Global Elastomeric Membrane Market Size, Trends & Analysis - Forecasts to 2026 By Type (Sheet, Liquid Applied), By Application (Roofs & Walls, Underground Construction, Wet Areas), By End-user (Non-residential, Residential Construction), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

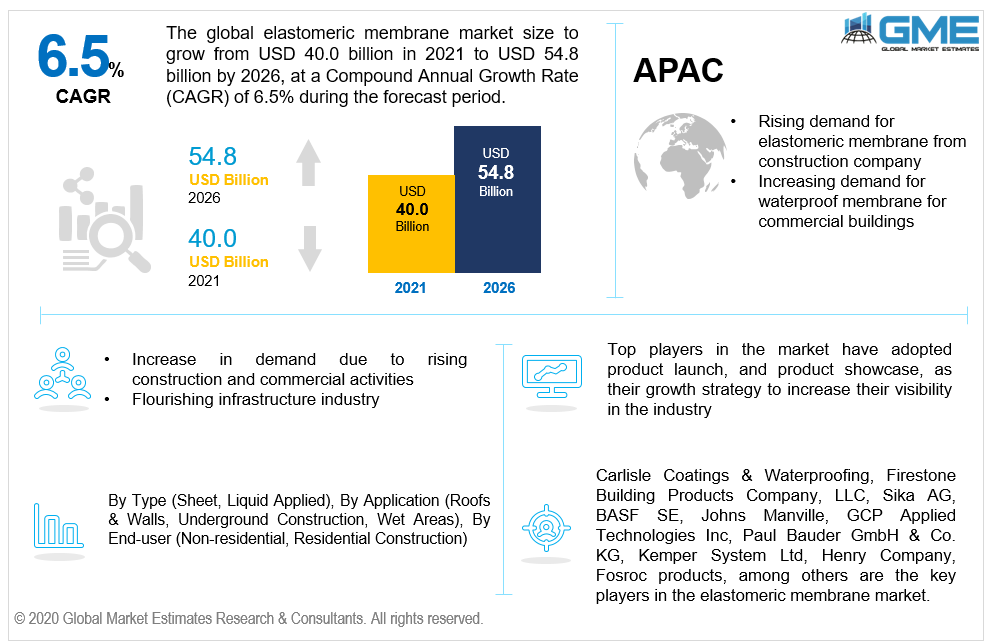

The global elastomeric membrane market is projected to grow from USD 40.0 billion in 2021 to USD 54.8 billion by 2026 at a CAGR value of 6.5% from 2021 to 2026.

The market is primarily driven by the growing infrastructure industry as well as rising stringent environmental norms and regulations related to the use of elastomeric membrane. In many regions, government rules have compelled most of the manufacturers to adhere to stringent standards and usage norms for waterproofing materials. Substantial spending in the commercial construction industry of emerging economies such as India, Indonesia, and many others are predicted to assist the elastomeric membrane market growth.

Elastomeric membrane is a weatherproof construction material that can withstand extreme temperatures while being strong and durable. It is especially suggested in areas where climatic conditions are extreme. Elastomeric membranes have a 25-to-30-year lifetime.

The elastomer membrane roofing material is commonly used on flat roofs with a wide surface area, such as those on commercial buildings. It is a high-performance roofing material that improves waterproofing while reducing maintenance.

The elastomeric membrane market is being driven by an increase in construction and commercial activities, as well as increased demand for elastomeric membrane in the construction industry and laws related to energy efficiency.

Elastomeric membrane is an appropriate choice for roofing because of its longevity and moisture resistance. These membranes are ideal for large flat and low-slope roofs as they necessitate minimal management. The outstanding water resistance of elastomeric membrane roofing is also a significant benefit. These materials are specifically developed to fit in regions where asphalt shingles are not an option.

The COVID-19 outbreak had a significant impact on the elastomeric membrane market. Because many industries were forced to halt operations owing to the lockout, demand for elastomeric membranes fell drastically, limiting the market growth and revenue of the in 2020. It also caused a supply chain disturbance, resulting in lower demand for elastomeric membranes.

On the other hand, the market's growth was being hampered by the availability of different low-cost alternative sources such as asphalt and gravel.

The expensive cost associated with membranes, as well as the lack of specialized skilled professionals required to handle elastomeric membrane appropriately, will, ultimately, limit the market's expansion. Price changes in raw materials are also a major stumbling block to market’s progress during the forecast period.

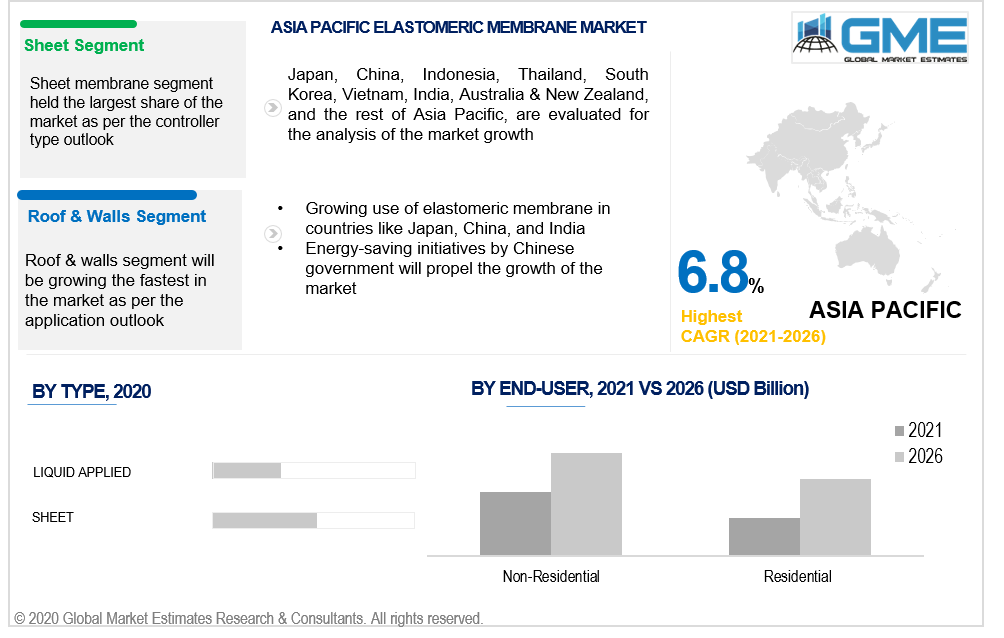

Based on the type of elastomeric membrane, the market is segmented into sheet, and liquid applied. The sheet membrane segment of elastomeric membrane market has the largest share during the forecast period due to its exceptional productivity and increased demand for flat roofs in non-residential constructions.

Commercial buildings often use TPO and EPDM sheet membranes to enhance their energy consumption. As the need for green roofing in sustainable building rises, sheet membranes are expected to become more popular. The liquid applied membrane is the fastest-growing variety owing to its seamless installation, ease of use, and accessibility of lesser quality materials in comparison to sheet membranes.

Based on the application of elastomeric membrane, the market is segmented into roofs & walls, underground construction, and wet areas. The roofs & walls segment is expected to hold the largest share of the market during the forecast period. Increased investment on non-residential developments such as industrial, educational, and apartment buildings is anticipated to promote the growth of the elastomeric membrane market in rooftops.

Any roof can benefit from elastomeric coatings since they provide a seamless layer. It also protects against pollution exposure, UV radiation, and salty air. Furthermore, these materials are reusable, and you can recoat your roof every ten years to extend its life, moving the market forward.

Based on the various end-users adopting elastomeric membrane, the market is segmented into non-residential, and residential construction. The non-residential segment is expected to hold the most dominant share of the market from 2021 to 2026. The non-residential construction end-use market is predicted to rise due to rapid growth for high-cost construction projects, as well as the affordability of elastomeric membranes and their capacity to minimise energy consumption in commercial and industrial buildings.

Due to the rising growth of commercial buildings such as retail malls, multiplexes, exhibition halls, commercial establishments, workplaces, and commercial sites, the market is also booming. Additionally, due to increased manufacturing activity and expansion in retail building to suit consumer needs, industrial construction projects are also on the rise.

Based on region, the market is segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and the Asia Pacific. The Asia Pacific region is expected to growth the fastest in the market from 2021 to 2026. Due to the sheer growing use of elastomeric membrane in countries like as Japan, China, and India, the Asia-Pacific region is the quickest developing market for elastomeric membrane. China is the world's largest construction market. Enhancing public infrastructure, and energy-saving initiatives by Chinese government have increased the demand for waterproof membranes, which has boosted APAC market growth.

North America controls a large portion of the elastomeric membrane industry, which is affected by US government rules and standards for pollution management. The region's non-residential sector is rapidly developing as a result of rising industrialization in the US and Canada, which is propelling organizational construction. Furthermore, the Middle East's real estate and infrastructure industries, particularly in Saudi Arabia and the United Arab Emirates, are projected to draw significant investment.

Carlisle Coatings & Waterproofing, Firestone Building Products Company, LLC, Sika AG, BASF SE, Johns Manville, GCP Applied Technologies Inc, Paul Bauder GmbH & Co. KG, Kemper System Ltd, Henry Company, Fosroc products, among others are the key players in the elastomeric membrane market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Elastomeric Membrane Market Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Elastomeric Membrane Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapidly rising demand from construction and commercial industry

3.3.2 End-User Challenges

3.3.2.1 Limited availability of different low-cost alternative materials

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Elastomeric Membrane Market, By Type

4.1 Type Outlook

4.2 Sheet

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Liquid Applied

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Elastomeric Membrane Market, By Application

5.1 Application Outlook

5.2 Roofs & Walls

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Underground Construction

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Wet Areas

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Elastomeric Membrane Market, By End-User

6.1 Non-Residential

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Residential Construction

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Elastomeric Membrane Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Sika AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Firestone Building Products Company, LLC

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Carlisle Coatings & Waterproofing

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 SOPREMA S.A.S

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 BASF SE

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 GCP Applied Technologies Inc

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Johns Manville

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Kemper System Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Copernit S.p.A

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Elastomeric Membrane Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Elastomeric Membrane Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS