Global Commercial Water Heaters Market Size, Trends, and Analysis - Forecasts to 2026 By Type (Electric, Oil, Gas, Solar, Hybrid, Heat Pump, Others [Bio-Fuel & Solid Fuel-Fired Commercial Water Heaters]), By Capacity (Up to 10kW, 10?50kW, 50?150kW, 150?300kW, Above 300kW), By Liter (Below 500 Liters, 500?1,000 Liters, 1,000?3,000 Liters, 3,000?4,000 Liters, Above 4,000 Liters), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

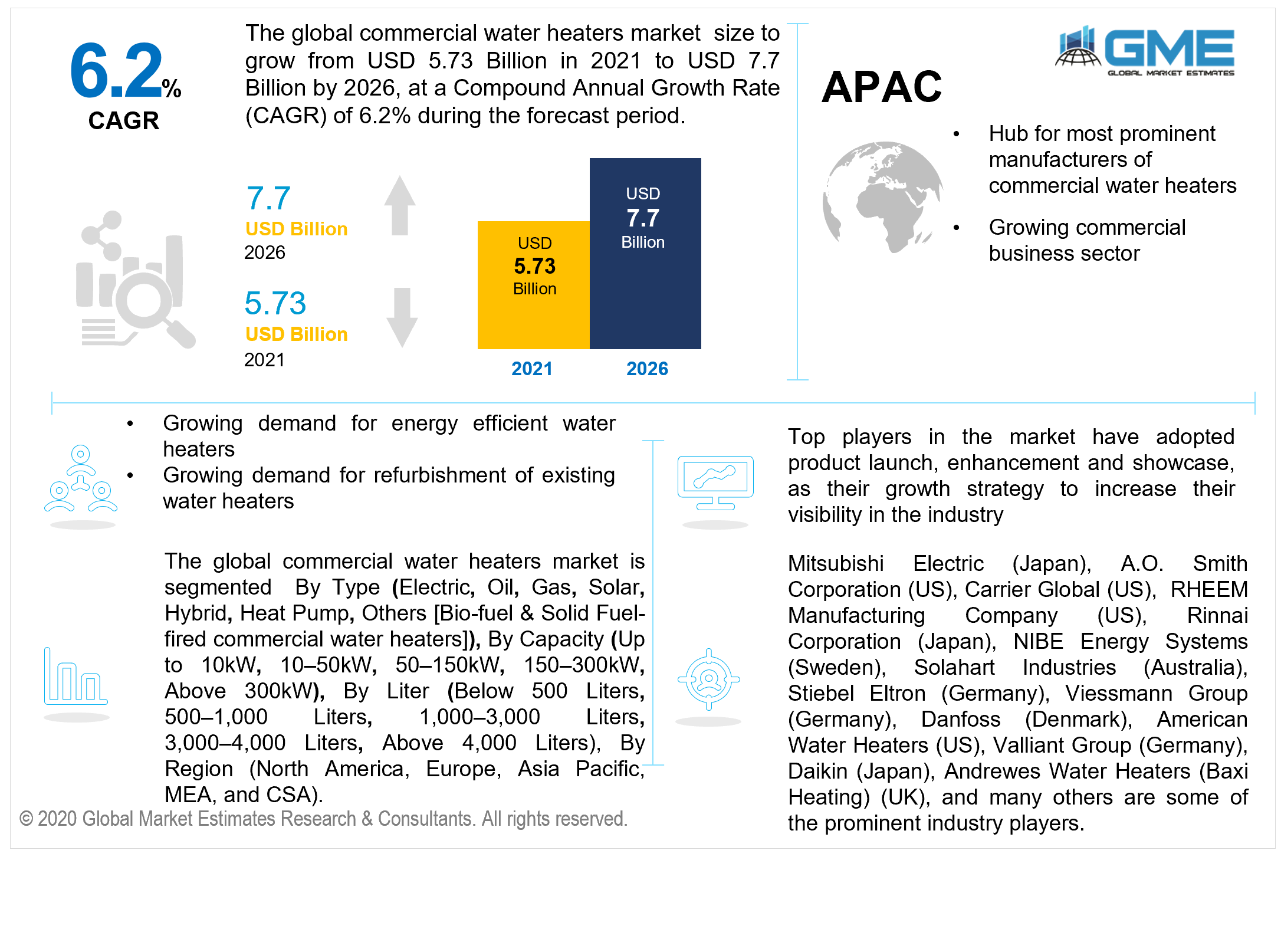

The global commercial water heaters market is projected to grow from USD 5.73 billion in 2021 to USD 7.7 billion by 2026 at a CAGR value of 6.2% between 2021 to 2026. Increased customer expenditures on innovation, research, and development to create and deploy sophisticated and scientifically improved water heating equipment, as well as robust expansion of the service industry, are expected to boost market share. The implementation of rigorous regulatory standards and guidelines promoting the use of energy-efficient heating equipment, as well as significant reductions in power costs, would boost the expansion of the commercial water heater market. Additionally, the fast growth of high-rise structures, fueled by different foreign investments, is expected to have an impact on product demand.

Increased expenditures for the construction and improvement of commercial sector activities throughout various areas are among the aspects supporting market expansion. Furthermore, favorable laws and incentives for the use of renewable energy sources in various implementations are likely to perform an important part in the evolution of this market throughout the forecast period. The evolving customer attention towards the benefits of water heaters, combined with rising demand from the hospitality industry, will have an impact on commercial water heater usage.

The awareness about corrosion has made manufacturers bring water heaters that are resistant to any corrosion, dust, or any impact of thermal energy. Nowadays, commercial water heater manufacturers have also been using renewable resources for mechanisms in these heaters. Along with renewable resources, the manufacturers are also bringing innovative techniques to heat the water, which can save time as well as the cost of consumption. Increasing infrastructural development also gives a new platform for water heater manufacturers to showcase a wide range of options to the consumers that suit the requirement.

The manufacturers have also incorporated user-friendly features like LEDs, safety measures, and other indicators to improve the user experience. These commercial water heaters come with a warranty of 10 to 15 years. The manufacturers have increased the service deliverability of these water heaters. However, improper usage of these heaters and lack of maintenance can lead to errors and failures in its service. These heaters can require multiple maintenance checks, which can add to the costs of the end-users, causing restraints on the commercial water heaters market.

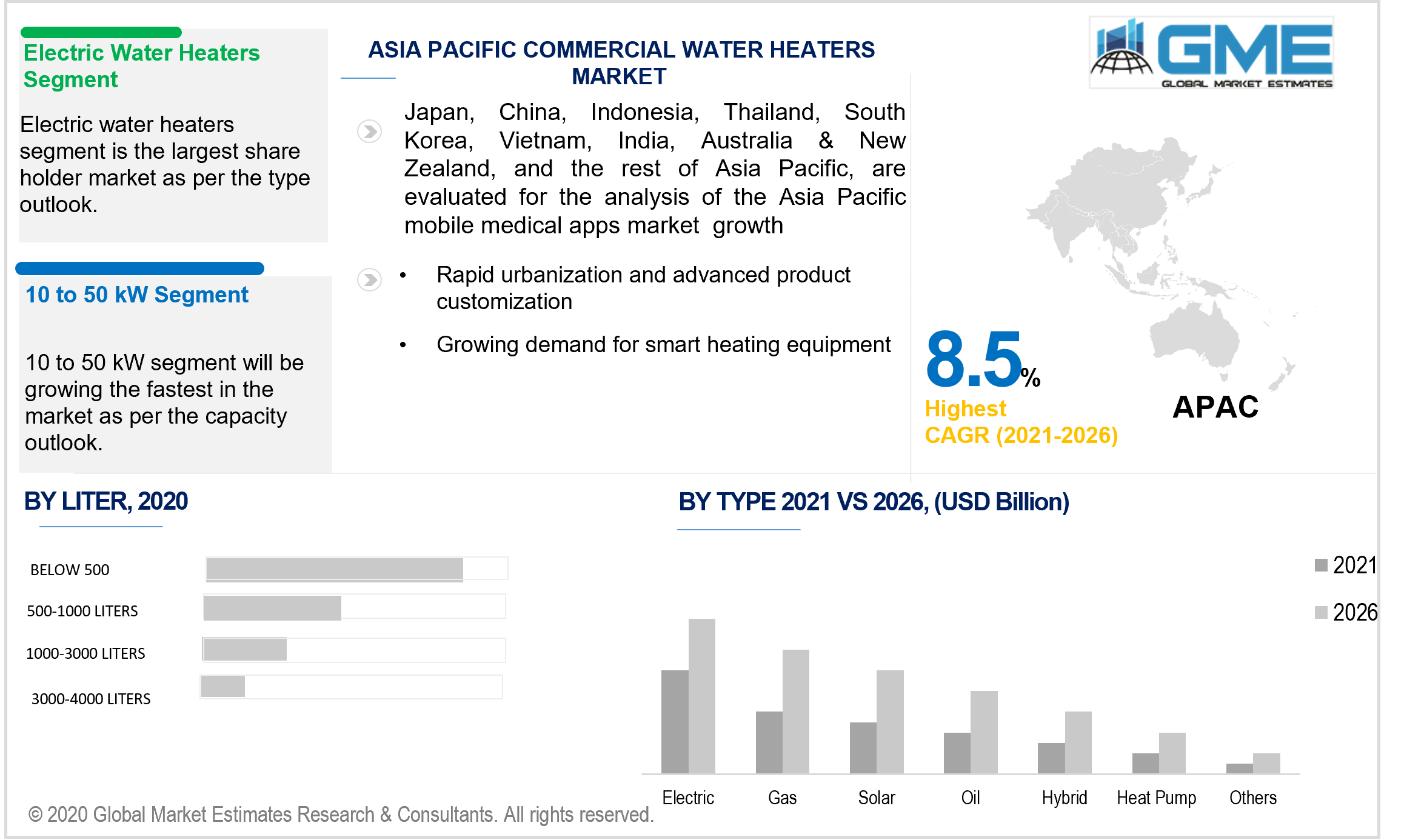

Based on the type, the market is categorized into electric, oil, gas, solar, hybrid, heat pump, and others. Electric water heaters are most prominently used in a wide range of commercial establishments. These electrical heaters provide more functionality and are easy to operate. In comparison with gas water heaters, these electric heaters are a bit expensive to use; however, when it comes to energy consumption, gas water heaters consume excess energy resources, causing extensive wastage, and that attributes more preference to electric water heaters.

Electric heaters also have the upper hand concerning their maintenance. They do require periodical checkups; however, they are not vulnerable to gas leaks or sediment blockages. Also, in terms of the installation process, electric water heaters end up being a more preferred and feasible option as it gives convenience and ease to the installers and the end-users, contrary to the time-consuming installation process of gas heaters.

Based on the capacity, the market is categorized into up to 10kW, 10?50kW, 50?150kW, 150?300kW, and above 300kW. Commercial establishments like hotels, restaurants, health care centers, shopping malls, and other businesses require a constant source of hot water. The heaters with a capacity of 10 to 50 kW are preferred the most.

Based on the liters, the market is categorized into below 500 liters, 500?1,000 liters, 1,000?3,000 liters, 3,000?4,000 liters, and above 4,000 liters. Commercial water heaters of below 500 liters are used majorly within the market. The end-users like restaurants, motels, and medical centers have a higher rate of water usage per day than domestic use. These verticals or end-users also prefer storage-based or attached tank commercial water heaters of below 500 liters as it supports better water usage and satisfies the hot water requirement efficiently.

Because of the existence of significant companies connected with commercial and residential water heaters and boilers, North America is expected to dominate the commercial water heaters market. Furthermore, huge expenditures for district schools' power utilization in the United States result in high utilization of different energy-consuming equipment including lights, space cooling, heating systems, space heating, and many others amongst schools all over the country. According to the US Department of Energy, school districts in the United States spend USD 6 billion per year on energy consumption, with water heaters accounting for 20% of total energy consumption in 2020.

Asia-Pacific region accounts for its high demand for commercial water heaters. A country like Thailand alone accounts to hold 2% of the commercial water heater market. The APAC region has a majority of its countries being in their developing phase, has undertaken various infrastructural planning projects requiring a tremendous amount of commercial water heaters for various purposes. These countries from the APAC region are also known for their innovative designs of commercial water heaters being demanded not just within the APAC region but all across the world. Countries like India, China having high population rates, require a tremendous amount of commercial water heaters across various verticals, thus attracting more investments into the market.

Mitsubishi Electric (Japan), A.O. Smith Corporation (US), Carrier Global (US), RHEEM Manufacturing Company (US), Rinnai Corporation (Japan), NIBE Energy Systems (Sweden), Solahart Industries (Australia), Stiebel Eltron (Germany), Viessmann Group (Germany), Danfoss (Denmark), American Water Heaters (US), Valliant Group (Germany), Daikin (Japan), Andrewes Water Heaters (Baxi Heating) (UK), and many others are some of the prominent market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2020, Danfoss launched a new design that works on a digital basis and an innovation center that facilitates new design tools, building information modeling (BIM) tools, and others by enabling easy access to the self-service method.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Commercial Water Heater Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Liter Overview

2.1.4 Capacity Overview

2.1.5 Regional Overview

Chapter 3 Global Commercial Water Heater Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Flourishing global commercial sector

3.3.1.2 Increasing demand for energy-efficient water heaters

3.3.2 Industry Challenges

3.3.2.1 High capital expenditure (CapEx) for development of commercial water heaters

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Liter Growth Scenario

3.4.3 Capacity Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Commercial Water Heater Market, By Type

4.1 Type Outlook

4.2 Electric

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Oil

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

4.4 Gas

4.4.1 Market Size, By Region, 2021-2026 (USD Billion)

4.5 Solar

4.5.1 Market Size, By Region, 2021-2026 (USD Billion)

4.6 Hybrid

4.6.1 Market Size, By Region, 2021-2026 (USD Billion)

4.7 Heat Pump

4.7.1 Market Size, By Region, 2021-2026 (USD Billion)

4.8 Others

4.8.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Global Commercial Water Heater Market, By Liter

5.1 Liter Outlook

5.2 Below 500 Liters

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 500?1,000 Liters

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 1,000?3,000 Liters

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

5.5 3,000?4,000 Liters

5.5.1 Market Size, By Region, 2021-2026 (USD Billion)

5.6 Above 4,000 Liters

5.6.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Global Commercial Water Heater Market, by Capacity

6.1 Capacity Outlook

6.2 Up to 10kW

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 10?50kW

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

6.4 50?150kW

6.4.1 Market Size, By Region, 2021-2026 (USD Billion)

6.5 150?300kW

6.5.1 Market Size, By Region, 2021-2026 (USD Billion)

6.6 Above 300kW

6.6.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Global Commercial Water Heater Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Type, 2021-2026 (USD Billion)

7.2.3 Market Size, By Liter, 2021-2026 (USD Billion)

7.2.4 Market Size, By Capacity, 2021-2026 (USD Billion)

7.2.5 U.S.

7.2.4.1 Market Size, By Type, 2021-2026 (USD Billion)

7.2.4.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.2.4.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.2.6.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.2.6.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Type, 2021-2026 (USD Billion)

7.3.3 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.4 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.5.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.5.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.8.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.8.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Type, 2021-2026 (USD Billion)

7.4.3 Market Size, By Liter, 2021-2026 (USD Billion)

7.4.4 Market Size, By Capacity, 2021-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.5.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.4.5.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.8.2 Market size, By Liter, 2021-2026 (USD Billion)

7.4.8.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.9.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Type, 2021-2026 (USD Billion)

7.5.3 Market Size, By Liter, 2021-2026 (USD Billion)

7.5.4 Market Size, By Capacity, 2021-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.5.5.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.5.5.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Type, 2021-2026 (USD Billion)

7.6.3 Market Size, By Liter, 2021-2026 (USD Billion)

7.6.4 Market Size, By Capacity, 2021-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.4.1 Market Size, By Type, 2021-2026 (USD Billion)

7.6.4.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.6.4.3 Market Size, By Capacity, 2021-2026 (USD Billion

7.6.6 UAE

7.6.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.6.5.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.6.5.3 Market Size, By Capacity, 2021-2026 (USD Billion)

7.6.7 South Africa

7.6.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Liter, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By Capacity, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Mitsubishi Electric (Japan)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 A.O. Smith Corporation (US)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 InfoGraphic Analysis

8.4 Carrier Global (US)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 InfoGraphic Analysis

8.5 RHEEM Manufacturing Company (US)

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 InfoGraphic Analysis

8.6 Rinnai Corporation (Japan)

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 InfoGraphic Analysis

8.7 NIBE Energy Systems (Sweden)

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 InfoGraphic Analysis

8.8 Solahart Industries (Australia)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 InfoGraphic Analysis

8.9 Stiebel Eltron (Germany)

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 InfoGraphic Analysis

8.10 Viessmann Group (Germany)

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 InfoGraphic Analysis

8.11 Danfoss (Denmark)

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 InfoGraphic Analysis

8.12 American Water Heaters (US)

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 InfoGraphic Analysis

8.13 Valliant Group (Germany)

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 InfoGraphic Analysis

8.14 Daikin (Japan)

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 InfoGraphic Analysis

8.15 Andrewes Water Heaters (Baxi Heating) (UK)

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 InfoGraphic Analysis

8.16 Other Companies

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 InfoGraphic Analysis

The Global Commercial Water Heaters Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Commercial Water Heaters Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS