Global Delta Robots for Medical and Pharmaceutical Operations Market Size, Trends & Analysis - Forecasts to 2026 By Number of Axes (4 Axes, 3 Axes, and 6 Axes Robots), By Product Type (Fixed Delta Robots and Mobile Delta Robots), By Application (Medical Device Manufacturing and Pharmaceutical Packaging Management), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

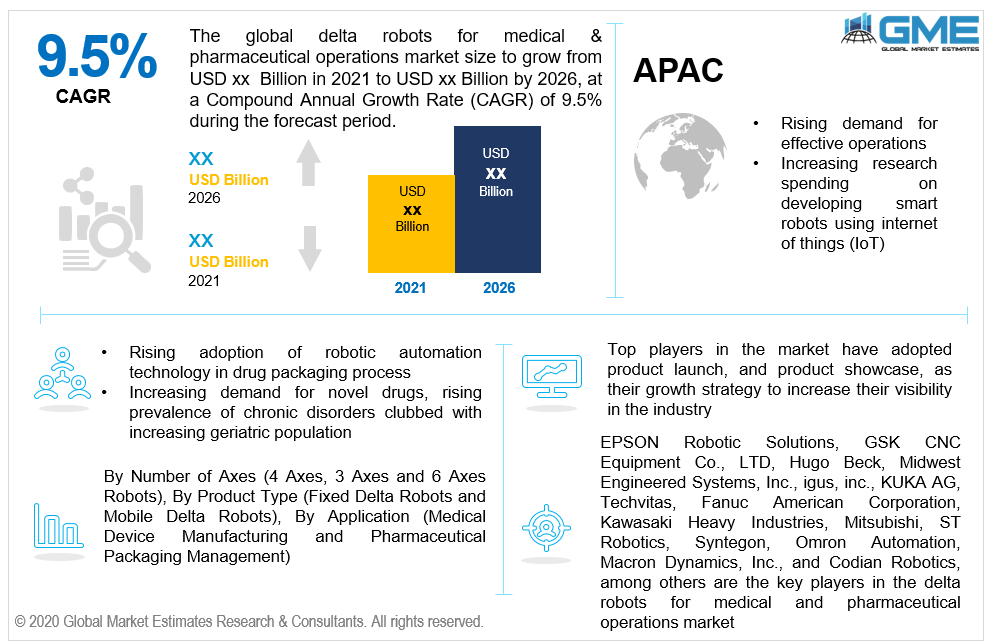

The Global Delta Robots for Medical and Pharmaceutical Operations Market is projected to grow at a CAGR value of 9.5% from 2021 to 2026.

A three-armed robot that can be connected to a universal joint is known as a delta robot. The prime feature of such a robot is the use of a parallelogram in the arms, which maintains the orientation of the end effector, in contrast to the Stewart platform that can change the orientation of its end effector. They are most widely used in pharmaceutical and medical device manufacturing industries to perform tasks related to material handling, part transfer, assembly, pick and place, dispensing, and packaging applications. Simple geometrics with lighter weight is handled by such robots since they are known to be operating at a faster speed as compared to other industrial robots. The high-speed feature of delta robots has helped industries like the packaging industry in medical and pharma sector to quickly adopt advanced technologies efficiently. Moreover, researchers have been keen on using delta robots for gaining stiffness in complicated surgeries, clean rooms for electronic products, and complex packaging processes.

The delta robots for medical and pharmaceutical operations market will be growing rapidly owing to rising adoption of robotic automation technology in drug packaging process, medical device manufacturing process and cleanroom management, increasing demand for novel drugs, rising prevalence of chronic disorders clubbed with increasing geriatric population and rising demand for wearable smart medical devices in developed and developing regions.

Moreover, increasing demand for labor-free technologies and the increasing need to curb or curtail operation costs across both industries worldwide are some of the other factors supporting the growth of the market.

The increased demand for delta robots was caused by a shortage of workers who stayed off duty due to COVID-19-related detentions. Hence, lately, manufacturers are resorting to robotics to reduce production costs and maintain a competitive cost edge and operate labor-free manufacturing sites. These trends have changed the dynamic of the operations market and are expected to continue during the forecast period.

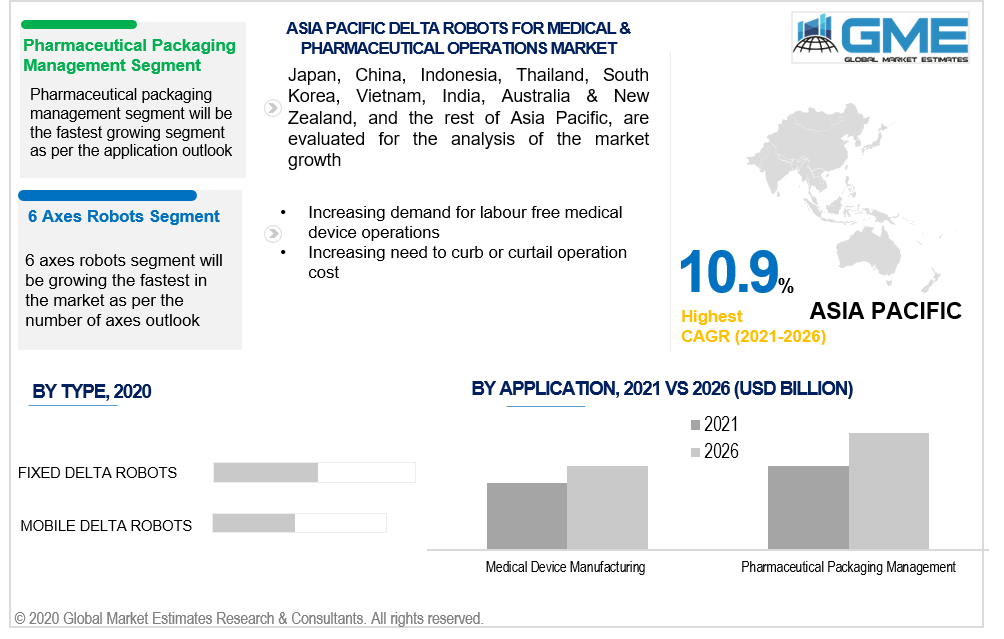

Based on the application, the market is segmented into medical device manufacturing and pharmaceutical packaging management. The application of delta robots for medical and pharmaceutical operations for pharmaceutical packaging management is estimated to grow rapidly during the forecast period.

Delta robotics help in easing out the complexity of the drug manufacturing process as well as helps in curbing the cost by offering a labor-free process. Delta robots have especially been used to curtail the drug shortage issue and hence, are the largest shareholders in the market. Moreover rapidly increasing demand for blockbuster drugs, novel drugs, and drugs for infectious viral diseases (especially due to COVID-19 impact), and the rising prevalence of chronic disorders are some of the factors supporting the growth of this segment.

Based on the product type, the market is segmented into fixed delta robots and mobile delta robots. Fixed delta robots are designed for applications where the payload is to be placed directly on a workpiece. The geometry of these types of robots enables them to deliver high precision at a constant speed while maintaining load capacity and rigidity during positioning or orienting tasks. Fixed delta robots are expected to be growing faster than other types during the forecast period.

Based on the number of axes, the market is segmented into 3-axes, 4-axes, and 6-axes robots. Delta Robots are available in either 3, 4, or 6 axes, and are specifically designed to maximize speed and versatility for high-speed picking and packing operations. While 6 axis robots are efficient for large-sized product packaging applications and hence have been analyzed to be the fastest-growing type in the market.

As per the geographical analysis, the delta robots for the medical and pharmaceutical operations market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the delta robots for medical and pharmaceutical operations market from 2021 to 2026. Rising awareness regarding robotic automation amongst small and medium-sized pharma companies, increasing demand for smart and wearable medical devices leading to increasing production volume size of these products, presence of top players of the market in the U.S. are some of the factors supporting the growth of the North American region.

Moreover, the Asia-Pacific region is expected to be the fastest growing segment in the delta robots for medical and pharmaceutical operations market during the forecast period. Increasing adoption of industry 4.0 in countries like China and Japan, and the rising prevalence of chronic disorders will propel the APAC market’s growth.

EPSON Robotic Solutions, GSK CNC Equipment Co., LTD, Hugo Beck, Midwest Engineered Systems, Inc., igus, inc., KUKA AG, Techvitas, Fanuc American Corporation, Kawasaki Heavy Industries, Mitsubishi, ST Robotics, Syntegon, Omron Automation, Macron Dynamics, Inc., and Codian Robotics, among others are the key players in the delta robots for medical and pharmaceutical operations market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Delta Robots for Medical and Pharmaceutical Operations Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 Number of Axes Overview

2.1.6 Regional Overview

Chapter 3 Delta Robots for Medical and Pharmaceutical Operations Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of chronic diseases and increasing demand for novel drugs

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated robotic systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Number of Axes Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Number of Axes Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Delta Robots for Medical and Pharmaceutical Operations Market, By Product Type

4.1 Product Type Outlook

4.2 Fixed Delta Robots

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Mobile Delta Robots

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Delta Robots for Medical and Pharmaceutical Operations Market, By Number of Axes

5.1 Number of Axes Outlook

5.2 4 Axes Robots

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 3 Axes Robots

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 6 Axes Robots

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Delta Robots for Medical and Pharmaceutical Operations Market, By Application

6.1 Medical Device Manufacturing

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 Pharmaceutical Packaging Management

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Delta Robots for Medical and Pharmaceutical Operations Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Product Type, 2021-2026 (USD Billion)

7.2.3 Market Size, By Application, 2021-2026 (USD Billion)

7.2.4 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2021-2026 (USD Billion)

7.2.4.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.2.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.3 Market Size, By Application, 2021-2026 (USD Billion)

7.3.4 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2021-2026 (USD Billion)

7.3.11.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Product Type, 2021-2026 (USD Billion)

7.4.3 Market Size, By Application, 2021-2026 (USD Billion)

7.4.4 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2021-2026 (USD Billion)

7.4.10.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Product Type, 2021-2026 (USD Billion)

7.5.3 Market Size, By Application, 2021-2026 (USD Billion)

7.5.4 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Product Type, 2021-2026 (USD Billion)

7.6.3 Market Size, By Application, 2021-2026 (USD Billion)

7.6.4 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2021-2026 (USD Billion)

7.6.6.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product Type, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By Number of Axes, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 EPSON Robotic Solutions

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 GSK CNC Equipment Co., LTD

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Hugo Beck

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Midwest Engineered Systems, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 igus, inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 KUKA AG

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Techvitas

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Fanuc American Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Kawasaki Heavy Industries

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Delta Robots for Medical and Pharmaceutical Operations Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Delta Robots for Medical and Pharmaceutical Operations Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS