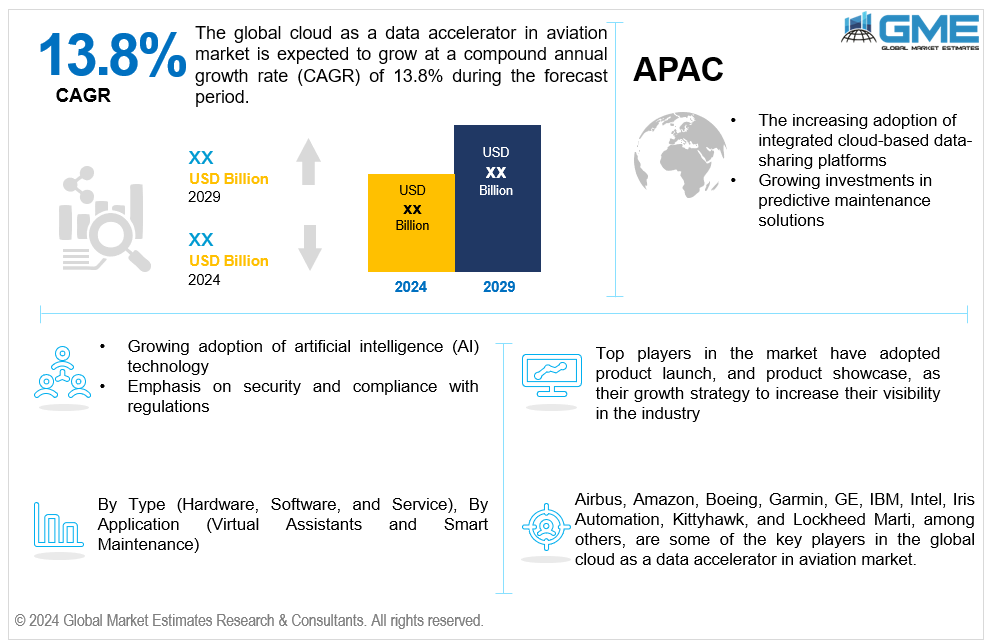

Global Cloud as a Data Accelerator in Aviation Market Size, Trends & Analysis - Forecasts to 2029 By Type (Hardware, Software, and Service), By Application (Virtual Assistants and Smart Maintenance), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global cloud as a data accelerator in aviation market is estimated to exhibit a CAGR of 13.8% from 2024 to 2029.

The primary factors propelling the market growth are the increasing adoption of integrated cloud-based data-sharing platforms and growing investments in predictive maintenance solutions. Massive volumes of data about aviation can be managed and stored centrally with integrated cloud-based data-sharing platforms. This simplifies data management procedures for airlines, airports, aircraft manufacturers, and other aviation industry stakeholders. Additionally, critical data can be accessed instantly from any location with an internet connection due to cloud-based solutions. Due to their ability to make decisions more quickly and intelligently based on current information, aviation companies can increase operational effectiveness and safety. For instance, EmpowerMX announced the release of EMX Insights, a cloud-based platform for data exchange, in July 2022. The system facilitates more data sharing between airlines and maintenance, repair, and overhaul companies.

The growing adoption of artificial intelligence (AI) technology, along with an emphasis on security and compliance with regulations, is expected to support market growth. Real-time flight route optimization is possible through analyzing flight data, weather forecasts, air traffic patterns, and fuel usage using AI-powered algorithms. Cloud-based solutions give airlines the computational capacity and scalability needed to effectively complete complicated route optimization calculations, which lowers fuel consumption, emissions, and operational costs while enhancing passenger experience and flight punctuality. For instance, Malaysia Airlines announced in 2022 that it has extended its Amadeus Altéa Passenger Service System contract and is working with the Amadeus IT group to implement Dynamic Intelligence Hub (DIH).

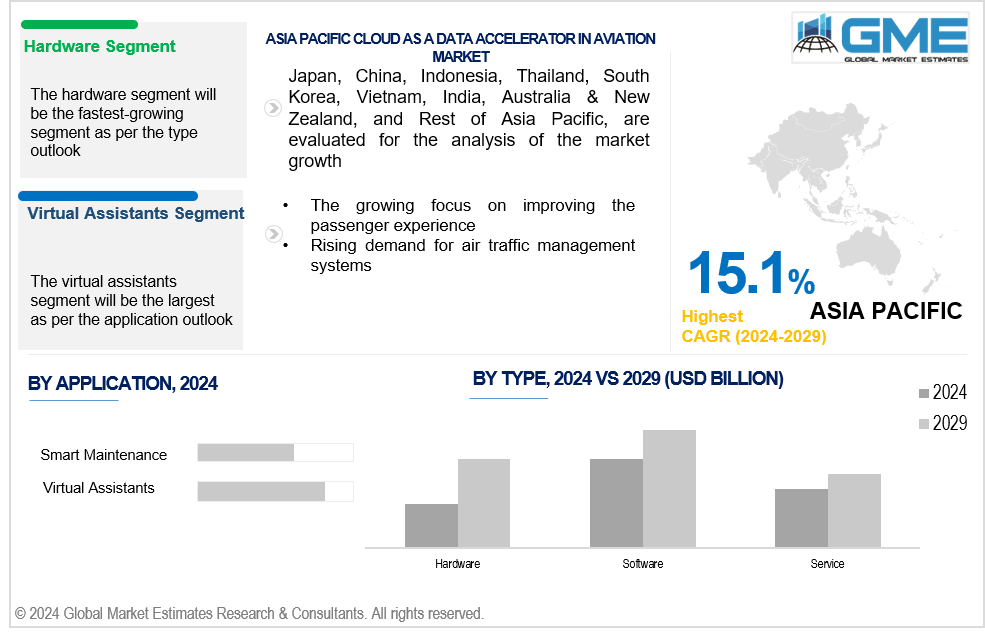

The growing focus on improving the passenger experience and rising demand for air traffic management systems propel market growth. Air traffic controllers can remotely monitor and administer various airports from centralized control centers due to cloud-based air traffic management systems, which facilitate remote tower operations. Remote tower systems ensure safety and compliance with regulations while improving operating efficiency, cost-effectiveness, and scalability by streaming live video feeds, radar data, and other sensor information to cloud-based control interfaces.

The increasing number of IoT devices in aviation, such as passenger wearables, ground support equipment, and aircraft sensors, offers opportunities to take advantage of cloud-based data acceleration platforms for data integration, analysis, and visualization. Moreover, aviation has many opportunities to utilize digital twin technology, which makes virtual copies of real assets and systems for testing, optimization, and simulation.

However, complexities in integrating with legacy systems and concerns about data privacy and security hinder market growth.

The software segment is expected to hold the largest share of the market over the forecast period. In order to gain insights from the massive amounts of aviation data, such as flight data, maintenance records, passenger information, and operational indicators, aviation companies are increasingly leveraging data analytics software. The computing capacity and scalability needed to efficiently process, analyze, and visualize this data are provided by cloud-based data acceleration solutions, empowering aviation stakeholders to make data-driven choices, optimize operations, and boost performance.

The hardware segment is expected to be the fastest-growing segment in the market from 2024 to 2029. To deploy and scale cloud-based data acceleration platforms, hardware components like servers, storage systems, networking equipment, and data center infrastructure are necessary. These components provide the processing power, storage capacity, and network bandwidth needed to efficiently process and analyze aviation data.

The virtual assistants segment is expected to hold the largest share of the market over the forecast period. Chatbots and voice assistants, two types of virtual assistants used in aviation applications, provide travellers with a more customized and engaging travel experience. In addition to improving overall consumer satisfaction and loyalty, these virtual assistants can handle booking and reservation administration, provide real-time flight information, respond to customer questions, make personalized recommendations, and enable self-service alternatives.

The smart maintenance segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Cloud-based smart maintenance solutions facilitate remote diagnostics and troubleshooting, enabling maintenance staff to monitor aircraft systems, identify problems, and troubleshoot activities from remote locations. Regardless of their location or physical proximity to the aircraft, maintenance teams can access real-time diagnostic data, historical maintenance data, and technical documentation by utilizing cloud-based data analytics and visualization tools. This allows for quick decision-making and problem-solving.

North America is expected to be the largest region in the global market. The growing airline traffic data is driving market growth in the North American region. With the continuous growth in airline traffic, the volume of data generated is expanding exponentially, necessitating efficient data management and processing solutions. For instance, the United States Department of Transportation reports that the U.S. airlines carried 194 million more passengers in 2022 than 2021, a 30% increase year over year.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Air travel is expanding quickly in the Asia Pacific region due to urbanization, increased disposable incomes, and increased leisure and business travel. This growth drives demand for cloud-based data acceleration solutions in aviation to handle the increasing volume of data generated by airlines, airports, and air traffic management systems. For instance, OAG Aviation reports that, in comparison to 2022, Air China has demonstrated the greatest capacity expansion, with a 14% rise in March 2023.

Airbus, Amazon, Boeing, Garmin, GE, IBM, Intel, Iris Automation, Kittyhawk, and Lockheed Marti, among others, are some of the key players in the global cloud as a data accelerator in aviation market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, the global cloud enterprise software provider IFS announced that Kongsberg Aviation Maintenance Services AS (KAMS), a top provider of maintenance, repair, and overhaul (MRO) services to the aviation sector for both government and commercial entities, has chosen IFS Cloud to increase long-term asset resilience and optimize operational efficiency.

In May 2022, Airbus and Capgemini collaborated to carry out a significant cloud transformation project. Capgemini provides the Airbus company a completely managed service for its central cloud infrastructure.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL CLOUD AS A DATA ACCELERATOR IN AVIATION MARKET, BY APPLICATION

4.1 Introduction

4.2 Cloud as a Data Accelerator in Aviation Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Virtual Assistants

4.4.1 Virtual Assistants Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Smart Maintenance

4.5.1 Smart Maintenance Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL CLOUD AS A DATA ACCELERATOR IN AVIATION MARKET, BY TYPE

5.1 Introduction

5.2 Cloud as a Data Accelerator in Aviation Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Hardware

5.4.1 Hardware Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Software

5.5.1 Software Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Service

5.6.1 Service Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL CLOUD AS A DATA ACCELERATOR IN AVIATION MARKET, BY REGION

6.1 Introduction

6.2 North America Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By Type

6.2.3 By Country

6.2.3.1 U.S. Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Application

6.2.3.1.2 By Type

6.2.3.2 Canada Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Application

6.2.3.2.2 By Type

6.2.3.3 Mexico Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Application

6.2.3.3.2 By Type

6.3 Europe Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Application

6.3.2 By Type

6.3.3 By Country

6.3.3.1 Germany Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Application

6.3.3.1.2 By Type

6.3.3.2 U.K. Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Application

6.3.3.2.2 By Type

6.3.3.3 France Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Application

6.3.3.3.2 By Type

6.3.3.4 Italy Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Application

6.3.3.4.2 By Type

6.3.3.5 Spain Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Application

6.3.3.5.2 By Type

6.3.3.6 Netherlands Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Type

6.3.3.7 Rest of Europe Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Type

6.4 Asia Pacific Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Application

6.4.2 By Type

6.4.3 By Country

6.4.3.1 China Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Application

6.4.3.1.2 By Type

6.4.3.2 Japan Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Application

6.4.3.2.2 By Type

6.4.3.3 India Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Application

6.4.3.3.2 By Type

6.4.3.4 South Korea Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Application

6.4.3.4.2 By Type

6.4.3.5 Singapore Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Application

6.4.3.5.2 By Type

6.4.3.6 Malaysia Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Type

6.4.3.7 Thailand Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Type

6.4.3.8 Indonesia Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Application

6.4.3.7.2 By Type

6.4.3.9 Vietnam Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Application

6.4.3.8.2 By Type

6.4.3.10 Taiwan Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Application

6.4.3.10.2 By Type

6.4.3.11 Rest of Asia Pacific Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Application

6.4.3.11.2 By Type

6.5 Middle East and Africa Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Application

6.5.2 By Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Application

6.5.3.1.2 By Type

6.5.3.2 U.A.E. Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Application

6.5.3.2.2 By Type

6.5.3.3 Israel Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Application

6.5.3.3.2 By Type

6.5.3.4 South Africa Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Application

6.5.3.4.2 By Type

6.5.3.5 Rest of Middle East and Africa Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Application

6.5.3.5.2 By Type

6.6 Central and South America Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Application

6.6.2 By Type

6.6.3 By Country

6.6.3.1 Brazil Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Application

6.6.3.1.2 By Type

6.6.3.2 Argentina Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Application

6.6.3.2.2 By Type

6.6.3.3 Chile Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Type

6.6.3.3 Rest of Central and South America Cloud as a Data Accelerator in Aviation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Airbus

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Amazon

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Boeing

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Garmin

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 GE

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 IBM

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Intel

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Iris Automation

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Kittyhawk

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Lockheed Marti

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

2 Virtual Assistants Market, By Region, 2021-2029 (USD Mllion)

3 Smart Maintenance Market, By Region, 2021-2029 (USD Mllion)

4 Global Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

5 Hardware Market, By Region, 2021-2029 (USD Mllion)

6 Software Market, By Region, 2021-2029 (USD Mllion)

7 Service Market, By Region, 2021-2029 (USD Mllion)

8 Regional Analysis, 2021-2029 (USD Mllion)

9 North America Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

10 North America Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

11 North America Cloud as a Data Accelerator in Aviation Market, By COUNTRY, 2021-2029 (USD Mllion)

12 U.S. Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

13 U.S. Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

14 Canada Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

15 Canada Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

16 Mexico Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

17 Mexico Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

18 Europe Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

19 Europe Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

20 EUROPE Cloud as a Data Accelerator in Aviation Market, By COUNTRY, 2021-2029 (USD Mllion)

21 Germany Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

22 Germany Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

23 U.K. Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

24 U.K. Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

25 France Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

26 France Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

27 Italy Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

28 Italy Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

29 Spain Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

30 Spain Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

31 Netherlands Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

32 Netherlands Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

33 Rest Of Europe Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

34 Rest Of Europe Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

35 Asia Pacific Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

36 Asia Pacific Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

37 ASIA PACIFIC Cloud as a Data Accelerator in Aviation Market, By COUNTRY, 2021-2029 (USD Mllion)

38 China Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

39 China Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

40 Japan Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

41 Japan Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

42 India Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

43 India Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

44 South Korea Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

45 South Korea Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

46 Singapore Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

47 Singapore Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

48 Thailand Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

49 Thailand Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

50 Malaysia Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

51 Malaysia Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

52 Indonesia Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

53 Indonesia Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

54 Vietnam Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

55 Vietnam Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

56 Taiwan Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

57 Taiwan Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

58 Rest of APAC Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

59 Rest of APAC Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

60 Middle East and Africa Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

61 Middle East and Africa Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

62 MIDDLE EAST & ADRICA Cloud as a Data Accelerator in Aviation Market, By COUNTRY, 2021-2029 (USD Mllion)

63 Saudi Arabia Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

64 Saudi Arabia Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

65 UAE Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

66 UAE Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

67 Israel Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

68 Israel Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

69 South Africa Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

70 South Africa Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

71 Rest Of Middle East and Africa Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

72 Rest Of Middle East and Africa Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

73 Central and South America Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

74 Central and South America Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

75 CENTRAL AND SOUTH AMERICA Cloud as a Data Accelerator in Aviation Market, By COUNTRY, 2021-2029 (USD Mllion)

76 Brazil Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

77 Brazil Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

78 Chile Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

79 Chile Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

80 Argentina Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

81 Argentina Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

82 Rest Of Central and South America Cloud as a Data Accelerator in Aviation Market, By Application, 2021-2029 (USD Mllion)

83 Rest Of Central and South America Cloud as a Data Accelerator in Aviation Market, By Type, 2021-2029 (USD Mllion)

84 Airbus: Products & Services Offering

85 Amazon: Products & Services Offering

86 Boeing: Products & Services Offering

87 Garmin: Products & Services Offering

88 GE: Products & Services Offering

89 IBM: Products & Services Offering

90 Intel : Products & Services Offering

91 Iris Automation: Products & Services Offering

92 Kittyhawk, Inc: Products & Services Offering

93 Lockheed Marti: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Cloud as a Data Accelerator in Aviation Market Overview

2 Global Cloud as a Data Accelerator in Aviation Market Value From 2021-2029 (USD Mllion)

3 Global Cloud as a Data Accelerator in Aviation Market Share, By Application (2023)

4 Global Cloud as a Data Accelerator in Aviation Market Share, By Type (2023)

5 Global Cloud as a Data Accelerator in Aviation Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Cloud as a Data Accelerator in Aviation Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Cloud as a Data Accelerator in Aviation Market

10 Impact Of Challenges On The Global Cloud as a Data Accelerator in Aviation Market

11 Porter’s Five Forces Analysis

12 Global Cloud as a Data Accelerator in Aviation Market: By Application Scope Key Takeaways

13 Global Cloud as a Data Accelerator in Aviation Market, By Application Segment: Revenue Growth Analysis

14 Virtual Assistants Market, By Region, 2021-2029 (USD Mllion)

15 Smart Maintenance Market, By Region, 2021-2029 (USD Mllion)

16 Global Cloud as a Data Accelerator in Aviation Market: By Type Scope Key Takeaways

17 Global Cloud as a Data Accelerator in Aviation Market, By Type Segment: Revenue Growth Analysis

18 Hardware Market, By Region, 2021-2029 (USD Mllion)

19 Software Market, By Region, 2021-2029 (USD Mllion)

20 Service Market, By Region, 2021-2029 (USD Mllion)

21 Regional Segment: Revenue Growth Analysis

22 Global Cloud as a Data Accelerator in Aviation Market: Regional Analysis

23 North America Cloud as a Data Accelerator in Aviation Market Overview

24 North America Cloud as a Data Accelerator in Aviation Market, By Application

25 North America Cloud as a Data Accelerator in Aviation Market, By Type

26 North America Cloud as a Data Accelerator in Aviation Market, By Country

27 U.S. Cloud as a Data Accelerator in Aviation Market, By Application

28 U.S. Cloud as a Data Accelerator in Aviation Market, By Type

29 Canada Cloud as a Data Accelerator in Aviation Market, By Application

30 Canada Cloud as a Data Accelerator in Aviation Market, By Type

31 Mexico Cloud as a Data Accelerator in Aviation Market, By Application

32 Mexico Cloud as a Data Accelerator in Aviation Market, By Type

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 Airbus: Company Snapshot

36 Airbus: SWOT Analysis

37 Airbus: Geographic Presence

38 Amazon: Company Snapshot

39 Amazon: SWOT Analysis

40 Amazon: Geographic Presence

41 Boeing: Company Snapshot

42 Boeing: SWOT Analysis

43 Boeing: Geographic Presence

44 Garmin: Company Snapshot

45 Garmin: Swot Analysis

46 Garmin: Geographic Presence

47 GE: Company Snapshot

48 GE: SWOT Analysis

49 GE: Geographic Presence

50 IBM: Company Snapshot

51 IBM: SWOT Analysis

52 IBM: Geographic Presence

53 Intel : Company Snapshot

54 Intel : SWOT Analysis

55 Intel : Geographic Presence

56 Iris Automation: Company Snapshot

57 Iris Automation: SWOT Analysis

58 Iris Automation: Geographic Presence

59 Kittyhawk, Inc.: Company Snapshot

60 Kittyhawk, Inc.: SWOT Analysis

61 Kittyhawk, Inc.: Geographic Presence

62 Lockheed Marti: Company Snapshot

63 Lockheed Marti: SWOT Analysis

64 Lockheed Marti: Geographic Presence

65 Other Companies: Company Snapshot

66 Other Companies: SWOT Analysis

67 Other Companies: Geographic Presence

The Global Cloud as a Data Accelerator in Aviation Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cloud as a Data Accelerator in Aviation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS