Global Cyanoacrylate Adhesives Market Size, Trends & Analysis - Forecasts to 2026 By Type (Alkoxy Ethyl, Ethyl Ester, Octyl Ester, and Others), By End-Users (Transportation, Footwear and Leather, Furniture, Consumer Goods, Healthcare, Electronics, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

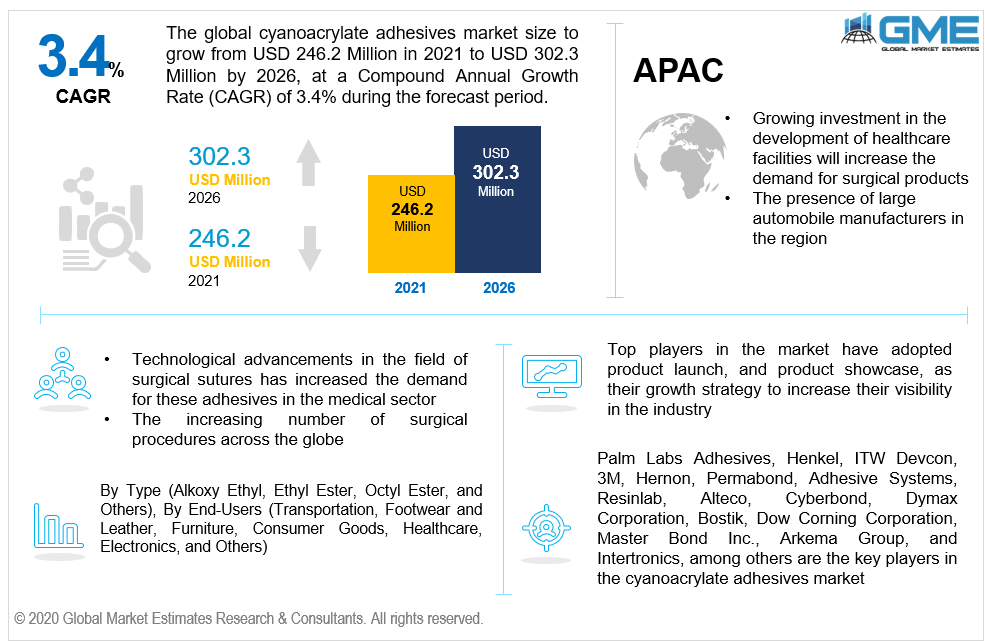

The global cyanoacrylate adhesives market is projected to grow from USD 246.2 million in 2021 to USD 302.3 million by 2026 at a CAGR value of 3.4%. Cyanoacrylate adhesives, commonly known as super glue are acrylate-based adhesives that harden when they come in contact with moisture. These adhesives have a very high bond strength when exposed to moisture and air, and because of which they have a wide spread application in various sectors. Their ability to bond with various materials like metals, plastics, rubber, and even human skin have been instrumental to the growth of the cyanoacrylate adhesives market.

The growing number of manufacturers in the consumer electronics sector has contributed to the growth of the market. The adhesive also has a large market presence among retail and commercial users. The high bond strength and ability to be used on the surface area in the presence of moisture have been vital to the growth of the market among commercial and retail users.

The market is restrained by rising environmental concerns associated with the production of adhesives. The stringent regulations targeted towards protecting the environment from the release of harmful toxins into the atmosphere and water bodies by industrial manufacturers have had a negative impact on the market. The fumes of these adhesives can irritate the respiratory system and prolonged exposure to these compounds can cause flu-like symptoms. These compounds have a very small shelf life, when not opened they can be stored for one year from the date of manufacturing. Post the exposure to the environment, they have to be used within a month or the product reacts with the moisture and becomes ineffective. These factors are likely to challenge the growth of the market globally.

In recent years, the market is witnessing an increasing number of research activities in order to study the use of cyanoacrylates or more specifically n-butyl-2-cyanoacrylate for the medical field. Scientists and researchers have found the use of the product as tissue adhesives for closing wounds in animals and human beings. As medical science evolved, the number of corrective surgeries available to people has also increased. The growing number of surgeries has increased the demand for wound closure products. N-butyl-2-cyanoacrylate has been widely used in the medical field as tissue adhesives. With increased investments into improving the non-toxicity of other cyanoacrylates, the use of these adhesives in the healthcare segment is expected to provide lucrative opportunities for adhesives manufacturers.

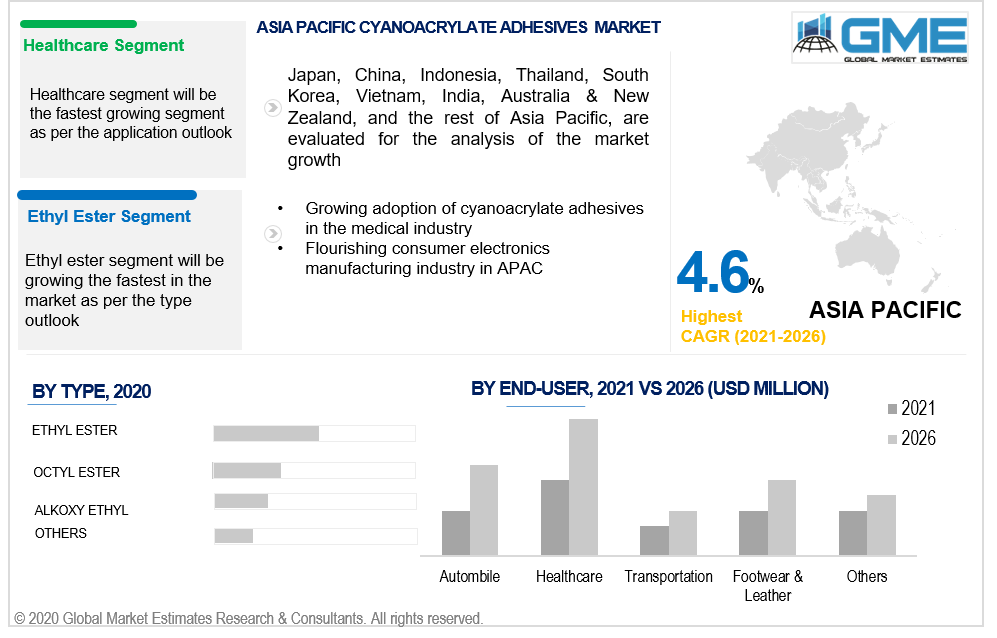

Based on the type of material, the market can be divided into octyl ester, alkoxy ethyl, ethyl ester, and others. The ethyl ester segment is analyzed to be the largest shareholder in the cyanoacrylate adhesives market. Ethyl esters are the most commonly used compound to make superglue by most manufacturers in the market. These compounds offer many properties such as a short curing time, strong bond strength, and the ability to be used on most surfaces. Ethyl esters have been identified as safe materials by the National Toxicology Program of the U.S and the U.K’s Health and Safety Executive. This has been the major reason for the dominance of the ethyl ester segment in the cyanoacrylate adhesives market.

The Octyl ester segment is envisaged to showcase a significantly greater growth rate than the other segments. 2-octyl cyanoacrylate has a lower degradation rate compared to ethyl-based cyanoacrylates. Hence, octyl esters have lower tissue toxicity than ethyl esters making them ideal for surgical sutures in the medical industry. The growing demand for cyanoacrylate adhesives in the medical field is the major driver of the octyl ester segment.

Based on the application, the market can be classified into transportation, healthcare, electronics, furniture, consumer goods, footwear and leather, and others. The automobile segment is envisaged to clutch the largest share of the cyanoacrylate adhesives market. The automobile segment utilizes adhesives to ensure that the smaller parts are bonded together. The large automobile production numbers have been the major factor for the growth of the cyanoacrylate adhesives market.

The healthcare segment is expected to grow at a faster growth rate than the other segments. Growing acceptance of 2-octyl cyanoacrylate for wound closure management due to its low tissue toxicity has been one of the major reasons for the expected growth of the healthcare segment. The growing number of surgeries combined with the growing use of cyanoacrylates among veterinarians are expected to have a positive impact on the growth of the cyanoacrylate adhesives market.

The cyanoacrylate adhesives market can be segmented as per regions into North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The Asia Pacific region is envisaged to grasp the largest share of the market during the forecast period. The high demand for these adhesives from countries like China, India, and Japan is due to the presence of large manufacturing base. The growing plastic and the consumer electronics manufacturing industry have paved the way for the dominance of the Asia Pacific region on the cyanoacrylate adhesives market. The region is also envisaged to showcase a quicker growth rate than the other regions during the forecast period. The flourishing healthcare sector and the growing number of surgeries are expected to have a positive impact on the growth of the market in the Asia Pacific region. North America is expected to be the 2nd largest segment in the market.

Palm Labs Adhesives, Henkel, ITW Devcon, 3M, Hernon, Permabond, Adhesive Systems, Resinlab, Alteco, Cyberbond, Dymax Corporation, Bostik, Dow Corning Corporation, Master Bond Inc., Arkema Group, and Intertronics, among others are the key players in the cyanoacrylate adhesives market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cyanoacrylate Adhesives Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Cyanoacrylate Adhesives Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing use of cyanoacrylate adhesives in the medical industry

3.3.2 Industry Challenges

3.3.2.1 Need for moisture to form the bond between the surfaces

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Cyanoacrylate Adhesives Market, By Type

4.1 Type Outlook

4.2 Ethyl Ester

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Octyl Ester

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Alkoxyl Ethyl

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Cyanoacrylate Adhesives Market, By End-User

5.1 End-User Outlook

5.2 Healthcare

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Transportation

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Footwear & Leather

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Furniture

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Consumer Goods

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

5.7 Electronics

5.7.1 Market Size, By Region, 2020-2026 (USD Million)

5.8 Others

5.8.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Cyanoacrylate Adhesives Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Type, 2020-2026 (USD Million)

6.2.3 Market Size, By End-User, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Type, 2020-2026 (USD Million)

6.3.3 Market Size, By End-User, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Type, 2020-2026 (USD Million)

6.4.3 Market Size, By End-User, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Type, 2020-2026 (USD Million)

6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Type, 2020-2026 (USD Million)

6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Palm Labs Adhesives

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Henkel

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 ITW Devcon

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 3M

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Hernon

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Permabond

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Adhesive Systems

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Resinlab

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Cyanoacrylate Adhesives Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cyanoacrylate Adhesives Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS