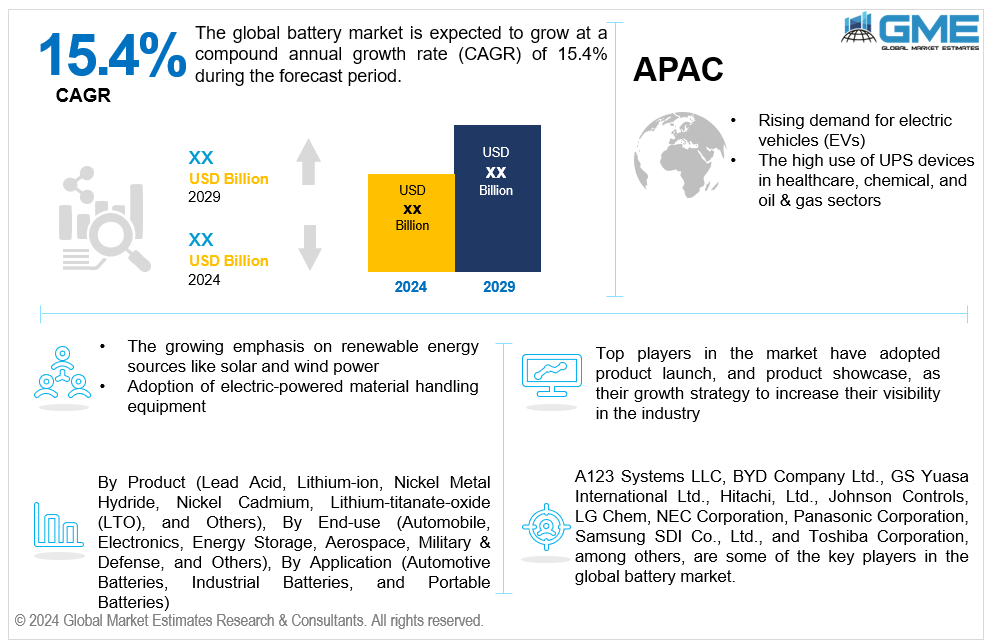

Global Battery Market Size, Trends & Analysis - Forecasts to 2029 By Product (Lead Acid, Lithium-ion, Nickel Metal Hydride, Nickel Cadmium, Lithium-titanate-oxide (LTO), and Others), By End-use (Automobile, Electronics, Energy Storage, Aerospace, Military & Defense, and Others), By Application (Automotive Batteries, Industrial Batteries, and Portable Batteries), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global battery market is estimated to exhibit a CAGR of 15.4% from 2024 to 2029.

The primary factors propelling the market growth are the rising demand for electric vehicles (EVs) and the high use of UPS devices in healthcare, chemical, and oil & gas sectors. Lithium-ion batteries are the most common type used in electric vehicles due to their high energy density, extended cycle life, and relatively lightweight compared to other battery types. Since lithium-ion batteries are an essential part of electric vehicle powertrains, demand for them is rising in tandem with the growth of the EV market. Additionally, growing demand for EV batteries encourages larger-scale production, which lowers manufacturing costs by utilizing standardized procedures, enhances production efficiency. For instance, the International Energy Agency (IEA) reports that in just three years, the percentage of electric vehicles sold worldwide increased more than three times, from around 4% in 2020 to 14% in 2022.

The growing emphasis on renewable energy sources like solar and wind power and the adoption of electric-powered material handling equipment is expected to support market growth. As solar and wind power generation depend on the weather, these energy sources are naturally sporadic. Batteries provide a way to store extra energy generated at times of peak generation for use during times of low or no generation. This balances out renewable energy supply and guarantees a steady power supply to the grid. For instance, over 80% of all power sector investments worldwide are made up of renewable energy, grids, and storage, according to the World Energy Investment 2022 report.

The proliferation of portable electronic devices and supportive government incentives and regulations propel market growth. Global ownership of portable electronic devices, including laptops, tablets, smartphones, wearables, and portable gaming consoles, has rapidly risen due to cost reductions and technological advancements. The number of device users directly correlates with the increased need for batteries to power various devices. Moreover, the growing need for batteries results from the widespread use of Internet of Things (IoT) gadgets and linked devices, such as wearable health monitors, smart home appliances, and IoT sensors. These devices need dependable, long-lasting batteries to power their wireless connectivity and allow smooth interaction with other devices and networks.

Batteries play a crucial role in powering telecom towers, data centers, and network infrastructure, presenting opportunities for battery manufacturers to provide scalable and efficient energy storage solutions. Furthermore, battery manufacturers have the opportunity to deliver energy storage solutions for grid resilience and optimization through grid modernization initiatives, including smart grid rollout and demand response programs.

However, fluctuating raw material prices and regulatory and policy uncertainty hinder market growth.

The lithium-ion segment is expected to hold the largest share of the market over the forecast period. Lithium-ion batteries can store more energy per unit volume or weight than other battery types due to their high energy density. Because of this, they are exceptionally well suited for applications where weight and space are crucial, such as electric cars and portable devices.

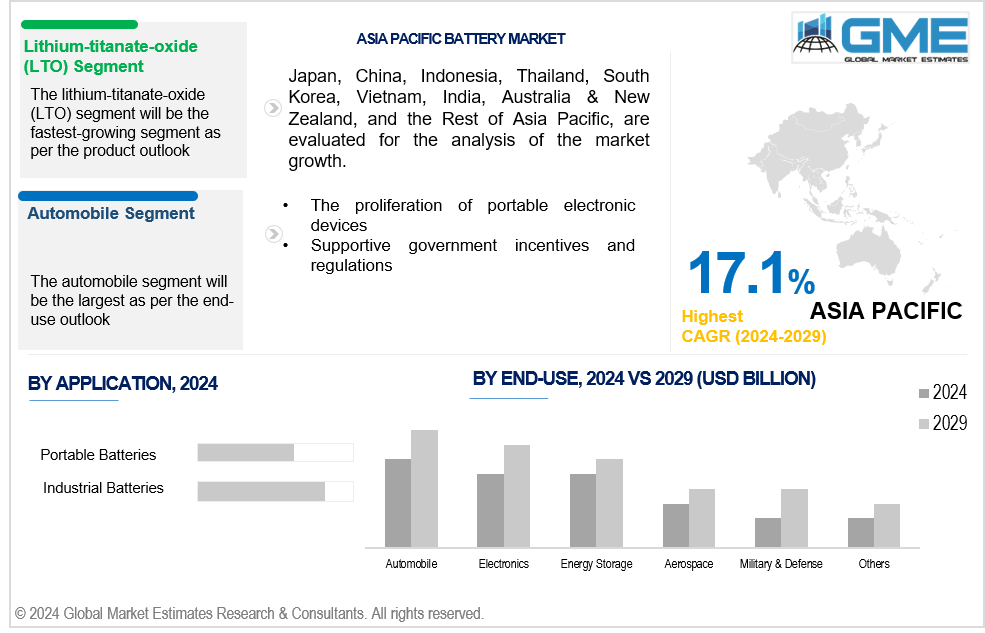

The lithium-titanate-oxide (LTO) segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Compared to many other lithium-ion battery chemistries, LTO batteries have a longer cycle life. As they do not significantly deteriorate after tens of thousands of charge-discharge cycles, they are ideal for applications where longevity and endurance are crucial, including energy storage systems for renewable integration and grid stabilization’.

The automobile segment is expected to hold the largest share of the market over the forecast period. The automotive sector is going electric to reduce greenhouse gas emissions, satisfy environmental standards, and improve fuel economy. Since automakers have made large expenditures in developing electric vehicles and extending their product lines, there is an increasing need for batteries.

The military & defense segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. For enhanced capabilities, boost efficiency, and remain ahead of changing threats, military forces worldwide are updating their equipment. This entails enhancing current platforms and systems with cutting-edge battery-operated technology for electronic warfare, communication, surveillance, and reconnaissance.

The industrial batteries segment is expected to hold the largest share of the market over the forecast period. Forklifts, pallet jacks, order pickers, and other material handling equipment are frequently powered by industrial batteries, such as lead-acid and lithium-ion batteries, in warehouses, distribution centers, manufacturing sites, and logistics operations. Growth of these material handling equipment support the overall growth of the industrial batteries segment by offering dependable and effective power for demanding industrial applications.

The portable batteries segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The demand for portable batteries is fueled by the growing trend toward connected devices, Internet of Things (IoT) gadgets, and smart home technology. As these devices need dependable power sources to stay connected, allow for remote monitoring and management, and facilitate on-the-go use, there is a growing need for portable batteries with extended endurance and quick charge times.

North America is expected to be the largest region in the global market. The rising deployment of energy storage systems for grid stabilization, peak shaving, and backup power applications is driving the market growth in the North American region. Batteries are used by ESS installations, both behind the meter and at the utility scale, to store and supply electricity when needed, improving grid resilience, flexibility, and dependability. For instance, the amount of battery storage in the United States increased from 47 MW in 2010 to 11,071 MW in 2023, according to the American Clean Power Association.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The Asia Pacific region is a central hub for automotive production and sales. Demand for batteries, especially lithium-ion batteries, which power EVs and hybrid cars, is growing due to the transition towards these vehicles. The market for electric vehicles is expanding, and government incentives, emission laws, and consumer preferences for cleaner mobility are driving the need for batteries. For instance, according to the Ministry of Road Transport and Highways of India, over 1.8 million electric vehicles were registered in India as of December 2022.

A123 Systems LLC, BYD Company Ltd., GS Yuasa International Ltd., Hitachi, Ltd., Johnson Controls, LG Chem, NEC Corporation, Panasonic Corporation, Samsung SDI Co., Ltd., and Toshiba Corporation, among others, are some of the key players operating in the global battery market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2022, Build Your Dreams (BYD) and First Automobile Works (FAW) planned to build a 45 GWh annual capacity electric vehicle battery production facility in northern China.

In November 2022, Panasonic announced that work on a new lithium-ion battery production plant in De Soto, Kansas, had begun. The initiative will significantly improve local economic activity and prospects in Kansas, positioning the state as a major participant in the domestic electric vehicle (EV) market.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL BATTERY MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BATTERY MARKET, BY PRODUCT

4.1 Introduction

4.2 Battery Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Lead Acid

4.4.1 Lead Acid Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Lithium-ion

4.5.1 Lithium-ion Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Nickel Metal Hydride

4.6.1 Nickel Metal Hydride Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Nickel Cadmium

4.7.1 Nickel Cadmium Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Lithium-titanate-oxide (LTO)

4.8.1 Lithium-titanate-oxide (LTO) Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL BATTERY MARKET, BY END-USE

5.1 Introduction

5.2 Battery Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Automobile

5.4.1 Automobile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Electronics

5.5.1 Electronics Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Energy Storage

5.6.1 Energy Storage Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Aerospace

5.7.1 Aerospace Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Military & Defense

5.8.1 Military & Defense Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL BATTERY MARKET, BY APPLICATION

6.1 Introduction

6.2 Battery Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Automotive Batteries

6.4.1 Automotive Batteries Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Industrial Batteries

6.5.1 Industrial Batteries Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Portable Batteries

6.6.1 Portable Batteries Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL BATTERY MARKET, BY REGION

7.1 Introduction

7.2 North America Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Product

7.2.2 By End-use

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Product

7.2.4.1.2 By End-use

7.2.4.1.3 By Application

7.2.4.2 Canada Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Product

7.2.4.2.2 By End-use

7.2.4.2.3 By Application

7.2.4.3 Mexico Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Product

7.2.4.3.2 By End-use

7.2.4.3.3 By Application

7.3 Europe Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Product

7.3.2 By End-use

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Product

7.3.4.1.2 By End-use

7.3.4.1.3 By Application

7.3.4.2 U.K. Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Product

7.3.4.2.2 By End-use

7.3.4.2.3 By Application

7.3.4.3 France Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Product

7.3.4.3.2 By End-use

7.3.4.3.3 By Application

7.3.4.4 Italy Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Product

7.3.4.4.2 By End-use

7.2.4.4.3 By Application

7.3.4.5 Spain Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Product

7.3.4.5.2 By End-use

7.2.4.5.3 By Application

7.3.4.6 Netherlands Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Product

7.3.4.6.2 By End-use

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Product

7.3.4.7.2 By End-use

7.2.4.7.3 By Application

7.4 Asia Pacific Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Product

7.4.2 By End-use

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Product

7.4.4.1.2 By End-use

7.4.4.1.3 By Application

7.4.4.2 Japan Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Product

7.4.4.2.2 By End-use

7.4.4.2.3 By Application

7.4.4.3 India Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Product

7.4.4.3.2 By End-use

7.4.4.3.3 By Application

7.4.4.4 South Korea Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Product

7.4.4.4.2 By End-use

7.4.4.4.3 By Application

7.4.4.5 Singapore Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Product

7.4.4.5.2 By End-use

7.4.4.5.3 By Application

7.4.4.6 Malaysia Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Product

7.4.4.6.2 By End-use

7.4.4.6.3 By Application

7.4.4.7 Thailand Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Product

7.4.4.7.2 By End-use

7.4.4.7.3 By Application

7.4.4.8 Indonesia Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Product

7.4.4.8.2 By End-use

7.4.4.8.3 By Application

7.4.4.9 Vietnam Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Product

7.4.4.9.2 By End-use

7.4.4.9.3 By Application

7.4.4.10 Taiwan Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Product

7.4.4.10.2 By End-use

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Product

7.4.4.11.2 By End-use

7.4.4.11.3 By Application

7.5 Middle East and Africa Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Product

7.5.2 By End-use

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Product

7.5.4.1.2 By End-use

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Product

7.5.4.2.2 By End-use

7.5.4.2.3 By Application

7.5.4.3 Israel Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Product

7.5.4.3.2 By End-use

7.5.4.3.3 By Application

7.5.4.4 South Africa Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Product

7.5.4.4.2 By End-use

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Product

7.5.4.5.2 By End-use

7.5.4.5.2 By Application

7.6 Central and South America Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Product

7.6.2 By End-use

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Product

7.6.4.1.2 By End-use

7.6.4.1.3 By Application

7.6.4.2 Argentina Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Product

7.6.4.2.2 By End-use

7.6.4.2.3 By Application

7.6.4.3 Chile Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Product

7.6.4.3.2 By End-use

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Battery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Product

7.6.4.4.2 By End-use

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 A123 Systems LLC

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 BYD Company Ltd.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 GS Yuasa International Ltd.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Hitachi, Ltd.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Johnson Controls

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 LG CHEM

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 NEC Corporation

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Panasonic Corporation

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Samsung SDI Co., Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Toshiba Corporation

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Battery Market, By Product, 2021-2029 (USD Mllion)

2 Lead Acid Market, By Region, 2021-2029 (USD Mllion)

3 Lithium-ion Market, By Region, 2021-2029 (USD Mllion)

4 Nickel Metal Hydride Market, By Region, 2021-2029 (USD Mllion)

5 Nickel Cadmium Market, By Region, 2021-2029 (USD Mllion)

6 Lithium-titanate-oxide (LTO) Market, By Region, 2021-2029 (USD Mllion)

7 Others Market, By Region, 2021-2029 (USD Mllion)

8 Global Battery Market, By End-use, 2021-2029 (USD Mllion)

9 Automobile Market, By Region, 2021-2029 (USD Mllion)

10 Electronics Market, By Region, 2021-2029 (USD Mllion)

11 Energy Storage Market, By Region, 2021-2029 (USD Mllion)

12 Aerospace Market, By Region, 2021-2029 (USD Mllion)

13 Military & Defense Market, By Region, 2021-2029 (USD Mllion)

14 Others Market, By Region, 2021-2029 (USD Mllion)

15 Global Battery Market, By Application, 2021-2029 (USD Mllion)

16 Automotive Batteries Market, By Region, 2021-2029 (USD Mllion)

17 Industrial Batteries Market, By Region, 2021-2029 (USD Mllion)

18 Portable Batteries Market, By Region, 2021-2029 (USD Mllion)

19 Regional Analysis, 2021-2029 (USD Mllion)

20 North America Battery Market, By Product, 2021-2029 (USD Million)

21 North America Battery Market, By End-use, 2021-2029 (USD Million)

22 North America Battery Market, By Application, 2021-2029 (USD Million)

23 North America Battery Market, By Country, 2021-2029 (USD Million)

24 U.S Battery Market, By Product, 2021-2029 (USD Million)

25 U.S Battery Market, By End-use, 2021-2029 (USD Million)

26 U.S Battery Market, By Application, 2021-2029 (USD Million)

27 Canada Battery Market, By Product, 2021-2029 (USD Million)

28 Canada Battery Market, By End-use, 2021-2029 (USD Million)

29 Canada Battery Market, By Application, 2021-2029 (USD Million)

30 Mexico Battery Market, By Product, 2021-2029 (USD Million)

31 Mexico Battery Market, By End-use, 2021-2029 (USD Million)

32 Mexico Battery Market, By Application, 2021-2029 (USD Million)

33 Europe Battery Market, By Product, 2021-2029 (USD Million)

34 Europe Battery Market, By End-use, 2021-2029 (USD Million)

35 Europe Battery Market, By Application, 2021-2029 (USD Million)

36 Europe Battery Market, By Country 2021-2029 (USD Million)

37 Germany Battery Market, By Product, 2021-2029 (USD Million)

38 Germany Battery Market, By End-use, 2021-2029 (USD Million)

39 Germany Battery Market, By Application, 2021-2029 (USD Million)

40 U.K. Battery Market, By Product, 2021-2029 (USD Million)

41 U.K. Battery Market, By End-use, 2021-2029 (USD Million)

42 U.K. Battery Market, By Application, 2021-2029 (USD Million)

43 France Battery Market, By Product, 2021-2029 (USD Million)

44 France Battery Market, By End-use, 2021-2029 (USD Million)

45 France Battery Market, By Application, 2021-2029 (USD Million)

46 Italy Battery Market, By Product, 2021-2029 (USD Million)

47 Italy Battery Market, By End-use, 2021-2029 (USD Million)

48 Italy Battery Market, By Application, 2021-2029 (USD Million)

49 Spain Battery Market, By Product, 2021-2029 (USD Million)

50 Spain Battery Market, By End-use, 2021-2029 (USD Million)

51 Spain Battery Market, By Application, 2021-2029 (USD Million)

52 Netherlands Battery Market, By Product, 2021-2029 (USD Million)

53 Netherlands Battery Market, By End-use, 2021-2029 (USD Million)

54 Netherlands Battery Market, By Application, 2021-2029 (USD Million)

55 Rest Of Europe Battery Market, By Product, 2021-2029 (USD Million)

56 Rest Of Europe Battery Market, By End-use, 2021-2029 (USD Million)

57 Rest of Europe Battery Market, By Application, 2021-2029 (USD Million)

58 Asia Pacific Battery Market, By Product, 2021-2029 (USD Million)

59 Asia Pacific Battery Market, By End-use, 2021-2029 (USD Million)

60 Asia Pacific Battery Market, By Application, 2021-2029 (USD Million)

61 Asia Pacific Battery Market, By Country, 2021-2029 (USD Million)

62 China Battery Market, By Product, 2021-2029 (USD Million)

63 China Battery Market, By End-use, 2021-2029 (USD Million)

64 China Battery Market, By Application, 2021-2029 (USD Million)

65 India Battery Market, By Product, 2021-2029 (USD Million)

66 India Battery Market, By End-use, 2021-2029 (USD Million)

67 India Battery Market, By Application, 2021-2029 (USD Million)

68 Japan Battery Market, By Product, 2021-2029 (USD Million)

69 Japan Battery Market, By End-use, 2021-2029 (USD Million)

70 Japan Battery Market, By Application, 2021-2029 (USD Million)

71 South Korea Battery Market, By Product, 2021-2029 (USD Million)

72 South Korea Battery Market, By End-use, 2021-2029 (USD Million)

73 South Korea Battery Market, By Application, 2021-2029 (USD Million)

74 malaysia Battery Market, By Product, 2021-2029 (USD Million)

75 malaysia Battery Market, By End-use, 2021-2029 (USD Million)

76 malaysia Battery Market, By Application, 2021-2029 (USD Million)

77 Thailand Battery Market, By Product, 2021-2029 (USD Million)

78 Thailand Battery Market, By End-use, 2021-2029 (USD Million)

79 Thailand Battery Market, By Application, 2021-2029 (USD Million)

80 Indonesia Battery Market, By Product, 2021-2029 (USD Million)

81 Indonesia Battery Market, By End-use, 2021-2029 (USD Million)

82 Indonesia Battery Market, By Application, 2021-2029 (USD Million)

83 Vietnam Battery Market, By Product, 2021-2029 (USD Million)

84 Vietnam Battery Market, By End-use, 2021-2029 (USD Million)

85 Vietnam Battery Market, By Application, 2021-2029 (USD Million)

86 Taiwan Battery Market, By Product, 2021-2029 (USD Million)

87 Taiwan Battery Market, By End-use, 2021-2029 (USD Million)

88 Taiwan Battery Market, By Application, 2021-2029 (USD Million)

89 Rest of Asia Pacific Battery Market, By Product, 2021-2029 (USD Million)

90 Rest of Asia Pacific Battery Market, By End-use, 2021-2029 (USD Million)

91 Rest of Asia Pacific Battery Market, By Application, 2021-2029 (USD Million)

92 Middle East and Africa Battery Market, By Product, 2021-2029 (USD Million)

93 Middle East and Africa Battery Market, By End-use, 2021-2029 (USD Million)

94 Middle East and Africa Battery Market, By Application, 2021-2029 (USD Million)

95 Middle East and Africa Battery Market, By Country, 2021-2029 (USD Million)

96 Saudi Arabia Battery Market, By Product, 2021-2029 (USD Million)

97 Saudi Arabia Battery Market, By End-use, 2021-2029 (USD Million)

98 Saudi Arabia Battery Market, By Application, 2021-2029 (USD Million)

99 UAE Battery Market, By Product, 2021-2029 (USD Million)

100 UAE Battery Market, By End-use, 2021-2029 (USD Million)

101 UAE Battery Market, By Application, 2021-2029 (USD Million)

102 Israel Battery Market, By Product, 2021-2029 (USD Million)

103 Israel Battery Market, By End-use, 2021-2029 (USD Million)

104 Israel Battery Market, By Application, 2021-2029 (USD Million)

105 South Africa Battery Market, By Product, 2021-2029 (USD Million)

106 South Africa Battery Market, By End-use, 2021-2029 (USD Million)

107 South Africa Battery Market, By Application, 2021-2029 (USD Million)

108 Rest of Middle East and Africa Battery Market, By Product, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Battery Market, By End-use, 2021-2029 (USD Million)

110 Rest of Middle East and Africa Battery Market, By Application, 2021-2029 (USD Million)

111 Central and South America Battery Market, By Product, 2021-2029 (USD Million)

112 Central and South America Battery Market, By End-use, 2021-2029 (USD Million)

113 Central and South America Battery Market, By Application, 2021-2029 (USD Million)

114 Central and South America Battery Market, By Country, 2021-2029 (USD Million)

115 Brazil Battery Market, By Product, 2021-2029 (USD Million)

116 Brazil Battery Market, By End-use, 2021-2029 (USD Million)

117 Brazil Battery Market, By Application, 2021-2029 (USD Million)

118 Argentina Battery Market, By Product, 2021-2029 (USD Million)

119 Argentina Battery Market, By End-use, 2021-2029 (USD Million)

120 Argentina Battery Market, By Application, 2021-2029 (USD Million)

121 Chile Battery Market, By Product, 2021-2029 (USD Million)

122 Chile Battery Market, By End-use, 2021-2029 (USD Million)

123 Chile Battery Market, By Application, 2021-2029 (USD Million)

124 Rest of Central and South America Battery Market, By Product, 2021-2029 (USD Million)

125 Rest of Central and South America Battery Market, By End-use, 2021-2029 (USD Million)

126 Rest of Central and South America Battery Market, By Application, 2021-2029 (USD Million)

127 A123 Systems LLC: Products & Services Offering

128 BYD Company Ltd.: Products & Services Offering

129 GS Yuasa International Ltd.: Products & Services Offering

130 Hitachi, Ltd.: Products & Services Offering

131 Johnson Controls: Products & Services Offering

132 LG CHEM: Products & Services Offering

133 NEC Corporation : Products & Services Offering

134 Panasonic Corporation: Products & Services Offering

135 Samsung SDI Co., Ltd., Inc: Products & Services Offering

136 Toshiba Corporation: Products & Services Offering

137 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Battery Market Overview

2 Global Battery Market Value From 2021-2029 (USD Mllion)

3 Global Battery Market Share, By Product (2023)

4 Global Battery Market Share, By End-use (2023)

5 Global Battery Market Share, By Application (2023)

6 Global Battery Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Battery Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Battery Market

11 Impact Of Challenges On The Global Battery Market

12 Porter’s Five Forces Analysis

13 Global Battery Market: By Product Scope Key Takeaways

14 Global Battery Market, By Product Segment: Revenue Growth Analysis

15 Lead Acid Market, By Region, 2021-2029 (USD Mllion)

16 Lithium-ion Market, By Region, 2021-2029 (USD Mllion)

17 Nickel Metal Hydride Market, By Region, 2021-2029 (USD Mllion)

18 Nickel Cadmium Market, By Region, 2021-2029 (USD Mllion)

19 Lithium-titanate-oxide (LTO) Market, By Region, 2021-2029 (USD Mllion)

20 Others Market, By Region, 2021-2029 (USD Mllion)

21 Global Battery Market: By End-use Scope Key Takeaways

22 Global Battery Market, By End-use Segment: Revenue Growth Analysis

23 Automobile Market, By Region, 2021-2029 (USD Mllion)

24 Electronics Market, By Region, 2021-2029 (USD Mllion)

25 Energy Storage Market, By Region, 2021-2029 (USD Mllion)

26 Aerospace Market, By Region, 2021-2029 (USD Mllion)

27 Military & Defense Market, By Region, 2021-2029 (USD Mllion)

28 Others Market, By Region, 2021-2029 (USD Mllion)

29 Global Battery Market: By Application Scope Key Takeaways

30 Global Battery Market, By Application Segment: Revenue Growth Analysis

31 Automotive Batteries Market, By Region, 2021-2029 (USD Mllion)

32 Industrial Batteries Market, By Region, 2021-2029 (USD Mllion)

33 Portable Batteries Market, By Region, 2021-2029 (USD Mllion)

34 Regional Segment: Revenue Growth Analysis

35 Global Battery Market: Regional Analysis

36 North America Battery Market Overview

37 North America Battery Market, By Product

38 North America Battery Market, By End-use

39 North America Battery Market, By Application

40 North America Battery Market, By Country

41 U.S. Battery Market, By Product

42 U.S. Battery Market, By End-use

43 U.S. Battery Market, By Application

44 Canada Battery Market, By Product

45 Canada Battery Market, By End-use

46 Canada Battery Market, By Application

47 Mexico Battery Market, By Product

48 Mexico Battery Market, By End-use

49 Mexico Battery Market, By Application

50 Four Quadrant Positioning Matrix

51 Company Market Share Analysis

52 A123 Systems LLC: Company Snapshot

53 A123 Systems LLC: SWOT Analysis

54 A123 Systems LLC: Geographic Presence

55 BYD Company Ltd.: Company Snapshot

56 BYD Company Ltd.: SWOT Analysis

57 BYD Company Ltd.: Geographic Presence

58 GS Yuasa International Ltd.: Company Snapshot

59 GS Yuasa International Ltd.: SWOT Analysis

60 GS Yuasa International Ltd.: Geographic Presence

61 Hitachi, Ltd.: Company Snapshot

62 Hitachi, Ltd.: Swot Analysis

63 Hitachi, Ltd.: Geographic Presence

64 Johnson Controls: Company Snapshot

65 Johnson Controls: SWOT Analysis

66 Johnson Controls: Geographic Presence

67 LG CHEM: Company Snapshot

68 LG CHEM: SWOT Analysis

69 LG CHEM: Geographic Presence

70 NEC Corporation : Company Snapshot

71 NEC Corporation : SWOT Analysis

72 NEC Corporation : Geographic Presence

73 Panasonic Corporation: Company Snapshot

74 Panasonic Corporation: SWOT Analysis

75 Panasonic Corporation: Geographic Presence

76 Samsung SDI Co., Ltd., Inc.: Company Snapshot

77 Samsung SDI Co., Ltd., Inc.: SWOT Analysis

78 Samsung SDI Co., Ltd., Inc.: Geographic Presence

79 Toshiba Corporation: Company Snapshot

80 Toshiba Corporation: SWOT Analysis

81 Toshiba Corporation: Geographic Presence

82 Other Companies: Company Snapshot

83 Other Companies: SWOT Analysis

84 Other Companies: Geographic Presence

The Global Battery Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Battery Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS