Global Cell Harvesting Market Size, Trends & Analysis - Forecasts to 2026 By Type (Manual Cell Harvesters, Automated Cell Harvesters), By Application (Biopharmaceutical Application, Stem Cell Research, Other Applications), By End-User (Biotechnology & Biopharmaceutical Companies, Research Institutes, Other End-Users), By Region (North America, Europe, Asia Pacific, CSA, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

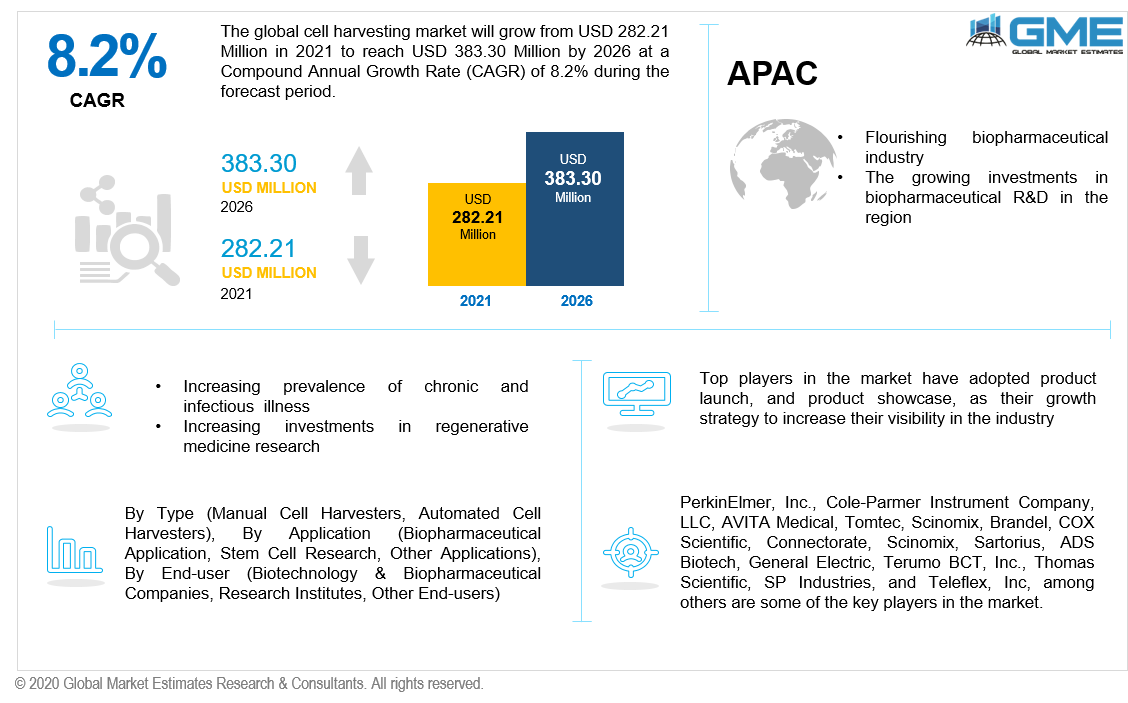

The global cell harvesting market will grow from USD 282.21 million in 2021 and is expected to reach USD 383.30 million by 2026 at a CAGR value of 8.2%.

Cell harvesting is a method of collecting stem cells in order to regenerate, transplant, or repair organs using healthy functioning cells. The cell harvesting technique reduces the invasiveness of bone marrow aspiration procedure by using few punctures on the patient. Cell harvesting has been proven to be a boon for cancer treatment as it offers an alternative to an invasive procedure. A stem cell transplant is used to treat chronic cancer and anaemia.

The rising emphasis on cell therapies, and also the growing number of cell research activities, are some of the primary drivers driving the market growth. The other factors supporting the growth of the cell harvesting market are the growing investments in cell-based research and regenerative medicine and the rising demand for stem-based cell therapy. Furthermore, increasing investments in stem cell logistic facilities, rising bone-marrow transplant registry for neuronal and heart disorders across developed and developing countries, and the rising demand for stem-cell banking procedures are analyzed to support the market growth in the coming years [2021-2026].

Moreover, change in lifestyle patterns and the increasing prevalence of chronic illness among the geriatric patient population have been instrumental to the growth of the cell harvesting market. As per the reports by WHO in 2020, it is estimated that chronic disease incidence will rise by 57% and this number is expected to grow rapidly.

The market for cell harvesting will be growing rapidly owing to factors such as the increasing number of cases associated with cardiovascular diseases, cancer, anaemia, etc., rising geriatric patient pool mainly in emerging regions, increasing research & development investments by biotechnology and biopharmaceutical industries. Moreover, the rising support from government organizations in the form of research funds for stem-cell research in third world countries and increasing healthcare expenditure is also helping the market attain rapid growth. Some of the leading players such as PerkinElmer, Inc., ADS Biotech, General Electric, Terumo BCT, Inc., and Teleflex, Inc, have adopted organic and inorganic strategies in order to effectively market their FDA-approved products.

However, lack of reimbursement policies for stem cell procedures, high cost associated with the therapy, and ethical issues about embryonic stem cell therapies will hamper the growth of the market to some extent.

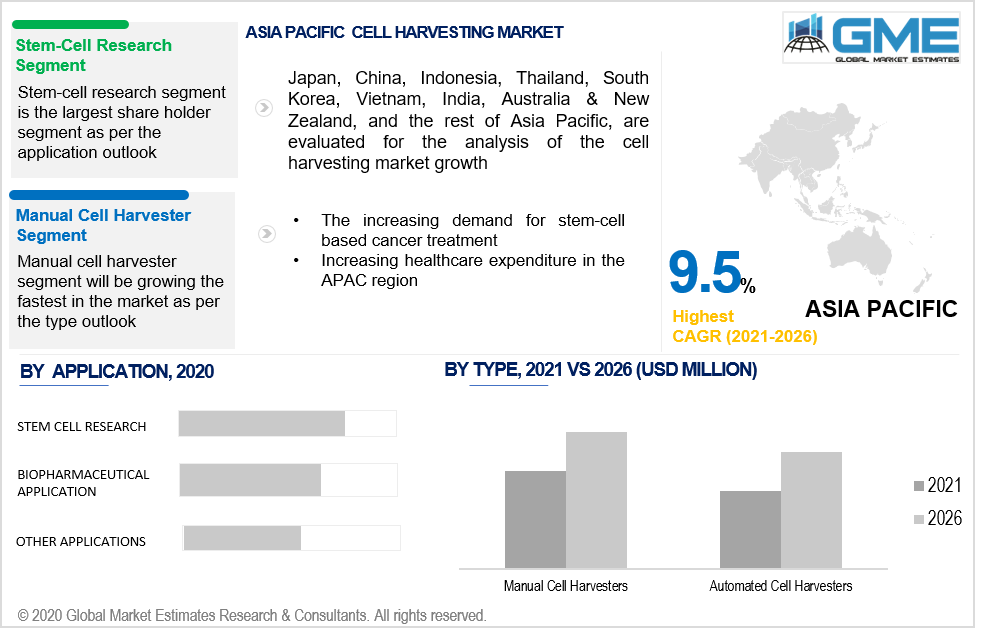

The cell harvesting type is categorized into manual cell harvesters and automated cell harvesters. The manual cell harvesters segment is analyzed to be the fastest-growing segment in the market from 2021 to 2026. This is mainly due to the ease of use and low cost associated with manual procedure. Moreover, the availability of manual cell harvester product in the market is one of the prime factors supporting the growth of this segment.

Biopharmaceutical application, stem cell research, and other applications are the major application segments of the cell harvesting market. The stem cell research application will be the largest shareholder of the market owing to factors such as increasing demand for gene & cell therapies, increasing stem cell research activities, and growing clinical trials for stem cell-based therapies. Human stem cell research offers immense potential to advance its understanding of basic human biology. Scientists have learned more about how the human body works and how diseases originate and affect the body by studying stem cells.

The market segmented based on end-user includes biotechnology & biopharmaceutical companies, research institutes, and other end-users. The biotechnology & biopharmaceutical companies segment is expected to hold the largest share of the market during the forecast period [2021 to 2026]. It is mainly due to the increasing prevalence of chronic illness such as cardiovascular disease, cancer, etc., and growing investments in research and development activities to produce new products worldwide.

As per the geographical analysis, the cell harvesting market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The high share of this region is mainly due to the presence of key players in the United States and Canada, growing government expenses in healthcare sector, high adoption rate for newly developed technologies in cell therapy, and increasing awareness about the availability of different treatments for cancer. Moreover, the increasing number of stem-cell transplantation and stem-cell clinical trials conducted in the North American region will be driving the market growth during the forecast period [2021-2026].

However, on the contrary, the Asia Pacific region will grow with the highest CAGR in the market. Rising chronic infections, rare and genetic cancer diseases, and increasing demand for stem-cell transplantation will impact the market positively. Also, growing investments by the government authorities on stem-cell research along with the increasing urbanization are some of the prime factors driving the growth of the APAC cell harvesting market.

PerkinElmer, Inc., Cole-Parmer Instrument Company, LLC, AVITA Medical, Tomtec, Scinomix, Brandel, COX Scientific, Connectorate, Scinomix, Sartorius, ADS Biotech, General Electric, Terumo BCT, Inc., Thomas Scientific, SP Industries, and Teleflex, Inc, among others are some of the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cell Harvesting Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Global Cell Harvesting Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising incidence of infectious and chronic diseases

3.3.2 Industry Challenges

3.3.2.1 Growing use of single-use bioprocessing containers

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cell Harvesting Market, By Type

4.1 Type Outlook

4.2 Manual Cell Harvesters

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Automated Cell Harvesters

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Global Cell Harvesting Market, By Application

5.1 Application Outlook

5.2 Biopharmaceutical Application

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Stem Cell Research

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Other Applications

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Cell Harvesting Market, By End-User

6.1 End-User Outlook

6.2 Biotechnology & Biopharmaceutical Companies

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

6.3 Research Institutes

6.3.1 Market Size, By Region, 2020-2026 (USD Million)

6.4 Other End-Users

6.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Cell Harvesting Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Type, 2020-2026 (USD Million)

7.2.3 Market Size, By Application, 2020-2026 (USD Million)

7.2.4 Market Size, By End-User, 2020-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2020-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.4 Market Size, By End-User, 2020-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Million)

7.4.2 Market Size, By Type, 2020-2026 (USD Million)

7.4.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.4 Market Size, By End-User, 2020-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.8.2 Market size, By Application, 2020-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.4 Market Size, By End-User, 2020-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2020-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.4 Market Size, By End-User, 2020-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2020-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Perkinelmer

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Brandel (Biomedical Research and Development Laboratories)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 COX Scientific

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Connectorate

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Scinomix

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Sartorius

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 ADS Biotec (A Subsidiary of Adstec)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 General Electric

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Terumo

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 Tomtec

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Cell Harvesting Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cell Harvesting Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS