Global Cholesterol Testing Products and Services Market Size, Trends & Analysis - Forecasts to 2026 By Type of Customer (Diagnostic Centres, Physicians/Hospitals, Government), By Product Type (Devices, Test Kits, and Services), By Age Group (Geriatric, Adults and Paediatric); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

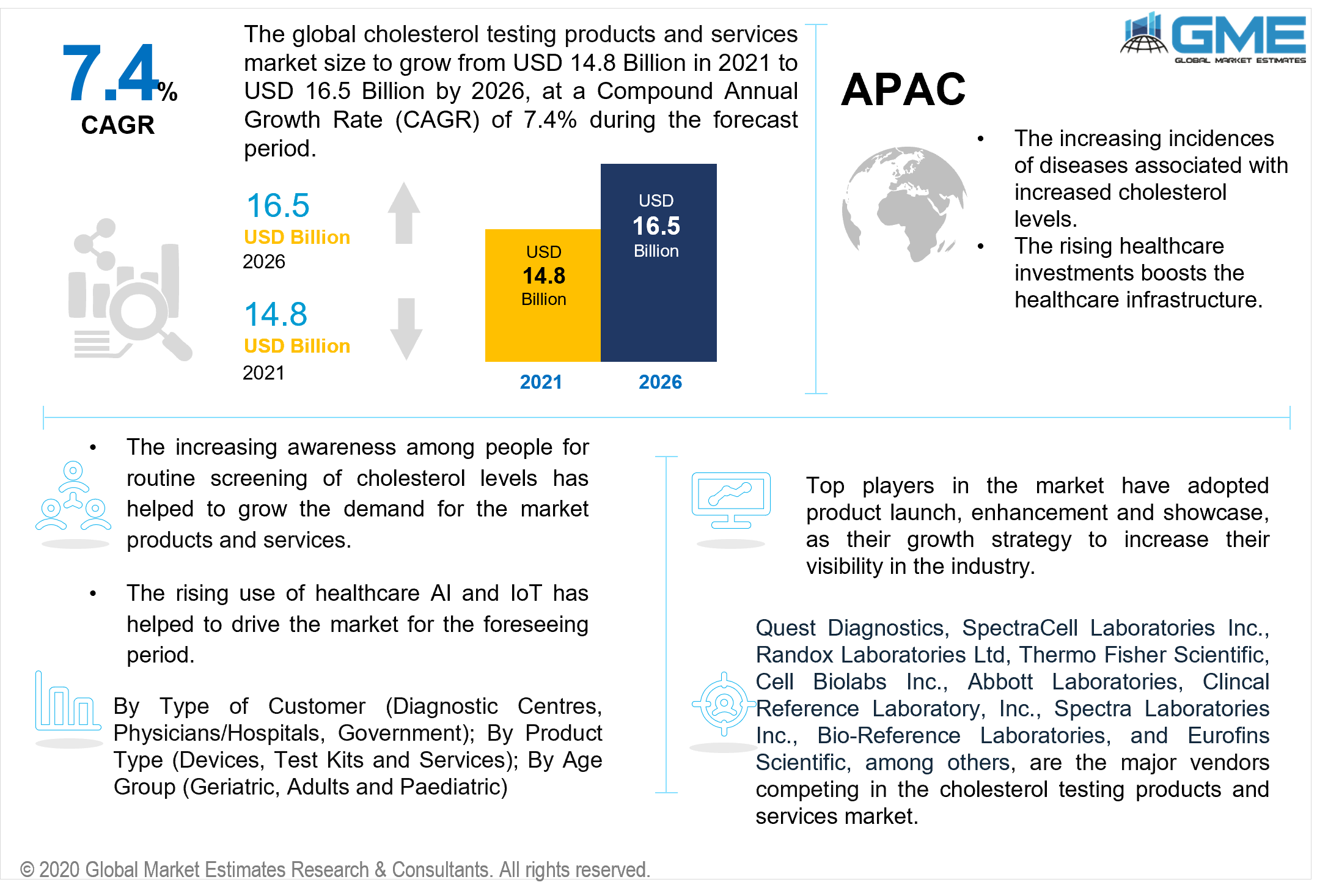

The global cholesterol testing products market is projected to grow from USD 14.8 billion in 2021 and is expected to reach USD 16.5 billion by 2026 at a CAGR of 7.4% from 2021 to 2026. The cholesterol testing products and services are a procedural testing product that helps in diagnosing cholesterol levels. The growing prevalence of high cholesterol levels amongst the general public which further emerges as a primary cause for any form of the disease has helped to drive the market during the forecast period.

The population above the age of 18 years is highly recommended to undergo blood cholesterol tests, at a frequent rate which helps them to keep a systematic record of their overall health. The deteriorating lifestyle of people has led them to be very less engaged in any form of physical activity and a rise in the consumption of food products high in fats and cholesterol had led to increased demand for cholesterol testing products and services. The increasing awareness among people for routine screening of cholesterol levels has helped them to enhance their lifestyle and reduce the incidences of diseases and plays to be a significant market driver.

The prevalence of cardiovascular diseases and rising cases of obesity has significantly fuelled the market growth. And also, the inelastic demand is associated with the fact that cardiovascular patients require cholesterol monitoring daily for effective treatment monitoring. The health departments of various countries state that children should be tested between 9 and 11, and young adults between 17 and 21. Cholesterol testing is essential to keep the health track of the patients, as high cholesterol shows no symptoms. The cholesterol test includes the estimation of different forms of lipids such as triglycerides, high-density lipoprotein, low-density lipoprotein and blood-total cholesterol. These tests when effectively performed with suitable precautions at every stage helps to reduce the risk of heart attack, peripheral artery diseases and heart stroke.

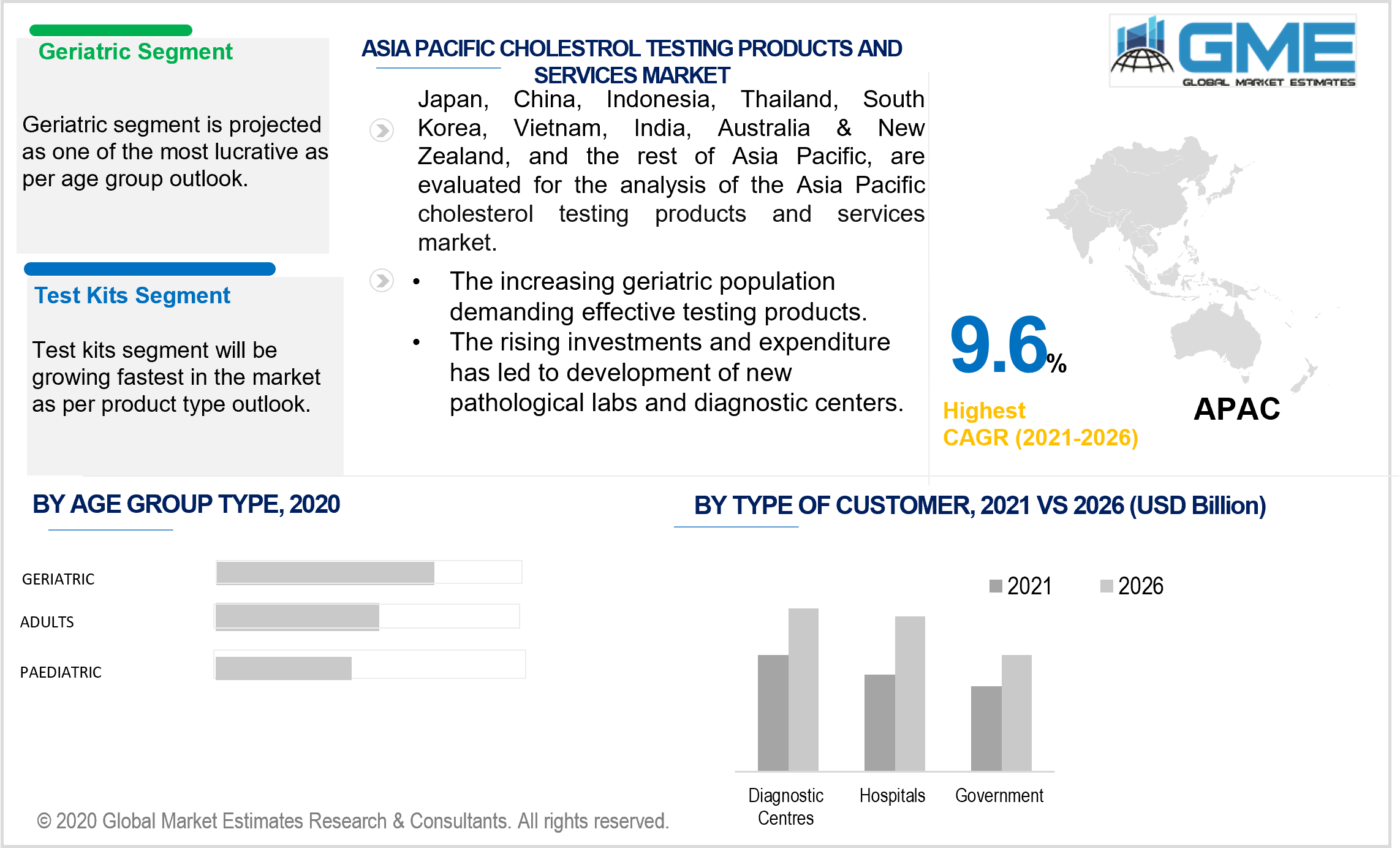

As per the estimations, the geriatric population accounts to capture the majority share of total cases of diseases associated with high cholesterol levels. And the increasing population of geriatric population helps to drive the demand for the market products and services. The cholesterol diagnosis helps to suspect the diseases at the primary level which helps to accommodate for initial level treatments.

The increasing incidents of heart attacks, diabetes, kidney failures and heart strokes have affected millions of people across the globe. The rising R&D investments and development of new advanced testing procedures backed with technological advancement in the medical infrastructure in developing countries have increased the demand for these tests. The advancement of medical infrastructure has facilitated high-level efficiency in diagnostic and management procedures. Moreover, the rising use of healthcare AI and IoT has helped to boost the market during the forecast period.

Based on various types of customers, the market is segmented into diagnostic centres, physicians/hospitals, and government. The diagnostic centres hold the dominant position as per the customer type owing to their high rate of adoption for carrying out the diagnosis. This market segment makes for the highest share in terms of revenue.

Government agencies are also foreseeing massive growth attributing this to their shift and increasing focus for preventive care and early diagnosis to avoid many chronic diseases. They aim to provide quality diagnostic testing services for all sections of society, which has led to making huge investments in the healthcare and diagnosis sector.

Based on the types of products and services available in the market, the market further can be segmented into devices, test kits, and services. The devices segment held the dominant share of the market. This market segment is majorly contributing to the success of the market. The development of the state of art kits and devices has helped to provide improved access to the patients for cholesterol testing. The technological advancement in lipid profile devices and testing kits are expected to result in the test kits segment becoming the fastest-growing segment.

The cholesterol testing products and services market based on its age group users is segmented into geriatric, adults and paediatric. The geriatric segment holds the largest share of the market, mainly due to the recent rise in the population of this age group. The rising cases of this specific age group have been excessively prevalent in developing countries, accounting for increasing suffering from diseases associated with high cholesterol levels has aided the market to grow for the years to come. The growing geriatric population across the globe and higher risk of cholesterol have been crucial in the dominance of the geriatric segment.

The North American region held the dominating position for the cholesterol testing products and services market worldwide, due to the rising number of people suffering from heart attack cases and heart strokes. The region also reports accommodating high obesity rates which are contributing to the dominance of the region in the market. The region has major government initiatives taking place to support the boosting of medical infrastructure.

The increasing patient awareness for preventive healthcare has risen the use of cholesterol testing products and services. The market’s potential players have helped to boost market efficiency with increased production of these testing kits and devices further increasing the market opportunities.

The APAC region is growing faster witnessing lucrative growth, owing to its increasing regional population. The rising investments and expenditure for medical infrastructure, has led to the development of diagnostic centres and pathological labs for better diagnosis.

Quest Diagnostics, SpectraCell Laboratories Inc., Randox Laboratories Ltd, Thermo Fisher Scientific, Cell Biolabs Inc., Abbott Laboratories, Clincal Reference Laboratory, Inc., Spectra Laboratories Inc., Bio-Reference Laboratories, and Eurofins Scientific, among others, are the major vendors competing in the cholesterol testing products and services market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2016, Quest Diagnostics launched a new patient testing services initiative named QuestDirect in the United States. This service will enable the customers to better manage their health by enabling them to order certain test kits directly without any consultation being required from the side of the physicians.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cholesterol Testing Products and Services Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type of Customer Overview

2.1.3 Product Overview

2.1.4 Age-Group Overview

2.1.6 Regional Overview

Chapter 3 Cholesterol Testing Products and Services Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of cholesterol among the population

3.3.2 Industry Challenges

3.3.2.1 Cost of cholesterol devices and kits and the lack of adequate insurance coverage

3.4 Prospective Growth Scenario

3.4.1 Type of Customer Growth Scenario

3.4.2 Product Growth Scenario

3.4.3 Age-Group Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Cholesterol Testing Products and Services Market, By Type of Customer

4.1 Type of Customer Outlook

4.2 Diagnostic Centres

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Physicians/Hospitals

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Government

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Cholesterol Testing Products and Services Market, By Product

5.1 Product Outlook

5.2 Devices

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Test Kits

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Services

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Cholesterol Testing Products and Services Market, By Age-Group

6.1 Geriatric

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Adults

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Paediatric

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Cholesterol Testing Products and Services Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.2.3 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.3 Market Size, By Product, 2020-2026 (USD Billion)

7.3.4 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.4.3 Market Size, By Product, 2020-2026 (USD Billion)

7.4.4 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Product, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.5.3 Market Size, By Product, 2020-2026 (USD Billion)

7.5.4 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.6.3 Market Size, By Product, 2020-2026 (USD Billion)

7.6.4 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type of Customer, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Age-Group, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Quest Diagnostics

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 SpectraCell Laboratories Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Randox Laboratories Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Thermo Fisher Scientific

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Cell Biolabs Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Abbott Laboratories

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Clincal Reference Laboratory, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Spectra Laboratories Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Bio-Reference Laboratories

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Cholesterol Testing Products and Services Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cholesterol Testing Products and Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS