Global Electronic Adhesives Market Size, Trends, and Analysis - Forecasts to 2026 By Form (Liquid, Solid, and Paste), By Resin Type (Epoxy, Silicone, Acrylic, PU, and Others [MMA, Rubber, Cyanoacrylates, Polyester, SMP, Parylene, Polysulfide, Urethane Acrylate, & Polyamide]), By Product Type (Electrically Conductive Adhesives, Thermally Conductive Adhesives, and Others [Optically Clear Adhesives, Structural Adhesives, Underfills, & Sealants]), By End-Use Industry (Computers & Servers, Communications, Consumer Electronics, Industrial, Medical, Automotive, Commercial Aviation, Defence, and Other Transportation), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

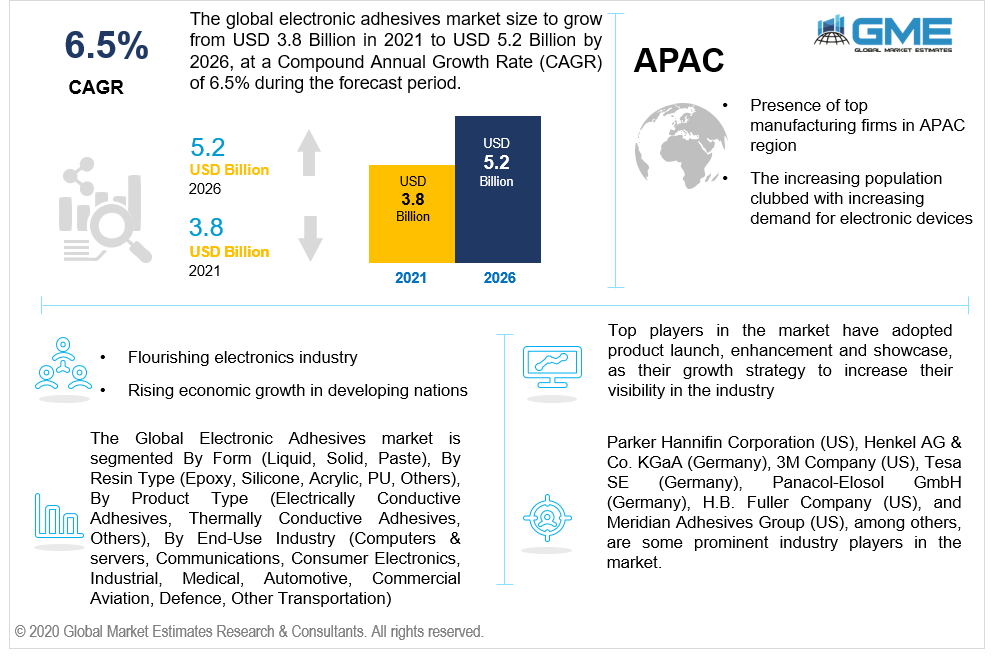

The global electronic adhesives market is projected to grow from USD 3.8 billion in 2021 and is analyzed to reach USD 5.2 billion by 2026 at CAGR of 6.5%.

The global electronic adhesives market will grow rapidly owing to flourishing electronics industry, rising economic growth in developing nations and increasing demand for electronic adhesives from computers & server manufacturers, smart communication device manufacturers, consumer electronics, and industrial, medical, automotive, commercial aviation, defense, & transportation industries.

The market has experienced an exponential increase in the demand for adhesives due to the increasing production and sales of long-term electronics and parts. These adhesives are also majorly used in components of bonding surface mounts, in wire tacking, and encapsulating the components used in electronics. Adhesives used in the electronic application are not only restricted for the purpose of guaranteeing a solid bond between two substrates, but they also protect the wirings present in the circuits and motherboards of the electronics and ensure the complete flow in the circuit. Adhesives such as hot glue and cold glue are also used to safeguard the operations in the electronics.

With an increase in the usage of consumer electronics all across the globe, the market for adhesvies is ought to grow exponentially. Increasing usage of smartphones, hard drives, computers, circuits, mobile phone power banks, headphones, television screens, and many more has increased the requirement of adhesives in the electronic manufacturing market. Besides the usage of these devices, the increasing technological and mechanical advancements due to rising demand for long-lasting electronic devices is also supporting the growth of the market.

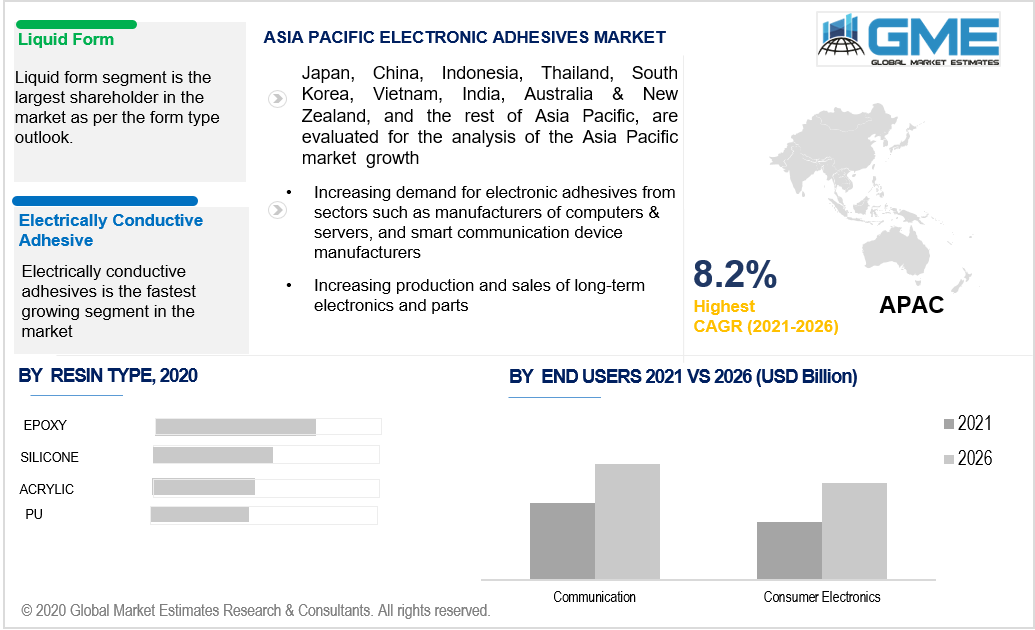

Based on the form type, the market is segmented into liquid, solid, and paste. The liquid form of adhesives are majorly used for applicational purposes in the electronics industry and hence hold the largest share in the electronic adhesives market. Liquid adhesives fulfill and ensure the reliability of various parts, tapes, dressings, and devices, for a significant time period. In the liquid form, these adhesives prevent the risk of displacement or dislodgement of the parts or wire connected to the respective devices. These adhesives, unlike under forms, prevent any device related mishaps or infections and enable the manufacturers to ensure safety at no risks. Liquid adhesives having the flexibility in usage also provide better efficiency in assembling the substrates to each other and hence will be the fastest growing segment too.

Based on the resin type, the market is segmented into Epoxy, Silicone, Acrylic, PU, and Others. The others segment include MMA, rubber, cyanoacrylates, polyester, SMP, Parylene, polysulfide, urethane acrylate, and polyamide. High adoptability and availability of Epoxy resins are the major reason for its dominance in the market.

Epoxy resins are extensively used in electronic manufacturing industries as their refined tuned nature acts as a plus point towards various specific applications. Compared to other resin types, epoxy type results to be very beneficial for the electronics manufacturers owing to its properties of efficiency in resistance to chemicals and moistures. These also provide excessive strength to the device, making it durable, with high mechanical properties.

Based on product, the market is divided into electrically conductive adhesives, thermally conductive adhesives, and others. The others segment include optically clear adhesives, structural adhesives, under fills, and sealants.

Electrically conductive adhesives are prominently used in electronic manufacturing industries, and hence this segment holds the largest share in the global market. Conductive adhesives have replaced the traditional tin-lead solders, due to their improvised property of being electrical insulators. They are available in either isotropic conductive form or anisotropic conductive form. Using electrically conductive adhesives reduces the production or manufacturing steps cost.

Based on end-user the market is segmented into computers & servers, communications, consumer electronics, industrial, medical, automotive, commercial aviation, defence, other transportation.

The growing communication industry has had a tremendous impact on the electronic adhesive market. The increasing demand for electronic mobile devices, along with expanding telecommunication industry, has helped the global electronic adhesives market grow rapidly. Hence, the communication segment will be the largest segment in the market. With the growing technological advancements in the communication sector, augment of Internet of Things (IoT), 4G and 5G telecommunication infrastructure, and the adoption of next generation telecommunication systems for electronic devices have supported the growth of this segment.

As per the geographical analysis, the market is segmented into North America, Europe, Asia Pacific, MEA, and CSA. Asia-Pacific region is analyzed to be the fastest growing segment in the market. Countries like China, Japan, Singapore are some of the biggest hubs for electronic and device manufacturers. The increasing population and rising demand for electronic devices like smartphones, television sets, and other communications systems are supporting the growth of the market. On the other hand, the North American region will have the largest share in the market. The presence of large enterprises in countries like the USA and Canada has enabled the North American region to sustain its dominant position in the market.

Parker Hannifin Corporation (US), Henkel AG & Co. KGaA (Germany), 3M Company (US), Tesa SE (Germany), Panacol-Elosol GmbH (Germany), H.B. Fuller Company (US), and Meridian Adhesives Group (US), among others, are some key industry players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2019, Henkel invested in a new production facility in Songdo, South Korea, to establish a global production hub for the electronics business. With this, the company expanded its geographic footprint and increased its market visibility.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Electronic Adhesives Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Resin Type Overview

2.1.4 End-User Overview

2.1.5 Form Overview

2.1.6 Regional Overview

Chapter 3 Electronic Adhesives Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for consumer electronics and medical devices

3.3.2 Industry Challenges

3.3.2.1 COVID-19 impact on manufacturing industry

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Resin Type Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Form Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Form Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Electronic Adhesives Market, By Type

4.1 Type Outlook

4.2 Electrically Conductive Adhesives

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Thermally Conductive Adhesives

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Others

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Electronic Adhesives Market, By End-User

5.1 End-User Outlook

5.2 Computers & Servers

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Communications

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Consumer Electronics

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Industrial

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Medical

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Automotive

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.8 Commercial Aviation

5.8.1 Market Size, By Region, 2016-2026 (USD Million)

5.9 Defence

5.9.1 Market Size, By Region, 2016-2026 (USD Million)

5.10 Transportation

5.10.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Electronic Adhesives Market, By Resin Type

6.1 Epoxy

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Silicone

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Acrylic

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 PU

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Electronic Adhesives Market, By Form

7.1 Liquid

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Solid

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Paste

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Electronic Adhesives Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Resin Type, 2016-2026 (USD Million)

8.2.4 Market Size, By End-User, 2016-2026 (USD Million)

8.2.5 Market Size, By Form, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.2.4.3 Market Size, By End-User, 2016-2026 (USD Million)

Market Size, By Form, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.5 Market Size, By Form, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Form, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.5 Market Size, By Form, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Resin Type, 2016-2026 (USD Million)

8.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Form, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5.5 Market Size, By Form, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Form, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6.5 Market Size, By Form, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Form, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Parker Hannifin Corporation (US)

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Henkel AG & Co. KGaA (Germany)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 3M Company (US)

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Tesa SE (Germany)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Panacol-Elosol GmbH (Germany)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 H.B. Fuller Company (US)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Meridian Adhesives Group (US)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Other Companies

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

The Global Electronic Adhesives Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electronic Adhesives Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS