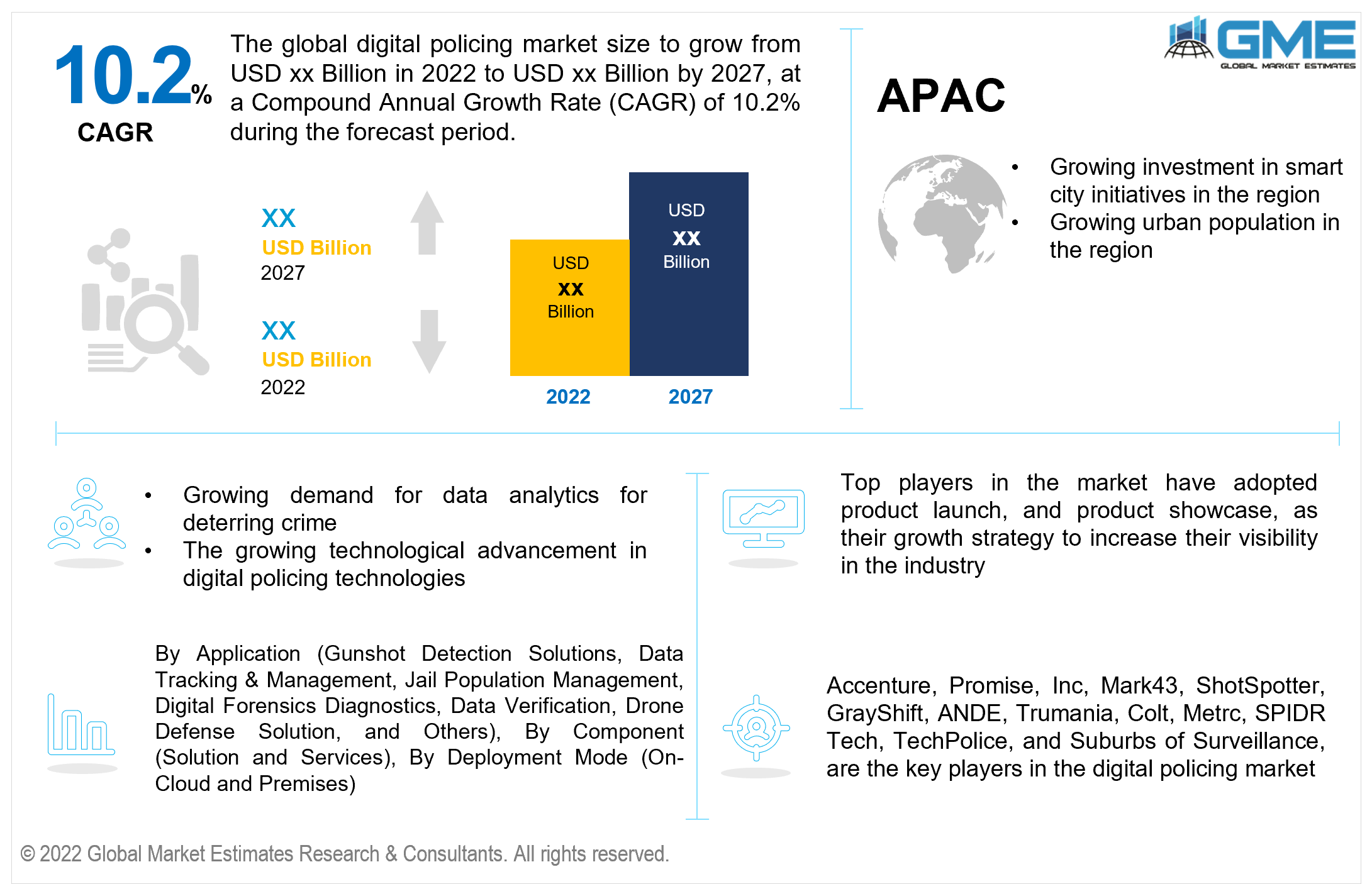

Global Digital Policing Market Size, Trends & Analysis - Forecasts to 2027 By Application (Gunshot Detection Solutions, Data Tracking & Management, Jail Population Management, Digital Forensics Diagnostics, Data Verification, Drone Defense Solution, and Others), By Component (Solution and Services), By Deployment Mode (On-Cloud and Premises), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global digital policing market is projected to grow at a CAGR value of 10.2% from 2022 to 2027. The digital policing market is largely driven by the growing number of cities across the globe, rising urban population, increasing investment in smart city infrastructure and solutions, and the rising number of anti-social elements in urban centers.

The police are fundamentally an organization created as a bridge between the state and the citizens, tasked with goals and powers aimed to preserve public order and security. The changing nature of society and interactions among people have necessitated the digitization of policing techniques to ensure public order and the security of citizens. The police are focusing on shifting from traditional models of providing physical presence to deter crime, to one that harnesses the capabilities of digital technologies. The growing adoption of digital transformation has changed the nature of crimes being reported, increased demand for policing services, and has fundamentally changed the nature of policing in recent years. These advancements and growing demands are expected to further enhance the adoption of digital solutions for policing during the forecast period.

Technological has made the decision-making processes more dependent on information and analytics. They allow police offers to provide their services as and when the crime occurs, analytics allows police officers to respond almost instantaneously or even predict crime in certain instances. Proactive action driven by data analytics helps police officers to deter criminal activity with increased patrol and police activity in at-risk areas during specific times, all determined by data analysis.

Social media platforms are also increasingly offering new avenues of engagement between citizens and law enforcement. Online crime reporting through social media informers, social media analysis, crowdsourcing intelligence, and digital media for whistle-blowers are increasing the adoption of digital media solutions for policing. Social media platforms are also vital in improving engagement between the community and police to increase cooperation and improve citizen involvement.

The COVID-19 pandemic has resulted in an increase in the adoption of such digital policing solutions. With mandatory lockdowns being implemented in many countries, police organizations began increasingly adopting digital policing solutions to improve policing through data analytics and social media drives. These solutions have played a vital role in allowing police to better engage with the community during the pandemic and mitigate the spread of COVID.

The market is restrained by the lack of adequate funding and budgetary retrains on police departments, growing demand for skilled professionals capable of utilizing digital policing solutions, high cost of adoption, the threat of cyberattacks, and privacy concerns regarding the collection of data and surveillance.

Based on application, the digital policing market is segmented into gunshot detection solutions, data tracking & management, jail population management, digital forensics diagnostics, data verification, drone defense solution, and others. The data tracking & management segment is expected to hold the largest piece of the market during the forecast period. The large amounts of data being generated through surveillance equipment spread throughout cities are being increasingly employed by police organizations to analyze and predict crime hotspots. The growing demand for data analytics to improve patrol patterns to improve response times and deter crime is expected to result in the segment becoming the fastest-growing segment during the forecast period.

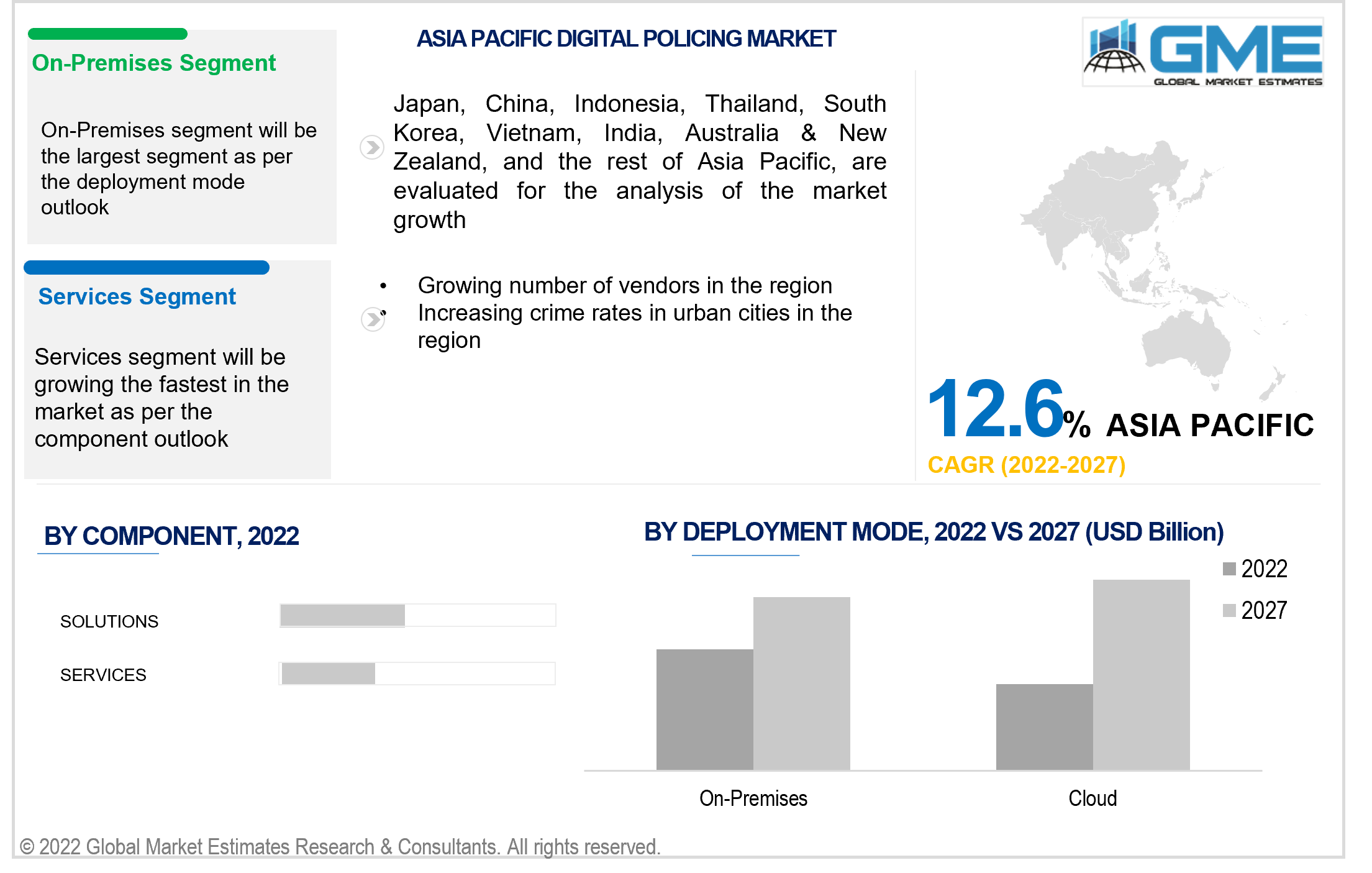

Based on the component, the digital policing market is segmented into solutions and services. The solutions segment is expected to hold the largest piece of the market during the forecast period. Solutions are more traditionally employed by police organizations owing to the nature of police work that involves high levels of secrecy and requires extensive training to ensure effective policing. The growing advancements in technology have increased the adoption of digital solutions, police officers are beginning to require training to utilize new technology and are expected to result in the services segment growing at the fastest rate during the forecast period.

Based on the deployment mode, the digital policing market is segmented into on-cloud and premises. The on-premises segment is expected to hold the largest piece of the market during the forecast period. The growing acceptance of cloud technology and services are expected to result in the cloud segment growing at the fastest rate during the forecast period.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The region’s strong surveillance network, large expenditure on policing, and a large number of the urban population are the major drivers of the market in the region. Growing adoption of technological advancements and increased investment in R&D have been the major drivers of the market.

The APAC region is expected to become the fastest-growing market region during the forecast period. The growing urban population in the region, increasing number of urban cities, and growing investment in smart city initiatives by governments in the region are the major contributors to the growth of the market in the region.

Accenture, Promise, Inc, Mark43, ShotSpotter, GrayShift, ANDE, Trumania, Colt, Metrc, SPIDR Tech, TechPolice, and Suburbs of Surveillance, among others, are the key players in the digital policing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Digital Policing Industry Overview, 2020-2027

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Component Overview

2.1.4 Deployment Mode Overview

2.1.6 Regional Overview

Chapter 3 Digital Policing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of crime rates

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and high cost of adoption

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 Deployment Mode Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Digital Policing Market, By Application

4.1 Application Outlook

4.2 Gunshot Detection Solutions

4.2.1 Market Size, By Region, 2020-2027 (USD Billion)

4.3 Data Tracking & Management

4.3.1 Market Size, By Region, 2020-2027 (USD Billion)

4.4 Jail Population Management

4.4.1 Market Size, By Region, 2020-2027 (USD Billion)

4.5 Digital Forensics Diagnostics

4.5.1 Market Size, By Region, 2020-2027 (USD Billion)

4.6 Data Verification

4.6.1 Market Size, By Region, 2020-2027 (USD Billion)

4.7 Drone Defense Solution

4.7.1 Market Size, By Region, 2020-2027 (USD Billion)

4.8 Others

4.8.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 5 Digital Policing Market, By Component

5.1 Component Outlook

5.2 Solutions

5.2.1 Market Size, By Region, 2020-2027 (USD Billion)

5.3 Services

5.3.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 6 Digital Policing Market, By Deployment Mode

6.1 Cloud

6.1.1 Market Size, By Region, 2020-2027 (USD Billion)

6.2 On-premises

6.2.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 7 Digital Policing Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2027 (USD Billion)

7.2.2 Market Size, By Application, 2020-2027 (USD Billion)

7.2.3 Market Size, By Component, 2020-2027 (USD Billion)

7.2.4 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Application, 2020-2027 (USD Billion)

7.2.4.2 Market Size, By Component, 2020-2027 (USD Billion)

7.2.4.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.2.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.2.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2027 (USD Billion)

7.3.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.3 Market Size, By Component, 2020-2027 (USD Billion)

7.3.4 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Application, 2020-2027 (USD Billion)

7.3.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.6.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.3.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.3.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Application, 2020-2027 (USD Billion)

7.3.9.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.9.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Application, 2020-2027 (USD Billion)

7.3.10.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.10.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Application, 2020-2027 (USD Billion)

7.3.11.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.11.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2027 (USD Billion)

7.4.2 Market Size, By Application, 2020-2027 (USD Billion)

7.4.3 Market Size, By Component, 2020-2027 (USD Billion)

7.4.4 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Application, 2020-2027 (USD Billion)

7.4.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.6.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.4.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.4.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Application, 2020-2027 (USD Billion)

7.4.9.2 Market size, By Component, 2020-2027 (USD Billion)

7.4.9.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Application, 2020-2027 (USD Billion)

7.4.10.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.10.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2027 (USD Billion)

7.5.2 Market Size, By Application, 2020-2027 (USD Billion)

7.5.3 Market Size, By Component, 2020-2027 (USD Billion)

7.5.4 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Application, 2020-2027 (USD Billion)

7.5.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.5.6.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.5.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.5.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.5.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.5.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2027 (USD Billion)

7.6.2 Market Size, By Application, 2020-2027 (USD Billion)

7.6.3 Market Size, By Component, 2020-2027 (USD Billion)

7.6.4 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Application, 2020-2027 (USD Billion)

7.6.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.6.6.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.6.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.6.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Application, 2020-2027 (USD Billion)

7.6.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.6.7.3 Market Size, By Deployment Mode, 2020-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 Accenture

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Promise, Inc

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Mark43

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 ShotSpotter

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 GrayShift

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 ANDE

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Trumania

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Colt

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Metrc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Digital Policing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Policing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS