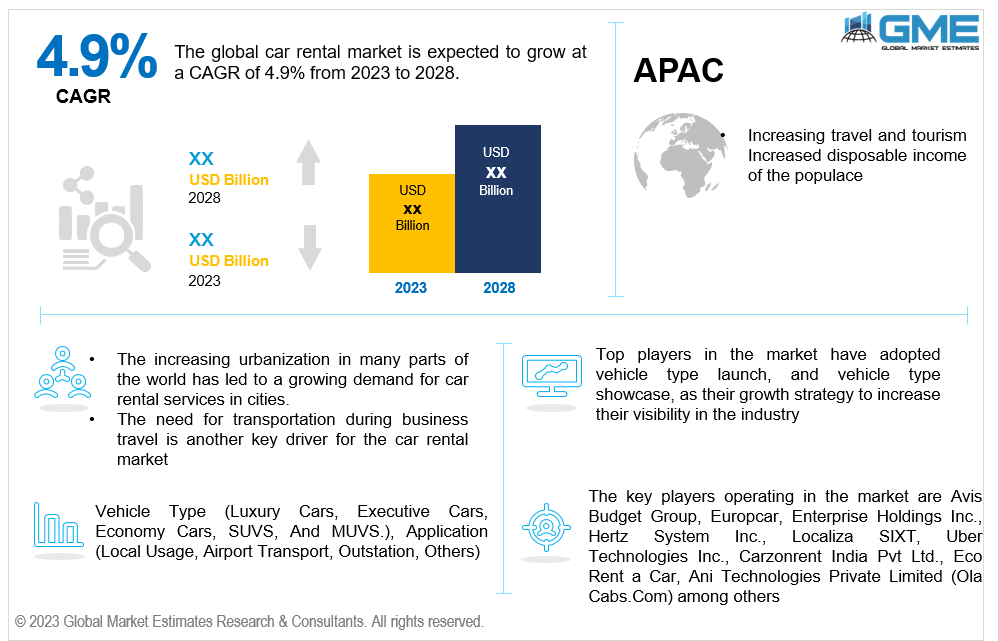

Global Car Rental Market Size, Trends & Analysis - Forecasts to 2028 Vehicle Type (Luxury Cars, Executive Cars, Economy Cars, SUVS, And MUVS.), Application (Local Usage, Airport Transport, Outstation, Others), and Region (North America, Asia Pacific, Central & South America, Europe, Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The global car rental market is expected to grow at a CAGR of 4.9% from 2023 to 2028. The service of renting out cars from offline or online sources for a defined amount of time is known as car rental. To better serve, car rental services were primarily developed for travellers and those without own vehicles. A car is generally an expensive liability for an individual as it increases the overall expense for him/her. Purchasing a car comes with a lot of additional costs like maintenance, insurance, fuel charges, high taxes based on the models, among others. Hence, the lack of affordability of buying cars has given an opportunity for the car rental business to flourish especially across developing nations. This acts as a cost saving model for the consumers too. Furthermore, the advancements in car rental platform technology has caused the launch of various types of car rental applications and services.

The car rental market has undergone significant changes in recent years due to the emergence of new technologies and shifts in consumer behavior. One of the major trend is the rise of car-sharing services, which offer short-term rentals by the hour or minute. Another trend is the increasing popularity of online booking platforms that enable customers to quickly and easily compare prices and reserve vehicles. Additionally, the market is seeing a growing demand for eco-friendly and electric vehicles, as consumers become more environmentally conscious.

Furthermore, one of the most significant trends is the increased adoption of electric and hybrid vehicles by rental companies, as consumers are increasingly concerned about the environment and interested in sustainable transportation options. Another trend is the growth of mobile applications and online booking platforms that make it easier for customers to rent cars and manage their reservations. Car rental companies are also expanding their offerings beyond traditional car rentals to include services like ride-sharing, car-sharing, and subscription-based services. Finally, there is a growing focus on customer experience, with companies investing in technology and other improvements to provide a more seamless and personalized rental experience for their customers.

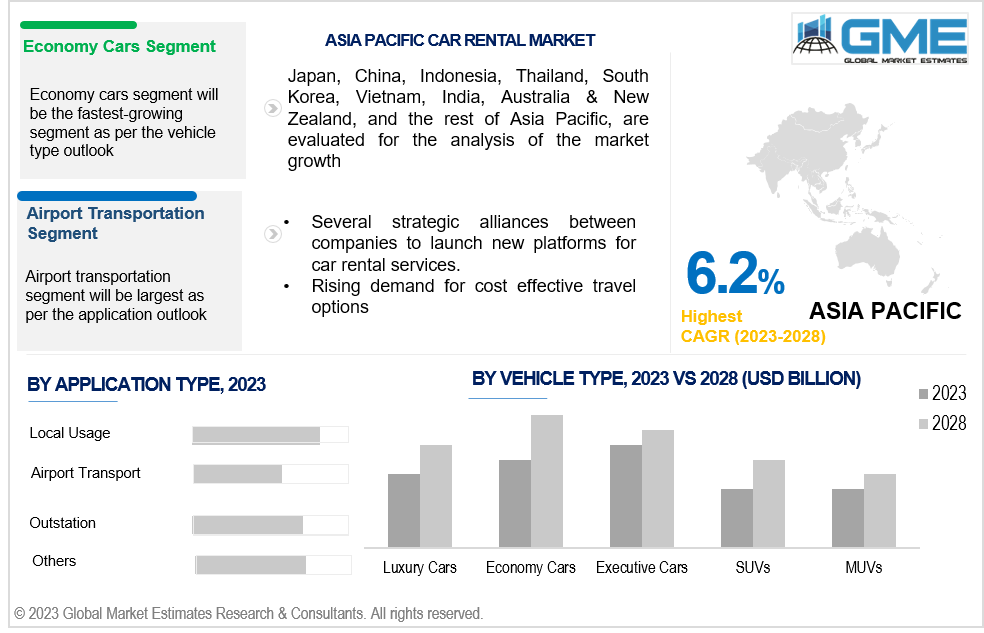

As per the vehicle type outlook, the economy cars segment will be the largest segment during the forecast period. The global car rental market is divided into luxury cars, executive cars, economy cars, SUVS, And MUVS based on vehicle type. Two of the key factors fostering the expansion of this sector are the cars' modest size and reasonable price. As a result, people prefer using budget vehicles more often to go around town and to the airport.

Luxury and premium vehicles are also a growing segment in the car rental market, particularly for business travellers and those seeking a more luxurious travel experience. In the automobile rental industry, electric and hybrid vehicles are also growing in popularity as customers become more environmentally concerned and search for sustainable mobility solutions.

As per the application outlook, the airport transportation segment will be the largest segment during the forecast period. The segment is divided into local usage, airport transport, outstation and others. Global air travel has significantly increased in recent years, which is expected to promote sector expansion. In light of this trend, several car rental organisations are expanding their fleets and publicising their offerings at key airports. Leading market players are present at airports where clients may use 24-hour automobile rental services, thus fuelling the segment's expansion. Another application of the car rental market that is gaining popularity is the short-term rental or car-sharing market. This allows individuals to rent vehicles for shorter periods of time, sometimes even by the hour, for quick trips or errands.

The North American region is analyzed to be the largest segment in the global car rental market in the forecast period. The North American car rental market had been significantly impacted by the COVID-19 pandemic, with many companies experiencing a drop in demand due to travel restrictions and reduced consumer confidence in travel.

However, as vaccinations became more widespread and travel restrictions were lifted, the car rental market started to recover, with an increase in demand for rental cars as people resumed traveling domestically. In addition, the rise of remote work and the desire for socially distanced travel options led to an increase in demand for road trips and leisure travel, which further boosted the car rental market.

Asia Pacific region is analyzed to be the fastest growing segment across the global car rental market. The Asia Pacific region is experiencing rapid urbanization and infrastructure development, which is increasing demand for car rental services. As more people move to cities and public transportation networks become more congested, car rental companies are able to offer a more flexible and convenient mode of transportation. Furthermore, the middle class in the Asia Pacific region is expanding, which is driving demand for travel and car rental services. As disposable incomes rise, more people are able to afford car rental services for leisure and business travel.

The key players operating in the market are Avis Budget Group, Europcar, Enterprise Holdings Inc., Hertz System Inc., Localiza SIXT, Uber Technologies Inc., Carzonrent India Pvt Ltd., Eco Rent a Car, and Ani Technologies Private Limited (Ola Cabs.Com) among others.

Please note: This is not an exhaustive list of companies profiled in the report.

The global car rental market has observed several strategic alliances between companies to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic OpportunLocal Usagey & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting OpportunLocal Usagey

1.1.4 High Growing Region/Country

1.1.5 CompetLocal Usageor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market OpportunLocal Usageies

3.1.3 Ancillary Market OpportunLocal Usageies

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market OpportunLocal Usageies: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New SubstLocal Usageutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 IntensLocal Usagey of CompetLocal Usageive Rivalry

3.3.2 SWOT Analysis; By Factor (PolLocal Usageical & Legal, Economic, and Technological)

3.3.2.1 PolLocal Usageical Landscape

4 GLOBAL CAR RENTAL MARKET, BY VEHICLE TYPE

4.2 Car Rental Market: Vehicle Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Economy Cars Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Executive Cars Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Luxury Cars Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 SUVs Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 MUVs Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL CAR RENTAL MARKET, BY APPLICATION

5.2 Car Rental Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 LOCAL USAGE Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Airport Transport Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Outstations Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL CAR RENTAL MARKET, BY REGION

6.2 North America Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1 U.S. Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2 Canada Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3 Mexico Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1 Germany Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2 U.K. Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3 France Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4 Local Usagealy Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5 Spain Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6 Netherlands Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.7 Rest of Europe Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4 Asia Pacific Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2 Japan Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3 India Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4 South Korea Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5 Singapore Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6 Malaysia Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7 Thailand Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8 Indonesia Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.9 Vietnam Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10 Taiwan Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11 Rest of Asia Pacific Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Middle East & Africa Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1 Saudi Arabia Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2 U.A.E. Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3 Israel Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4 South Africa Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Central & South America Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1 Brazil Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2 Argentina Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3 Chile Car Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7 COMPETLOCAL USAGEIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant PosLocal Usageioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Enterprise Holdings Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Carzonrent India Pvt Ltd.

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Ani Technologies Private Limited (Ola Cabs.Com)

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

8.1.1 Market DefinLocal Usageion

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data ReposLocal Usageory

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Application of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & LimLocal Usageations

8.6.2 Research LimLocal Usageations

LIST OF TABLES

1 Global Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

2 Economy Cars Market, By Region, 2020-2028 (USD Mllion)

3 Executive Cars Market, By Region, 2020-2028 (USD Mllion)

4 Luxury Cars Market, By Region, 2020-2028 (USD Mllion)

5 suvs Market, By Region, 2020-2028 (USD Mllion)

6 MUVs Market, By Region, 2020-2028 (USD Mllion)

7 Global Car Rental Market, By Application, 2020-2028 (USD Mllion)

8 LOCAL USAGE Market, By Region, 2020-2028 (USD Mllion)

9 Airport Transport Market, By Region, 2020-2028 (USD Mllion)

10 Outstations Market, By Region, 2020-2028 (USD Mllion)

11 Others Market, By Region, 2020-2028 (USD Mllion)

12 Regional Analysis, 2020-2028 (USD Mllion)

13 North America Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

14 North America Car Rental Market, By Application, 2020-2028 (USD Mllion)

15 U.S. Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

16 U.S. Car Rental Market, By Application, 2020-2028 (USD Mllion)

17 Canada Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

18 Canada Car Rental Market, By Application, 2020-2028 (USD Mllion)

19 Mexico Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

20 Mexico Car Rental Market, By Application, 2020-2028 (USD Mllion)

21 Europe Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

22 Europe Car Rental Market, By Application, 2020-2028 (USD Mllion)

23 Germany Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

24 Germany Car Rental Market, By Application, 2020-2028 (USD Mllion)

25 U.K. Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

26 U.K. Car Rental Market, By Application, 2020-2028 (USD Mllion)

27 France Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

28 France Car Rental Market, By Application, 2020-2028 (USD Mllion)

29 Local Usagealy Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

30 Local Usagealy Car Rental Market, By Application, 2020-2028 (USD Mllion)

31 Spain Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

32 Spain Car Rental Market, By Application, 2020-2028 (USD Mllion)

33 Netherlands Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

34 Netherlands Car Rental Market, By Application, 2020-2028 (USD Mllion)

35 Rest Of Europe Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

36 Rest Of Europe Car Rental Market, By Application, 2020-2028 (USD Mllion)

37 Asia Pacific Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

38 Asia Pacific Car Rental Market, By Application, 2020-2028 (USD Mllion)

39 China Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

40 China Car Rental Market, By Application, 2020-2028 (USD Mllion)

41 Japan Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

42 Japan Car Rental Market, By Application, 2020-2028 (USD Mllion)

43 India Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

44 India Car Rental Market, By Application, 2020-2028 (USD Mllion)

45 South Korea Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

46 South Korea Car Rental Market, By Application, 2020-2028 (USD Mllion)

47 Singapore Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

48 Singapore Car Rental Market, By Application, 2020-2028 (USD Mllion)

49 Thailand Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

50 Thailand Car Rental Market, By Application, 2020-2028 (USD Mllion)

51 Malaysia Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

52 Malaysia Car Rental Market, By Application, 2020-2028 (USD Mllion)

53 Indonesia Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

54 Indonesia Car Rental Market, By Application, 2020-2028 (USD Mllion)

55 Vietnam Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

56 Vietnam Car Rental Market, By Application, 2020-2028 (USD Mllion)

57 Taiwan Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

58 Taiwan Car Rental Market, By Application, 2020-2028 (USD Mllion)

59 Rest of APAC Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

60 Rest of APAC Car Rental Market, By Application, 2020-2028 (USD Mllion)

61 Middle East & Africa Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

62 Middle East & Africa Car Rental Market, By Application, 2020-2028 (USD Mllion)

63 Saudi Arabia Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

64 Saudi Arabia Car Rental Market, By Application, 2020-2028 (USD Mllion)

65 UAE Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

66 UAE Car Rental Market, By Application, 2020-2028 (USD Mllion)

67 Israel Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

68 Israel Car Rental Market, By Application, 2020-2028 (USD Mllion)

69 South Africa Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

70 South Africa Car Rental Market, By Application, 2020-2028 (USD Mllion)

71 Rest Of Middle East & Africa Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

72 Rest Of Middle East & Africa Car Rental Market, By Application, 2020-2028 (USD Mllion)

73 Central & South America Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

74 Central & South America Car Rental Market, By Application, 2020-2028 (USD Mllion)

75 Brazil Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

76 Brazil Car Rental Market, By Application, 2020-2028 (USD Mllion)

77 Chile Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

78 Chile Car Rental Market, By Application, 2020-2028 (USD Mllion)

79 Argentina Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

80 Argentina Car Rental Market, By Application, 2020-2028 (USD Mllion)

81 Rest Of Central & South America Car Rental Market, By Vehicle Type, 2020-2028 (USD Mllion)

82 Rest Of Central & South America Car Rental Market, By Application, 2020-2028 (USD Mllion)

83 Avis Budget Group : Products & Services Offering

84 Europcar: Products & Services Offering

85 Enterprise Holdings Inc.: Products & Services Offering

86 Hertz System Inc.: Products & Services Offering

87 Localiza SIXT: Products & Services Offering

88 UBER TECHNOLOGIES INC.: Products & Services Offering

89 Carzonrent India Pvt Ltd. : Products & Services Offering

90 Eco Rent a Car: Products & Services Offering

91 Ani Technologies Private Limited (Ola Cabs.Com), Inc: Products & Services Offering

92 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Car Rental Market Overview

2 Global Car Rental Market Value From 2020-2028 (USD Mllion)

3 Global Car Rental Market Share, By Vehicle Type (2022)

4 Global Car Rental Market Share, By Application (2022)

5 Global Car Rental Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Car Rental Market

7 Four Quadrant CompetLocal Usageor PosLocal Usageioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Car Rental Market

10 Impact Of Challenges On The Global Car Rental Market

11 Porter’s Five Forces Analysis

12 Global Car Rental Market: By Vehicle Type Scope Key Takeaways

13 Global Car Rental Market, By Vehicle Type Segment: Revenue Growth Analysis

14 Economy Cars Market, By Region, 2020-2028 (USD Mllion)

15 Executive Cars Market, By Region, 2020-2028 (USD Mllion)

16 Luxury Cars Market, By Region, 2020-2028 (USD Mllion)

17 SUVs Market, By Region, 2020-2028 (USD Mllion)

18 MUVs Market, By Region, 2020-2028 (USD Mllion)

19 Global Car Rental Market: By Application Scope Key Takeaways

20 Global Car Rental Market, By Application Segment: Revenue Growth Analysis

21 LOCAL USAGE Market, By Region, 2020-2028 (USD Mllion)

22 Airport Transport Market, By Region, 2020-2028 (USD Mllion)

23 Outstations Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global Car Rental Market: Regional Analysis

27 North America Car Rental Market Overview

28 North America Car Rental Market, By Vehicle Type

29 North America Car Rental Market, By Application

30 North America Car Rental Market, By Country

31 U.S. Car Rental Market, By Vehicle Type

32 U.S. Car Rental Market, By Application

33 Canada Car Rental Market, By Vehicle Type

34 Canada Car Rental Market, By Application

35 Mexico Car Rental Market, By Vehicle Type

36 Mexico Car Rental Market, By Application

37 Four Quadrant PosLocal Usageioning Matrix

38 Company Market Share Analysis

39 Avis Budget Group : Company Snapshot

40 Avis Budget Group : SWOT Analysis

41 Avis Budget Group : Geographic Presence

42 Europcar: Company Snapshot

43 Europcar: SWOT Analysis

44 Europcar: Geographic Presence

45 Enterprise Holdings Inc.: Company Snapshot

46 Enterprise Holdings Inc.: SWOT Analysis

47 Enterprise Holdings Inc.: Geographic Presence

48 Hertz System Inc.: Company Snapshot

49 Hertz System Inc.: Swot Analysis

50 Hertz System Inc.: Geographic Presence

51 Localiza SIXT: Company Snapshot

52 Localiza SIXT: SWOT Analysis

53 Localiza SIXT: Geographic Presence

54 UBER TECHNOLOGIES INC.: Company Snapshot

55 UBER TECHNOLOGIES INC.: SWOT Analysis

56 UBER TECHNOLOGIES INC.: Geographic Presence

57 Carzonrent India Pvt Ltd. : Company Snapshot

58 Carzonrent India Pvt Ltd. : SWOT Analysis

59 Carzonrent India Pvt Ltd. : Geographic Presence

60 Eco Rent a Car: Company Snapshot

61 Eco Rent a Car: SWOT Analysis

62 Eco Rent a Car: Geographic Presence

63 Ani Technologies Private Limited (Ola Cabs.Com), Inc.: Company Snapshot

64 Ani Technologies Private Limited (Ola Cabs.Com), Inc.: SWOT Analysis

65 Ani Technologies Private Limited (Ola Cabs.Com), Inc.: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The Global Car Rental Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Car Rental Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS