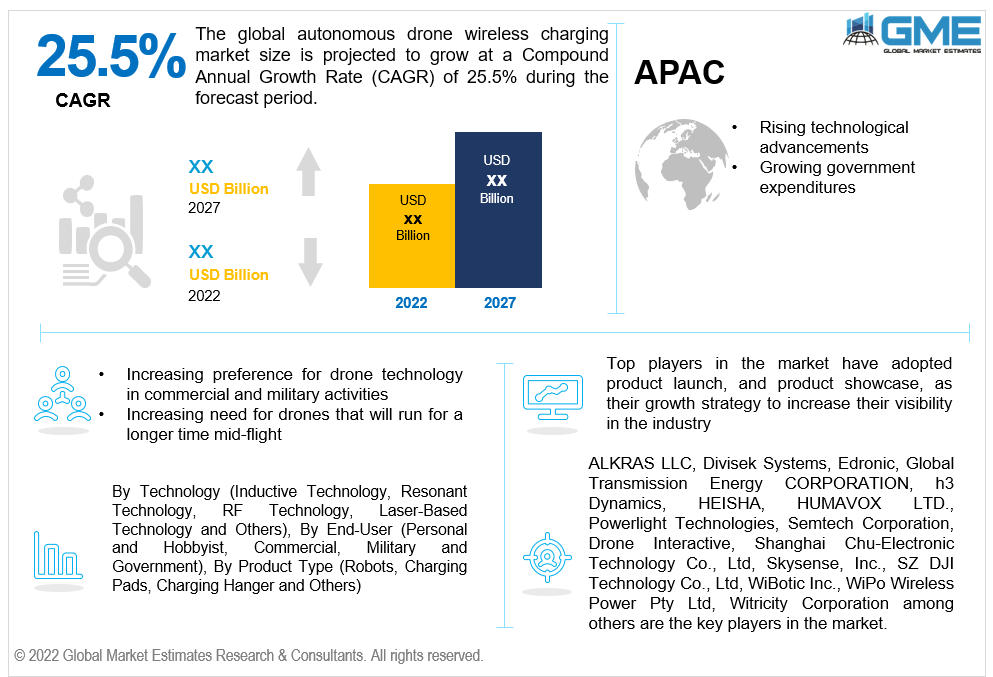

Global Autonomous Drone Wireless Charging and Infrastructure Market Size, Trends & Analysis - Forecasts to 2027 By Technology (Inductive Technology, Resonant Technology, RF Technology, Laser-Based Technology and Others), By End-User (Personal and Hobbyist, Commercial, Military and Government), By Product Type (Robots, Charging Pads, Charging Hanger and Others) By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global autonomous drone wireless charging and infrastructure market is projected to grow at a CAGR value of 25.5% from 2022 to 2027.

Unmanned drones have fast become a required technology for governments and organizations across the globe. Drones gather information on the weather forecast, survey dangerous area and capture live events without the need of a human being to handle its functioning. Despite its many uses, drones require changing of batteries every time they run out. Autonomous drone wireless charging infrastructure brings along with itself the higher flight times of drones and more efficiency. This infrastructure helps with increasing the flight time of the drones by reducing the time for changing the batteries of the drones and creating ‘hotspots’ that will simply charge the drone within minutes while still being in-flight.

The market will be driven during the forecast period by increasing use of unmanned drones for a variety of commercial and security activities, rising need for drones that can work for longer hours with lower downtime, increasing wireless power transfer in modern technological devices and growing attempts to improve efficiency of drones by increasing the lifespan of the batteries.

Furthermore, rising demand for Beyond Visual Line of Sight (BVLOS) drones in developed and developing countries for monitoring infrastructure, increasing demand for auto charge drones that can charge themselves without the need of wires or human intervention are some of the factors supporting the growth of the market.

The COVID-19 pandemic has been determined to have had bought forward newer ways of using drone technology. The use of drones has been identified with respect to monitoring public spaces, aerial spraying of disinfectants on area which might have traces of the virus and picking up and collecting samples and reports. An autonomous drone wireless charging and infrastructure will prove to be beneficial during the pandemic period with a rising demand in the usage of drones and the need for reducing human intervention in technological activities. As a normal drone would require human assistance to change the batteries, it would to be possible in a pandemic driven situation to employ the appropriate employees for the same. An autonomous drone wireless charging infrastructure would not require human beings to handle the drones and this will bring about efficiency as well as safety to individuals.

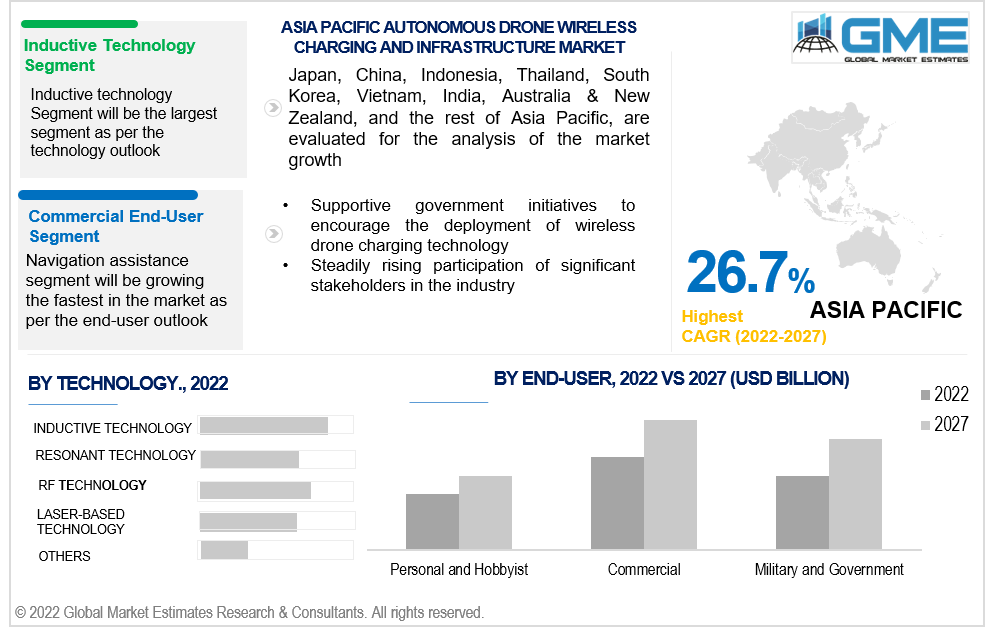

Based on the technology, the autonomous drone wireless charging and infrastructure market is divided into Inductive technology, resonant technology, RF technology, laser-based technology and others. The inductive technology has the largest market share and has been consistently dominant segment in the autonomous drone wireless charging and infrastructure.

Inductive technology has gained more prominence with respect to autonomous drone wireless charging and infrastructure market. This is because of inductive technology induced in charging devices that sense current measurements from the inductive coils and adjust the device accordingly in order to maximize the charging rate of the device.

Based on the application, the autonomous drone wireless charging and infrastructure market is divided into personal and hobbyist, commercial, military and government. The Commercial segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

The commercial use of drone technology is set to be highly impactful in the coming years with companies making use of drones for safe deliveries to collecting data. For instance, the Department of Transportation (DOT) had established the Unmanned Aircraft (UAS) Integration Pilot Program (IPP) encouraging commercial players with awards if they are to make use of drones. The commercial sector is expected to make use of this segments and are turning to autonomous drone wireless charging infrastructure in order to increase the efficiency of drone related services.

Based on the product type, autonomous drone wireless charging and Infrastructure market is divided into robots, charging pads, charging hanger and others. Charging pods segment have been analyzed to be the fastest growing segment in the market. This is mainly due to the rising demand and popularity of contactless charging stations for drones in various end-user industries.

As per the geographical analysis, the autonomous drone wireless charging and infrastructure market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the autonomous drone wireless charging and infrastructure market from 2022 to 2027. The major factor driving the growth of the market in the North American region is due to the presence of a large number of autonomous wireless drones charging infrastructure manufacturers and increasing awareness regarding charging pads and advanced drone management robots. The U.S government has also encouraged the sector with the disposition of BVLOS drones across United States of America in various fields and sectors.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the autonomous drone wireless charging and Infrastructure market during the forecast period. Increased technological progress along with government investment is going to propel the growth of drone technology and subsequent wireless charging infrastructure.

ALKRAS LLC, Divisek Systems, Edronic, Global Transmission Energy CORPORATION, h3 Dynamics, HEISHA, HUMAVOX LTD., Powerlight Technologies, Semtech Corporation, Drone Interactive, Shanghai Chu-Electronic Technology Co., Ltd, Skysense, Inc., SZ DJI Technology Co., Ltd, WiBotic Inc., WiPo Wireless Power Pty Ltd, Witricity Corporation among others are the key players in the autonomous drone wireless charging and infrastructure market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Autonomous Drone Wireless Charging and Infrastructure Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 End-User Overview

2.1.4 Product Overview

2.1.6 Regional Overview

Chapter 3 Autonomous Drone Wireless Charging and Infrastructure Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising preference for wireless charging in technological devices in military & defense industry

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated laboratory systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Product Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Autonomous Drone Wireless Charging and Infrastructure Market, By Technology

4.1 Technology Outlook

4.2 Inductive Technology

4.2.1 Market Size, By Region, 2022-2027 (USD Million)

4.3 Resonant Technology

4.3.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Autonomous Drone Wireless Charging and Infrastructure Market, By End-User Type

5.1 End-User Outlook

5.2 Personal and Hobbyist

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Commercial

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

5.4 Military and Government

5.4.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Autonomous Drone Wireless Charging and Infrastructure Market, By Product

6.1 Robots

6.1.1 Market Size, By Region, 2022-2027 (USD Million)

6.2 Charging Pads

6.2.1 Market Size, By Region, 2022-2027 (USD Million)

6.3 Charging Hanger

6.3.1 Market Size, By Region, 2022-2027 (USD Million)

6.4 Others

6.4.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 7 Autonomous Drone Wireless Charging and Infrastructure Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Million)

7.2.2 Market Size, By Technology, 2022-2027 (USD Million)

7.2.3 Market Size, By End-User Type, 2022-2027 (USD Million)

7.2.4 Market Size, By End-User, 2022-2027 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Technology, 2022-2027 (USD Million)

7.2.4.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.2.4.3 Market Size, By End-User, 2022-2027 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.2.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.2.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Million)

7.3.2 Market Size, By Technology, 2022-2027 (USD Million)

7.3.3 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.4 Market Size, By End-User, 2022-2027 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Technology, 2022-2027 (USD Million)

7.3.6.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.6.3 Market Size, By End-User, 2022-2027 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.3.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.3.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Technology, 2022-2027 (USD Million)

7.3.9.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.9.3 Market Size, By End-User, 2022-2027 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Technology, 2022-2027 (USD Million)

7.3.10.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.10.3 Market Size, By End-User, 2022-2027 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Technology, 2022-2027 (USD Million)

7.3.11.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.3.11.3 Market Size, By End-User, 2022-2027 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Million)

7.4.2 Market Size, By Technology, 2022-2027 (USD Million)

7.4.3 Market Size, By End-User Type, 2022-2027 (USD Million)

7.4.4 Market Size, By End-User, 2022-2027 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Technology, 2022-2027 (USD Million)

7.4.6.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.4.6.3 Market Size, By End-User, 2022-2027 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.4.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.4.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.4.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.4.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Technology, 2022-2027 (USD Million)

7.4.9.2 Market size, By End-User Type, 2022-2027 (USD Million)

7.4.9.3 Market Size, By End-User, 2022-2027 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Technology, 2022-2027 (USD Million)

7.4.10.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.4.10.3 Market Size, By End-User, 2022-2027 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Million)

7.5.2 Market Size, By Technology, 2022-2027 (USD Million)

7.5.3 Market Size, By End-User Type, 2022-2027 (USD Million)

7.5.4 Market Size, By End-User, 2022-2027 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Technology, 2022-2027 (USD Million)

7.5.6.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.5.6.3 Market Size, By End-User, 2022-2027 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.5.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.5.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.5.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.5.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Million)

7.6.2 Market Size, By Technology, 2022-2027 (USD Million)

7.6.3 Market Size, By End-User Type, 2022-2027 (USD Million)

7.6.4 Market Size, By End-User, 2022-2027 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Technology, 2022-2027 (USD Million)

7.6.6.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.6.6.3 Market Size, By End-User, 2022-2027 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.6.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.6.7.3 Market Size, By End-User, 2022-2027 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Technology, 2022-2027 (USD Million)

7.6.7.2 Market Size, By End-User Type, 2022-2027 (USD Million)

7.6.7.3 Market Size, By End-User, 2022-2027 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 ALKRAS LLC

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Divisek Systems

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Edronic

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Global Transmission Energy Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 H3 Dynamics

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 HEISHA

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 HUMAVOX Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Powerlight Technologies

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Semtech Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Drone Interactive

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Shanghai Chu-Electronic Technology Co., Ltd

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Skysense, Inc.

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Solace Power Inc.

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 SZ DJI Technology Co., Ltd.,

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 WiBiotic Inc.

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

8.17 WiPo Wireless Power Pty Ltd

8.17.1 Company Overview

8.17.2 Financial Analysis

8.17.3 Strategic Positioning

8.17.4 Info Graphic Analysis

8.18 Witricity Corporation

8.18.1 Company Overview

8.18.2 Financial Analysis

8.18.3 Strategic Positioning

8.18.4 Info Graphic Analysis

8.19 Others

8.19.1 Company Overview

8.19.2 Financial Analysis

8.19.3 Strategic Positioning

8.19.4 Info Graphic Analysis

The Global Autonomous Drone Wireless Charging and Infrastructure Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Autonomous Drone Wireless Charging and Infrastructure Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS