Global DNA Sequencing Market Size, Trends & Analysis - Forecasts to 2026 By Products & Services (Consumables, Instruments, Services), By Technology (Sanger Sequencing, Next-Generation Sequencing [Whole Genome Sequencing, Whole Exome Sequencing], Third Generation DNA Sequencing [Single-Molecule Real-Time Sequencing (SMRT), Nanopore Sequencing]), By Application (Oncology, Clinical Investigation, Reproductive Health, Agrigenomics & Forensics, Consumer Genomics, HLA Typing/Immune System Monitoring, Others), By End-Use (Clinical Research, Pharmaceutical and Biotechnology Companies, Academic Research, Hospitals & Clinics, Other Users), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

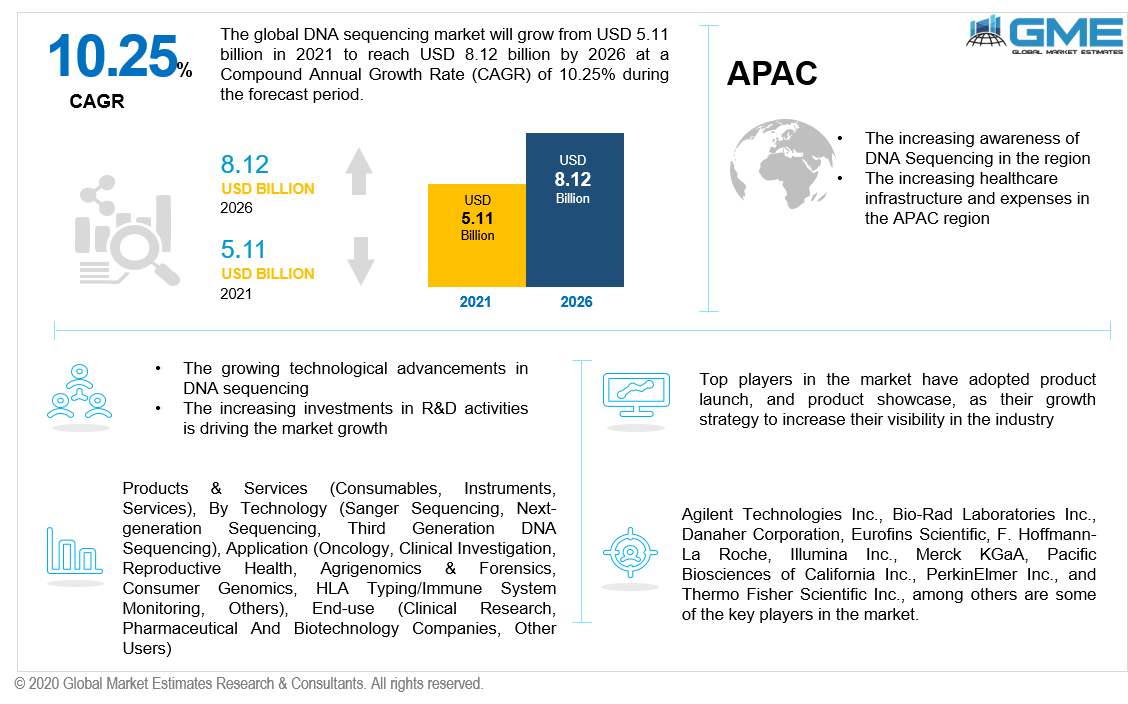

The global DNA sequencing market will grow from USD 5.11 billion in 2021 to reach USD 8.12 billion in 2026, with a CAGR of 10.25% during the forecast period.

The increasing product launch strategies by top market players, rising technological developments in DNA sequencing techniques and its application in medical science are some of the key drivers expected to drive market growth during the forecast period.

DNA sequencing is a laboratory technique used to determine the exact sequence of bases (A, C, G, and T) in a DNA molecule. The DNA base sequence carries the information a cell needs to assemble protein and RNA molecules. DNA sequence information is important to scientists investigating the functions of genes.

The other factors supporting the growth of the DNA sequencing market are the growing application of sequencing in clinical diagnosis and rising investments in research & development activities by government organizations.

Moreover, the growing global burden of the elderly population, cancer, diabetes, CVDs and infectious disease, rising demand for personalized drugs and medicines, increasing research activities related to gene target drug delivery systems are some of the other factors anticipated to fuel the market expansion.

The rising prevalence of genetic disorders will propel the growth of the market. As per research conducted in Scientific Reports Journal 2019 by Hong-Yan Liu et al., it is estimated that 80% of rare diseases are genetic in origin, making genome sequencing-based diagnosis a promising alternative for rare-disease management.

The market is witnessing a series of the launch of software and mobile applications that empowers the scientist by bringing the latest peer-reviewed NGS algorithms out of the command line and into an intuitive point and click interface. These apps support during the process of reference-guided alignments, de novo assembly, variant calling, or SNP analyses. For instance, GelApp 2.0, a DNA sequencing Android software, was recently updated in 2019 and released with a 56.0 percent increase in protein band detection accuracy and a 36.0 percent increase in DNA band detection accuracy.

The COVID-19 pandemic has a favorable impact on the market, as it has increased demand for DNA sequencing technologies in the development of treatments and diagnostic procedures of infectious disease, bacterial and viral infection (including SARS-CoV-2). The demand for DNA sequencing technologies has increased significantly as the number of COVID-19 cases has increased dramatically since 2020. The National Health Service of the United Kingdom, Genomics England, and Genetics of Mortality in Critical Care collaborated with Illumina to generate whole-genome sequence of 35,000 citizens infected with COVID-19 in the United Kingdom in order to study the virus and its physiological effects.

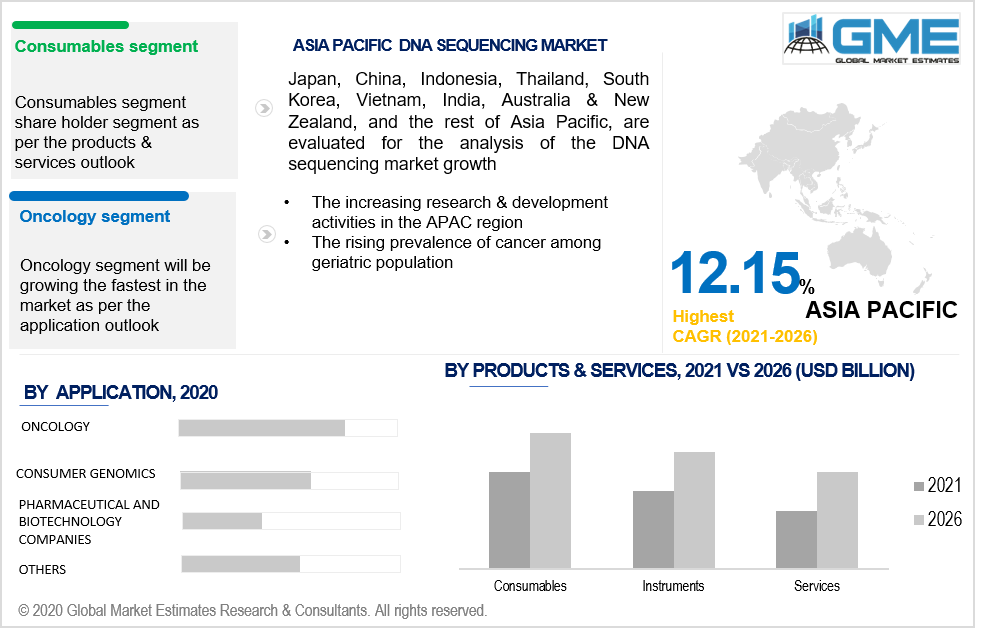

The product & services segment is categorized into consumables, instruments, and services. The consumables segment is expected to hold the largest market share during the forecast period [2021 to 2026]. The widespread availability of reagents and kits for all stages of library construction, such as DNA fragmentation, enrichment, adapter ligation, and quality control, are some of the leading drivers that support the DNA sequencing market growth.

Oncology, clinical investigation, reproductive health, agrigenomics & forensics, consumer genomics, HLA typing/immune system monitoring, and other applications are the major application segments of the DNA sequencing market. The consumer genomics application will be the fastest-growing segment with the highest CAGR value from 2021 to 2026. This is due to the increasing number of paternity tests, genetic disease diagnosis, ancestry diagnosis, and genealogical tests.

The oncology segment is expected to hold the largest market share during the forecast period. The technology has a wide range of potential in clinical research and the development of cancer diagnoses and treatments. However, NGS technology has proved its ability to identify and characterize clinically relevant genetic variations across several genes at an extraordinary speed in a single test, demonstrating its capabilities as a high-throughput and cost-effective technique.

Sanger sequencing, next-generation sequencing, and third-generation DNA sequencing are some of the technologies used in this segment. The next-generation sequencing segment dominated the market and is also expected to hold the largest market share during the forecast period. Genome sequencing is faster, more economical, and more precise because of substantial breakthroughs in these technologies and the low cost of sequencing service. Furthermore, NGS technology is in demand as a routine clinical diagnostic test, which boosts the growth of DNA sequencing market’s revenue share.

The end-use segment is categorized into clinical research, pharmaceutical and biotechnology companies, academic research, hospitals & clinics, and other users. The academic research segment is expected to capture the largest share of the market from 2021 to 2026. Next-Generation Sequencing and Sanger technology and are widely accepted in academic and institutional research projects. Furthermore, rising financing and investment initiatives have helped increase the demand for DNA sequencing products in these organizations, resulting in the growth of the market.

As per the geographical analysis, the DNA sequencing market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. North America region is expected to hold the largest market share due to the presence of key players in the US market, increasing investments in R&D activities, and rising healthcare expenses on disease diagnostic domain. Moreover, the growing government initiatives in Canada and the United States to promote cancer drug development and personalized drug therapy research along with the rising healthcare infrastructure are some of the other factors propelling DNA sequencing market share over the forecast period.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising cases of cancer, rising government expenditure in the healthcare sector, and increasing R&D investments in genome research will impact the DNA sequencing market growth positively.

Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation, Eurofins Scientific, F. Hoffmann-La Roche, Illumina Inc., Merck KGaA, Pacific Biosciences of California Inc., PerkinElmer Inc., and Thermo Fisher Scientific Inc., among others are some of the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2019, Thermo Fisher Scientific launched a new product the Ion Torrent Genexus System. It is the first fully integrated next-generation sequencing (NGS) platform with an automated specimen-to-report workflow that provides results in a single day at a reasonable cost.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global DNA Sequencing Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Products & Services Overview

2.1.3 End-Use Overview

2.1.4 Application Overview

2.1.5 Technology Overview

2.1.6 Regional Overview

Chapter 3 DNA Sequencing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising investments in DNA sequencing research activities

3.3.2 Industry Challenges

3.3.2.1 Lack of skilled professionals and infrastructure

3.4 Prospective Growth Scenario

3.4.1 Products & Services Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 DNA Sequencing Market, By Products & Services

4.1 Products & Services Outlook

4.2 Consumables

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Instruments

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Services

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 DNA Sequencing Market, By End-Use

5.1 End-Use Outlook

5.2 Clinical Research

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Pharmaceutical and Biotechnology Companies

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Academic Research

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Hospitals & Clinics

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Other Users

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 DNA Sequencing Market, By Application

6.1 Application Outlook

6.2 Oncology

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Clinical Investigation

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Reproductive Health

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Agrigenomics & Forensics

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Consumer Genomics

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 HLA Typing/Immune System Monitoring

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Others

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 DNA Sequencing Market, By Technology

7.1 Technology Outlook

7.2 Sanger Sequencing

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Next-Generation Sequencing

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3.1.1 Whole Genome Sequencing Market Size, By Region, 2020-2026 (USD Billion)

7.3.1.2 Whole Exome Sequencing Market Size, By Region, 2020-2026 (USD Billion)

7.4 Third Generation DNA Sequencing

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4.1.1 Single-Molecule Real-Time Sequencing (SMRT) Market Size, By Region, 2020-2026 (USD Billion)

7.4.1.2 Nanopore Sequencing Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 DNA Sequencing Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.4 Market Size, By Application, 2020-2026 (USD Billion)

8.2.5 Market Size, By End-Use, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.5 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.5 Market Size, By End-Use, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.5 Market Size, By End-Use, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.5 Market Size, By End-Use, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By End-Use, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Products & Services, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By End-Use, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Agilent Technologies Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Bio-Rad Laboratories Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Danaher Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 F. Hoffmann-La Roche

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Illumina Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Thermo Fisher Scientific Inc

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Merck KGaA

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 PerkinElmer Inc

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 Pacific Biosciences of California Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Eurofins Scientific

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global DNA Sequencing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the DNA Sequencing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS