Global Companion Animal Pharmaceuticals Market Size, Trends & Analysis - Forecasts to 2027 By Indication (Infectious Diseases, Dermatologic Diseases, Pain, Orthopedic Diseases, Behavioral Diseases, Other Indications), By Animal Type (Dogs, Cats, Horses, Other Companion Animals), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Retail Pharmacies), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

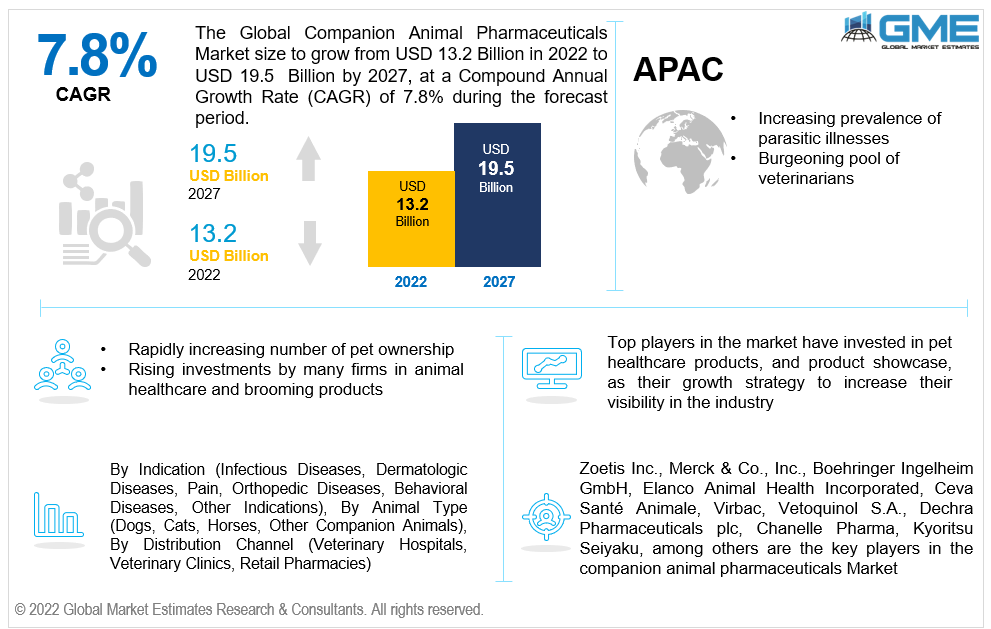

The Global Companion Animal Pharmaceuticals Market is projected to grow from USD 13.2 billion in 2022 to USD 19.5 billion by 2027 at a CAGR value of 7.8% from 2022 to 2027.

The worldwide animal health market supports a thriving business that caters to the needs of a variety of companion animals (dogs, cats, and horses) as well as production animals (cattle, pigs, sheep, and poultry). In the last three years, the US has approved 39 healthcare medicines for the farm animal sector, with 34 medications approved for companion animals.

Furthermore, five of the seven animal healthcare breakthrough medications (annual sales larger than $100 million) developed in the last two decades were aimed at companion animals.

The rapidly increasing number of pet ownership, accelerated commitment of owners to pay for optimal healthcare, expanded pet life expectancies, and the introduction of age-related illness targets such as rheumatoid arthritis, cancers, and obesity are all contributing to an explosive growth trend in the companion animal health sector during the forecast period.

This shift is being fueled by the cheaper expense and schedule necessary to produce medications for companion animals, as well as the bigger market potential contrasted to the commercial animal segment. In addition, a growing tendency for the creation of innovative veterinary-specific medications in recent years are some of the factors propelling market growth.

Some of the reasons driving market expansion include rising demand for animal pet insurance, an increase in the incidence of diseases globally, rising pet health expenditures, and numerous animal organizations and government initiatives to foster pets throughout the world.

Moreover, changes in population and lifestyle, growing urbanisation, nuclear families with few or no children, and employment pressures are all factors driving market expansion.

According to the American Pet Production Association's (APPA) National Pet Owners Survey, 2017-2018, the United States has 89.7 million dogs, 94.2 million cats, and 7.6 million horses, with 68% of US households owning pets.

Increasing adoption for differentiated companion pharmaceutical drugs with diverse therapeutic objectives, as well as the rising occurrence of zoonotic diseases, are all contributing to market expansion. The global companion animal pharmaceuticals market, on the other hand, is being held back by rising pet care costs and an expanding number of novel diseases and antibiotics.

The COVID-19 had a significant impact on the global market for Companion Animal Pharmaceuticals as many countries have closed their borders and restricted transit and movement, impacting international trade and transportation. Since this, supply chain for companion animal medications were disrupted, and demand for these supplies fell temporarily. Many people were also afraid that pet owners will acquire animal diseases including covid, which are factors impeding market growth.

Based on the indication, the market is segmented into infectious diseases, dermatologic diseases, pain, orthopedic diseases, behavioral diseases, and other indications.

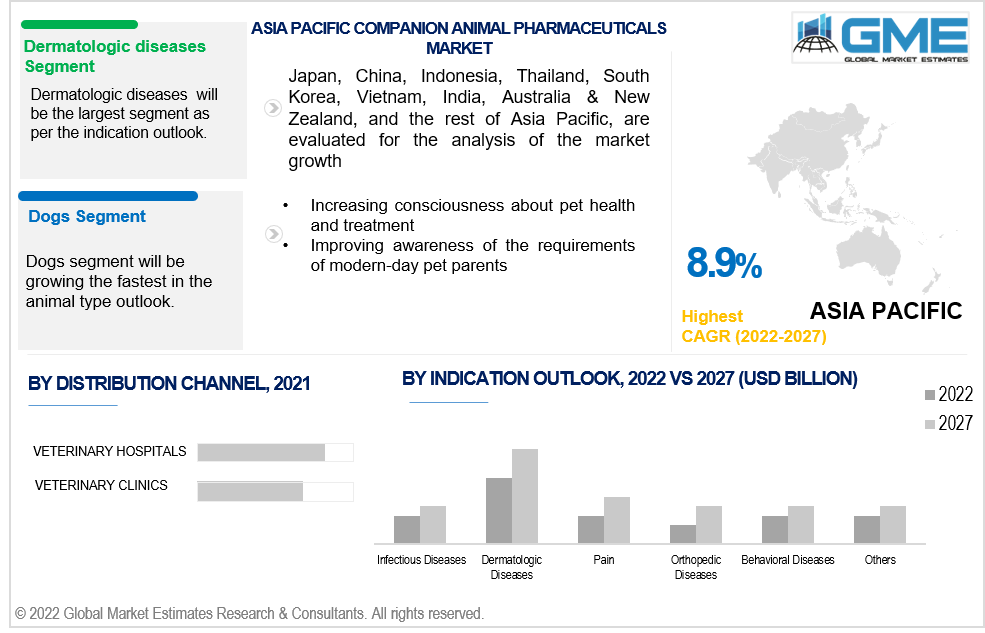

The dermatologic diseases segment is expected to grow the fastest in the companion animal pharmaceuticals market from 2022 to 2027. The rising prevalence of dermatological illnesses, rising understanding of disease development and aetiology, and a spike in the proportion of clinical trials testing the safety and efficacy of a variety of therapeutic medications are all expected to contribute to the segment's expansion.

The market is segmented into dogs, cats, horses, and other companion animals based on animal type. The dog’s segment is expected to grow the fastest in the companion animal pharmaceuticals market from 2022 to 2027.

Increased pet adoption around the world, as well as extensive understanding of pet insurance and the significance of animal health, are expected to drive segment expansion.

Veterinary hospitals, veterinary clinics and retail pharmacies are segmentation based on distribution channel. The veterinary hospitals segment is expected to grow the fastest in the companion animal pharmaceuticals market from 2022 to 2027.

Factors such as shifting food tastes as a result of changing living patterns and population increase are driving up demand for veterinary services such as immunizations, increasing market growth. To provide better treatment for all animals, several veterinary care providers are embracing big data technologies. This technology is also utilised to diagnose and assess prospective ailments, which helps the segment flourish.

As per the geographical analysis, the companion animal pharmaceuticals market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the companion animal pharmaceuticals market from 2022 to 2027. The region's growing prevalence of pet owners, rising investment in R&D by firms, large concentration of veterinary clinics and hospitals, and increasing expenditure on animal healthcare by the pet owners are boosting regional growth.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the companion animal pharmaceuticals market during the forecast period. The increasing prevalence of parasitic illnesses, as well as the burgeoning pool of veterinarians, increasing consciousness about pet health and treatment, and improving awareness of the requirements of modern-day pet parents, are all contributing to the market's rise in this region.

Zoetis Inc., Merck & Co., Inc., Boehringer Ingelheim GmbH, Elanco Animal Health Incorporated, Ceva Santé Animale, Virbac, Vetoquinol S.A., Dechra Pharmaceuticals plc, Chanelle Pharma, Kyoritsu Seiyaku, among others are the key players in the companion animal pharmaceuticals market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Companion Animal Pharmaceuticals Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Indication Overview

2.1.3 Animal Type Overview

2.1.4 Distribution Channels Overview

2.1.6 Regional Overview

Chapter 3 Companion Animal Pharmaceuticals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for animal pet insurance

3.3.2 Industry Challenges

3.3.2.1 Increasing number of new diseases and antibiotics

3.4 Prospective Growth Scenario

3.4.1 Indication Growth Scenario

3.4.2 Animal Type Growth Scenario

3.4.3 Distribution Channels Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Companion Animal Pharmaceuticals Market, By Indication

4.1 Indication Outlook

4.2 Infectious Diseases

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Dermatologic Diseases

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Pain

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Orthopedic Diseases

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Behavioral Diseases

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

4.7 Other Indications

4.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Companion Animal Pharmaceuticals Market, By Animal Type

5.1 Animal Type Outlook

5.2 Dogs

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Cats

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Horses

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Other Companion Animals

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Companion Animal Pharmaceuticals Market, By Distribution Channel

6.1 Veterinary Hospitals

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Veterinary Clinics

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Retail Pharmacies

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Companion Animal Pharmaceuticals Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Indication, 2022-2027 (USD Billion)

7.2.3 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.2.4 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.3 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.4 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Indication, 2022-2027 (USD Billion)

7.4.3 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.4.4 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.4.9.2 Market size, By Animal Type, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Indication, 2022-2027 (USD Billion)

7.5.3 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.5.4 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Indication, 2022-2027 (USD Billion)

7.6.3 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.6.4 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Animal Type, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Distribution Channels, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2022

8.2 Zoetis Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Merck & Co., Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Boehringer Ingelheim GmbH

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Elanco Animal Health Incorporated

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Ceva Santé Animale

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Virbac

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Vetoquinol S.A.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Dechra Pharmaceuticals plc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Chanelle Pharma

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Companion Animal Pharmaceuticals Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Companion Animal Pharmaceuticals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS