Global Courier, Express and Parcel Market Size, Trends & Analysis - Forecasts to 2026 By Service Type (Business to Business (B2B), Business to Consumer (B2C), Consumer to Consumer (C2C)), By Destination (Domestic, Internation) By Mode of Delivery (Air, Ship, Rail, Road), By End-User (Services (BFSI – Banking, Financial Services, and Insurance), Wholesale and Retail Trade (e-Commerce), Manufacturing, Construction and Utilities, Others), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

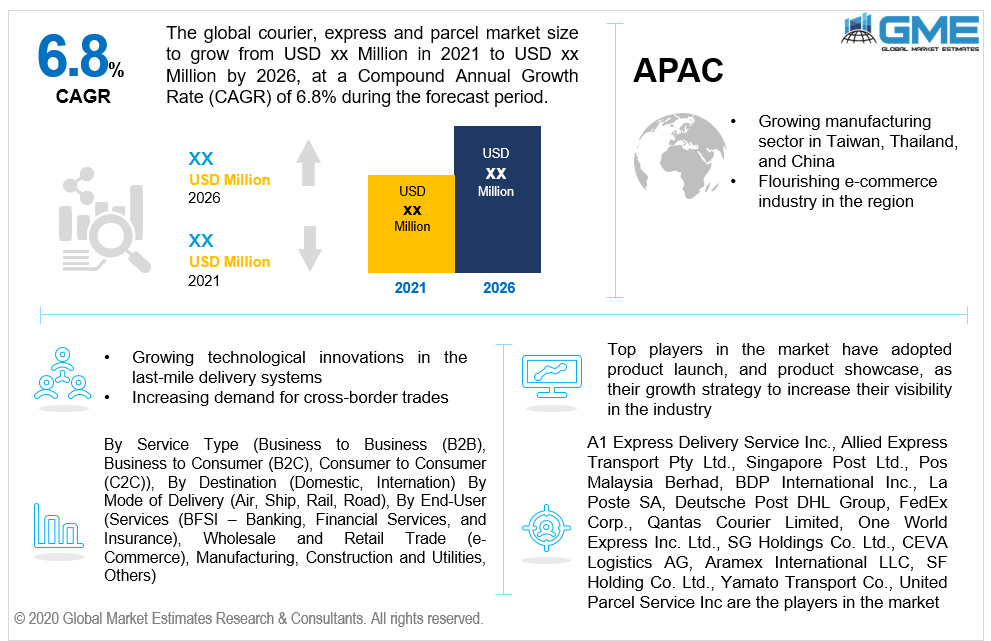

The global courier, express, and parcel market is projected to grow at a CAGR value of 6.8% during the forecast period [2021 to 2026]. Services that deliver goods and mail through various modes of transportation like airplanes, ships, motor vehicles, and railways are collectively known as courier, express, and parcel (CEP).

The global courier, express, and parcel market is expected to be driven by the growing e-commerce industry and the increasing technological advancements in the last mile delivery systems employed by courier, express, and parcel vendors. E-commerce vendors are beginning to form partnerships with courier, express, and parcel service vendors to ensure their products are delivered to customers as efficiently as possible. Rapid urbanization and the growing number of e-commerce vendors in developed nations across Europe and North America and developing nations like India are expected to result in the growth of the CEP market.

Increased cross-border trading between businesses in different regions owing to rapid globalization and efficient transportation systems have resulted in the growth of the global market size for the courier, express, and parcel services. Technological advancements like package tracking services are increasing the services that are provided by courier, express, and parcel service vendors. Various technological innovations in last-mile delivery systems are making courier, express, and parcel services more efficient and cheaper for the consumer.

Courier, express, and parcel service vendors are beginning to employ new technologies like crowdsourced deliveries, drone delivery, self-driving vehicles, and delivery lockers to enhance their services. Increased international trade due to an increase in purchasing power of consumers is also expected to have a positive impact on the growth of the courier, express, and parcel services market.

The courier, express and parcel (cep) market is restrained by fluctuating fuel prices. The fluctuating fuel prices have a significant impact on the profitability of the courier, express, and parcel vendors. The COVID-19 pandemic has had a significant impact on the courier, express, and parcel market, with international transportation being shut down, supply chains and transport logistics have been heavily impacted which has increased the costs incurred by the vendors as well as reducing their courier, express and parcel (cep) market size during the pandemic induced shutdown. The report gives a brief explanation about the market trends and also gives the estimated and analyzed global cep market size.

The market can be classified as per the type of service offered by the vendor and can be segmented into consumer to consumer (C2C), business to consumer (B2C), and business to business segments. The business to business segment held the bulk of the global cep market size.

Business to business services involves large volumes of goods being transported which increases the profitability of courier, express, and parcel service vendors. The business to consumer segment is expected to log the fastest growth rate from 2021 to 2026 owing to the growth in the e-commerce industry.

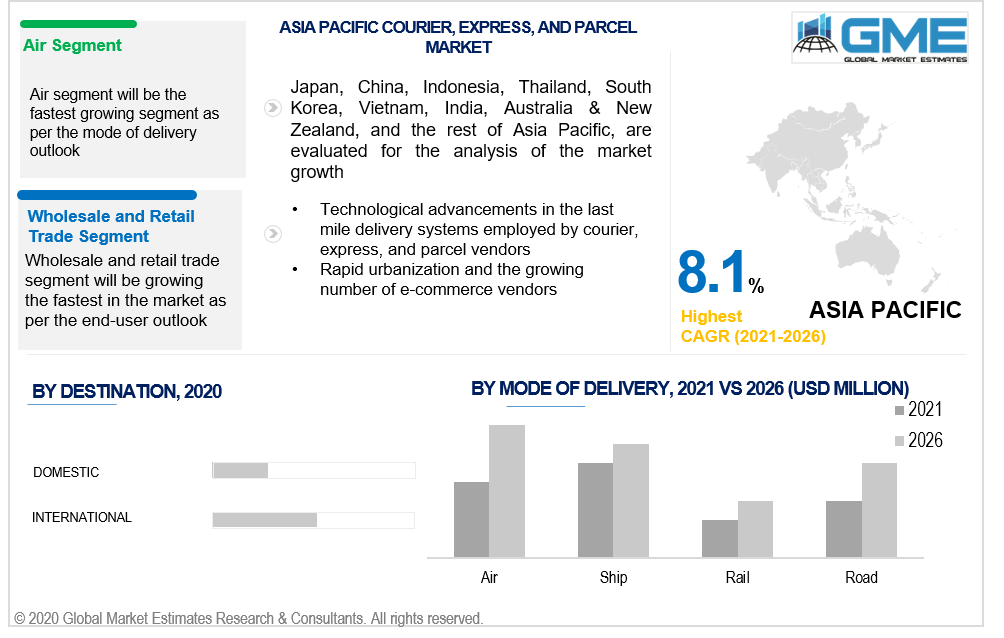

The market is segmented into international and domestic segments based on the final destination of the package with respect to the origin. The international segment clutched the largest CEP market share. International services have become increasingly popular due to rapid globalization and growth in the e-commerce industry.

Based on the various delivery modes available, the market is segmented into air, ship, rail, and road segments. The air segment is expected to hold the lion’s share of the courier, express, and parcel market. Airways offer fast and reliable shipping options for consumers who require faster delivery. With the increased use of tracking systems and logistical tools, airways have become a very common mode of delivery for courier, express, and parcel vendors in the market.

Based on the end-users of courier, express, and parcel services, the market is segmented into services, manufacturing, construction and utilities, wholesale and retail trade, and others. The wholesale and retail trade segment held the dominant share of the courier, express, and parcel market. Rapid urbanization and increased disposable income among consumers have resulted in the dominance of the wholesale and retail segment. The COVID-19 pandemic has increased the number of wholesale and retail vendors using e-commerce services to sell their products which has also contributed to the growth of the wholesale and retail segment.

Based on the geography, the market is segmented into North America, Latin America, Europe, Middle East and Africa, and Asia Pacific. The Asia Pacific region held the largest CEP market share by region. The APAC region is also expected to witness the fastest growth rate during the forecast period. Growing market penetration of handheld devices has contributed to the increase in the number of e-commerce users in the region. The growing e-commerce industry in countries like India, China, Japan, Korea, and Taiwan has contributed to the market domination by the APAC courier, express, and parcel market. CEP Industry in India has shown that the pandemic has caused an increase in the demand for wholesale and retail vendors selling their products online. With increased partnerships between e-commerce vendors and courier, express, and parcel service vendors, the market is expected to continue to grow rapidly during the forecast period [2021 to 2026].

Also, based on the CEP Industry Analysis of India, it is estimated that India will be the fastest-growing country from 2021 to 2026. The expected revival of the manufacturing industries in countries like China, Japan, Korea, Taiwan, and Thailand is expected to contribute to the growth of the courier, express, and parcel market in the APAC region. However, the CEP Market in Europe is analyzed to be the 2nd largest regional segment from 2021 to 2026.

Allied Express Transport Pty Ltd., Singapore Post Ltd., Pos Malaysia Berhad, BDP International Inc., La Poste SA, Deutsche Post DHL Group, FedEx Corp., Qantas Courier Limited, One World Express Inc. Ltd., SG Holdings Co. Ltd., CEVA Logistics AG, Aramex International LLC, SF Holding Co. Ltd., Yamato Transport Co., A1 Express Delivery Service Inc., United Parcel Service Inc., among others are the key players in the courier, express and parcel market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Courier, Express, and Parcel Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Service Type Overview

2.1.3 Mode of Delivery Overview

2.1.4 Destination Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Courier, Express, and Parcel Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in last-mile delivery technology

3.3.1.2 Growing of e-commerce in APAC region

3.3.2 Industry Challenges

3.3.2.1 Fluctuating fuel prices

3.4 Prospective Growth Scenario

3.4.1 Service Type Growth Scenario

3.4.2 Mode of Delivery Growth Scenario

3.4.3 Destination Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Courier, Express, and Parcel Market, By Service Type

4.1 Service Type Outlook

4.2 Business to Business (B2B)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Business to Consumer (B2C)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Consumer to Consumer (C2C)

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Courier, Express, and Parcel Market, By Destination

5.1 Destination Outlook

5.2 Oil & Gas and Petrochemical

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Domestic

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 International

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Courier, Express, and Parcel Market, By Mode of Delivery

6.1 Air

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Ship

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Rail

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Road

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Courier, Express, and Parcel Market, By End-User

7.1 Services

7.1.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Wholesale and Retail Trade

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Manufacturing

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Construction and Utilities

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Others

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Courier, Express, and Parcel Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Service Type, 2019-2026 (USD Million)

8.2.3 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.2.4 Market Size, By Destination, 2019-2026 (USD Million)

8.2.5 Market Size, By End-User, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.2.4.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.2.4.3 Market Size, By Destination, 2019-2026 (USD Million)

8.2.4.4 Market Size, By End-User, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Destination, 2019-2026 (USD Million)

8.2.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.3 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.4 Market Size, By Destination, 2019-2026 (USD Million)

8.3.5 Market Size, By End-User, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Destination, 2019-2026 (USD Million)

8.3.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Destination, 2019-2026 (USD Million)

8.3.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Destination, 2019-2026 (USD Million)

8.3.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Destination, 2019-2026 (USD Million)

8.3.9.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Destination, 2019-2026 (USD Million)

8.3.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Destination, 2019-2026 (USD Million)

8.3.11.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Service Type, 2019-2026 (USD Million)

8.4.3 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.4.4 Market Size, By Destination, 2019-2026 (USD Million)

8.4.5 Market Size, By End-User, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Destination, 2019-2026 (USD Million)

8.4.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Destination, 2019-2026 (USD Million)

8.4.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Destination, 2019-2026 (USD Million)

8.4.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.4.9.2 Market size, By Mode of Delivery, 2019-2026 (USD Million)

8.4.9.3 Market Size, By Destination, 2019-2026 (USD Million)

8.4.9.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Destination, 2019-2026 (USD Million)

8.4.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Service Type, 2019-2026 (USD Million)

8.5.3 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.5.4 Market Size, By Destination, 2019-2026 (USD Million)

8.5.5 Market Size, By End-User, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Destination, 2019-2026 (USD Million)

8.5.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Destination, 2019-2026 (USD Million)

8.5.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Destination, 2019-2026 (USD Million)

8.5.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Service Type, 2019-2026 (USD Million)

8.6.3 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.6.4 Market Size, By Destination, 2019-2026 (USD Million)

8.6.5 Market Size, By End-User, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Destination, 2019-2026 (USD Million)

8.6.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Destination, 2019-2026 (USD Million)

8.6.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Service Type, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Mode of Delivery, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Destination, 2019-2026 (USD Million)

8.6.8.4 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 AI Express Delivery Service Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 SG Holdings Co. Ltd.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Qantas Courier Limited

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Deutsche Post DHL Group

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 FedEx Corp.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 La Poste SA

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 United Parcel Service Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 One World Express Inc. Ltd.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 BDP International Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Courier, Express and Parcel Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Courier, Express and Parcel Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS