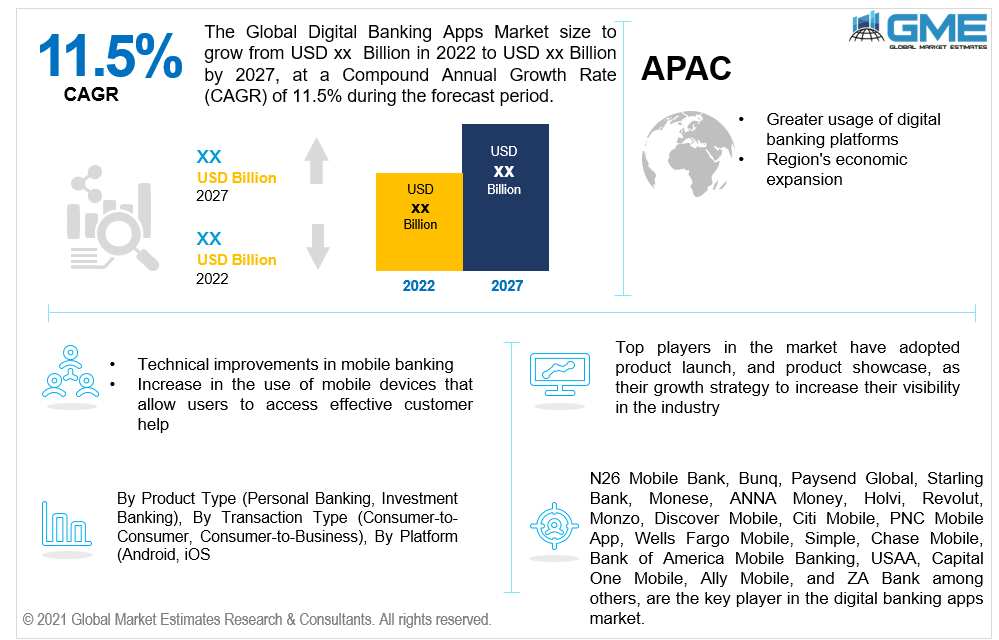

Global Digital Banking Apps Market Size, Trends & Analysis - Forecasts to 2027 By Product Type (Personal Banking, Investment Banking), By Transaction Type (Consumer-to-Consumer, Consumer-to-Business), By Platform (Android, iOS), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

The Global Digital Banking Apps Market is projected to grow at a CAGR value of 11.5% from 2022 to 2027.

According to a report published by Payments Journal, as of 2020 atleast once a month, around 73% of Americans use online banking. The rising need for self-service banking procedures and customization of banking products and services will propel the market's growth.

Furthermore, technical improvements in mobile banking, such as the provision of customized real-time customer support via intelligent chatbots and an increase in the use of smartphones that allow users to access practical customer help, are propelling the market expansion during the forecast period.

Mobile applications are popular due to their mobility, unique nature, networkability, textual/visual content, and the confluence of multiple technologies. User-friendliness is also a vital component of accessibility, as mobile technology devices offer straightforward, simple-to-use features to consumers and provide valuable functionality interfaces and capabilities. These factors are driving the growth of the market.

According to the Global Digital Report of 2020, around 5.19 billion people (or 67% of the world's population) use smartphones, while 4.54 billion people (or 59%) use the Internet daily.

Customers can conduct business through various encrypted digital platforms, while the bank handles information security, vulnerability assessments, and compliance with regulations.

Additionally, data is processed into valid information using analysis tools, better customer engagement is offered, and more business is generated through customer-specific contact. These factors contributed to the bank's enhanced operating performance and increased revenue, boosting the market growth.

Longer-tail advantages, such as the opportunity to go cashless, along with other features, such as peer-to-peer transactions, availability of ATMs in remote areas, and cardless ATM withdrawals, are some of the factors propelling the market growth.

Furthermore, digital payments and e-wallets provide more confidentiality than physical cards. The capacity to handle daily transactions and provide a broader base of communication that can be utilized for educating financial literacy are pushing the market growth upwards.

Even though mobile banking was already a growing field in global financial services, the COVID-19 pandemic, social distance limits, and work from home norms expedited the adoption of digital marketing methods and digitalization in banking services.

Mobile banking applications' convenience, speed, enjoyment, and safety have a favorable impact on attitudes and intentions to use mobile banking during a pandemic. In contrast, financial risk perceptions of applications have a negative effect.

Nonetheless, concerns with technology and infrastructure, inefficiency in significant transactions, a lack of a financial consultant, and the inconvenient nature of depositing funds are challenges limiting market expansion.

The Ukraine-Russia war will harm the BFSI sector for an extended period. With the rising oil prices and inflation, the central bank-controlled currencies are expected to become less valuable due to a loss of confidence in the investment strategies initiated in Russia and Ukraine.

Furthermore, with the SWIFT impact on Russia and with the United States, the United Kingdom, Europe, and Canada denying access to Russian banks and financial markets, the market is expected to be affected negatively during the forecast period.

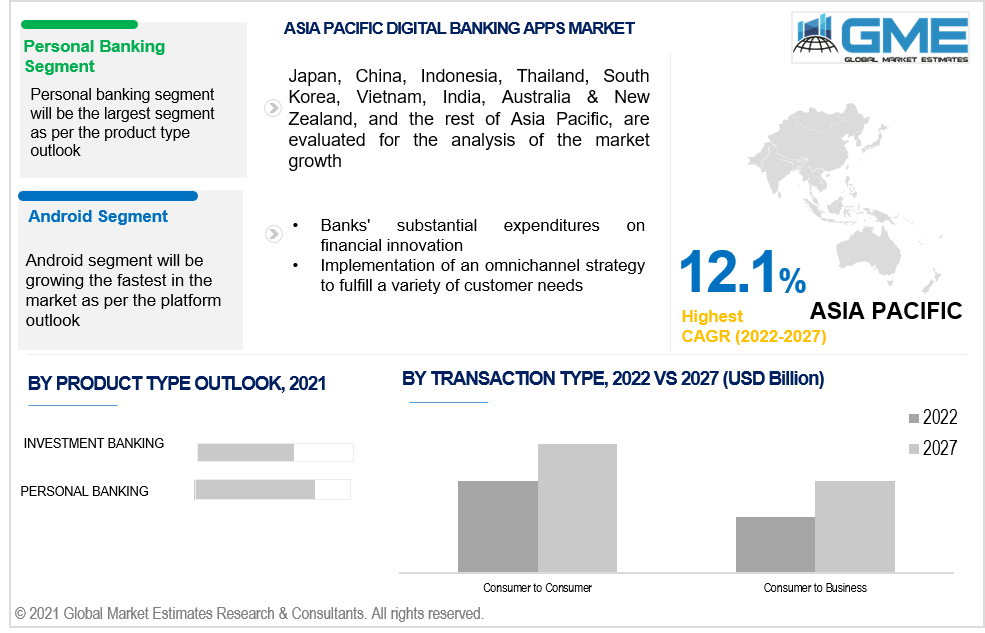

Personal banking is expected to be the most prominent digital banking apps market segment from 2022 to 2027. Private internet banking has several advantages, including quicker credit card payments, 24/7 account access, and funds transfer between accounts. Also, account balances and operations are more visible, and personal records can now be synced with the help of mobile banking. Hence, these features have helped in the growth of the segment.

On the other hand, the investment banking is expected to be the fastest-growing segment in the market. The rising interest in digital stock transactions, increasing demand for customized and user-friendly payment methods, and an increasing number of SMEs adopting digital banking apps are some of the factors responsible for the growth of this segment.

Consumer-to-Consumer is expected to be the most prominent digital banking apps market segment from 2022 to 2027. The additional benefits that consumers experience and the improvement of services over time are linked as growth drivers for this segment. Furthermore, unlike transaction models, one-time payment models have a set return on capital on customer acquisition cost (CAC), whereas transaction services do not.

Consumer-to-Business is expected to be the fastest-growing segment in the market. This is attributed to the rising number of start-up firms across developed and developing regions, increasing popularity of businesses on e-commerce platforms, and rising penetration of internet and digital payment method in developing and remote areas.

Android is the most prominent digital banking apps market segment from 2022 to 2027. Rising penetration of android and smartphones in developing and remote regions and increasing awareness about digital banking facilities are the key drivers for the growth of this segment.

Considering the lion’s share of the North American region and the higher number of apple users than android, the market for the iOS platform is expected to be the fastest-growing segment in the market.

North America (the United States, Canada, and Mexico) will dominate the digital banking apps market from 2022 to 2027. Banks in this region are investing in upgrading their mobile banking applications to provide tailored product offerings, enhanced customer experience, and accessibility for their subscribers, which are driving growth.

The United States is expected to have the lion's share in the North American digital banking apps market. This is attributed to the rising number of online transactions for e-commerce purchases, increased awareness regarding customized and personalized banking products, and the presence of top digital banking apps vendors in the U.S.

Moreover, the Asia-Pacific region is expected to be the fastest-growing digital banking apps market segment during the forecast period. The expansion is supported by more significant usage of digital banking platforms and the region's economic development. Furthermore, banks' substantial expenditures on financial innovation and an omnichannel strategy to fulfill a variety of customer needs are propelling the regional market growth.

China is expected to hold the largest share in the Asia Pacific digital banking apps market. With intense penetration of online banking in individual and corporate customers and with hefty investments in emerging and established enterprises, the China digital banking apps market is expected to propel during the forecast period.

N26 Mobile Bank, Bunq, Paysend Global, Starling Bank, Monese, ANNA Money, Holvi, Revolut, Monzo, Discover Mobile, Citi Mobile, PNC Mobile App, Wells Fargo Mobile, Simple, Chase Mobile, Bank of America Mobile Banking, USAA, Capital One Mobile, Ally Mobile, and ZA Bank among others, are the key players in the digital banking apps market.

Please note: This is not an exhaustive list of companies profiled in the report.

The global digital banking apps market has observed several strategic alliances between key players to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Bank Group, IBEF, CISA, International Finance, International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA)

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Product Type Outlook

2.3 Transaction Type Outlook

2.4 Platform Outlook

2.5 Regional Outlook

Chapter 3 Global Digital Banking Apps Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Digital Banking Apps Market

3.4 Metric Data on Digital Banking Industry

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Digital Banking Apps Market: Product Type Trend Analysis

4.1 Product Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Personal Banking

4.2.1 Market Estimates & Forecast Analysis of Personal Banking Segment, By Region, 2019-2027 (USD Billion)

4.3 Business Banking

4.3.1 Market Estimates & Forecast Analysis of Business Banking Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Digital Banking Apps Market: Transaction Type Trend Analysis

5.1 Transaction Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Consumer to Business

5.2.1 Market Estimates & Forecast Analysis of Consumer to Business Segment, By Region, 2019-2027 (USD Billion)

5.3 Consumer to Consumer

5.3.1 Market Estimates & Forecast Analysis of Consumer to Consumer Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Digital Banking Apps Market: Platform Trend Analysis

6.1 Platform: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 iOS

6.2.1 Market Estimates & Forecast Analysis of iOS Platform Segment, By Region, 2019-2027 (USD Billion)

6.3 Android

6.3.1 Market Estimates & Forecast Analysis of Android Platform Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Digital Banking Apps Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.7 Mexico

7.5.5.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Product Type, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Transaction Type, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 N26 Mobile Bank

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Bunq

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Paysend Global

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Starling Bank

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Monzo

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Monese

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 ANNA Money

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Holvi

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Revolut

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements In Digital Banking Apps Market

2 Global Digital Banking Apps Market: Key Market Drivers

3 Global Digital Banking Apps Market: Key Market Challenges

4 Global Digital Banking Apps Market: Key Market Opportunities

5 Global Digital Banking Apps Market: Key Market Restraints

6 Global Digital Banking Apps Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

8 Personal Banking: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

9 Investment Banking: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

10 Global Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

11 Consumer To Business: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

12 Consumer To Consumer: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

13 Global Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

14 Android: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

15 iOS: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

16 Regional Analysis: Global Digital Banking Apps Market, By Region, 2019-2027 (USD Billion)

17 North America: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

18 North America: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

19 North America: Digital Banking Apps Market, By Platform , 2019-2027 (USD Billion)

20 North America: Digital Banking Apps Market, By Country, 2019-2027 (USD Billion)

21 U.S: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

22 U.S: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

23 U.S: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

24 Canada: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

25 Canada: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

26 Canada: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

27 Mexico: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

28 Mexico: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

29 Mexico: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

30 Europe: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

31 Europe: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

32 Europe: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

33 Europe: Digital Banking Apps Market, By Country, 2019-2027 (USD Billion)

34 Germany: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

35 Germany: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

36 Germany: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

37 UK: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

38 UK: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

39 UK: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

40 France: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

41 France: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

42 France: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

43 Italy: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

44 Italy: Digital Banking Apps Market, By T Transaction Type Ype, 2019-2027 (USD Billion)

45 Italy: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

46 Spain: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

47 Spain: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

48 Spain: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

49 Rest Of Europe: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

50 Rest Of Europe: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

51 Rest Of Europe: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

52 Asia Pacific: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

53 Asia Pacific: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

54 Asia Pacific: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

55 Asia Pacific: Digital Banking Apps Market, By Country, 2019-2027 (USD Billion)

56 China: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

57 China: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

58 China: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

59 India: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

60 India: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

61 India: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

62 Japan: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

63 Japan: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

64 Japan: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

65 South Korea: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

66 South Korea: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

67 South Korea: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

68 Middle East & Africa: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

69 Middle East & Africa: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

70 Middle East & Africa: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

71 Middle East & Africa: Digital Banking Apps Market, By Country, 2019-2027 (USD Billion)

72 Saudi Arabia: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

73 Saudi Arabia: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

74 Saudi Arabia: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

75 UAE: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

76 UAE: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

77 UAE: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

78 Central & South America: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

79 Central & South America: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

80 Central & South America: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

81 Central & South America: Digital Banking Apps Market, By Country, 2019-2027 (USD Billion)

82 Brazil: Digital Banking Apps Market, By Product Type, 2019-2027 (USD Billion)

83 Brazil: Digital Banking Apps Market, By Transaction Type, 2019-2027 (USD Billion)

84 Brazil: Digital Banking Apps Market, By Platform, 2019-2027 (USD Billion)

85 N26 Mobile Bank: Products Offered

86 Bunq: Products Offered

87 Paysend Global: Products Offered

88 Starling Bank: Products Offered

89 Monese: Products Offered

90 ANNA Money: Products Offered

91 Holvi: Products Offered

92 Mozon: Products Offered

93 Other Companies: Products Offered

List of Figures

1. Global Digital Banking Apps Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Digital Banking Apps Market: Penetration & Growth Prospect Mapping

7. Global Digital Banking Apps Market: Value Chain Analysis

8. Global Digital Banking Apps Market Drivers

9. Global Digital Banking Apps Market Restraints

10. Global Digital Banking Apps Market Opportunities

11. Global Digital Banking Apps Market Challenges

12. Key Digital Banking Apps Market Manufacturer Analysis

13. Global Digital Banking Apps Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. N26 Mobile Bank: Company Snapshot

16. N26 Mobile Bank: Swot Analysis

17. Bunq: Company Snapshot

18. Bunq: Swot Analysis

19. Paysend Global: Company Snapshot

20. Paysend Global: Swot Analysis

21. Starling Bank: Company Snapshot

22. Starling Bank: Swot Analysis

23. Monese: Company Snapshot

24. Monese: Swot Analysis

25. ANNA Money: Company Snapshot

26. ANNA Money: Swot Analysis

27. Holvi: Company Snapshot

28. Holvi: Swot Analysis

29. Revolut: Company Snapshot

30. Revolut: Swot Analysis

31. Monzo: Company Snapshot

32. Monzo: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: Swot Analysis

The Global Digital Banking Apps Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Banking Apps Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS