Global Barrier Film Flexible Market Size, Trends, and Analysis - Forecasts To 2026 By Material (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET/BOPET), Polyamide, Organic Coatings [EVOH, PVOH, PVDC], Inorganic Coatings [Aluminum Oxide, Silicon Oxide, Silicon Nitride Coatings], Others), By End-Use Industry (Food & Beverage Packaging, Pharmaceutical Packaging, Agriculture, Others [Electronics, Automotive, Aerospace]), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

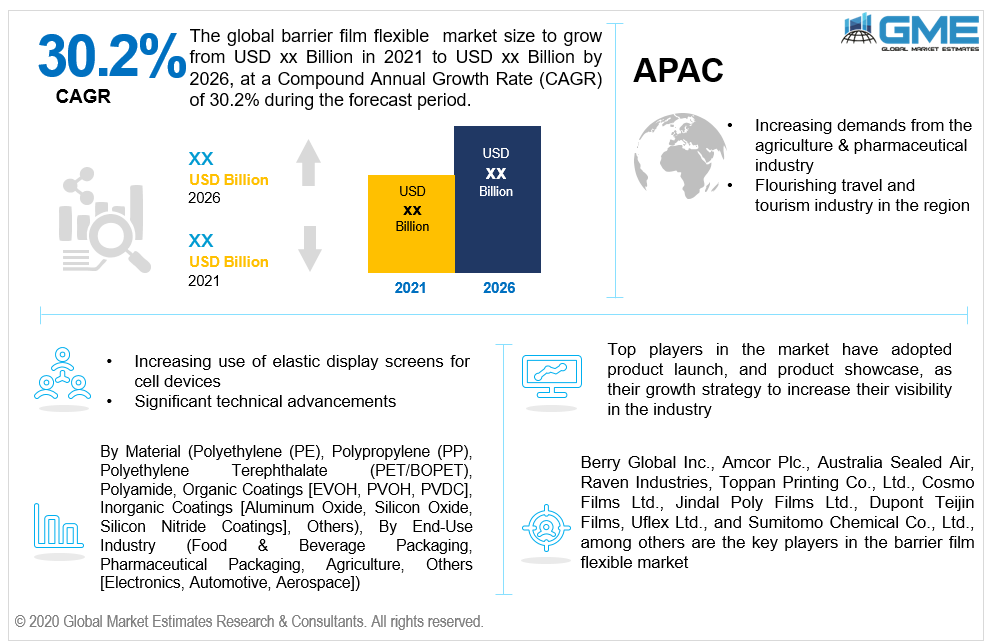

The Global Barrier Film Flexible Market is projected to grow at a CAGR value of 30.2% from 2021 to 2026.

Barrier films are a pliable barrier coverings used to protect electronic displays and electronic systems from deteriorating due to air, moisture, or other environmental factors. These films have a wide range of applications and serve to extend the life of devices while remaining light in weight. These also do not impair the device's functioning and have a benefit over conventional protective measures such as glass, which really is fragile and rigid. The development of flexible devices allows for an efficient performance while also providing the equipment with a sturdy durability, compact size, and adaptability.

Rising use of mobile gadgets, increasing sales of organic and printable digital equipment, rising consumption expenditure and significant technical advancements in digital equipment are likely to boost market growth for barrier films flexible electronics.

With the current COVID 19 outbreak, flexible packaging makers have been inundated with a slew of concerns that were only anticipated to last for a short period of time. Supply chain interruptions, shortage of raw materials utilized in the manufacturing method, workforce constraints, unpredictable pricing, and transportation issues were some of the repercussions of shutdown.

Furthermore, advances in barrier films allow for accurate observations at the permeability level needed for organic solar cells and OLEDs. Flexible barrier films protect elastic, inorganic, and printable electronics from erosion while maintaining their efficiency and usefulness. Yet, the market's growth is being hampered by lack of awareness regarding barrier film flexible packaging segment and burden of operating expense in developing countries.

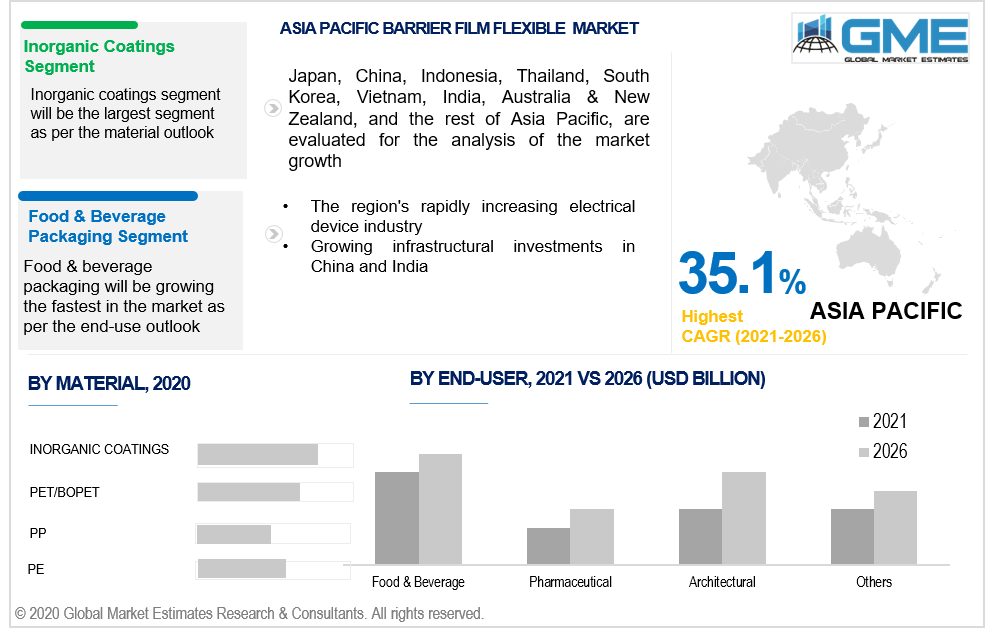

Based on the material, the market is segmented into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET/BOPET), Polyamide, organic coatings, inorganic coatings and others.

The inorganic coating segment is expected to grow the fastest in the barrier film flexible market from 2021 to 2026. The enhanced features of EVOH, such as greater flexibility and a superior barrier towards air, ammonia, and carbon dioxide, are some of the factors contributing to the growth of the segment. PVDC protects against corrosion, water loss, and odor transfer. These properties of EVOH and PVDC make them ideal materials for packaging, particularly in the food and beverage, medical, and agriculture sectors, adding to the inorganic oxide coating films segment's growth.

Based on the end-user, the market is segmented into food & beverage packaging, pharmaceutical packaging, and agriculture, others (electronics, automotive, and aerospace). The food and beverage packaging segment are expected to hold a larger share as compared to other segments as barrier film is widely used in the food sector for commodities such as bread goods, biscuit, frozen meals, animal feeds, chip and nibbles, meat, and dry fruits. Modern consumers are more concerned with efficiency and opt for grab-and-go commodities instead of bulk purchases, resulting in a high desire for packaged foods. The need for barrier film packaging solutions in the food industry is being driven by the rise of grab-and-go food and snacks.

As per the geographical analysis, the barrier film flexible market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), will have a dominant share in the barrier film flexible market from 2021 to 2026. The North America (the United States, Canada, and Mexico) region will have a dominant share in the barrier film flexible market from 2021 to 2026. With a rising demand for meat and meat products, increasing packaging capacity for meat products, such as steak cuts, beef, pork, the demand for retort packaging for these meat products is likely to develop in the region. Furthermore, the desire for ready-to-eat food is increasing throughout the region. Ready-to-eat meals (REM) or take-home food items are a significant source of opportunity for the retail food and beverage industry, and sales from in this sector are critical to increasing income.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest growing segment in the barrier film flexible market during the forecast period. The expansion is attributed to rising demands from the agriculture and pharmaceutical and food industries, as well as the involvement of significant enterprises in the region's economies. Furthermore, the rapidly growing travel and tourism industry in different countries of this region is supporting the growth of the barrier films market for pharmaceutical product production.

Berry Global Inc., Amcor Plc., Australia Sealed Air, Raven Industries, Toppan Printing Co., Ltd., Cosmo Films Ltd., Jindal Poly Films Ltd., Dupont Teijin Films, Uflex Ltd., and Sumitomo Chemical Co., Ltd., among others are the key players in the barrier film flexible market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Barrier Film Flexible Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Material Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Barrier Film Flexible Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased use of mobile gadgets

3.3.2 Industry Challenges

3.3.2.1 Recyclable issues with various packaging goods

3.4 Prospective Growth Scenario

3.4.1 Material Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Barrier Film Flexible Market, By Material

4.1 Material Outlook

4.2 Polyethylene (PE)

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4. Polypropylene (PP)

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Polyethylene Terephthalate (PET/BOPET)

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Polyamide

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.6 Organic Coatings

4.6.1 Market Size, By Region, 2020-2026 (USD Million)

4.7 Inorganic Coatings

4.7.1 Market Size, By Region, 2020-2026 (USD Million)

4.8 Others

4.8.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Barrier Film Flexible Market, By End-User

5.1 End-User Outlook

5.2 Food & Beverage Packaging

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Pharmaceutical Packaging

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Agriculture

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Barrier Film Flexible Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Material, 2020-2026 (USD Million)

6.2.3 Market Size, By End-User, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Material, 2020-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Material, 2020-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Material, 2020-2026 (USD Million)

6.3.3 Market Size, By End-User, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Material, 2020-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Material, 2020-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Material, 2020-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Material, 2020-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Material, 2020-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Material, 2020-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Material, 2020-2026 (USD Million)

6.4.3 Market Size, By End-User, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Material, 2020-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Material, 2020-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Material, 2020-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Material, 2020-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Material, 2020-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Material, 2020-2026 (USD Million)

6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Material, 2020-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Material, 2020-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Material, 2020-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Material, 2020-2026 (USD Million)

6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Material, 2020-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Material, 2020-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Material, 2020-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Berry Global Inc

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Amcor Plc

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 AustraliaSealed Air

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Raven Industries

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Toppan Printing Co., Ltd

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Cosmo Films Ltd

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Jindal Poly Films Ltd

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Dupont Teijin Films

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Barrier Film Flexible Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Barrier Film Flexible Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS