Global Cell Lysis Market Size, Trends, and Analysis - Forecasts to 2026 By Product (Consumables [Kits and Reagents, Enzymes, Detergent Solutions, Others], Instruments [Sonicators, Homogenizers, Other Instruments]), By Cell Type (Mammalian Cells, Microbial Cells, Other Cells), Application (Protein Purification and Isolation, Nucleic Acid Isolation and Purification, Other Application), End User (Research Laboratories and Institutes, Biopharmaceutical and Biotechnology Companies, Other End User), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

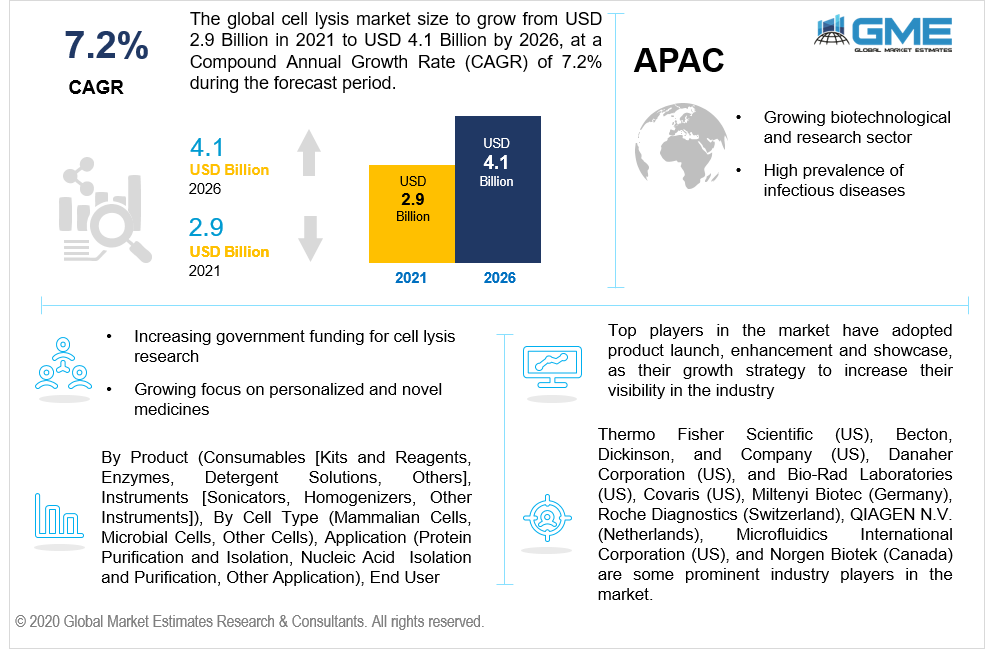

The global cell lysis market is projected to grow from USD 2.9 billion in 2021 and is expected to reach USD 4.1 billion by 2026 at a CAGR value of 7.2%. Growth of the market is driven mainly by increasing government funding for cell lysis research, high prevalence of infectious and chronic diseases clubbed with changing lifestyles and growing focus on personalized and novel medicines.

Cell Lysis is a process where the cell membrane or the outer cover is removed in order to reach the inner cell material like proteins, DNAs, RNAs, and other cellular materials. The cell lysis method helps the professionals in diagnostic operations like studying the structure of pathogens or immunoassays, drug analysis, DNA scanning, RNA screening, and other required diagnostics. The breaking down of cells from their outer membrane helps the professionals analyze the properties of cells in isolation and understand their chemical composition and characteristics.

Cells are essential units of the body of an organism. These cells contain important details about the characteristic traits of the organisms in the form of DNA and RNA. In order to understand these inner traits, it is crucial to overcome the cell membrane that encloses these details within them. With some required help of detergents, this cell membrane can be broken down to achieve a detailed analysis. A cell lysis process like this ensures no damage or force while breaking down on the membrane on the inner materials present in the cell. This process also ensures rapid extraction of all the proteins, DNA, RNAs, and other inner material with the quick dissolution of the cell membrane. This process being carried out manually enables the professionals to have the cell lysis process under constant observation without causing any errors.

The growing healthcare sector and medical centers have increased the demand for cell lysis in the market. The increasing cancer cases, rising number of autoimmune diseases that require drug testings, sampling, and analysis of inner properties of cells of various organisms are some of the other factors supporting the rising demand for cell lysis technique.

The COVID-19 pandemic and its infectious spread across the globe has brought a surge in cell lysis demand in the market. The overwhelmingly increasing cases and lack of knowledge related to the cure has condemned most of the governments across the globe invest heavily in the R&D department of the healthcare centers to analyze and conduct drug surveys on cells of different organisms to curb the increasing number of patients.

Based on the product type, the market is segmented itno consumables [kits and reagents, enzymes, detergent solutions, others], and instruments [sonicators, homogenizers, other instruments]. The consumables are the tools, types of equipment, and medical aids that are used in the process of cell lysis and can be disposed of after single use and are also one of the largest shareholders of the market.

These kinds of equipment or kits are replaced for every undertaken cell lysis process. These are certainly manufactured with one time use validity. These consumables like kits and reagents, and detergent solutions enable easy removal or breaking of the cell membrane process.

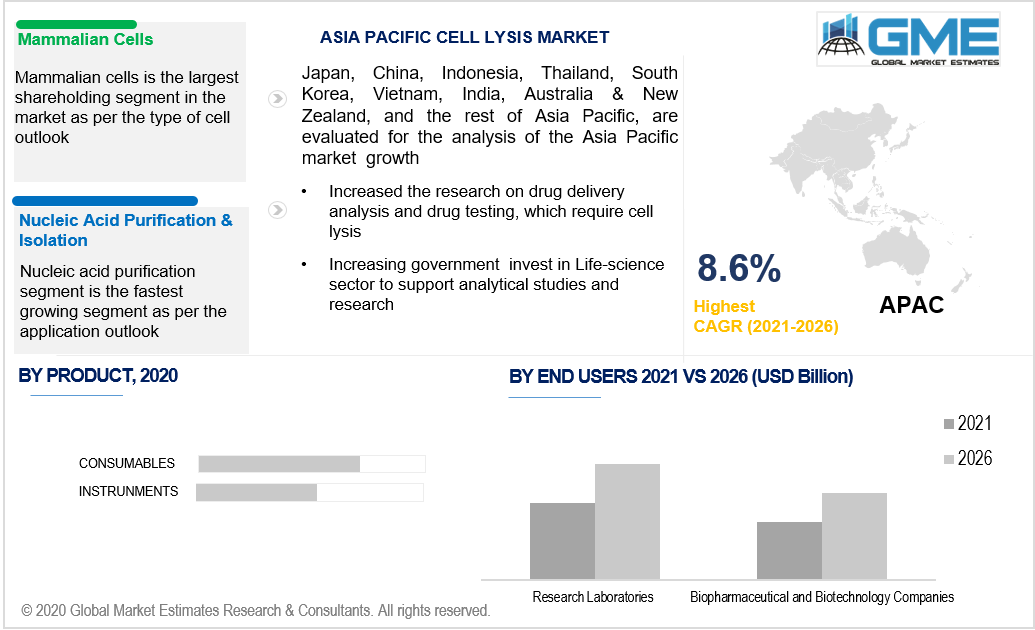

Based on the cell type, the market is segmented into mammalian cells, microbial cells, and other cells. The mammalian cells are most commonly used in cell lysis and hence is the fastest-growing segment in the market.

These cells have a cytoplasmic membrane known as the plasmic membrane, a thin layer that encloses the inner materials from the outer environment where the cell is surviving. Mammlian cell membrane is comparatively easier to access and break through compared to the bacterial or microbial cell’s membrane.

Based on the application outlook, the market is segmented into protein purification and isolation, nucleic acid isolation and purification, other application. Nucleic acid purification and isolation is the most necessary application process under cell lysis and also the largest shareholder of the market.

Cell lysis or cell membrane destruction is the initial step in applying nucleic acid purification and isolation process. These steps are followed in nucleic acid purification and isolation enable the researchers to attain highly pure DNA and RNAs to conduct further analysis. The quality of these acids can affect the nature of the materials present in the cells. The cell lysis is a crucial process in nucleic acid purification and isolation as it allows the researchers to separate the nucleic acids from the cell’s inner components, which need to be accessed.

Based on the end user, the market is segmented into research laboratories and institutes, biopharmaceutical and biotechnology companies, and other end users. Research laboratories and institutes are the most significant end users of the cell lysis process and this segment is also analyzed to be the largest shareholder of the market.

The cell analysis, DNA, RNA, and protein testing procedure has become very essential. The lack of resistance to the human cells to various emerging viruses calls for more detailed research and analysis. The growing medical and healthcare sector across the world is also encouraging research and study of various cells and understand the features of the inner components in those cells.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions. North America has the largest share in the global cell lysis market.

This region has its strong hold over the medical, research & development and health care sector. The countries in the North American region extensively carry out various research and development programs and are also the largest center for medical institutes and research laboratories. This region is also the parent country for many scholarly researchers who have gone into the depths of cell lysis and DNA studying.

Asia Pacific region is one of the fastest growing regions. Countries like India and China have been highly undertaking the cell lysis processes in the research and development departments. The APAC biotechnological and research sector is growing rapidly. Countries with a large population are also exposed to various infectious diseases requiring treatments and cures, which is also one of the major driving factors for this segment to grow the fastest.

Thermo Fisher Scientific (US), Becton, Dickinson, and Company (US), Danaher Corporation (US), and Bio-Rad Laboratories (US), Covaris (US), Miltenyi Biotec (Germany), Roche Diagnostics (Switzerland), QIAGEN N.V. (Netherlands), STEMCELL Technologies Inc. (Canada), Cell Signaling Technology Inc. (US), PromoCell GmbH (Germany), NZYTech Lda (Portugal), Labfreez Instruments Group Co., Limited (China), G-Biosciences (US), Merck KGaA (Germany), Claremont BioSolutions LLC (US), Microfluidics International Corporation (US), Qsonica LLC (US), Parr Instrument Company (US), BioVision Inc.(US), and Norgen Biotek (Canada) are key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2020, Danaher Corporation took over the business of biopharma product line from GE Company’s life science segment and enhanced its cell lysis segment.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cell Lysis Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Cell Type Overview

2.1.3 Product Type Overview

2.1.4 End-User Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Cell Lysis Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 High prevalence of cancer and chronic infectious cases

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate research infrastructure and automated labs in developing nations

3.4 Prospective Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Cell Lysis Market, By Cell Type

4.1 Cell Type Outlook

4.2 Mammalian Cells

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Microbial Cells

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

4.4 Other Cells

4.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Cell Lysis Market, By End-User

5.1 End-User Outlook

5.2 Research Laboratories and Institutes

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Biopharmaceutical and Biotechnology Companies

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 Other End User

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Cell Lysis Market, By Product Type

6.1 Consumables

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 Instruments

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Cell Lysis Market, By Application

7.1 Protein Purification and Isolation

7.1.1 Market Size, By Region, 2021-2026 (USD Billion)

7.2 Nucleic Acid Isolation and Purification

7.2.1 Market Size, By Region, 2021-2026 (USD Billion)

7.2 Others

7.2.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 8 Cell Lysis Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2021-2026 (USD Billion)

8.2.2 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.2.3 Market Size, By Product Type, 2021-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

8.2.5 Market Size, By Application, 2021-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.2.4.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2021-2026 (USD Billion)

Market Size, By Application, 2021-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.2.7.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.2.7.4 Market Size, By Application, 2021-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2021-2026 (USD Billion)

8.3.2 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.3 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.5 Market Size, By Application, 2021-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.6.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.6.4 Market Size, By Application, 2021-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.7.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.7.4 Market Size, By Application, 2021-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.8.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.8.4 Market Size, By Application, 2021-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.9.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.9.4 Market Size, By Application, 2021-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.10.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.10.4 Market Size, By Application, 2021-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.3.11.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.3.11.4 Market Size, By Application, 2021-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2021-2026 (USD Billion)

8.4.2 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.4.3 Market Size, By Product Type, 2021-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

8.4.5 Market Size, By Application, 2021-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.4.6.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.4.6.4 Market Size, By Application, 2021-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.4.7.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.4.7.4 Market Size, By Application, 2021-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.4.8.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.4.8.4 Market Size, By Application, 2021-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.4.9.2 Market size, By Product Type, 2021-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.4.9.4 Market Size, By Application, 2021-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.4.10.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.4.10.4 Market Size, By Application, 2021-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2021-2026 (USD Billion)

8.5.2 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.5.3 Market Size, By Product Type, 2021-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

8.5.5 Market Size, By Application, 2021-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.5.6.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.5.6.4 Market Size, By Application, 2021-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.5.7.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.5.7.4 Market Size, By Application, 2021-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.5.8.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.5.8.4 Market Size, By Application, 2021-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2021-2026 (USD Billion)

8.6.2 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.6.3 Market Size, By Product Type, 2021-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2021-2026 (USD Billion)

8.6.5 Market Size, By Application, 2021-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.6.6.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.6.6.4 Market Size, By Application, 2021-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.6.7.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.6.7.4 Market Size, By Application, 2021-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Cell Type, 2021-2026 (USD Billion)

8.6.8.2 Market Size, By Product Type, 2021-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

8.6.8.4 Market Size, By Application, 2021-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Thermo Fisher Scientific (US)

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Becton, Dickinson, and Company (US)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Danaher Corporation (US)

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Bio-Rad Laboratories (US)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Covaris (US)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Miltenyi Biotec (Germany)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Roche Diagnostics (Switzerland)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 QIAGEN N.V. (Netherlands)

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 STEMCELL Technologies Inc. (Canada)

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Cell Lysis Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cell Lysis Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS