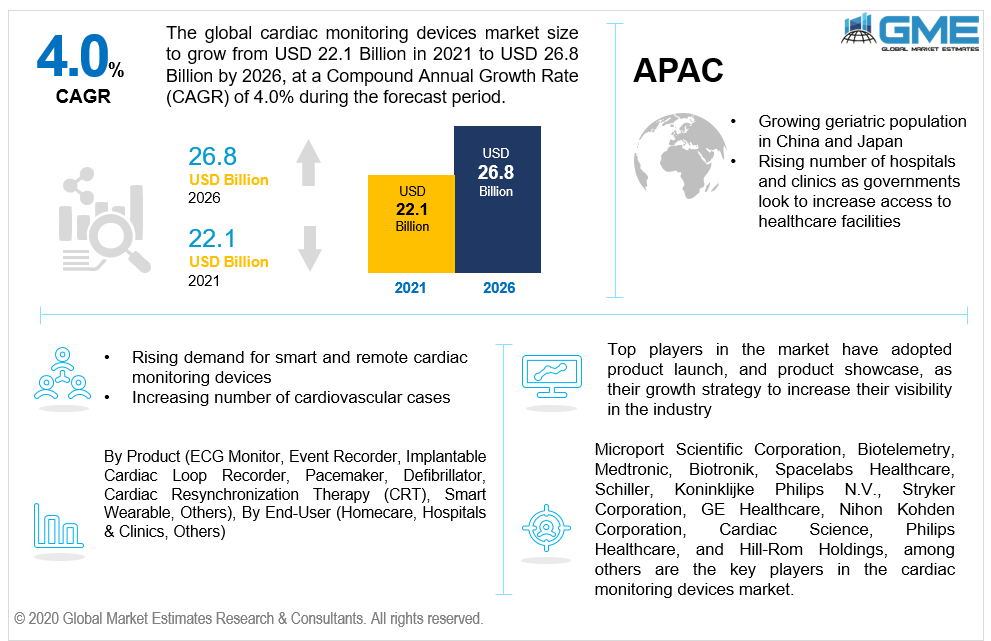

Global Cardiac Monitoring Devices Market Size, Trends & Analysis - Forecasts to 2026 By Product (ECG Monitor, Event Recorder, Implantable Cardiac Loop Recorder, Pacemaker, Defibrillator, Cardiac Resynchronization Therapy (CRT), Smart Wearable, Others), By End-User (Homecare, Hospitals & Clinics, Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The global cardiac monitoring devices market is projected to grow from USD 22.1 billion in 2021 to USD 26.8 billion by 2026 at a CAGR value of 4.0%. Growing incidences of cardiovascular diseases and the growing demand for homecare among patients have been the major drivers of the cardiac monitoring market.

As per the WHO estimates, cardiovascular diseases are the number one cause of death globally and are responsible for causing 17.9 million deaths annually. With only one-third of the deaths occurring among people below the age of 70, the growing geriatric population will increase the demand for cardiac monitoring devices during the forecast period.

As per WHO estimates, obesity rates have tripled globally since 1975. Obese individuals are at a higher risk of suffering from cardiovascular diseases due to higher blood pressure as they require more blood to be pumped to supply oxygen and nutrients in their bodies. Along with growing obesity rates, tobacco consumption, physical inactivity, diabetes, and genetic disorders, among other risk factors are the major causes of cardiovascular diseases. The growing preference of cardiovascular patients for remote monitoring is expected to result in the growth of the cardiac monitor devices market.

Globally, the pandemic has caused an increased need for patient care with reduced physical interaction between the patient and healthcare provider. Growing concerns of being infected with coronavirus have resulted in the development of smart cardiac monitors that allow healthcare providers to remotely monitor patients. Periodic cardiac monitoring if not continuous monitoring of cardiac patients can significantly reduce the risk of death.

Technological developments have made cardiac monitors more efficient, smaller, and reduced power consumption. Technological advancements have made it easier for healthcare providers to monitor cardiac patients. Growing investments in the research and development of cardiac monitors by private companies and public institutions will have a positive impact on the growth of the cardiac monitoring devices market. The availability of insurance and increasing reimbursement provision for cardiac monitoring devices are expected to improve the access to cardiac monitoring devices in developed nations.

The cardiac monitoring devices market is restrained by the growing concerns among consumers about the vulnerability of cardiac monitoring devices to cyberattacks. In 2017, the FDA recalled over 500,000 cardiac monitors from the market citing their vulnerability to cyberattacks. Such stringent regulations are major hurdles to the widening of the cardiac monitoring market size. The lack of availability of reimbursement options and insurance in Asia Pacific countries is a major hindrance to the broadening of the cardiac monitoring devices market. Cardiac monitoring devices are expensive and there is a chance of catching infections if not handled properly, these factors affect the growth of the cardiovascular monitoring market.

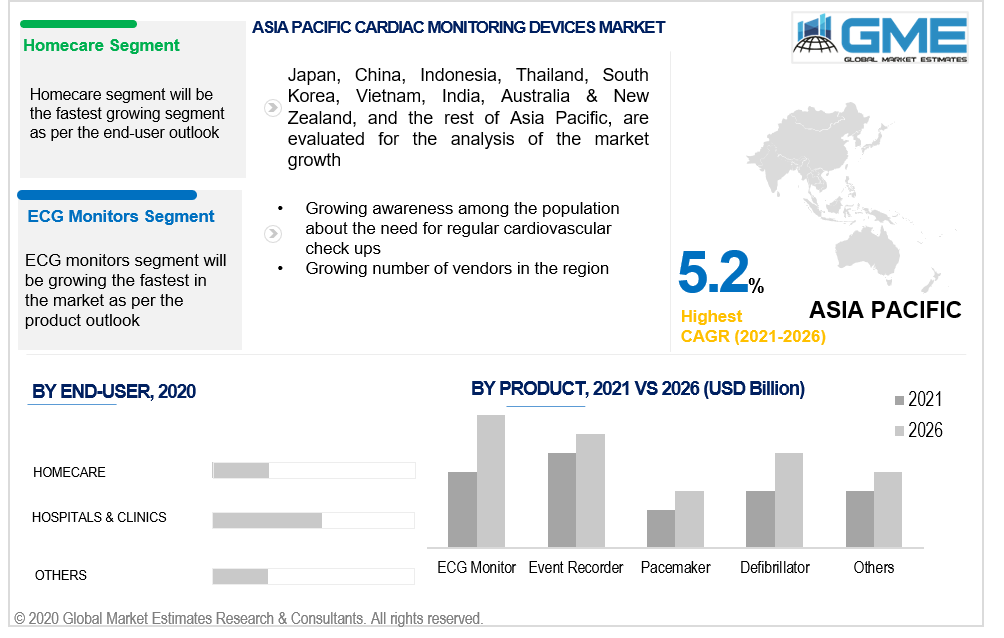

Based on the products offered by the vendors, the cardiac monitoring devices market can be divided into ECG monitors, implantable cardiac loop recorder, pacemaker, defibrillator, smart wearable, cardiac resynchronization therapy (CRT), event recorder, and other segments. The ECG monitors segment held the bulk of the cardiac monitoring devices market. Patients suffering from cardiovascular diseases often require chronic monitoring of their ECG to inhibit the chances of a cardiac arrest. Previously, ECG monitoring was only possible in hospitals but the growth in remote ECG monitoring devices allows healthcare providers to provide remote care to the patients at the comfort of their homes.

The technological advancements in wireless communications are expected to further increase the demand for ECG monitors. The ECG monitors segment is hence envisaged to flourish at an elevated rate during the forecast period.

Based on the various end-users of the cardiac monitoring devices, the market can be fragmented into homecare, hospitals and clinics, and others fragments. The hospitals & clinics segment held the largest chunk of the cardiac monitoring devices market by end-user. Hospitals & clinics have been the foremost point of care for patients. Hospitals and clinics are well prepared to handle patients suffering from cardiovascular diseases. Patients have greater confidence in hospitals and clinics to receive the necessary diagnosis and treatment which have been the major drivers of the hospitals and clinics segment. The increased reimbursement options available to patients in developed nations like the U.S have also contributed to the growth of the hospitals and clinics segment.

The homecare segment is envisaged to balloon significantly during the forecast period. As patients who have to maintain their disease chronically are increasingly preferring to get diagnosed at the comfort of their homes. Technological developments have made this possible in recent years and with more advanced technology anticipated during the forecast period, the homecare segment will witness a significant increase in its growth.

Based on geography, the market can be fragmented into North America, South America, Middle East & Africa, Asia Pacific, and Europe fragments. The North American region monopolized the cardiac monitoring devices market based on revenue.

The presence of some of the major industry leaders in the region combined with the large spending on research and development of novel technology have been some of the major push factors for the cardiac monitoring devices market in the North American region. The North American region’s insurance and reimbursement schemes available to patients have increased the access to cardiac monitoring devices contributing to the growth of the market in the region.

The APAC region is anticipated to log a significantly higher growth rate compared to all regions during the forecast period. The APAC region has been witnessing an increase in the number of cases of cardiovascular diseases annually. The growing number of new hospitals and clinics in the region is expected to drive the cardiac monitoring devices market in the region during the forecast period. With the geriatric population increasing in East Asian countries like China and Japan, the APAC region represents a lucrative market for cardiac monitoring devices market.

Zoll Medical Corporation, Boston Scientific Corporation, Livanova, Microport Scientific Corporation, Biotelemetry, Medtronic, Biotronik, Spacelabs Healthcare, Schiller, Koninklijke Philips N.V., Stryker Corporation, GE Healthcare, Nihon Kohden Corporation, Cardiac Science, Philips Healthcare, and Hill-Rom Holdings, among others are the key players in the cardiac monitoring devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cardiac Monitoring Devices Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Cardiac Monitoring Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing prevalence of cardiovascular diseases

3.3.2 Industry Challenges

3.3.2.1 lack of reimbursement and insurance schemes in developing and underdeveloped regions

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Cardiac Monitoring Devices Market, By Product

4.1 Product Outlook

4.2 ECG Monitor

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Event Recorder

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Implantable Cardiac Loop Recorder

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Pacemaker

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Defibrillator

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Cardiac Resynchronization Therapy (CRT)

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Smart Wearable

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Others

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Cardiac Monitoring Devices Market, By End-User

5.1 End-User Outlook

5.2 Hospitals & Clinics

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Homecare

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Others

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Cardiac Monitoring Devices Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7.2 Market size, By End-User, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Zoll Medical Corporation

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Boston Scientific Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Spacelabs Healthcare

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Schiller

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Koninklijke Philips N.V.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Stryker Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 GE Healthcare

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Nihon Kohden Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Cardiac Monitoring Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cardiac Monitoring Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS