Global Digital Chemical Industry Market Size, Trends & Analysis - Forecasts to 2026 By Technology (IoT, 3D Printing, Augmented Reality (AR) & Virtual Reality (VR), Artificial Intelligence, Digital Twin, and Others), By Vertical (Petrochemicals & Polymers, Specialty Chemicals, Fertilizers & Agrochemicals, and Others), By Process (Research & Development, Manufacturing, Procurement, Packaging, Supply Chain Management & Logistics, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

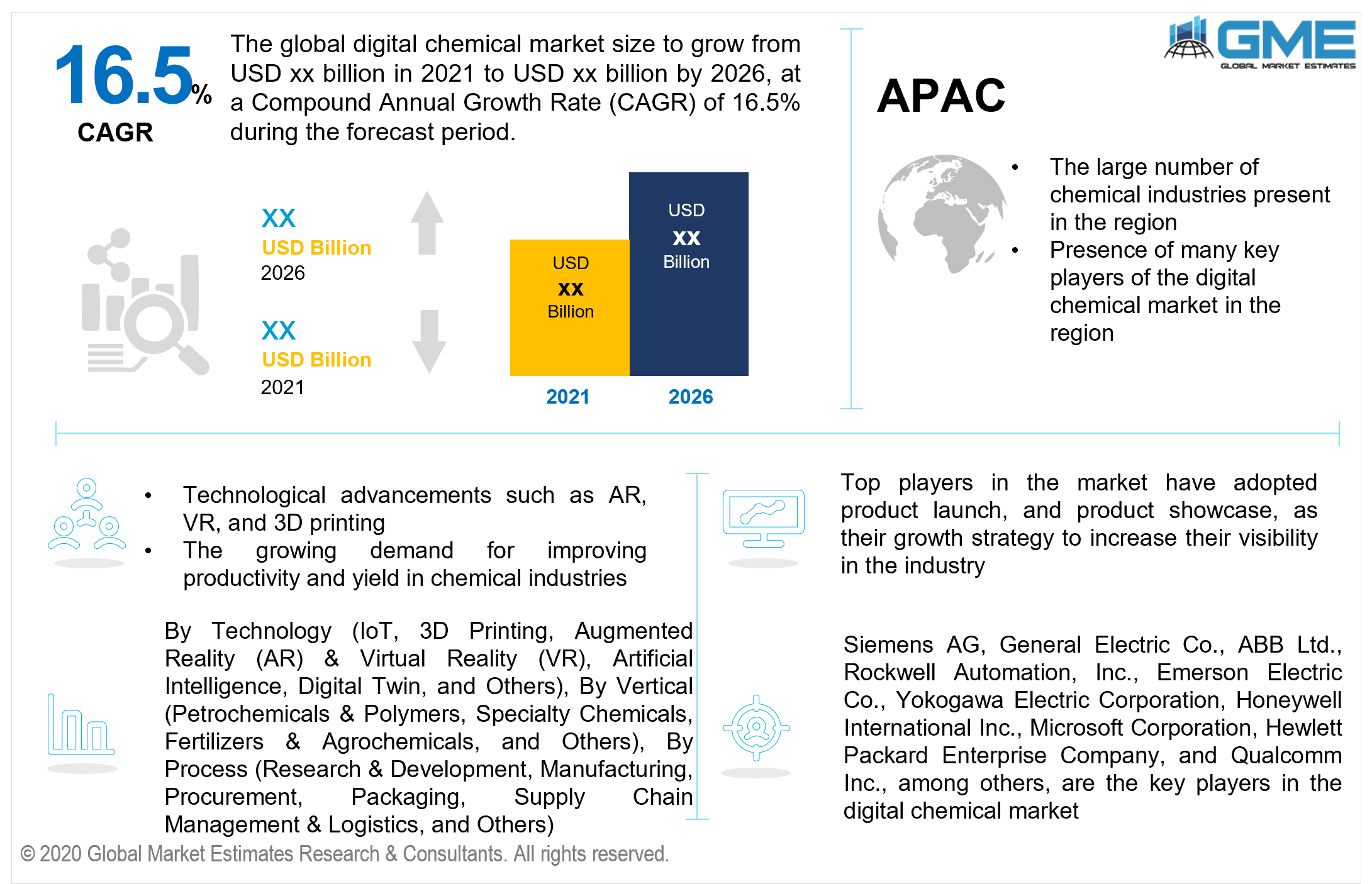

The global digital chemical industry market is projected to grow at a CAGR value of 16.5% between 2021 and 2026. Digitization of the chemical industry is expected to increase productivity in the industry, greater innovation, modify supply chains, and create new market channels. Chemical industries that have incorporated existing technologies generate and store large amounts of data at lower costs due to the greater computational capabilities of modern technology. With the help of digitization, chemical industries can increase productivity in manufacturing, improve marketing and sales revenues, and implementation of new technologies in research and development.

By exploiting the availability of advanced data analytics, industries can analyze data at the management level to increase production capabilities without increasing their input. Most chemical industries produce large amounts of data during their manufacturing process but with efficient utilization of the generated data, companies can improve their yield, lower energy consumption, and provide proactive and effective maintenance. Polyurethane manufacturers that have introduced data analytics through their manufacturing process improved their output of isocyanates by 10% without any capital investment and can generate savings by lowering their usage of high-pressure steam.

Implementation of technologies like IoT and digital twins with cloud computation capabilities allow plant operators to remotely monitor the plant’s productivity and optimize the working parameters to improve profitability. Augmented reality, virtual reality, 3D printing, and other technologies are becoming increasingly common in the research and development of new products and improving manufacturing processes. Predictive analytics and digitization will allow chemical industries to stay a step ahead of demand cycles and predict opportunities that are not as apparent.

The growing demand for optimization of manufacturing processes, supply chain modifications, and increasing market revenue through new products and market channels is expected to increase the demand for digitization in the chemical industry. Technological innovations in mobile app and devices and their growing penetration are expected to further enhance the digital chemical industry market during the forecast period.

The advantages of digitization in the chemical industry are plenty, however, the market is restrained by various environmental and safety regulations. The high cost of implementing new technologies and the need for a skilled labor force capable of efficient utilization of said technology is expected to hamper the growth of the market.

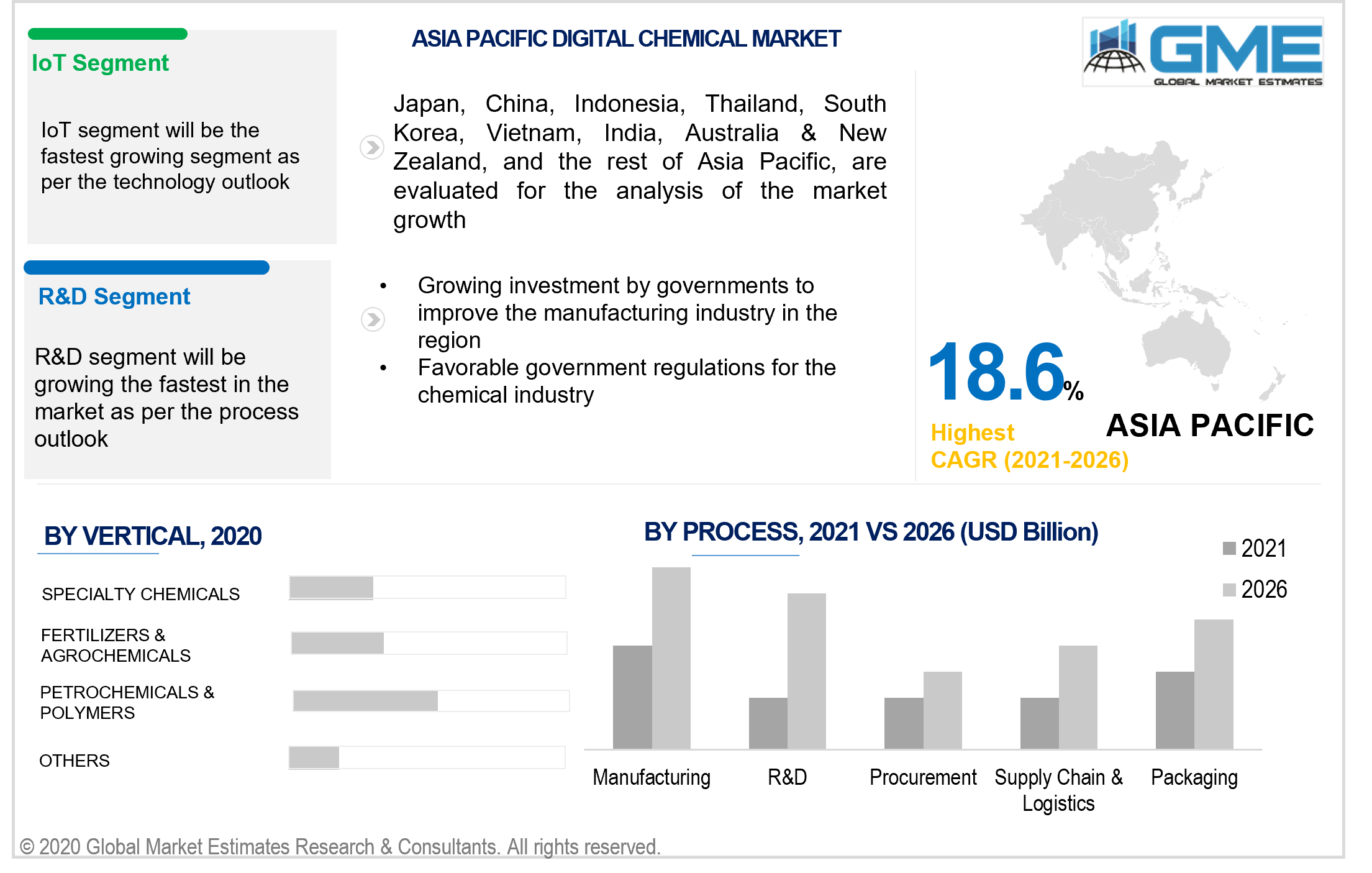

Based on the technology implemented in the industry, the market is segmented into IoT, 3D printing, augmented reality (AR) & virtual reality (VR), artificial intelligence, digital twin, and others. The IoT segment is expected to hold the lion’s share of the revenues being generated in the market during the forecast period. IoT offers a greater degree of control to plant operators owing to their integration of various machinery. The integration allows operators to observe the working of integrated machinery and make informed decisions to increase productivity. These functions can be performed and observed from a single platform and can even be monitored remotely.

The growing adoption of IoT in chemical industries and their ability to integrate new technologies such as blockchain, predictive analytics, track-and-trace, and other technologies are expected to increase the demand for digitization in the chemical industry.

Based on the vertical in the chemical industry, the market is segmented into petrochemicals & polymers, specialty chemicals, fertilizers & agrochemicals, and others. The petrochemicals & polymers segment is envisaged to hold the dominant share of the revenues generated in the market. The heavy demand for petrochemicals and polymers in various end-use industries is the major driver of the segment. Petrochemicals and polymers are used extensively in plastic manufacturing and the ever-increasing demand for plastics is expected to increase the demand for digitization in the chemical industry.

Environmental regulations and safety regulations are forcing chemical industries to improve their products to reduce their carbon footprint and develop new recyclable products. Digitization allows chemical industries to address regulatory restrictions and incorporate recyclable materials in their production processes and invest in recycling technologies. The growing demand for sustainability and recycling in the chemical industry is expected to further enhance the demand for digitization among petrochemicals and polymer chemical industries.

Based on the various processes in the chemical industry, the market is segmented into research & development, manufacturing, procurement, packaging, supply chain management & logistics, and others. The manufacturing segment is expected to hold the largest share of the revenues generated in the digitization of chemical industries. Digitization of the manufacturing process allows industries to increase productivity without any capital investments. The use of digitization in chemical manufacturing processes can reduce raw material requirements and cut down emissions.

The implementation of novel technologies such as AR, VR, and 3D printing is expected to result in the research and development segment becoming the fastest-growing segment during the forecast period. The growing investment in the research and development of innovative products and manufacturing processes will only further enhance the growth of the research and development segment.

Based on region, the market is segmented into North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions. The North American region is expected to hold the lion’s share of the digital chemical industry market. Heavy investment in R&D by industries in the region and the large number of firms offering digitization solutions are the major drivers of the market in the region.

The APAC region is expected to become the fastest-growing region in terms of revenue generated. A large number of chemical industries, favorable environmental regulations, and the growing investment by governments to promote manufacturing in the region are expected to be the major drivers of the market in the APAC region.

Siemens AG, General Electric Co., ABB Ltd., Rockwell Automation, Inc., Emerson Electric Co., Yokogawa Electric Corporation, Honeywell International Inc., Mitsubishi Electric Corporation, Schneider Electric SE, Fanuc Corporation, Fortive, International Business Machines Corporation, Cisco Systems, Inc., Microsoft Corporation, Stratasys Ltd., Hewlett Packard Enterprise Company, and Qualcomm Inc., among others are the key players in the digital chemical industry market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Digital Chemical Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Vertical Overview

2.1.4 Process Overview

2.1.6 Regional Overview

Chapter 3 Digital Chemical Industry Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for improving efficiency and productivity in chemical plants

3.3.2 Industry Challenges

3.3.2.1 High cost of digitization

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Vertical Growth Scenario

3.4.3 Process Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Digital Chemical Industry Market, By Technology

4.1 Technology Outlook

4.2 IoT

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 3D Printing

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Augmented Reality (AR) & Virtual Reality (VR)

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Artificial Intelligence (AI)

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Digital Twin

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Others

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Digital Chemical Industry Market, By Vertical

5.1 Vertical Outlook

5.2 Petrochemicals & Polymers

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Specialty Chemicals

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Fertilizers & Agrochemicals

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Digital Chemical Industry Market, By Process

6.1 Research & Development (R&D)

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Manufacturing

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Procurement

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Packaging

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Supply Chain Management and Logistics

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Others

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Digital Chemical Industry Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.2.4 Market Size, By Process, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Process, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.4 Market Size, By Process, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Process, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Process, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Process, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Process, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.4 Market Size, By Process, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Process, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Vertical, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Process, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Process, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.4 Market Size, By Process, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Process, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.4 Market Size, By Process, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Process, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Process, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Process, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Siemens AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 General Electric Co.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 ABB Ltd.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Rockwell Automation, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Emerson Electric Co.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Yokogawa Electric Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Honeywell International Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Mitsubishi Electric Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Schneider Electric SE

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Fanuc Corporation

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Digital Chemical Industry Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Chemical Industry Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS