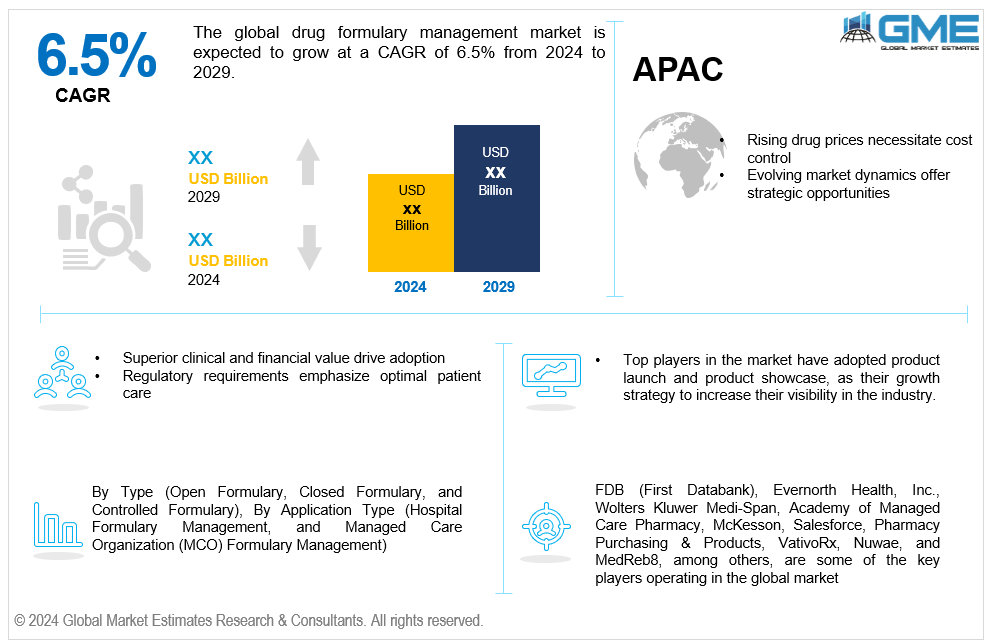

Global Drug Formulary Management Market Size, Trends & Analysis - Forecasts to 2029 By Type (Open Formulary, Closed Formulary, and Controlled Formulary), By Application Type (Hospital Formulary Management and Managed Care Organization (MCO) Formulary Management), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global drug formulary management market is expected to exhibit a CAGR of 6.5% from 2024 to 2029.

The drug formulary management market plays a critical role in the healthcare sector, particularly as the prices of medications continue to rise. Formularies serve as curated lists of drugs covered by specific healthcare plans, ensuring access to necessary medicines while controlling costs. Effective formulary management becomes essential for maintaining optimal clinical and financial value with the constant influx of new drugs to the market. This involves continuous monitoring of the market landscape to capitalize on cost-saving opportunities and adjust formularies accordingly. Moreover, alongside utilization management and benefit design, formularies contribute significantly to managing trends in healthcare costs.

Formulary development typically involves an independent panel of clinical experts who prioritize clinical factors and consider excluding products with comparable alternatives or questionable efficacy. Plans must, however, also make sure that members have access to the drugs they need, even if they are not initially listed in the formulary. Pharmacy benefit managers (PBMs), who profit from their collective scale, are essential in negotiating discounts and providing affordable medications on national formularies. Like generics, biosimilar products, for instance, have the potential to save a significant amount of money by increasing competition and cutting costs without sacrificing efficacy.

The drug formulary management industry is expected to grow rapidly as healthcare environments and technologies evolve. As healthcare systems navigate the complexities of medication management, formulary management is expected to remain critical to promoting therapeutic outcomes and clinically sound, economically sustainable pharmacological therapy.

The global drug formulary management market is being driven by a myriad of factors, including advancements in pharmaceutical formulation software and drug development platforms. These technologies enable pharmaceutical companies to optimize drug formulations, streamline formulation processes, and enhance drug stability through formulation stability testing. Additionally, formulation management systems, drug formulation databases and formulation optimization tools play a crucial role in automating formulation workflow management, ensuring efficient formulation scale-up solutions, and maintaining formulation quality control throughout the drug development lifecycle. Moreover, the integration of regulatory compliance software facilitates adherence to regulatory guidelines, ensuring that drug formulations meet the required standards and drug formulation documentation requirements.

Furthermore, pharmaceutical formulation automation and pharmaceutical formulation services and pharmaceutical formulation consultancy offer valuable expertise in formulation design software services, formulation ingredient sourcing, Drug formulation analytics, formulation risk assessment, and formulation cost analysis, contributing to the overall efficiency and success of drug formulary management. With the increasing complexity of drug formulations and the stringent regulatory landscape, the demand for comprehensive formulation solutions is expected to rise, driving market growth. As pharmaceutical companies continue to prioritize innovation and efficiency in drug development, the adoption of advanced formulation technologies and services will remain pivotal in driving the evolution of the global drug formulary management market

Furthermore, collaboration between pharmacy benefit managers (PBMs) and plan sponsors allows for deeper discounts and the availability of cost-effective medications on national formularies, resulting in cost reductions for both sponsors and patients. The drug formulary management market is likely to evolve in response to technological improvements and changes in the healthcare industry. As healthcare systems navigate the challenges of medication management, formulary management is expected to play an essential role in achieving clinically sound, cost-effective drug therapy and excellent therapeutic results.

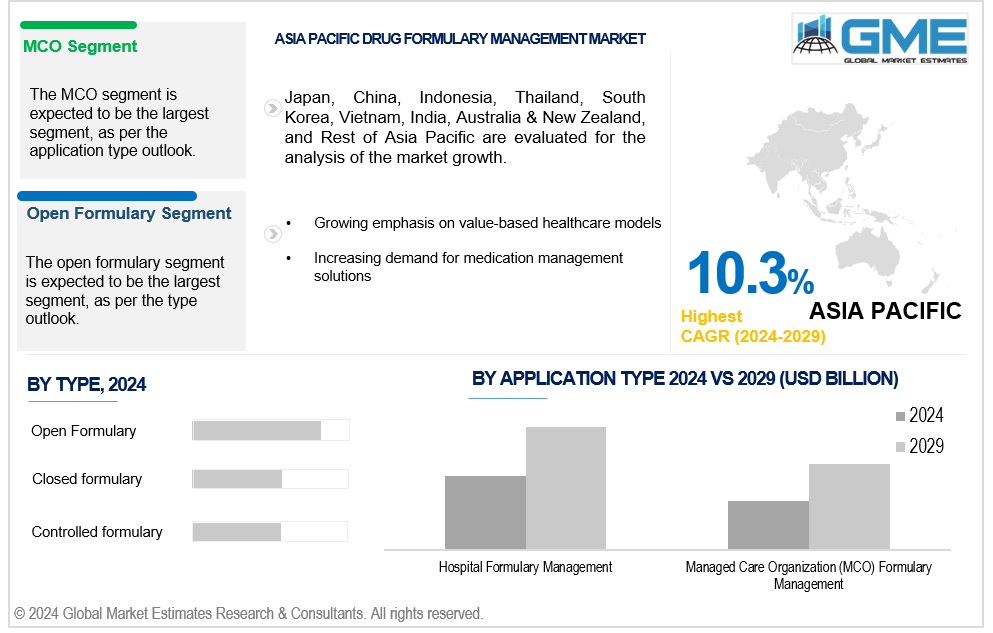

The open formulary is expected to be the fastest-growing segment over the forecast period. Open formularies cover a wide range of pharmaceuticals, with the plan sponsor often covering a percentage of the cost for all drugs, regardless of formulary classification. This flexibility appeals to many sponsors and patients since it allows access to a wide choice of treatments without severe restrictions. The open formulary type is particularly appealing for plans that want additional options to their members, allowing individuals to access prescriptions depending on their specific requirements and preferences..

The closed formulary segment is expected to hold the largest share of the market during the forecast period. In closed formularies, plan sponsors cover just the pharmaceuticals on the formulary, with non-formulary drugs being excluded unless approved through a formulary override procedure. This method enables sponsors to maintain tighter control over drug prices and utilization while encouraging the use of clinically favored drugs. While closed formularies may limit patient options compared to open formularies, they frequently result in lower total prescription spending for plan sponsors. Closed formularies can also ease administrative processes and decision-making for both sponsors and patients.

Within the global drug formulary management market, the hospital formulary management is anticipated to stand out as the fastest-growing segment. Hospital formulary management involves creating and maintaining medication lists tailored to the specific needs and requirements of healthcare facilities. These formularies are designed to optimize patient care, promote cost-effective medication use, and ensure compliance with regulatory standards. Hospitals are increasingly adopting advanced formulary management solutions to streamline medication processes, enhance patient safety, and improve overall operational efficiency. With the rising demand for comprehensive healthcare services and the growing focus on patient outcomes, hospital formulary management solutions are expected to experience significant growth in the coming years.

Conversely, the managed care organization (MCO) formulary management is expected to be the largest segment in the global drug formulary management market. Managed care organizations play a crucial role in administering healthcare benefits and services to their members, including the management of drug formularies. MCO formulary management involves developing, evaluating, and implementing medication lists that align with the organization's clinical and financial objectives. These formularies are designed to balance patient needs, cost considerations, and evidence-based medicine to optimize healthcare outcomes. With the increasing complexity of healthcare delivery systems and the rising emphasis on value-based care, MCOs are investing in advanced formulary management solutions to enhance care coordination, control drug costs, and improve patient outcomes. As a result, the MCO formulary management segment continues to dominate the market, driven by the ongoing evolution of managed care practices and the growing demand for integrated healthcare solutions.

In the global drug formulary management market, North America is expected to be the largest region. This estimate is based on various variables, including a well-established healthcare infrastructure, widespread use of new healthcare technologies, and the existence of large pharmaceutical corporations and healthcare organizations. Furthermore, North America's stringent regulatory frameworks and robust reimbursement policies contribute to the region's dominant position. Furthermore, the increased emphasis on cost-cutting initiatives and the growing demand for effective drug management solutions are boosting the use of formulary management systems throughout North American healthcare institutions.

Asia Pacific is expected to witness the fastest growth in the global drug formulary management market over the forecast period. The APAC region's rapid growth can be ascribed to increasing population, rising healthcare expenditure, and the construction of healthcare infrastructure in emerging economies. Furthermore, government measures aimed at improving healthcare access and affordability are driving the implementation of innovative healthcare technology, such as formulary management solutions, across APAC. Furthermore, the rising frequency of chronic diseases, combined with a growing awareness of the value of evidence-based prescription management, is boosting demand for effective formulary management systems across APAC countries.

FDB (First Databank), Evernorth Health, Inc., Wolters Kluwer Medi-Span, Academy of Managed Care Pharmacy, McKesson, Salesforce, Pharmacy Purchasing & Products, VativoRx, Nuwae, and MedReb8, among others, are some of the key players operating in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2023, the Federal Trade Commission (FTC) issued compulsory orders to two group purchasing organizations (GPOs) responsible for negotiating drug rebates on behalf of other PBMs. FTC also announced its ongoing investigation into pharmacy benefit managers (PBMs) and their influence on prescription drug accessibility and affordability. These orders were issued to Zinc Health Services, LLC, and Ascent Health Services, LLC, and compelled the entities to provide detailed information and records regarding their business practices. This action followed the FTC's issuing compulsory orders to the six largest PBMs in the U.S. healthcare industry. These PBMs, which are often part of vertically integrated companies, served as intermediaries negotiating rebates and fees with drug manufacturers, establishing drug formularies, and reimbursing pharmacies for patients' prescriptions.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL DRUG FORMULARY MANAGEMENT MARKET, BY TYPE

4.1 Introduction

4.2 Drug Formulary Management Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Open Formulary

4.4.1 Open Formulary Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Closed Formulary

4.5.1 Closed Formulary Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Controlled Formulary

4.6.1 Controlled Formulary Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL DRUG FORMULARY MANAGEMENT MARKET, BY APPLICATION

5.1 Introduction

5.2 Drug Formulary Management Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Hospital Formulary Management

5.4.1 Hospital Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Managed Care Organization (MCO) Formulary Management

5.5.1 Managed Care Organization (MCO) Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL DRUG FORMULARY MANAGEMENT MARKET, BY REGION

6.1 Introduction

6.2 North America Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central & South America Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central & South America Drug Formulary Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 FDB (First Databank)

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Evernorth Health, Inc.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Wolters Kluwer Medi-Span

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Academy of Managed Care Pharmacy

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 McKesson

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Salesforce

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Pharmacy Purchasing & Products

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 VativoRx

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Nuwae

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 MedReb8

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 InApplicationation Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company InApplicationation Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

2 Open Formulary Market, By Region, 2021-2029 (USD Million)

3 Closed Formulary Market, By Region, 2021-2029 (USD Million)

4 Controlled Formulary Market, By Region, 2021-2029 (USD Million)

5 Global Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

6 Hospital Formulary Management Market, By Region, 2021-2029 (USD Million)

7 Managed Care Organization (MCO) Formulary Management Market, By Region, 2021-2029 (USD Million)

8 Regional Analysis, 2021-2029 (USD Million)

9 North America Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

10 North America Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

11 North America Drug Formulary Management Market, By Country, 2021-2029 (USD Million)

12 U.S. Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

13 U.S. Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

14 Canada Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

15 Canada Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

16 Mexico Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

17 Mexico Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

18 Europe Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

19 Europe Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

20 Europe Drug Formulary Management Market, By Country, 2021-2029 (USD Million)

21 Germany Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

22 Germany Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

23 U.K. Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

24 U.K. Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

25 France Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

26 France Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

27 Italy Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

28 Italy Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

29 Spain Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

30 Spain Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

31 Netherlands Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

32 Netherlands Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

33 Rest Of Europe Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

34 Rest Of Europe Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

35 Asia Pacific Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

36 Asia Pacific Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

37 Asia Pacific Drug Formulary Management Market, By Country, 2021-2029 (USD Million)

38 China Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

39 China Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

40 Japan Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

41 Japan Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

42 India Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

43 India Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

44 South Korea Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

45 South Korea Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

46 Singapore Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

47 Singapore Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

48 Thailand Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

49 Thailand Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

50 Malaysia Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

51 Malaysia Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

52 Indonesia Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

53 Indonesia Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

54 Vietnam Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

55 Vietnam Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

56 Taiwan Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

57 Taiwan Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

58 Rest of APAC Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

59 Rest of APAC Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

60 Middle East and Africa Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

61 Middle East and Africa Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

62 Middle East and Africa Drug Formulary Management Market, By Country, 2021-2029 (USD Million)

63 Saudi Arabia Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

64 Saudi Arabia Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

65 UAE Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

66 UAE Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

67 Israel Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

68 Israel Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

69 South Africa Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

70 South Africa Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

71 Rest Of Middle East and Africa Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

72 Rest Of Middle East and Africa Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

73 Central & South America Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

74 Central & South America Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

75 Central & South America Drug Formulary Management Market, By Country, 2021-2029 (USD Million)

76 Brazil Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

77 Brazil Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

78 Chile Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

79 Chile Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

80 Argentina Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

81 Argentina Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

82 Rest Of Central & South America Drug Formulary Management Market, By Type, 2021-2029 (USD Million)

83 Rest Of Central & South America Drug Formulary Management Market, By Application, 2021-2029 (USD Million)

84 FDB (First Databank): Products & Services Offering

85 Evernorth Health, Inc.: Products & Services Offering

86 Wolters Kluwer Medi-Span: Products & Services Offering

87 Academy of Managed Care Pharmacy: Products & Services Offering

88 McKesson: Products & Services Offering

89 Salesforce: Products & Services Offering

90 Pharmacy Purchasing & Products : Products & Services Offering

91 VativoRx: Products & Services Offering

92 Nuwae, Inc: Products & Services Offering

93 MedReb8: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Drug Formulary Management Market Overview

2 Global Drug Formulary Management Market Value From 2021-2029 (USD Million)

3 Global Drug Formulary Management Market Share, By Type (2023)

4 Global Drug Formulary Management Market Share, By Application (2023)

5 Global Drug Formulary Management Market, By Region (Global Market)

6 Technological Trends In Global Drug Formulary Management Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Drug Formulary Management Market

10 Impact Of Challenges On The Global Drug Formulary Management Market

11 Porter’s Five Forces Analysis

12 Global Drug Formulary Management Market: By Type Scope Key Takeaways

13 Global Drug Formulary Management Market, By Type Segment: Revenue Growth Analysis

14 Open Formulary Market, By Region, 2021-2029 (USD Million)

15 Closed Formulary Market, By Region, 2021-2029 (USD Million)

16 Controlled Formulary Market, By Region, 2021-2029 (USD Million)

17 Global Drug Formulary Management Market: By Application Scope Key Takeaways

18 Global Drug Formulary Management Market, By Application Segment: Revenue Growth Analysis

19 Hospital Formulary Management Market, By Region, 2021-2029 (USD Million)

20 Managed Care Organization (MCO) Formulary Management Market, By Region, 2021-2029 (USD Million)

21 Regional Segment: Revenue Growth Analysis

22 Global Drug Formulary Management Market: Regional Analysis

23 North America Drug Formulary Management Market Overview

24 North America Drug Formulary Management Market, By Type

25 North America Drug Formulary Management Market, By Application

26 North America Drug Formulary Management Market, By Country

27 U.S. Drug Formulary Management Market, By Type

28 U.S. Drug Formulary Management Market, By Application

29 Canada Drug Formulary Management Market, By Type

30 Canada Drug Formulary Management Market, By Application

31 Mexico Drug Formulary Management Market, By Type

32 Mexico Drug Formulary Management Market, By Application

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 FDB (First Databank): Company Snapshot

36 FDB (First Databank): SWOT Analysis

37 FDB (First Databank): Geographic Presence

38 Evernorth Health, Inc.: Company Snapshot

39 Evernorth Health, Inc.: SWOT Analysis

40 Evernorth Health, Inc.: Geographic Presence

41 Wolters Kluwer Medi-Span: Company Snapshot

42 Wolters Kluwer Medi-Span: SWOT Analysis

43 Wolters Kluwer Medi-Span: Geographic Presence

44 Academy of Managed Care Pharmacy: Company Snapshot

45 Academy of Managed Care Pharmacy: Swot Analysis

46 Academy of Managed Care Pharmacy: Geographic Presence

47 McKesson: Company Snapshot

48 McKesson: SWOT Analysis

49 McKesson: Geographic Presence

50 Salesforce: Company Snapshot

51 Salesforce: SWOT Analysis

52 Salesforce: Geographic Presence

53 Pharmacy Purchasing & Products : Company Snapshot

54 Pharmacy Purchasing & Products : SWOT Analysis

55 Pharmacy Purchasing & Products : Geographic Presence

56 VativoRx: Company Snapshot

57 VativoRx: SWOT Analysis

58 VativoRx: Geographic Presence

59 Nuwae, Inc.: Company Snapshot

60 Nuwae, Inc.: SWOT Analysis

61 Nuwae, Inc.: Geographic Presence

62 MedReb8: Company Snapshot

63 MedReb8: SWOT Analysis

64 MedReb8: Geographic Presence

65 Other Companies: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

The Global Drug Formulary Management Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Drug Formulary Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS