Global Disposable Medical Device Sensors Market Size, Trends & Analysis - Forecasts to 2027 By Product (Biosensors, Accelerometers, Pressure Sensors, Temperature Sensors, Image Sensors, Other Sensors), By Type of Sensors (Stripe Sensors, Wearable Sensors, Invasive Sensors, Ingestible Sensors), By Application (Patient Monitoring, Diagnostic Testing, Therapeutics, Diagnostic Imaging), By End-User (Homecare setting, Hospital and Clinics, Research Centers), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

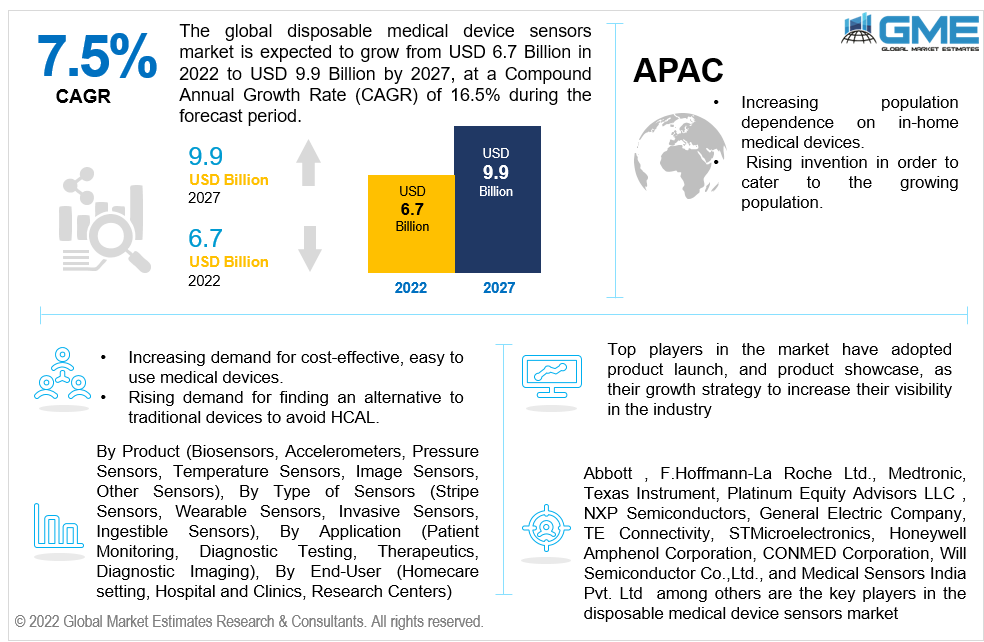

The Global Disposable Medical Device Sensors Market is projected to grow from USD 6.7 Billion in 2022 to USD 9.9 Billion by 2027 at CAGR value of 7.5% from 2022 to 2027.

Medical practitioners are relying on medical and patient healthcare data in order to plan treatment and medication. This type of data is possible to collect, manage and evaluate due to medical device sensors which allow doctors to collect reliable and precise data and collate them in order to diagnose a patient’s illness. Apart from the accuracy, disposable medical device sensors are easy to use, low-cost and have readable output.

Disposable medical device sensors market growth is largely driven by rising concerns over hospital-acquired infections and contamination, the increasing incidence of target conditions, the growing demand for home-based medical care devices, significant technological advancements in the last few years, and government support for R&D activities for these devices.

The emerging markets in developing countries are also expected to provide growth opportunities for players in the disposable medical device sensors market.

Furthermore, rising need for time-saving medical devices which can be used to measure health-stats at the patient’s convenience and rising awareness of remote patient monitoring will propel the market magnanimously.

Disposable medical device sensors conveniently protect patients from HCAI and other viral spreads, because of its single-use, safe and sterilized features. According to WHO, Healthcare-associated Infection (HCAI) cause 16 million additional days of hospital care and contribute to 110000 deaths every year. Along with this, patients incur financial loss with annual losses approximately touted to be 7 billion pounds.

The COVID-19 situation has significantly boosted the disposable medical device sensors market. This is because disposable devices do not spread infectious diseases. An example of this is YOY sales of the company Ambu, whose disposable bronchoscope sales increased by 50% in the pandemic year.

This was because bronchoscopes were in demand and the disposable ones even higher given the nature of the SARS-CoV-2 disease. Manufacturers producing similar disposable medical devices have seen an increase in their sales due to people not going to the doctor for consultations owing to certain COVID-19 restrictions, lack of available medical professionals and devices and for safety reasons.

The medical industry has seen severe disruptions in its activity owing to the conflict between Russia and Ukraine. Disruption in raw material of medical supplies, devices, equipments, instruments, reagents and other products owing to blockades in the Black Sea and other shipping routes has resulted in a fall in demand for shipping through seaways. With major shipping companies stopping services to and from Russia, the demand for healthcare services and products has fallen in the two countries.

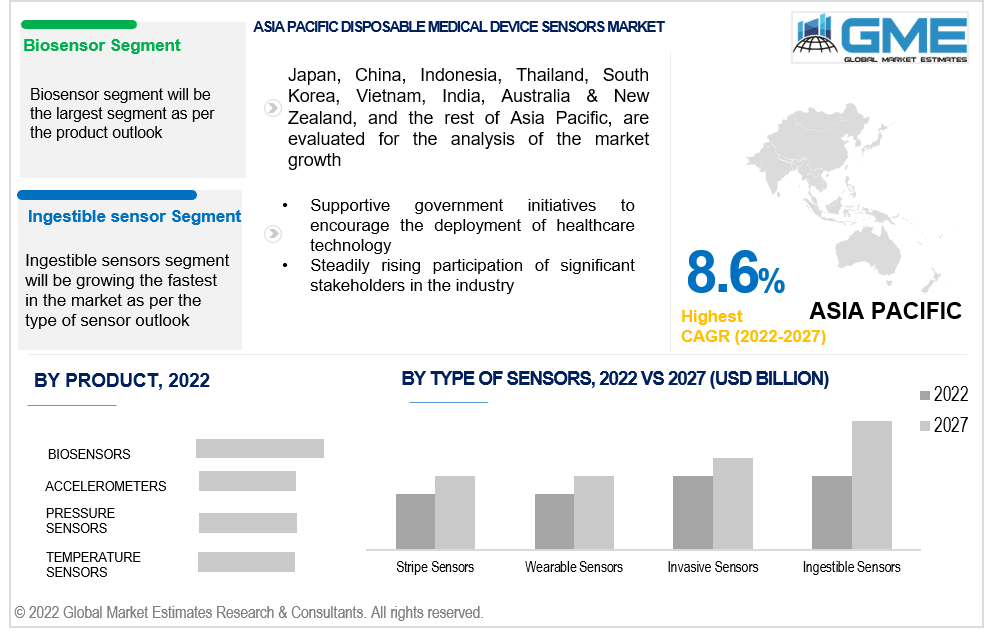

Based on the Product, the disposable medical device sensors market is divided into biosensors, accelerometers, pressure sensors, temperature sensors, image sensor and other sensors. The biosensors segment is expected to be the largest segment in the market from 2022 to 2027.

Biosensors are used in several devices such as drug test strips, alcohol detection test strips, infectious disease test strips as well as blood glucose monitoring. These biosensors help in early detection of all kind of disease or health issues and are hence widely used by people before approaching medical practitioners. Temperature sensors are expected to be growing the fastest owing to rising demand amid COVID-19 pandemic.

Based on the type of sensors, the disposable medical device sensors market is divided into stripe sensors, wearable sensors, invasive sensors and ingestible sensors. The ingestible sensor segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

Ingestible sensors are generally in the form of pills are used to detect bodily functions such as heart rate, blood pressure and infections. The results can be monitored through a handheld device like a mobile phone. Hence, rising prevalence of blood pressure patients, CVDs and other cardiac diseases will help the market grow

Based on the application, the disposable medical device sensors market is divided into patient monitoring, diagnostic testing, therapeutics and diagnostic imaging. The diagnostic testing segment is expected to have the largest share in the market from 2022 to 2027.

Diagnostic testing has become extremely prevalent among symptomatic and asymptomatic patients after the onset of coronavirus. Rapid antigen diagnostic tests for detection of COVID-19 were used throughout the pandemic by people who experienced symptoms of the disease to the ones who wanted to travel and also by the individuals who were in direct contact with patients.

Based on the End-User, the disposable medical device sensors market is divided into homecare setting, hospital and clinics and research centers. Homecare segment will be the largest and fastest growing segment.

Rising concerns over hospital-acquired infections and contamination, the increasing incidence of target conditions, the growing demand for home-based medical care devices, significant technological advancements are some of the factors driving the growth of this segment.

North America (the United States, Canada, and Mexico) will have a dominant share in the Disposable Medical Device Sensors market from 2022 to 2027. The major factor driving the growth of the market in the North American region is due to a large presence of prominent companies in the region and the rising concern of HCAI rates across the region.

High adoption rate of the devices by individuals along with positively growing research and development activities are some of the other reasons for the market’s growth.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the disposable medical device sensors market during the forecast period.

Increasing population and its dependence on at-home medical devices due to lack of medical devices at all times has boosted the disposable medical device sensors market. Rising invention in medical devices in order to cater to the growing population has also helped the market substantially.

Abbott, F.Hoffmann-La Roche Ltd., Medtronic, Texas Instrument, Platinum Equity Advisors LLC , NXP Semiconductors, General Electric Company, TE Connectivity, STMicroelectronics, Honeywell International Inc. , Analog Devices, Inc. , Smiths Group Plc, Koninklijke Philips N.V., Sensirion AG, Endress+Hauser Group Services AG, VitalConnect, Amphenol Corporation, CONMED Corporation, Will Semiconductor Co.,Ltd., and Medical Sensors India Pvt. Ltd among others are the key players in the disposable medical device sensors market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filing, Company Blogs & Website

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Application & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Product Outlook

2.3 Type of Sensor Outlook

2.4 Application Outlook

2.5 End-User Outlook

2.6 Regional Outlook

Chapter 3 Global Disposable Medical Device Sensors Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Disposable Medical Device Sensors Market

3.4 Metric Data on Healthcare Industry

3.5 Market Dynamic

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Disposable Medical Device Sensors Market: Product Trend Analysis

4.1 Product: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Biosensors

4.2.1 Market Estimates & Forecast Analysis of Biosensors Segment, By Region, 2019-2027 (USD Billion)

4.3 Accelerometers

4.3.1 Market Estimates & Forecast Analysis of Accelerometers Markets Segment, By Region, 2019-2027 (USD Billion)

4.4 Pressure Sensors

4.4.1 Market Estimates & Forecast Analysis of Pressure Sensors Markets Segment, By Region, 2019-2027 (USD Billion)

4.5 Temperature Sensors

4.5.1 Market Estimates & Forecast Analysis of Temperature Sensors Markets Segment, By Region, 2019-2027 (USD Billion)

4.6 Image Sensors

4.6.1 Market Estimates & Forecast Analysis of Image Sensors Markets Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Disposable Medical Device Sensors Market: Type of Sensor Trend Analysis

5.1 Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Stripe Sensors

5.2.1 Market Estimates & Forecast Analysis of Stripe Sensors Segment, By Region, 2019-2027 (USD Billion)

5.3 Wearable Sensors

5.3.1 Market Estimates & Forecast Analysis of Wearable Sensors Segment, By Region, 2019-2027 (USD Billion)

5.4 Invasive Sensors

5.4.1 Market Estimates & Forecast Analysis of Invasive Sensors Segment, By Region, 2019-2027 (USD Billion)

5.5 Ingestible Sensors

5.5.1 Market Estimates & Forecast Analysis of Ingestible Sensors Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Disposable Medical Device Sensors Market: Application Trend Analysis

6.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Patient Monitoring

6.2.1 Market Estimates & Forecast Analysis of Patient Monitoring Segment, By Region, 2019-2027 (USD Billion)

6.3 Diagnostic Testing

6.3.1 Market Estimates & Forecast Analysis of Governance, Diagnostic Testing Segment, By Region, 2019-2027 (USD Billion)

6.4 Therapeutics, and Diagnostic Imaging

6.4.1 Market Estimates & Forecast Analysis of Therapeutics, and Diagnostic Imaging Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Disposable Medical Device Sensors Market: End-User Trend Analysis

7.1 End-User: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

7.2 BFSI

7.2.1 Market Estimates & Forecast Analysis of BFSI Segment, By Region, 2019-2027 (USD Billion)

7.3 Homecare setting

7.3.1 Market Estimates & Forecast Analysis of Homecare setting Segment, By Region, 2019-2027 (USD Billion)

7.4 Hospitals

7.4.1 Market Estimates & Forecast Analysis of Hospitals Segment, By Region, 2019-2027 (USD Billion)

7.5 Clinics, and Research Centres

7.5.1 Market Estimates & Forecast Analysis of Clinics, and Research Centres Segment, By Region, 2019-2027 (USD Billion)

Chapter 9 Disposable Medical Device Sensors Market, By Region

8.1 Regional Outlook

8.2 North America

8.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

8.2.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.2.3 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.2.4 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.2.5 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.2.6 U.S.

8.2.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.2.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.2.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.2.6.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.2.7 Canada

8.2.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.2.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.2.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.2.7.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.2.8 Mexico

8.2.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

8.2.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

8.2.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

8.2.8.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3 Europe

8.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

8.3.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.3 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.4 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.5 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.6 Germany

8.3.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.6.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.7 UK

8.3.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.7.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.8 France

8.3.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.8.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.9 Russia

8.3.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.9.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.9.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.10 Italy

8.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.10.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.10.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.10.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.11 Spain

8.3.11.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.3.11.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.3.11.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.3.11.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.3.12 Rest of Europe

8.3.12.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

8.3.12.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

8.3.12.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

8.3.12.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4 Asia Pacific

8.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

8.4.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.4.3 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.4.4 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.4.5 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4.6 China

8.4.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.4.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.4.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.4.6.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4.7 India

8.4.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.4.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.4.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.4.7.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4.8 Japan

8.4.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.4.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.4.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.4.8.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4.9 Australia

8.4.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.4.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.4.9.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.4.9.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4.10 South Korea

8.4.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.4.10.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.4.10.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.4.10.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.4.11 Rest of Asia Pacific

8.4.11.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

8.4.11.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

8.4.11.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

8.4.11.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.5 Central & South America

8.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

8.5.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.5.3 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.5.4 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.5.5 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.5.6 Brazil

8.5.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.5.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.5.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.5.6.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.5.7 Rest of Central & South America

8.5.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.5.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.5.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.5.7.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.6 Middle East & Africa

8.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

8.6.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.6.3 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.6.4 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.6.5 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.6.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.6.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.6.6.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.6.7 United Arab Emirates

8.6.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.6.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.6.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.6.7.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.6.8 South Africa

8.6.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

8.6.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027(USD Billion)

8.6.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027(USD Billion)

8.6.8.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

8.6.9 Rest of Middle East & Africa

8.6.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

8.6.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

8.6.9.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

8.6.9.4 Market Estimates & Forecast Analysis, By End-User, 2019-2027(USD Billion)

Chapter 9 Competitive Analysis

9.1 Key Global Players, Recent Developments & their Impact on the Industry

9.2 Four Quadrant Competitor Positioning Matrix

9.2.1 Key Innovators

9.2.2 Market Leaders

9.2.3 Emerging Players

9.2.4 Market Challengers

9.3 Vendor Landscape Analysis

9.4 End-User Landscape Analysis

9.5 Company Market Share Analysis, 2021

Chapter 10 Company Profile Analysis

10.1 Abbott

10.1.1 Company Overview

10.1.2 Financial Analysis

10.1.3 Strategic Initiatives

10.1.4 Product Benchmarking

10.2 F. Hoffmann-La Roche Ltd

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Initiatives

10.2.4 Product Benchmarking

10.3 Medtronic

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Initiatives

10.3.4 Product Benchmarking

10.4 Texas Instrument

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Initiatives

10.4.4 Product Benchmarking

10.5 Platinum Equity Advisors LLC

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Initiatives

10.5.4 Product Benchmarking

10.6 NXP Semiconductors

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Initiatives

10.6.4 Product Benchmarking

10.7 General Electric Company

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Initiatives

10.7.4 Product Benchmarking

10.8 TE Connectivity

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Strategic Initiatives

10.8.4 Product Benchmarking

10.9 STMicroelectronics

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Initiatives

10.9.4 Product Benchmarking

10.10 Honeywell International Inc

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Initiatives

10.10.4 Product Benchmarking

10.11 Other Companies

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Initiatives

10.11.4 Product Benchmarking

List of Tables

1 Technological Advancements In Disposable Medical Device Sensors Market

2 Global Disposable Medical Device Sensors Market: Key Market Drivers

3 Global Disposable Medical Device Sensors Market: Key Market Challenges

4 Global Disposable Medical Device Sensors Market: Key Market Opportunities

5 Global Disposable Medical Device Sensors Market: Key Market Restraints

6 Global Disposable Medical Device Sensors Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

8 Biosensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

9 Accelerometers Markets: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

10 Pressure Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

11 Temperature Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

12 Image Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

13 Global Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

14 Stripe Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

15 Wearable Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

16 Invasive Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

17 Ingestible Sensors: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

18 Global Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

19 Patient Monitoring: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

20 Diagnostic Testing: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

21 Therapeutics, and Diagnostic Imaging: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

22 Global Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

23 Homecare setting: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

24 Hospitals: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

25 Clinics, and Research Centres: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

26 Regional Analysis: Global Disposable Medical Device Sensors Market, By Region, 2019-2027 (USD Billion)

27 North America: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

28 North America: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

29 North America: Disposable Medical Device Sensors Market, By Application , 2019-2027 (USD Billion)

30 North America: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

31 North America: Disposable Medical Device Sensors Market, By Country, 2019-2027 (USD Billion)

32 U.S: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

33 U.S: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

34 U.S: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

35 U.S: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

36 Canada: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

37 Canada: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

38 Canada: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

39 Canada: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

40 Mexico: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

41 Mexico: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

42 Mexico: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

43 Mexico: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

44 Europe: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

45 Europe: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

46 Europe: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

47 Europe: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

48 Germany: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

49 Germany: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

50 Germany: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

51 Germany: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

52 UK: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

53 UK: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

54 UK: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

55 UK: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

56 France: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

57 France: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

58 France: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

59 France: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

60 Italy: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

61 Italy: Disposable Medical Device Sensors Market, By T Type of Sensor Ype, 2019-2027 (USD Billion)

62 Italy: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

63 ltaly: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

64 Spain: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

65 Spain: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

66 Spain: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

67 Spain: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

68 Rest Of Europe: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

69 Rest Of Europe: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

70 Rest Of Europe: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

71 Rest of Europe: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

72 Asia Pacific: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

73 Asia Pacific: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

74 Asia Pacific: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

75 Asia Pacific: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

76 Asia Pacific: Disposable Medical Device Sensors Market, By Country, 2019-2027 (USD Billion)

77 China: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

78 China: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

79 China: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

80 China: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

81 India: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

82 India: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

83 India: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

84 India: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

85 Japan: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

86 Japan: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

87 Japan: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

88 Japan: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

89 South Korea: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

90 South Korea: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

91 South Korea: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

92 South Korea: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

93 Middle East & Africa: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

94 Middle East & Africa: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

95 Middle East & Africa: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

96 Middle East & Africa: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

97 Middle East & Africa: Disposable Medical Device Sensors Market, By Country, 2019-2027 (USD Billion)

98 Saudi Arabia: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

99 Saudi Arabia: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

100 Saudi Arabia: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

101 Saudi Arabia: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

102 UAE: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

103 UAE: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

104 UAE: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

105 UAE: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

106 Central & South America: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

107 Central & South America: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

108 Central & South America: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

109 Central & South America: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

110 Central & South America: Disposable Medical Device Sensors Market, By Country, 2019-2027 (USD Billion)

111 Brazil: Disposable Medical Device Sensors Market, By Product, 2019-2027 (USD Billion)

112 Brazil: Disposable Medical Device Sensors Market, By Type, 2019-2027 (USD Billion)

113 Brazil: Disposable Medical Device Sensors Market, By Application, 2019-2027 (USD Billion)

114 Brazil: Disposable Medical Device Sensors Market, By End-User, 2019-2027 (USD Billion)

115 Abbott: Products Offered

116 F. Hoffmann-La Roche Ltd: Products Offered

117 Medtronic: Products Offered

118 Texas Instrument: Products Offered

119 Platinum Equity Advisors LLC: Products Offered

120 NXP Semiconductors: Products Offered

121 General Electric Company: Products Offered

122 TE Connectivity: Products Offered

123 STMicroelectronics: Products Offered

124 Honeywell International Inc: Products Offered

125 Analog Devices, Inc: Products Offered

126 Other Companies: Products Offered

List of Figures

1. Global Disposable Medical Device Sensors Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Disposable Medical Device Sensors Market: Penetration & Growth Prospect Mapping

7. Global Disposable Medical Device Sensors Market: Value Chain Analysis

8. Global Disposable Medical Device Sensors Market Drivers

9. Global Disposable Medical Device Sensors Market Restraints

10. Global Disposable Medical Device Sensors Market Opportunities

11. Global Disposable Medical Device Sensors Market Challenges

12. Key Disposable Medical Device Sensors Market Manufacturer Analysis

13. Global Disposable Medical Device Sensors Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Abbott: Company Snapshot

16. Abbott: Swot Analysis

17. F. Hoffmann-La Roche Ltd: Company Snapshot

18. F. Hoffmann-La Roche Ltd: Swot Analysis

19. Medtronic: Company Snapshot

20. Medtronic: Swot Analysis

21. Texas Instrument: Company Snapshot

22. Texas Instrument: Swot Analysis

23. Platinum Equity Advisors LLC: Company Snapshot

24. Platinum Equity Advisors LLC: Swot Analysis

25. NXP Semiconductors: Company Snapshot

26. NXP Semiconductors: Swot Analysis

27. General Electric Company: Company Snapshot

28. General Electric Company: Swot Analysis

29. TE CONNECTIVITY: Company Snapshot

30. TE CONNECTIVITY: Swot Analysis

31. STMicroelectronics: Company Snapshot

32. STMicroelectronics: Swot Analysis

33. Enchandia AB Software: Company Snapshot

34. Enchandia AB Software: Swot Analysis

35. Honeywell International Inc: Company Snapshot

36. Honeywell International Inc: Swot Analysis

37. Analog Devices, Inc: Company Snapshot

38. Analog Devices, Inc: Swot Analysis

39. Other Companies: Company Snapshot

40. Other Companies: Swot Analysis

The Global Disposable Medical Device Sensors Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Disposable Medical Device Sensors Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS