Global Biopharmaceutical Stability Testing Market Size, Trends & Analysis - Forecasts to 2027 By Type (Monoclonal Antibodies & Antibody-Drug Conjugates, Recombinant Proteins, Vaccines, Others), By End-User (Pharmaceutical & Biopharmaceutical Companies, CMOs & CROs, Academic & Government Research Institutes), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

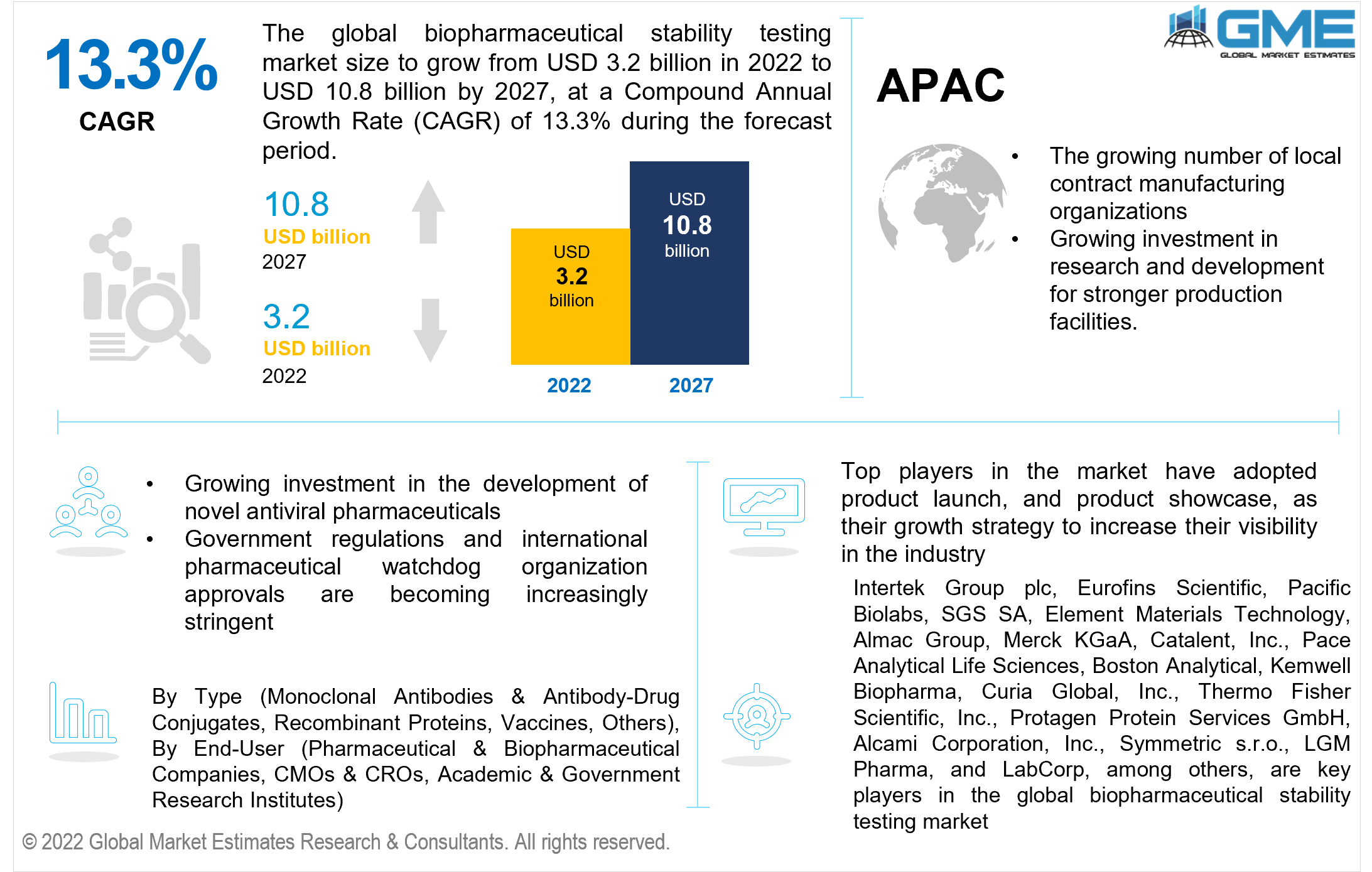

The global biopharmaceutical stability testing market is projected to grow from USD 3.2 billion in 2022 to USD 10.8 billion in 2027 at a CAGR of 13.3% from 2022 to 2027.

The growing investment in the development of novel antiviral pharmaceuticals, COVID-19 vaccines, cancer therapeutics, and other pharmaceutical drugs is the major driver of the biopharmaceutical stability testing market. The growing number of local contract manufacturing organizations that specialize in local approval acquisition for novel pharmaceuticals are also expected to further propel the growth of the market during the forecast period.

Government regulations and international pharmaceutical watchdog organization approvals are becoming increasingly stringent. Global pharmaceutical manufacturers require approvals from various bodies such as the Food & Drug Administration (FDA) in the United States, the World Health Organization (WHO), the European Medicines Agency (EMA) in Europe, and the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), among others.

In recent years, more governmental and commercial organizations have been ready to prioritize expenditures on cancer research due to the rising prevalence of cancer in the population. The need for biopharmaceutical stability testing has risen as a result of the increasing number of partnerships between pharmaceutical firms and academic institutions for the development of novel oncology drugs. There will probably be 1.9 million additional cases of cancer in the United States alone, according to data from the American Cancer Society. In the United States, cancerous growths are predicted to be responsible for 609,360 fatalities by 2022. In 2020, cancer was responsible for almost 10 million deaths globally, according to data from the WHO.

The availability of low-cost, high-quality labor in developing countries has led to an increase in the number of pharmaceutical companies resorting to outsourcing as a way to reduce costs, which has increased the size of the pharmaceutical outsourcing industry. Consumers and regulatory authorities are concerned about the rising number of incidents of adverse medication reactions in hospitals throughout the world. According to the National Centre for Biotechnology Information, 5 percent of all hospitalizations in Europe are thought to be brought on by negative medication responses. Clinical studies are necessary to assess the safety of pharmaceutical firms' new medications because they release new pharmaceuticals. These regulatory restrictions are expected to further increase the demand for biopharmaceutical stability testing services.

The COVID-19 pandemic has caused profits of several pharmaceutical and biotechnology companies to soar. As a result of the outbreak, the healthcare industry as a whole has expanded quickly, albeit certain sectors, including oncology, have had to take a backseat as the world focused on limiting the pandemic's impacts. With more cash becoming available as the globe starts to return to normal, pharmaceutical and biotechnology companies are expected to increase their investment in the creation of cutting-edge cancer therapies and diagnostics.

On the other hand, increased focus on COVID vaccine development and therapeutics development has led to many companies outsourcing the development of new vaccines and therapeutics to CROs and CMOs. The race to market their new products have seen companies increasingly invest in biopharmaceutical stability testing services to ensure a smooth approval process which has been instrumental in the growth of the market.

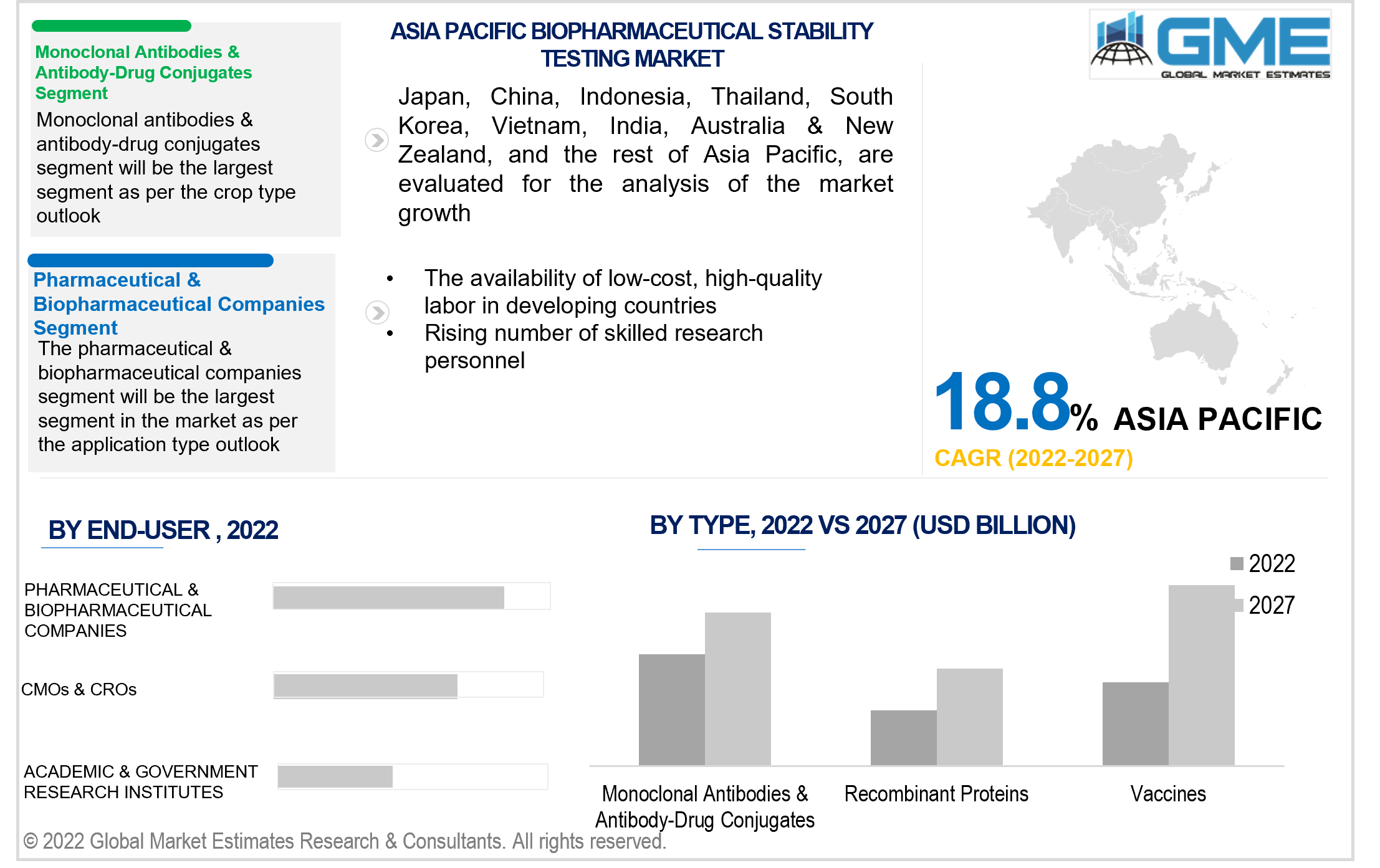

The monoclonal antibodies & antibody-drug conjugates segment is expected to witness the largest share in the global biopharmaceutical stability testing market during the forecast period, based on type. The substantial proportion share of this market segment is due to the increase in government funding for monoclonal antibody medication research as well as the occurrence of infections.

The vaccines segment is expected to grow the fastest in the market, based on type. The factors that are expected to contribute to the growth of this segment are the expanding public vaccination campaigns, rising disease prevalence, and rising corporate investments in vaccine development are boosting demand for this market.

The pharmaceutical & biopharmaceutical companies segment is expected to hold the largest share in the market, based on end-user. Biopharmaceutical companies have been investing heavily in attaining regional approvals from pharmaceutical regulatory bodies. The need for rapid approval and the need to protect themselves from potential harm from potential lawsuits due to adverse medication reactions has been instrumental in the growth of the biopharmaceutical stability testing market. Biopharmaceutical companies are increasingly opening new centers and forming partnerships with local companies which has led to the large demand for biopharmaceutical testing across the globe.

The CMOs & CROs segment is expected to grow the fastest in the market, based on end-user. The rapid adoption of outsourcing pharmaceutical manufacturing and development to regional outsourcing companies is expected to drive the growth of this segment. Pharmaceutical companies are turning to CROs and CMOs for biopharmaceutical stability testing services as these companies can offer faster approval rates from local bodies and outsourcing pharmaceutical development and manufacturing has been shown to be more cost-effective for large corporations.

The North American region is expected to witness the largest share in the global biopharmaceutical stability testing market during the forecast period of 2022-2027. The creation of novel therapeutics, vaccines, and pharmaceuticals, as well as the large number of current and future projects, will increase the market in the North American area. These factors also include the growing development of research and development facilities in the life sciences and expansion in the pharmaceutical sectors.

The United States is expected to hold the dominant share of the North American market. This dominance is attributed to the heavy investment in healthcare facilities, a strong research base, and a large number of pharmaceutical companies and CROs in the country. The country’s stringent regulatory authorities and watchdog organizations are also responsible for the rapid growth in the region.

Asia-Pacific is expected to grow the fastest during 2022-2027. The APAC region's growing pharmaceutical manufacturing, increasingly stringent regulatory guidelines for pharmaceutical manufacturing, and the region’s rising number of contract manufacturing organizations that develop pharmaceuticals for multination corporations are expected to drive the APAC market.

Intertek Group plc, Eurofins Scientific, Pacific Biolabs, SGS SA, Element Materials Technology, Almac Group, Merck KGaA, Catalent, Inc., Pace Analytical Life Sciences, Boston Analytical, Kemwell Biopharma, Curia Global, Inc., Thermo Fisher Scientific, Inc., ProtaGene, Alcami Corporation, Inc., Symmetric s.r.o., LGM Pharma, and LabCorp, among others, are key players in the global biopharmaceutical stability testing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1 Global Market Outlook

2.2 End-User Outlook

2.3 Type Outlook

2.4 Regional Outlook

Chapter 3 Global Biopharmaceutical Stability Testing Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Biopharmaceutical Stability Testing Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Biopharmaceutical Stability Testing Market: By End-User Trend Analysis

4.1 By End-User: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Pharmaceutical & Biopharmaceutical Companies

4.2.1 Market Estimates & Forecast Analysis of Pharmaceutical & Biopharmaceutical Companies Segment, By Region, 2019-2027 (USD Billion)

4.3 CMOs & CROs

4.3.1 Market Estimates & Forecast Analysis of CMOs & CROs Segment, By Region, 2019-2027 (USD Billion)

4.4 Academic & Government Research Institutes

4.4.1 Market Estimates & Forecast Analysis of Academic & Government Research Institutes Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Biopharmaceutical Stability Testing Market: By Type Trend Analysis

5.1 By Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Greenhouses

5.2.1 Market Estimates & Forecast Analysis of Greenhouses, By Region, 2019-2027 (USD Billion)

5.3 Vertical Farms

5.3.1 Market Estimates & Forecast Analysis of Vertical Farms Market Segment, By Region, 2019-2027 (USD Billion)

5.4 Indoor Farms

5.4.1 Market Estimates & Forecast Analysis of Indoor Farms Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Biopharmaceutical Stability Testing Market: By Type Trend Analysis

5.1 By Type: Historic Data vs. Forecast Data Analysis, 2022 vs. 2027

5.2 Monoclonal Antibodies & Antibody-Drug Conjugates

5.2.1 Market Estimates & Forecast Analysis of Monoclonal Antibodies & Antibody-Drug Conjugates Segment, By Region, 2019-2027 (USD Billion)

5.3 Recombinant Proteins

5.3.1 Market Estimates & Forecast Analysis of Recombinant Proteins Segment, By Region, 2019-2027 (USD Billion)

5.4 Vaccines

5.4.1 Market Estimates & Forecast Analysis of Vaccines Segment, By Region, 2019-2027 (USD Billion)

5.5 Others

5.5.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Biopharmaceutical Stability Testing Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.6 Mexico

6.2.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.7 Russia

6.3.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.8 Italy

6.3.8.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.9 Spain

6.3.9.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.10 Netherlands

6.3.10.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.11 Rest of Europe

6.3.11.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.11.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.7 South Korea

6.4.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.8 Thailand

6.4.8.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.9 Indonesia

6.4.9.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.10 Malaysia

6.4.10.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.10.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.11 Singapore

6.4.11.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.11.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.12 Vietnam

6.4.12.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.12.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.13 Rest of Asia Pacific

6.4.13.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.13.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.5 Argentina

6.5.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.6 Chile

6.5.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.7 Rest of Central & South America

6.5.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.5 United Arab Emirates

6.6.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.7 Israel

6.6.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.8 Rest of Middle East & Africa

6.6.8.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 End-User Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 Intertek Group plc

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Product Benchmarking

8.2 Eurofins Scientific

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Product Benchmarking

8.3 Pacific Biolabs

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Product Benchmarking

8.4 SGS SA

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Product Benchmarking

8.5 Element Materials Technology

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Product Benchmarking

8.6 Almac Group

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.7 Merck KGaA

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Product Benchmarking

8.8 Catalent, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Product Benchmarking

8.9 Pace Analytical Life Sciences

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Initiatives

8.9.4 Product Benchmarking

8.10 Other Companies

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Biopharmaceutical Stability Testing Market

2 Global Biopharmaceutical Stability Testing Market: Key Market Drivers

3 Global Biopharmaceutical Stability Testing Market: Key Market Challenges

4 Global Biopharmaceutical Stability Testing Market: Key Market Opportunities

5 Global Biopharmaceutical Stability Testing Market: Key Market Restraints

6 Global Biopharmaceutical Stability Testing Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

8 Pharmaceutical & Biopharmaceutical Companies: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

9 CMOs & CROs: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

10 Academic & Government Research Institutes: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

11 Global Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

12 Monoclonal Antibodies & Antibody-Drug Conjugates: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

13 Recombinant Proteins: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

14 Vaccines: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

15 Others: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

16 Regional Analysis: Global Biopharmaceutical Stability Testing Market, By Region, 2019-2027 (USD Billion)

17 North America: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

18 North America: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

19 North America: Biopharmaceutical Stability Testing Market, By Country, 2019-2027 (USD Billion)

20 U.S: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

21 U.S: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

22 Canada: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

23 Canada: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

24 Mexico: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

25 Mexico: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

26 Rest of North America: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

27 Rest of North America: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

28 Europe: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

29 Europe: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

30 Europe: Biopharmaceutical Stability Testing Market, By Country, 2019-2027 (USD Billion)

31 Germany: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

32 Germany: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

33 UK: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

34 UK: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

35 France: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

36 France: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

37 Italy: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

38 Italy: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

39 Spain: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

40 Spain: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

41 Netherlands: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

42 Netherlands: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

43 Rest Of Europe: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

44 Rest Of Europe: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

45 Asia Pacific: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

46 Asia Pacific: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

47 Asia Pacific: Biopharmaceutical Stability Testing Market, By Country, 2019-2027 (USD Billion)

48 China: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

49 China: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

50 India: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

51 India: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

52 Japan: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

53 Japan: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

54 South Korea: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

55 South Korea: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

56 Thailand: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

57 Thailand: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

58 Indonesia: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

59 Indonesia: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

60 Malaysia: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

61 Malaysia: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

62 Singapore: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

63 Singapore: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

64 Vietnam: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

65 Vietnam: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

66 Rest of APAC: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

67 Rest of APAC: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

68 Middle East & Africa: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

69 Middle East & Africa: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

70 Middle East & Africa: Biopharmaceutical Stability Testing Market, By Country, 2019-2027 (USD Billion)

71 Saudi Arabia: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

72 Saudi Arabia: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

73 UAE: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

74 UAE: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

75 Israel: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

76 Israel: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

77 South Africa: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

78 South Africa: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

79 Rest of MEA: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

80 Rest of MEA: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

81 Central & South America: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

82 Central & South America: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

83 Central & South America: Biopharmaceutical Stability Testing Market, By Country, 2019-2027 (USD Billion)

84 Brazil: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

85 Brazil: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

86 Chile: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

87 Chile: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

88 Argentina: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

89 Argentina: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

90 Rest of CSA: Biopharmaceutical Stability Testing Market, By End-User, 2019-2027 (USD Billion)

91 Rest of CSA: Biopharmaceutical Stability Testing Market, By Type, 2019-2027 (USD Billion)

92 Intertek Group plc: Products Offered

93 Eurofins Scientific: Products Offered

94 Pacific Biolabs: Products Offered

95 SGS SA: Products Offered

96 Element Materials Technology: Products Offered

97 Almac Group: Products Offered

98 Illumitex: Products Offered

99 Merck KGaA: Products Offered

100 Catalent, Inc.: Products Offered

101 Other Companies: Products Offered

List of Figures

1. Global Biopharmaceutical Stability Testing Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Biopharmaceutical Stability Testing Market: Penetration & Growth Prospect Mapping

7. Global Biopharmaceutical Stability Testing Market: Value Chain Analysis

8. Global Biopharmaceutical Stability Testing Market Drivers

9. Global Biopharmaceutical Stability Testing Market Restraints

10. Global Biopharmaceutical Stability Testing Market Opportunities

11. Global Biopharmaceutical Stability Testing Market Challenges

12. Key Biopharmaceutical Stability Testing Market Manufacturer Analysis

13. Global Biopharmaceutical Stability Testing Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Intertek Group plc: Company Snapshot

16. Intertek Group plc: Swot Analysis

17. Eurofins Scientific: Company Snapshot

18. Eurofins Scientific: Swot Analysis

19. Pacific Biolabs: Company Snapshot

20. Pacific Biolabs: Swot Analysis

21. SGS SA: Company Snapshot

22. SGS SA: Swot Analysis

23. Element Materials Technology: Company Snapshot

24. Element Materials Technology: Swot Analysis

25. Illumitex: Company Snapshot

26. Illumitex: Swot Analysis

27. Merck KGaA: Company Snapshot

28. Merck KGaA: Swot Analysis

29. Catalent, Inc.: Company Snapshot

30. Catalent, Inc.: Swot Analysis

31. Almac Group: Company Snapshot

32. Almac Group: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Biopharmaceutical Stability Testing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biopharmaceutical Stability Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS