Global Autonomous Mobile Robots Market Size, Trends & Analysis - Forecasts to 2026 By Type (Unmanned Aerial Vehicles, Goods-to-Person Picking Robots, Autonomous Inventory Robots, Self-Driving Forklifts), By Battery Type (Lead Battery, Lithium-Ion Battery, Nickel-Based Battery, Others), By End-User (Real Estate and Construction, Power and Energy, Defense and Security, Manufacturing and Logistics, Automotive, Education and Research, Warehouse & Distribution, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

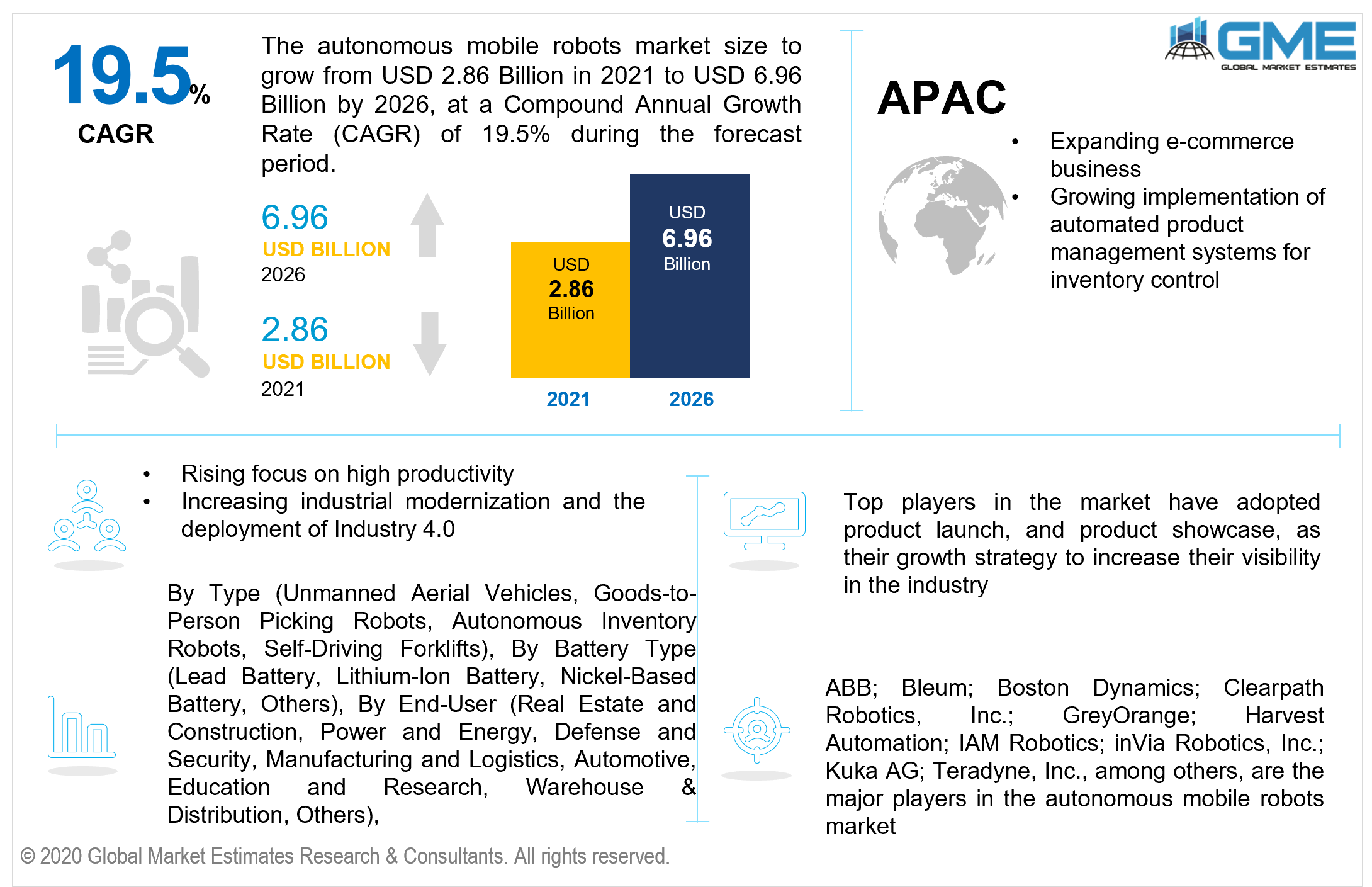

The global autonomous mobile robots market is projected to grow from USD 2.86 billion in 2021 to USD 6.96 billion by 2026 at a CAGR value of 19.5% between 2021 to 2026. Substantial expansion in the retail business across the world, together with the introduction of Industry 4.0, is one of the major drivers driving the market's optimistic prognosis. In addition, the growing implementation of automated product management systems for inventory control is propelling market expansion. Autonomous mobile robots (AMRs) are being used by e-commerce companies to streamline warehouse management and optimize product production workflows.

In accordance with this, they are also used in army combat missions, improving troop security on the battlefield and rescuing injured soldiers. Furthermore, technical advances including the incorporation of onboard intelligence systems and the use of advanced sensors for precise awareness of the surroundings are boosting market expansion. Additional factors, such as growing urbanization and intensive research and development (R&D), are expected to propel the market.

Amazon has deployed an army of mobile robots in its facilities. These robots are programmed to manage, coordinate, and carry out certain duties on their own. In the instance of Amazon, the robots functioned as planned, and the corporation is still using the technology in its warehouses. Additionally, dealing with these devices presents several obstacles. Current robotic systems, as well as those previously utilized in Amazon facilities, have not been taught to operate securely with robots. In a few cases, this resulted in accidents.

Robotic technology is becoming more popular in a variety of commercial and industrial contexts. Hospitals, for example, are already deploying autonomous mobile robots to carry goods and monitor patient health. Professional service robots are used in the military and defense industry and are deployed in combat scenarios. Furthermore, mobile robots improve army skills by providing forces with an edge on the ground.

Furthermore, field robots, which are professional service robots, are utilized in this sector for a range of tasks such as transporting heavy equipment, acting in life-threatening circumstances to protect soldiers, and rescuing wounded troops in battle zones. Another important aspect driving the advancement of the AMR market is the growing need for automation solutions. The need for automation solutions is increasing globally as a consequence of high labor costs in developed countries, a growth in complicated industrial processes, a rising focus on high productivity, and a shortage of appropriate manpower. For example, original equipment manufacturers (OEMs) in the automobile industry require the assistance of robots in a variety of sophisticated assembly procedures.

AMRs are also utilized in warehouses and logistics to handle critical activities including loading, unloading, and transporting. Autonomous mobile robots (AMRs) are utilized in manufacturing and distribution facilities to select, move, and sort things without the need for human interaction. AMRs employ vision cameras, onboard sensors, and a facility map connected with warehouse execution software (WES) to conduct numerous tasks within the facility, such as moving raw materials and produced items. These features aid in the wider acceptance of AMRs.

Based on the type, the market is divided into unmanned aerial vehicles, goods-to-person picking robots, autonomous inventory robots, and self-driving forklifts. The goods-to-person picking robots segment is presumed to lead in the market. This can be ascribed to the persistent implementation of self-driving robots to replace paper-based and manual selection systems. To transfer products between employees and terminals, the goods-to-person picking robots may be trained to transport carts and navigate through various pathways. Several robotics companies are offering autonomous mobile robotic picking systems that can potentially add a new level of efficiency to the manufacturing and warehousing operations.

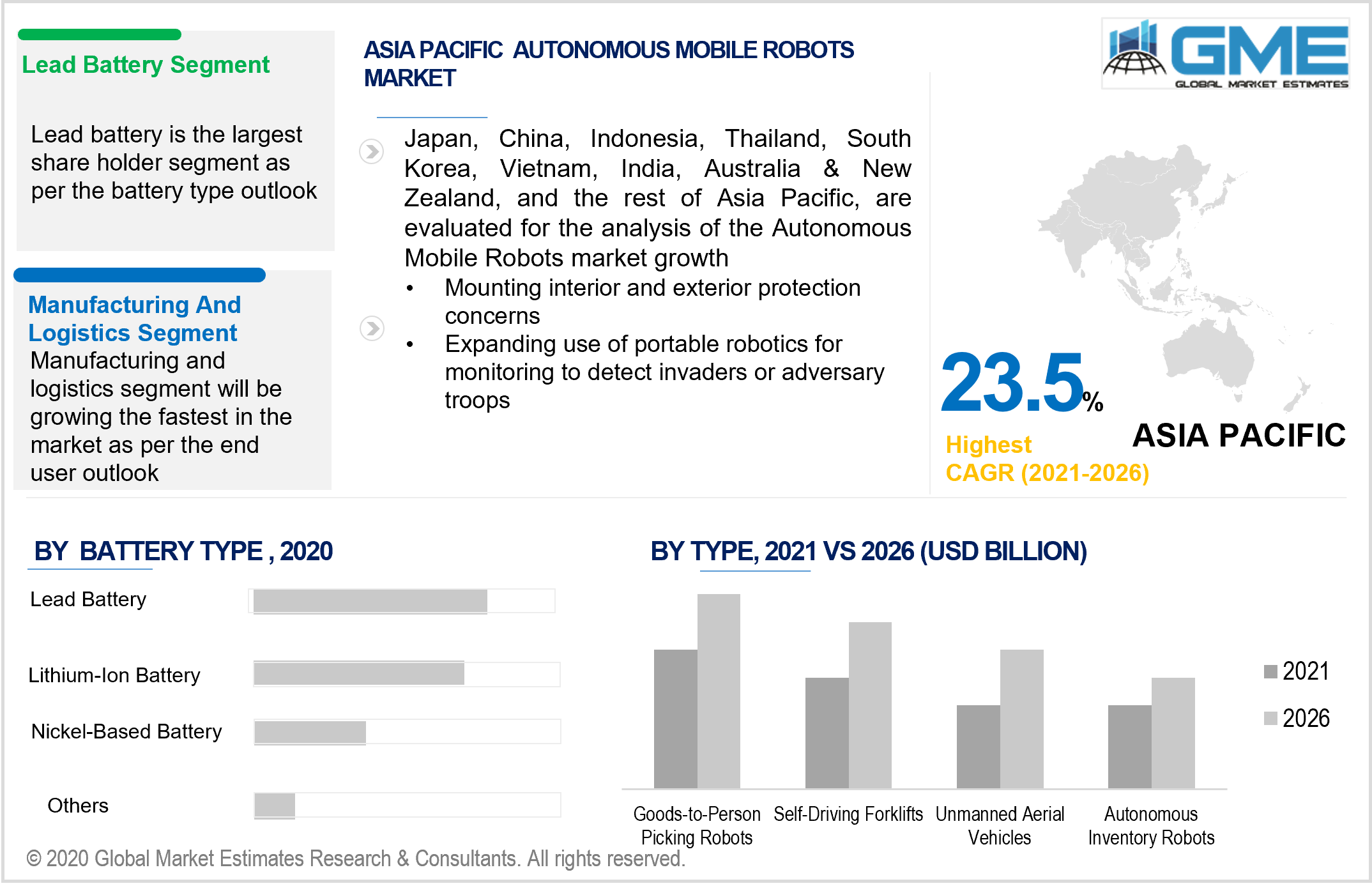

Based on the type of battery, the market is divided into the lead battery, lithium-ion battery, nickel-based battery, and others. The lead battery segment is foreseen to account for the largest market share because of the inexpensive price of these batteries. Lead batteries also have a steady voltage, high reusability, and extended operational life, making them ideal for a wide spectrum of industrial operations.

Based on the end-user, the market is divided into real estate and construction, power and energy, defense and security, manufacturing and logistics, automotive, education and research, warehouse & distribution, and others. Due to the continuing process automation in the global manufacturing industry, the manufacturing and logistics segment is presumed to lead in this market. This supremacy can be ascribed to the attempts to adopt agile manufacturing, different activities such as assembling, painting, sealing, finishing, machinery handling & component exchange, and components elimination, and also internal logistics connected with automobile production, are performed.

Europe is presumed to be the dominant regional market because of the strong demand for freight management technology from the production industry's competitors. Operational automation across numerous sectors and industrial divisions will remain to boost the regional market. Regional players are working to promote industrial modernization and the deployment of Industry 4.0.

Asia Pacific is estimated to register the highest CAGR. The expanding e-commerce business in Asia Pacific's rising nations is notably encouraging the use of AMRs for inventory administration. AMRs are being used in warehouses by e-commerce businesses in especially to streamline intralogistics operations.

North America is presumed to emerge as a leading market trailing Europe. The necessities for portable robots in the area are constantly expanding, attributable to considerations including mounting interior and exterior protection concerns, heightened terrorist operations, and expanding use of portable robotics for monitoring to detect invaders or adversary troops.

ABB; Bleum; Boston Dynamics; Clearpath Robotics, Inc.; GreyOrange; Harvest Automation; IAM Robotics; inVia Robotics, Inc.; Kuka AG; and Teradyne, Inc., among others, are the major players in the autonomous mobile robots market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Autonomous Mobile Robots Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Battery Type Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Autonomous Mobile Robots Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing usage of mobile robots for patrolling to spot intruders or enemy forces

3.3.1.2 Extensive research and development (R&D) activities

3.3.2 Industry Challenges

3.3.2.1 Higher cost of setup

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Battery Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Autonomous Mobile Robots Market, By Type

4.1 Type Outlook

4.2 Unmanned Aerial Vehicles

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Goods-to-Person Picking Robots

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Autonomous Inventory Robots

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Self-Driving Forklifts

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Autonomous Mobile Robots Market, By Battery Type

5.1 Battery Type

5.2 Lead Battery

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Lithium-Ion Battery

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Nickel-Based Battery

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Others

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Autonomous Mobile Robots Market, By End-User

6.1 End-User

6.2 Real Estate and Construction

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Power and Energy

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Defense and Security

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Manufacturing and Logistics

6.5.1 Market Size, By Region, 2019-2026 (USD Billion)

6.6 Automotive

6.6.1 Market Size, By Region, 2019-2026 (USD Billion)

6.7 Education and Research

6.7.1 Market Size, By Region, 2019-2026 (USD Billion)

6.8 Warehouse & Distribution

6.8.1 Market Size, By Region, 2019-2026 (USD Billion)

6.9 Others

6.9.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Autonomous Mobile Robots Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Type, 2019-2026 (USD Billion)

7.2.3 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Type, 2019-2026 (USD Billion)

7.3.3 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Battery Type, 2019-2026(USD Billion)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Type, 2019-2026 (USD Billion)

7.4.3 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.8.2 Market size, By Battery Type, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country, 2019-2026 (USD Billion)

7.5.2 Market Size, By Type, 2019-2026 (USD Billion)

7.5.3 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Billion)

7.7.2 Market Size, By Type, 2019-2026 (USD Billion)

7.7.3 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.7.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.7.5.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.7.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.7.6 UAE

7.7.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.7.6.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.7.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.7.7 South Africa

7.7.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.7.7.2 Market Size, By Battery Type, 2019-2026 (USD Billion)

7.7.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 ABB

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Bleum

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Boston Dynamics

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Clearpath Robotics, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 GreyOrange

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Harvest Automation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 IAM Robotics

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 inVia Robotics, Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Kuka AG

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Teradyne, Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Autonomous Mobile Robots Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Autonomous Mobile Robots Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS