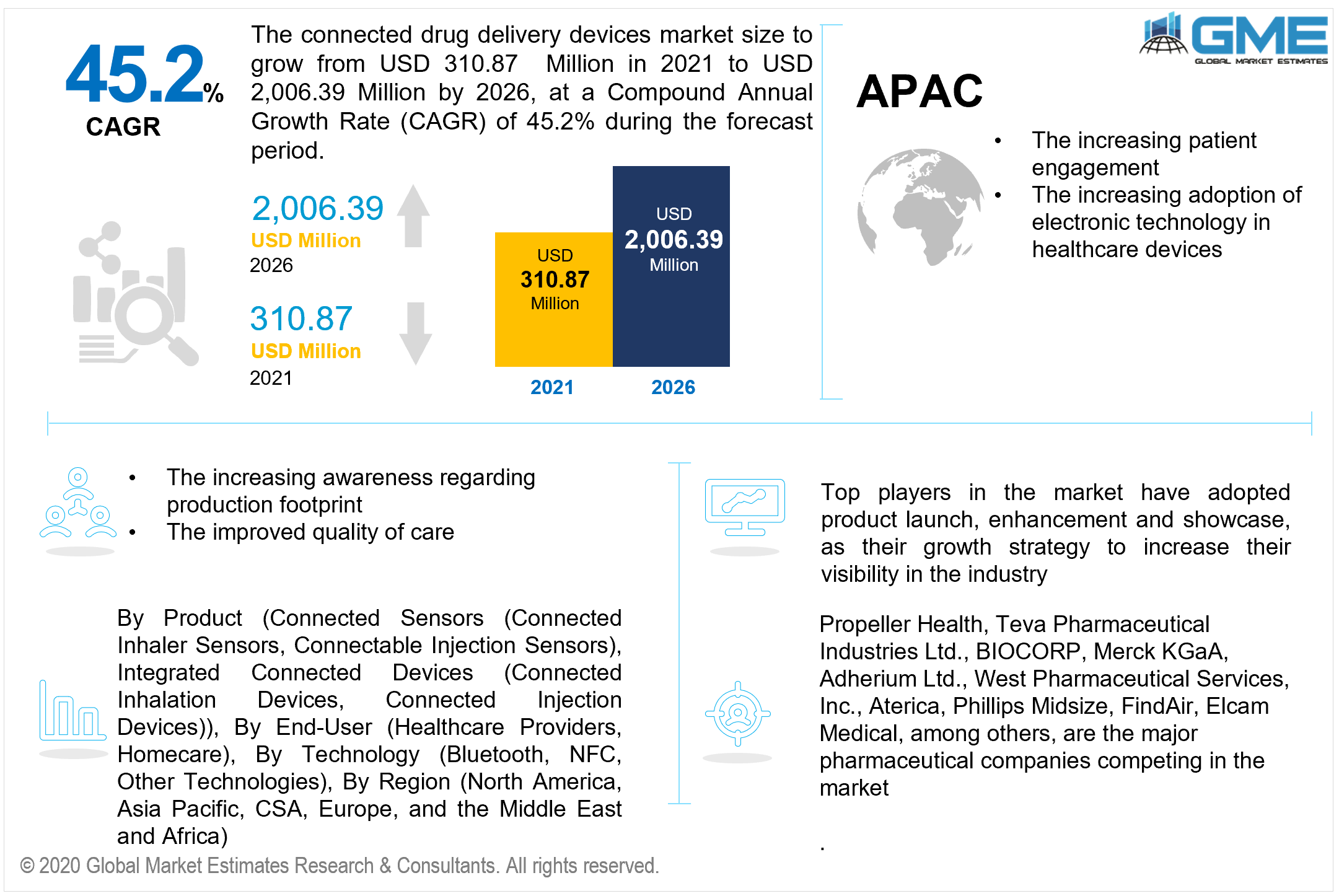

Global Connected Drug Delivery Devices Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Connected Sensors (Connected Inhaler Sensors, Connectable Injection Sensors), Integrated Connected Devices (Connected Inhalation Devices, Connected Injection Devices)), By End-User (Healthcare Providers, Homecare), By Technology (Bluetooth, NFC, Other Technologies), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The connected drug delivery devices market is projected to grow from USD 310.87 million in 2021 to USD 2,006.39 million by 2026 at a CAGR value of 45.2% between 2021 to 2026. The market is likely to be driven by enhanced patient involvement and connection as a result of the rising implementation of the Internet of Things (IoT) in the healthcare devices sector.

During the Covid-19 epidemic, the market grew at an unprecedented rate owing to increased demand for medication delivery systems that could be utilized at residence. The device is foreseen to grow significantly in the long term as well, attributable to a widening accentuation on the prevailing tendency of enhanced patient conformance and standard of healthcare, increased recognition concerning manufacturing footprint and accompanying expenses, and expanding use of self-administered and integrated drug treatment.

A growing number of programs and efforts focused on rising consciousness concerning the merits of adhering to physician-prescribed treatments will further aid market expansion. Furthermore, growing awareness of the advantages of networked systems over traditional systems is projected to drive product demand, therefore boosting market growth throughout the forecast period.

In recent times, there has been a significant increase in demand for integrated medication delivery systems, attributed mostly to an increase in chronic disease cases. This is accelerating the evolution of the global market for smart medication delivery devices.

Key drivers encompass an increment in the geriatric demographic, a boost in the prevalence of pathologic illness, a raise in the predisposition for intravenous drug delivery, an improvement in demand for drugs containing sizeable molecules in pre-filled syringes, an upsurge in the use of self-administration of opioids via connected drug delivery device., increased usage of mobile-based healthcare apps, as well as a preference for cloud-based computing paradigms. Furthermore, the increasing use of cutting-edge technology in linked medication delivery devices is expected to open up attractive prospects for market advancement throughout the forecast period.

The constantly expanding expense of healthcare treatments, as well as the growing desire to enhance patient care results, are two of the primary drivers fueling demand for connected drug delivery systems. In addition, a movement in inclinations favoring home-based therapy is fueling market development. Furthermore, the growing number of people experiencing incurable diseases, combined with a greater concentration on preventative treatment, is favorably affecting the market. Additionally, the growing use of connected devices in laboratory facilities and hospitals for the maintenance of electronic health records (EHR) is boosting market expansion.

Aside from that, numerous companies provide gadgets that can link to applications and programs, transmit information, facilitate automated monitoring, and optimize patient wellbeing. Connected drug delivery systems are progressively being used by biopharma firms to determine compliance enhancement objectives for authorities, insurers, and patients since they also give accessibility to real-time patient information.

Expanding demand for connected medication delivery gadgets throughout numerous end-use sectors including home care services and hospitals is projected to boost target market expansion in the coming years. Furthermore, the expanding spectrum of its use in the healthcare sector is projected to boost revenue development in the core demographic over the next few years. An additional trend predicted to fuel worldwide market expansion is the skyrocketing prevalence of IoT-enabled devices and the Internet.

Nevertheless, the increased price of connected drug delivery devices is likely to limit the expansion of the global market to some extent. Furthermore, the general populace's ignorance of different advanced technologies and electronic gadgets is likely to stymie the target market's progress. Furthermore, an absence of security regulations and the danger of information theft are two other factors that are likely to stymie global market expansion throughout the forecast period.

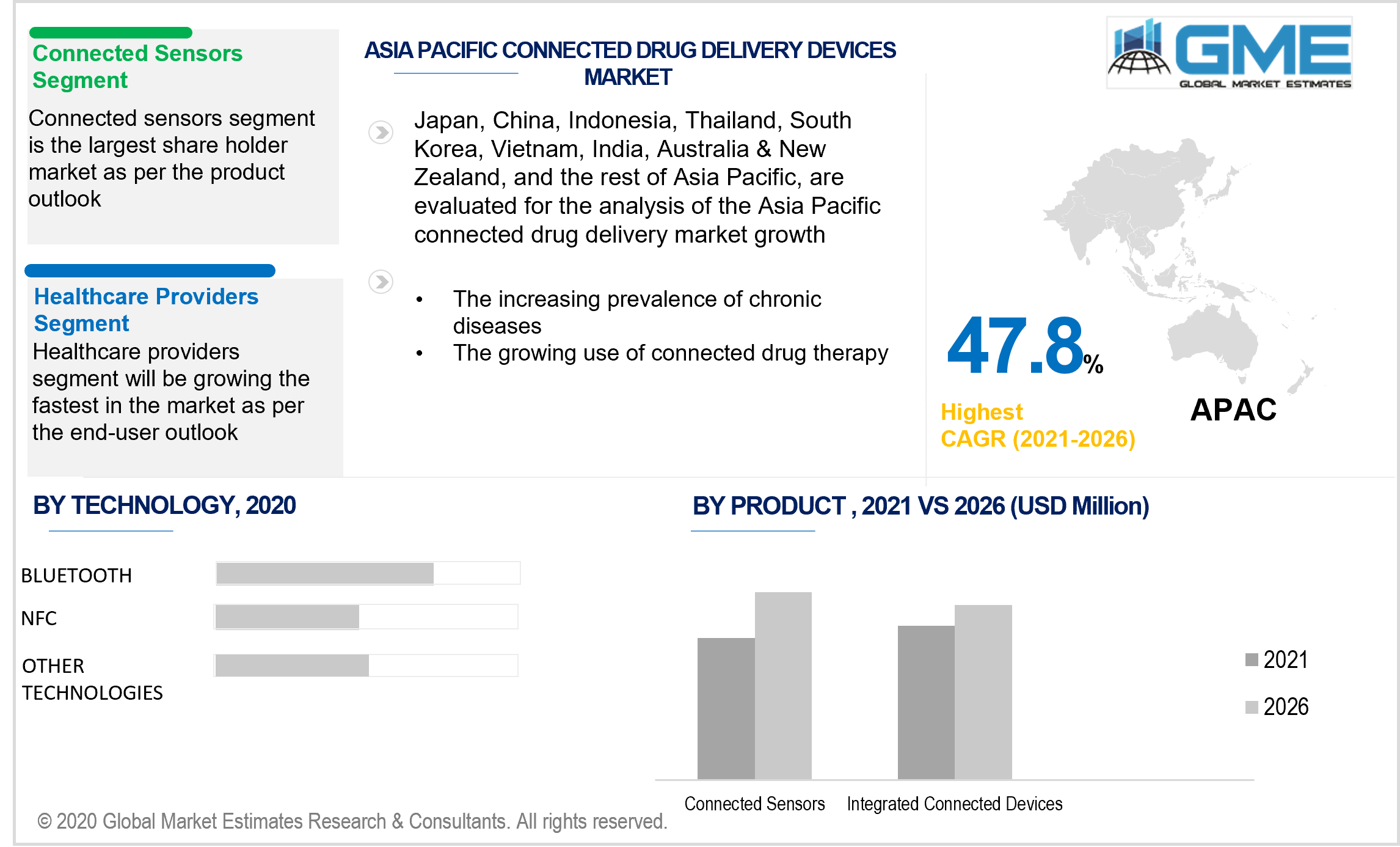

According to the product analysis, the two categories include connected sensors (connected inhaler sensors, connectable injection sensors) and integrated connected devices (connected inhalation devices, connected injection devices). The category of connected sensors is the largest shareholder over the forecast period out of which inhaler sensors constitute a major part of the segment. Connected sensors could well be incorporated with contemporary delivery devices without interrupting their regular operation, and they can also be recycled if the device is biodegradable.

The merits of inhalation devices compared to injectable devices, including needleless medication administration, have led to a rise in their use. The rising prevalence of chronic respiratory illnesses including asthma and Chronic Obstructive Pulmonary Disease (COPD) is projected to increase the demand for inhalation devices.

According to the end-user analysis, the two segments are healthcare providers and homecare. Healthcare providers are predicted to predominate in the market because of the rising instances of COPD, Cardiovascular Diseases (CVDs), diabetes, and other chronic illnesses that necessitate the appropriate preservation of the patient's health information Connected drug delivery systems track medicine consumption and delivery while also keeping track of health information.

According to the technology analysis, the three segments are Bluetooth, NFC, and other technologies. Bluetooth is predicted to be the largest shareholder in terms of revenue growth in the market because of the widespread use of Bluetooth technology in medication delivery devices. With technological improvements, the market is projected to increase significantly in the future years. Furthermore, when compared to NFC and other similar technologies, the technology is less expensive and more widely available.

North America is foreseen to lead in the global market. The area is anticipated to maintain its leadership position over the forecast period because of high per capita healthcare spending, rapid implementation of novel technology and equipment, and growing consciousness of the negative consequences of non-compliance with medication therapy. This dominance can be ascribed to the area's well-developed healthcare industry as well as its well-developed network infrastructure. Furthermore, exorbitant healthcare costs and growing knowledge of the detrimental implications of non-adherence to approved medicines aids in the overall market expansion.

Europe is anticipated to be the fastest-growing regional market over the forecast period because of the growing prevalence of chronic illnesses and the availability of a diverse target demographic base. The European market is anticipated to grow significantly because of an increase in incurable illness cases, public desire to indulge in well-being, and the emergence of fast communication systems. Furthermore, high discretionary income and a tendency to spend more for sophisticated medical services are projected to accelerate the target market's expansion.

Propeller Health, Teva Pharmaceutical Industries Ltd., BIOCORP, Merck KGaA, Adherium Ltd., West Pharmaceutical Services, Inc., Aterica, Phillips Midsize, FindAir, Elcam Medical, among others, are the key players competing in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Connected Drug Delivery Devices Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End-User Overview

2.1.4 Technology Overview

2.1.5 Regional Overview

Chapter 3 Global Connected Drug Delivery Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rising initiatives to create awareness regarding complexities caused by overdosage or under dosage of medicines

3.3.1.2 The growing use of self-administration of drugs

3.3.2 Industry Challenges

3.3.2.1 The rising concerns for cybersecurity

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Connected Drug Delivery Devices Market, By Product

4.1 Product Outlook

4.2 Connected Sensors

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Integrated Connected Devices

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Global Connected Drug Delivery Devices Market, By End-User

5.1 End-User Outlook

5.2 Healthcare Providers

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Homecare

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Global Connected Drug Delivery Devices Market, by Technology

6.1 Technology Outlook

6.2 Bluetooth

6.2.1 Market Size, By Region, 2021-2026 (USD Million)

6.3 NFC

6.3.1 Market Size, By Region, 2021-2026 (USD Million)

6.4 Other Technologies

6.4.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 7 Global Connected Drug Delivery Devices Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Million)

7.2.2 Market Size, By Product, 2021-2026 (USD Million)

7.2.3 Market Size, By End-User, 2021-2026 (USD Million)

7.2.4 Market Size, By Technology, 2021-2026 (USD Million)

7.2.5 U.S.

7.2.4.1 Market Size, By Product, 2021-2026 (USD Million)

7.2.4.2 Market Size, By End-User, 2021-2026 (USD Million)

7.2.4.3 Market Size, By Technology, 2021-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2021-2026 (USD Million)

7.2.6.2 Market Size, By End-User, 2021-2026 (USD Million)

7.2.6.3 Market Size, By Technology, 2021-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Million)

7.3.2 Market Size, By Product, 2021-2026 (USD Million)

7.3.3 Market Size, By End-User, 2021-2026 (USD Million)

7.3.4 Market Size, By Technology, 2021-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Product, 2021-2026 (USD Million)

7.3.5.2 Market Size, By End-User, 2021-2026 (USD Million)

7.3.5.3 Market Size, By Technology, 2021-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2021-2026 (USD Million)

7.3.6.2 Market Size, By End-User, 2021-2026 (USD Million)

7.3.6.3 Market Size, By Technology, 2021-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2021-2026 (USD Million)

7.3.7.2 Market Size, By End-User, 2021-2026 (USD Million)

7.3.7.3 Market Size, By Technology, 2021-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2021-2026 (USD Million)

7.3.8.2 Market Size, By End-User, 2021-2026 (USD Million)

7.3.8.3 Market Size, By Technology, 2021-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2021-2026 (USD Million)

7.3.9.2 Market Size, By End-User, 2021-2026 (USD Million)

7.3.9.3 Market Size, By Technology, 2021-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2021-2026 (USD Million)

7.3.10.2 Market Size, By End-User, 2021-2026 (USD Million)

7.3.10.3 Market Size, By Technology, 2021-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Million)

7.4.2 Market Size, By Product, 2021-2026 (USD Million)

7.4.3 Market Size, By End-User, 2021-2026 (USD Million)

7.4.4 Market Size, By Technology, 2021-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2021-2026 (USD Million)

7.4.5.2 Market Size, By End-User, 2021-2026 (USD Million)

7.4.5.3 Market Size, By Technology, 2021-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2021-2026 (USD Million)

7.4.6.2 Market Size, By End-User, 2021-2026 (USD Million)

7.4.6.3 Market Size, By Technology, 2021-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2021-2026 (USD Million)

7.4.7.2 Market Size, By End-User, 2021-2026 (USD Million)

7.4.7.3 Market Size, By Technology, 2021-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2021-2026 (USD Million)

7.4.8.2 Market size, By End-User, 2021-2026 (USD Million)

7.4.8.3 Market Size, By Technology, 2021-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2021-2026 (USD Million)

7.4.9.2 Market Size, By End-User, 2021-2026 (USD Million)

7.4.9.3 Market Size, By Technology, 2021-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Million)

7.5.2 Market Size, By Product, 2021-2026 (USD Million)

7.5.3 Market Size, By End-User, 2021-2026 (USD Million)

7.5.4 Market Size, By Technology, 2021-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2021-2026 (USD Million)

7.5.5.2 Market Size, By End-User, 2021-2026 (USD Million)

7.5.5.3 Market Size, By Technology, 2021-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2021-2026 (USD Million)

7.5.6.2 Market Size, By End-User, 2021-2026 (USD Million)

7.5.6.3 Market Size, By Technology, 2021-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2021-2026 (USD Million)

7.5.7.2 Market Size, By End-User, 2021-2026 (USD Million)

7.5.7.3 Market Size, By Technology, 2021-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Million)

7.6.2 Market Size, By Product, 2021-2026 (USD Million)

7.6.3 Market Size, By End-User, 2021-2026 (USD Million)

7.6.4 Market Size, By Technology, 2021-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.4.1 Market Size, By Product, 2021-2026 (USD Million)

7.6.4.2 Market Size, By End-User, 2021-2026 (USD Million)

7.6.4.3 Market Size, By Technology, 2021-2026 (USD Million)

7.6.6 UAE

7.6.5.1 Market Size, By Product, 2021-2026 (USD Million)

7.6.5.2 Market Size, By End-User, 2021-2026 (USD Million)

7.6.5.3 Market Size, By Technology, 2021-2026 (USD Million)

7.6.7 South Africa

7.6.6.1 Market Size, By Product, 2021-2026 (USD Million)

7.6.6.2 Market Size, By End-User, 2021-2026 (USD Million)

7.6.7.3 Market Size, By Technology, 2021-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Propeller Health

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Teva Pharmaceutical Industries Ltd.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 InfoGraphic Analysis

8.4 BIOCORP

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 InfoGraphic Analysis

8.5 Merck KGaA

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 InfoGraphic Analysis

8.6 Adherium Ltd.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 InfoGraphic Analysis

8.7 West Pharmaceutical Services, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 InfoGraphic Analysis

8.8 Phillips Midsize

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 InfoGraphic Analysis

8.9 Elcam Medical

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 InfoGraphic Analysis

8.10 Aterica

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 InfoGraphic Analysis

8.11 FindAir

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 InfoGraphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 InfoGraphic Analysis

The Global Connected Drug Delivery Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Connected Drug Delivery Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS