electronically regulated mechanical device that is utilized for transferring the fuel into the engine for the construction of an alike (air-fuel) compound for effective engine oxidization.

Based on vehicle type, the market is segmented into commercial and passenger vehicles. The market of light commercial vehicles contributed with more than 75% of the aggregate commercial vehicle sales. The reason for this is associated with a more than 5 percent increase in sales of commercial vehicles from 2019 to 2020. The consumer choice for light vehicles has an affirmative impact on the global market share.

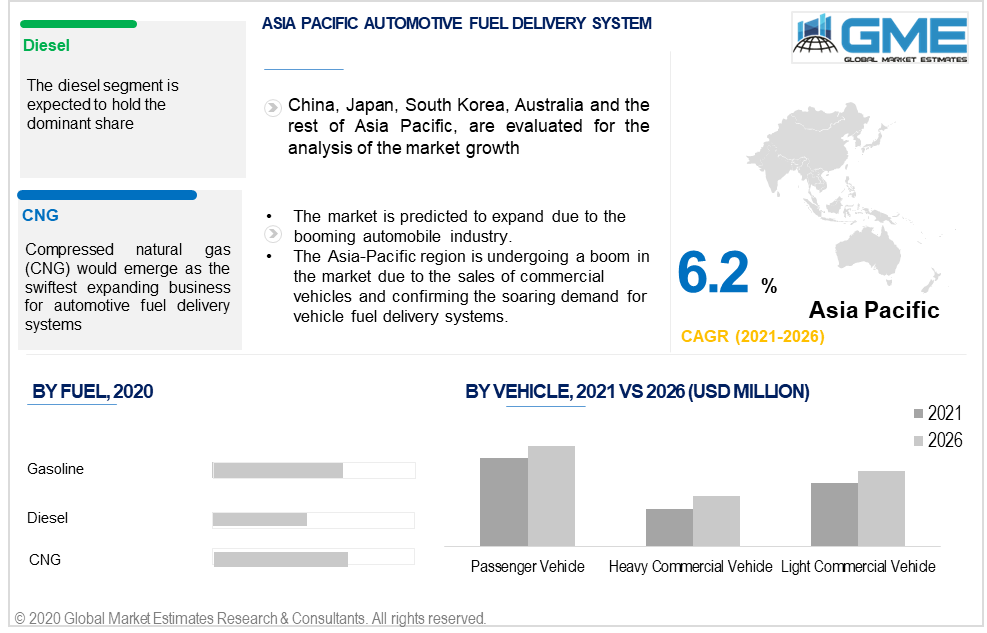

The Asia Pacific accommodates a notable revenue share and will continue to lead during the forecast period. The regional share is predicted to expand due to the booming automobile industry. The trade of passenger and commercial cars in the advancing nations of India and China is anticipated to progress in the subsequent years.

North America is the fastest expanding region globally. The demand for commercial vehicles is booming due to advancing logistics businesses, coupled with the increased appropriation of light commercial vehicles like vans, which will influence regional growth.

The key market players include Autobest, Continental AG, Delphi Automotive, Denso Corporation, Edelbrock, Keihin Corporation, Magneti Marelli, Magneti Marelli SPA, MSD Performance, Robert Bosch GmbH, and TI Automotive, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Automotive Fuel Delivery System Market Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Vehicle Overview

2.1.4 Fuel Overview

2.1.6 Regional Overview

Chapter 3 Automotive Fuel Delivery System Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.2 Industry Challenges

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Vehicle Growth Scenario

3.4.3 Fuel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Fuel Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Automotive Fuel Delivery System Market, By Component

4.1 Component Outlook

4.2 Fuel Pump

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Fuel Injector

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

4.4 Fuel Pressure Regulator

4.4.1 Market Size, By Region, 2021-2026 (USD Million)

4.5 Fuel Filter

4.5.1 Market Size, By Region, 2021-2026 (USD Million)

4.6 Fuel Rail

4.6.1 Market Size, By Region, 2021-2026 (USD Million)

4.7 Air Control Value

4.7.1 Market Size, By Region, 2021-2026 (USD Million)

4.8 Throttle Position Sensor

4.8.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Automotive Fuel Delivery System Market, By Vehicle

5.1 Vehicle Outlook

5.2 Passenger Cars

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Commercial Vehicles

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Automotive Fuel Delivery System Market, By Fuel

6.1 Fuel Outlook

6.2 Gasoline

6.2.1 Market Size, By Region, 2021-2026 (USD Million)

6.3 Diesel

6.3.1 Market Size, By Region, 2021-2026 (USD Million)

6.4 Alternate Fuel

6.4.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 7 Automotive Fuel Delivery System Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Million)

7.2.2 Market Size, By Component, 2021-2026 (USD Million)

7.2.3 Market Size, By Vehicle, 2021-2026 (USD Million)

7.2.4 Market Size, By Fuel, 2021-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.2.4.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.2.4.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.2.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.2.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Million)

7.3.2 Market Size, By Component, 2021-2026 (USD Million)

7.3.3 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.4 Market Size, By Fuel, 2021-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.6.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.6.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.9.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.9.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.10.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.10.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.11.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.3.11.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Million)

7.4.2 Market Size, By Component, 2021-2026 (USD Million)

7.4.3 Market Size, By Vehicle, 2021-2026 (USD Million)

7.4.4 Market Size, By Fuel, 2021-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.6.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.4.6.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.4.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.4.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.9.2 Market size, By Vehicle, 2021-2026 (USD Million)

7.4.9.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.10.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.4.10.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Million)

7.5.2 Market Size, By Component, 2021-2026 (USD Million)

7.5.3 Market Size, By Vehicle, 2021-2026 (USD Million)

7.5.4 Market Size, By Fuel, 2021-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.5.6.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.5.6.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.5.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.5.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.5.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.5.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Million)

7.6.2 Market Size, By Component, 2021-2026 (USD Million)

7.6.3 Market Size, By Vehicle, 2021-2026 (USD Million)

7.6.4 Market Size, By Fuel, 2021-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.6.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.6.6.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.6.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.7.2 Market Size, By Vehicle, 2021-2026 (USD Million)

7.6.7.3 Market Size, By Fuel, 2021-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 Autobest

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Continental AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Delphi Automotive

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Denso Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Edelbrock

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Keihin Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Magneti Marelli

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 MSD Performance

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Robert Bosch GmbH

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 TI Automotive

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Automotive Fuel Delivery System Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Fuel Delivery System Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS