Global Biotechnology Market Size, Trends & Analysis - Forecasts to 2030 By Technology (Nanobiotechnology, Tissue Engineering & Regeneration, DNA Sequencing, Cell-based Assays, Fermentation, PCR Technology, Chromatography, and Others), By Application (Health, Food & Agriculture, Natural Resources & Environment, Industrial Processing, Bioinformatics, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

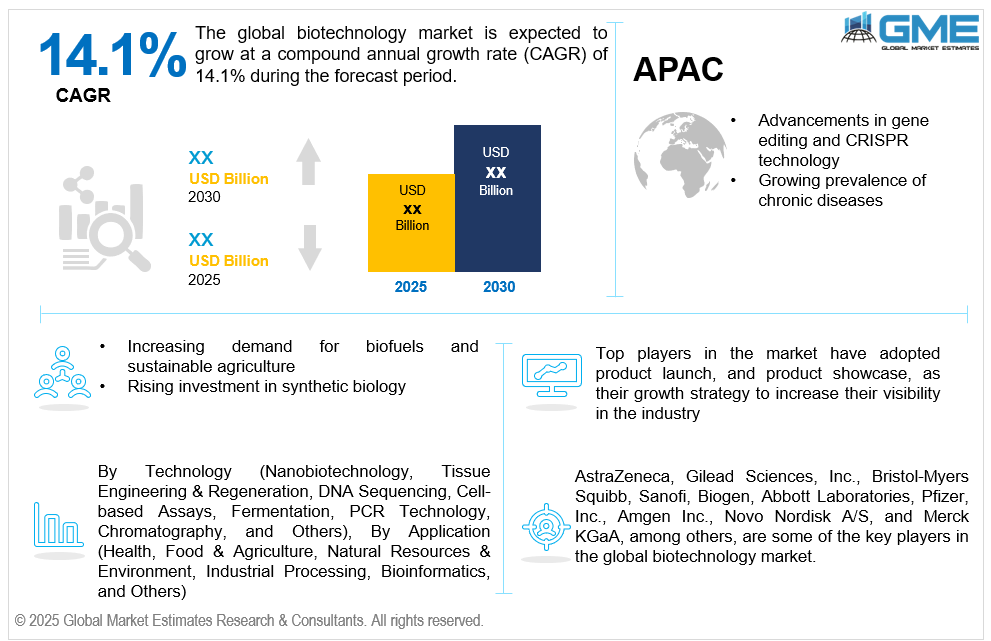

The global biotechnology market is estimated to exhibit a CAGR of 14.1% from 2025 to 2030.

The primary factors propelling the market growth are the advancements in gene editing and CRISPR technology and the growing prevalence of chronic diseases. Gene editing tools have revolutionized genetic engineering by enabling precise, efficient, and cost-effective modifications of DNA. CRISPR has accelerated research in areas such as gene therapy, drug discovery, and the development of genetically modified organisms (GMOs). Its application in treating genetic disorders like sickle cell anemia, cystic fibrosis, and certain cancers has attracted substantial investment from both public and private sectors. Moreover, the technology's potential in agriculture for developing drought-resistant or pest-resistant crops is expanding its relevance beyond healthcare. The increasing adoption of CRISPR in academic, clinical, and industrial settings underscores its transformative role in biotechnology. As regulatory frameworks evolve to accommodate these innovations, companies are fast-tracking CRISPR-based therapies and solutions, driving market demand. Overall, gene editing is not only unlocking new therapeutic pathways but also reshaping the future of global biotechnology applications.

The increasing demand for biofuels and sustainable agriculture, and the rising investment in synthetic biology, are expected to support the market growth. As the world faces growing concerns over climate change, fossil fuel dependency, and food security, biotechnology offers innovative solutions to produce cleaner energy and enhance agricultural productivity. Biotech-based biofuels, such as ethanol and biodiesel derived from genetically modified algae or crops, provide renewable alternatives that reduce greenhouse gas emissions. Simultaneously, agricultural biotechnology enables the development of high-yield, drought-resistant, and pest-tolerant crops, reducing the need for chemical fertilizers and pesticides while ensuring food sustainability. These technologies are particularly vital for emerging economies with growing energy needs and limited arable land. Governments and international organizations are increasingly supporting research and development in these areas through subsidies and favorable policies. As industries and consumers shift towards eco-friendly and resource-efficient practices, the integration of biotechnology into the energy and agriculture sectors is accelerating, significantly boosting market growth.

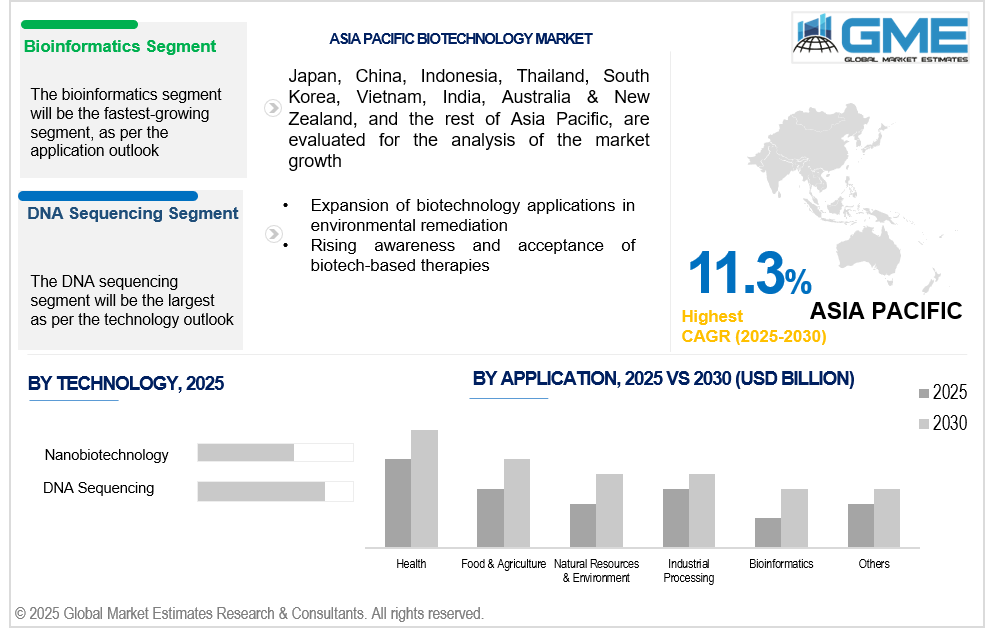

Expansion of biotechnology applications in environmental remediation, coupled with the rising awareness and acceptance of biotech-based therapies, propels market growth. As industrial pollution, soil degradation, and water contamination pose growing threats to ecosystems and public health, biotechnology offers powerful tools for sustainable cleanup and restoration. Bioremediation techniques—using microorganisms, plants, or enzymes to degrade hazardous pollutants—are gaining traction as cost-effective and eco-friendly alternatives to traditional chemical and mechanical methods. For instance, genetically engineered microbes can break down oil spills, heavy metals, and toxic waste, while phytoremediation leverages plants to absorb contaminants from soil and water. These approaches are being widely adopted across industries such as mining, manufacturing, and waste management. Rising environmental regulations and global sustainability initiatives are further encouraging investment in biotech-based remediation solutions. As awareness of environmental risks grows, demand for innovative, biology-driven cleanup technologies is expanding, positioning environmental biotechnology as a crucial growth segment within the broader biotechnology market.

A growing opportunity exists in integrating bioinformatics and AI to analyze biological data, streamline R&D, and predict therapeutic outcomes. This convergence enhances innovation, reduces development time, and offers competitive advantages for biotechnology firms exploring data-driven solutions. Furthermore, biotechnology is opening up revolutionary possibilities in regenerative medicine, such as tissue engineering and stem cell therapy. By restoring or replacing damaged tissues and organs, these treatments provide hope for diseases that were formerly thought to be incurable and increase demand in international markets. However, lengthy regulatory approval and pricing and reimbursement issues impede market growth.

The DNA sequencing segment is expected to hold the largest share of the market over the forecast period. DNA sequencing plays a central role in diverse biotechnology fields such as genomics, oncology, infectious disease detection, and rare disorder identification. Its broad applicability across diagnostics, drug development, and personalized medicine continues to drive its dominance in the biotechnology landscape.

The nanobiotechnology segment is expected to be the fastest-growing segment in the market from 2025 to 2030. Nanobiotechnology improves diagnostic sensitivity and speed through nanosensors and quantum dots that detect biomarkers at extremely low concentrations. These advancements are leading to early disease detection, including cancers and infections, thereby accelerating the adoption of nanotech in clinical diagnostics.

The health segment is expected to hold the largest share of the market over the forecast period. The health segment benefits from biotechnological innovations in personalized medicine, which uses genetic data to tailor treatments. As precision medicine becomes more mainstream, its integration with biotechnology boosts healthcare outcomes and supports the segment’s expansion in clinical and commercial settings.

The bioinformatics segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. Bioinformatics is increasingly combined with AI and machine learning to accelerate data analysis and identify patterns in complex biological datasets. This integration enhances predictive modeling, improves drug discovery processes, and strengthens bioinformatics' role in biotech research, fueling its growth.

North America is expected to be the largest region in the global market. North America's healthcare system is a major driver for biotechnology adoption, with strong demand for innovative therapies, drugs, and diagnostic tools. The focus on personalized medicine and advanced healthcare solutions further strengthens the region’s leading position in the biotechnology sector.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific’s growing focus on genomics and personalized medicine is driving demand for biotechnology products. With advancements in gene sequencing technologies and personalized treatments, biotech companies in the region are developing more targeted therapies, contributing to market growth.

AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb, Sanofi, Biogen, Abbott Laboratories, Pfizer, Inc., Amgen Inc., Novo Nordisk A/S, and Merck KGaA, among others, are some of the key players in the global biotechnology market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2024, AGC Biologics and NEC Bio Therapeutics established a partnership to progress the development of NECVAX-NEO1, a DNA vaccine that targets tumor neoantigens unique to each patient. The goal of the partnership was to improve the development of customized cancer therapies.

In July 2024, in a Series A fundraising round, Spear Bio, Inc. secured USD 45 million to speed up the launch of its protein research and disease detection products. The funding will be utilized to quickly expand their assay selection and provide biotech researchers with commercial solutions.

REPORT CONTENT

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL BIOTECHNOLOGY MARKET, BY Application

4.2 Biotechnology Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4.1 Health Market Estimates and Forecast, 2021-2029 (USD Million)

4.5.1 Food & Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Natural Resources & Environment

4.6.1 Natural Resources & Environment Market Estimates and Forecast, 2021-2029 (USD Million)

4.7.1 Industrial Processing Market Estimates and Forecast, 2021-2029 (USD Million)

4.8.1 Bioinformatics Market Estimates and Forecast, 2021-2029 (USD Million)

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

5.2 Biotechnology Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4.1 Nanobiotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Tissue Engineering & Regeneration

5.5.1 Tissue Engineering & Regeneration Market Estimates and Forecast, 2021-2029 (USD Million)

5.6.1 DNA Sequencing Market Estimates and Forecast, 2021-2029 (USD Million)

5.7.1 Cell-based Assays Market Estimates and Forecast, 2021-2029 (USD Million)

5.8.1 Fermentation Market Estimates and Forecast, 2021-2029 (USD Million)

5.9.1 PCR Technology Market Estimates and Forecast, 2021-2029 (USD Million)

5.10.1 Chromatography Market Estimates and Forecast, 2021-2029 (USD Million)

5.11.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL BIOTECHNOLOGY MARKET, BY REGION

6.2 North America Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1 U.S. Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2 Canada Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3 Mexico Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3 Europe Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1 Germany Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2 U.K. Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3 France Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4 Italy Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5 Spain Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6 Netherlands Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.7 Rest of Europe Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4 Asia Pacific Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1 China Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2 Japan Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3 India Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4 South Korea Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5 Singapore Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6 Malaysia Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7 Thailand Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8 Indonesia Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.9 Vietnam Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10 Taiwan Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11 Rest of Asia Pacific Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Middle East and Africa Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1 Saudi Arabia Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2 U.A.E. Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3 Israel Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4 South Africa Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Central and South America Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1 Brazil Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2 Argentina Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3 Chile Biotechnology Market Estimates and Forecast, 2021-2029 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Type of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Biotechnology Market, By Application, 2021-2029 (USD Million)

2 Health Market, By Region, 2021-2029 (USD Million)

3 Food & Agriculture Market, By Region, 2021-2029 (USD Million)

4 Natural Resources & Environment Market, By Region, 2021-2029 (USD Million)

5 Industrial Processing Market, By Region, 2021-2029 (USD Million)

6 Bioinformatics Market, By Region, 2021-2029 (USD Million)

7 Others Market, By Region, 2021-2029 (USD Million)

8 Global Biotechnology Market, By Technology, 2021-2029 (USD Million)

9 Nanobiotechnology Market, By Region, 2021-2029 (USD Million)

10 Tissue Engineering & Regeneration Market, By Region, 2021-2029 (USD Million)

11 DNA Sequencing Market, By Region, 2021-2029 (USD Million)

12 Cell-based Assays Market, By Region, 2021-2029 (USD Million)

13 Fermentation Market, By Region, 2021-2029 (USD Million)

14 PCR Technology Market, By Region, 2021-2029 (USD Million)

15 Chromatography Market, By Region, 2021-2029 (USD Million)

16 Others Market, By Region, 2021-2029 (USD Million)

17 Regional Analysis, 2021-2029 (USD Million)

18 North America Biotechnology Market, By Application, 2021-2029 (USD Million)

19 North America Biotechnology Market, By Technology, 2021-2029 (USD Million)

20 North America Biotechnology Market, By COUNTRY, 2021-2029 (USD Million)

21 U.S. Biotechnology Market, By Application, 2021-2029 (USD Million)

22 U.S. Biotechnology Market, By Technology, 2021-2029 (USD Million)

23 Canada Biotechnology Market, By Application, 2021-2029 (USD Million)

24 Canada Biotechnology Market, By Technology, 2021-2029 (USD Million)

25 Mexico Biotechnology Market, By Application, 2021-2029 (USD Million)

26 Mexico Biotechnology Market, By Technology, 2021-2029 (USD Million)

27 Europe Biotechnology Market, By Application, 2021-2029 (USD Million)

28 Europe Biotechnology Market, By Technology, 2021-2029 (USD Million)

29 EUROPE Biotechnology Market, By COUNTRY, 2021-2029 (USD Million)

30 Germany Biotechnology Market, By Application, 2021-2029 (USD Million)

31 Germany Biotechnology Market, By Technology, 2021-2029 (USD Million)

32 U.K. Biotechnology Market, By Application, 2021-2029 (USD Million)

33 U.K. Biotechnology Market, By Technology, 2021-2029 (USD Million)

34 France Biotechnology Market, By Application, 2021-2029 (USD Million)

35 France Biotechnology Market, By Technology, 2021-2029 (USD Million)

36 Italy Biotechnology Market, By Application, 2021-2029 (USD Million)

37 Italy Biotechnology Market, By Technology, 2021-2029 (USD Million)

38 Spain Biotechnology Market, By Application, 2021-2029 (USD Million)

39 Spain Biotechnology Market, By Technology, 2021-2029 (USD Million)

40 Netherlands Biotechnology Market, By Application, 2021-2029 (USD Million)

41 Netherlands Biotechnology Market, By Technology, 2021-2029 (USD Million)

42 Rest Of Europe Biotechnology Market, By Application, 2021-2029 (USD Million)

43 Rest Of Europe Biotechnology Market, By Technology, 2021-2029 (USD Million)

44 Asia Pacific Biotechnology Market, By Application, 2021-2029 (USD Million)

45 Asia Pacific Biotechnology Market, By Technology, 2021-2029 (USD Million)

46 ASIA PACIFIC Biotechnology Market, By COUNTRY, 2021-2029 (USD Million)

47 China Biotechnology Market, By Application, 2021-2029 (USD Million)

48 China Biotechnology Market, By Technology, 2021-2029 (USD Million)

49 Japan Biotechnology Market, By Application, 2021-2029 (USD Million)

50 Japan Biotechnology Market, By Technology, 2021-2029 (USD Million)

51 India Biotechnology Market, By Application, 2021-2029 (USD Million)

52 India Biotechnology Market, By Technology, 2021-2029 (USD Million)

53 South Korea Biotechnology Market, By Application, 2021-2029 (USD Million)

54 South Korea Biotechnology Market, By Technology, 2021-2029 (USD Million)

55 Singapore Biotechnology Market, By Application, 2021-2029 (USD Million)

56 Singapore Biotechnology Market, By Technology, 2021-2029 (USD Million)

57 Thailand Biotechnology Market, By Application, 2021-2029 (USD Million)

58 Thailand Biotechnology Market, By Technology, 2021-2029 (USD Million)

59 Malaysia Biotechnology Market, By Application, 2021-2029 (USD Million)

60 Malaysia Biotechnology Market, By Technology, 2021-2029 (USD Million)

61 Indonesia Biotechnology Market, By Application, 2021-2029 (USD Million)

62 Indonesia Biotechnology Market, By Technology, 2021-2029 (USD Million)

63 Vietnam Biotechnology Market, By Application, 2021-2029 (USD Million)

64 Vietnam Biotechnology Market, By Technology, 2021-2029 (USD Million)

65 Taiwan Biotechnology Market, By Application, 2021-2029 (USD Million)

66 Taiwan Biotechnology Market, By Technology, 2021-2029 (USD Million)

67 Rest of APAC Biotechnology Market, By Application, 2021-2029 (USD Million)

68 Rest of APAC Biotechnology Market, By Technology, 2021-2029 (USD Million)

69 Middle East and Africa Biotechnology Market, By Application, 2021-2029 (USD Million)

70 Middle East and Africa Biotechnology Market, By Technology, 2021-2029 (USD Million)

71 MIDDLE EAST & AFRICA Biotechnology Market, By COUNTRY, 2021-2029 (USD Million)

72 Saudi Arabia Biotechnology Market, By Application, 2021-2029 (USD Million)

73 Saudi Arabia Biotechnology Market, By Technology, 2021-2029 (USD Million)

74 UAE Biotechnology Market, By Application, 2021-2029 (USD Million)

75 UAE Biotechnology Market, By Technology, 2021-2029 (USD Million)

76 Israel Biotechnology Market, By Application, 2021-2029 (USD Million)

77 Israel Biotechnology Market, By Technology, 2021-2029 (USD Million)

78 South Africa Biotechnology Market, By Application, 2021-2029 (USD Million)

79 South Africa Biotechnology Market, By Technology, 2021-2029 (USD Million)

80 Rest Of Middle East and Africa Biotechnology Market, By Application, 2021-2029 (USD Million)

81 Rest Of Middle East and Africa Biotechnology Market, By Technology, 2021-2029 (USD Million)

82 Central and South America Biotechnology Market, By Application, 2021-2029 (USD Million)

83 Central and South America Biotechnology Market, By Technology, 2021-2029 (USD Million)

84 CENTRAL AND SOUTH AMERICA Biotechnology Market, By COUNTRY, 2021-2029 (USD Million)

85 Brazil Biotechnology Market, By Application, 2021-2029 (USD Million)

86 Brazil Biotechnology Market, By Technology, 2021-2029 (USD Million)

87 Chile Biotechnology Market, By Application, 2021-2029 (USD Million)

88 Chile Biotechnology Market, By Technology, 2021-2029 (USD Million)

89 Argentina Biotechnology Market, By Application, 2021-2029 (USD Million)

90 Argentina Biotechnology Market, By Technology, 2021-2029 (USD Million)

91 Rest Of Central and South America Biotechnology Market, By Application, 2021-2029 (USD Million)

92 Rest Of Central and South America Biotechnology Market, By Technology, 2021-2029 (USD Million)

93 AstraZeneca: Products & Services Offering

94 Gilead Sciences, Inc.: Products & Services Offering

95 Bristol-Myers Squibb: Products & Services Offering

96 Sanofi: Products & Services Offering

97 Biogen: Products & Services Offering

98 ABBOTT LABORATORIES: Products & Services Offering

99 Pfizer, Inc.: Products & Services Offering

100 Amgen Inc.: Products & Services Offering

101 Novo Nordisk A/S, Inc: Products & Services Offering

102 Merck KGaA: Products & Services Offering

103 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Biotechnology Market Overview

2 Global Biotechnology Market Value From 2021-2029 (USD Million)

3 Global Biotechnology Market Share, By Application (2023)

4 Global Biotechnology Market Share, By Technology (2023)

5 Global Biotechnology Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Biotechnology Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Biotechnology Market

10 Impact Of Challenges On The Global Biotechnology Market

11 Porter’s Five Forces Analysis

12 Global Biotechnology Market: By Application Scope Key Takeaways

13 Global Biotechnology Market, By Application Segment: Revenue Growth Analysis

14 Health Market, By Region, 2021-2029 (USD Million)

15 Food & Agriculture Market, By Region, 2021-2029 (USD Million)

16 Natural Resources & Environment Market, By Region, 2021-2029 (USD Million)

17 Industrial Processing Market, By Region, 2021-2029 (USD Million)

18 Bioinformatics Market, By Region, 2021-2029 (USD Million)

19 Others Market, By Region, 2021-2029 (USD Million)

20 Global Biotechnology Market: By Technology Scope Key Takeaways

21 Global Biotechnology Market, By Technology Segment: Revenue Growth Analysis

22 Nanobiotechnology Market, By Region, 2021-2029 (USD Million)

23 Tissue Engineering & Regeneration Market, By Region, 2021-2029 (USD Million)

24 DNA Sequencing Market, By Region, 2021-2029 (USD Million)

25 Cell-based Assays Market, By Region, 2021-2029 (USD Million)

26 Fermentation Market, By Region, 2021-2029 (USD Million)

27 PCR Technology Market, By Region, 2021-2029 (USD Million)

28 Chromatography Market, By Region, 2021-2029 (USD Million)

29 Others Market, By Region, 2021-2029 (USD Million)

30 Regional Segment: Revenue Growth Analysis

31 Global Biotechnology Market: Regional Analysis

32 North America Biotechnology Market Overview

33 North America Biotechnology Market, By Application

34 North America Biotechnology Market, By Technology

35 North America Biotechnology Market, By Country

36 U.S. Biotechnology Market, By Application

37 U.S. Biotechnology Market, By Technology

38 Canada Biotechnology Market, By Application

39 Canada Biotechnology Market, By Technology

40 Mexico Biotechnology Market, By Application

41 Mexico Biotechnology Market, By Technology

42 Four Quadrant Positioning Matrix

43 Company Market Share Analysis

44 AstraZeneca: Company Snapshot

45 AstraZeneca: SWOT Analysis

46 AstraZeneca: Geographic Presence

47 Gilead Sciences, Inc.: Company Snapshot

48 Gilead Sciences, Inc.: SWOT Analysis

49 Gilead Sciences, Inc.: Geographic Presence

50 Bristol-Myers Squibb: Company Snapshot

51 Bristol-Myers Squibb: SWOT Analysis

52 Bristol-Myers Squibb: Geographic Presence

53 Sanofi: Company Snapshot

54 Sanofi: Swot Analysis

55 Sanofi: Geographic Presence

56 Biogen: Company Snapshot

57 Biogen: SWOT Analysis

58 Biogen: Geographic Presence

59 ABBOTT LABORATORIES: Company Snapshot

60 ABBOTT LABORATORIES: SWOT Analysis

61 ABBOTT LABORATORIES: Geographic Presence

62 Pfizer, Inc. : Company Snapshot

63 Pfizer, Inc. : SWOT Analysis

64 Pfizer, Inc. : Geographic Presence

65 Amgen Inc.: Company Snapshot

66 Amgen Inc.: SWOT Analysis

67 Amgen Inc.: Geographic Presence

68 Novo Nordisk A/S, Inc.: Company Snapshot

69 Novo Nordisk A/S, Inc.: SWOT Analysis

70 Novo Nordisk A/S, Inc.: Geographic Presence

71 Merck KGaA: Company Snapshot

72 Merck KGaA: SWOT Analysis

73 Merck KGaA: Geographic Presence

74 Other Companies: Company Snapshot

75 Other Companies: SWOT Analysis

76 Other Companies: Geographic Presence

The Global Biotechnology Market has been studied from the year 2019 till 2030. However, the CAGR provided in the report is from the year 2025 to 2030. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biotechnology Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS