Global Electronics & Electrical Licensing Market Size, Trends & Analysis - Forecasts to 2027 By Type of Retailer (Online Retailers and Brick & Mortar Retailers), By Type of Product (Electronic Devices and Home Appliances), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global electronics & electrical licensing market is projected to grow at a high CAGR value from 2022 to 2027. The growing demand for electronics and electrical appliances has been one of the major drivers of the market. Also, the growing number of electronics devices that are becoming available in the market and the variations in the products of different manufacturers have increased the need for protection against counterfeit products and theft of proprietary products.

Technological developments have also played a crucial role in the growth of the electronics and electrical licensing market. The adoption of new technologies like IoT, cloud technology, machine learning, and analytics, among others have increased the functionalities of electronic devices. With increased functionality, electronics manufacturers are increasingly turning to licensing to prevent the theft of their intellectual property and increase revenue generation through new revenue streams. Feature-based licensing is being increasingly explored by manufacturers to restrict specific features to users, market segments, and regions. Electronics manufacturers are also beginning to adopt subscription-based models which are expected to increase the demand for licensing during the forecast period.

With the advent of interconnected devices through IoT and cloud technologies, cloud-based licensing and analytics are also being developed to protect proprietary technology and protect revenue streams. The growing demand for restricting users to certain levels of device capabilities based on their subscription has also played a major role in the growing demand for electronics and electrical licensing.

The devices being manufactured by different companies are often identical and differentiated by their proprietary technology. Companies with unique products that work better than competitors or those that offer different functionalities from their competitors are required to protect their intellectual property from being exploited. The growing number of counterfeit products in the market harm the reputation of companies that make the original products and exploit customers. Licensing allows companies to protect their products from being exploited and take legal recourse against those attempting to do so.

Growing environmental regulations on products and their working, as well as power regulations in different regions and counties, have also increased the demand for electronics and electrical licensing services. Increasingly complex electronic devices and products require electronic components made by other manufacturers. The rise in the production of complex products has increased the demand for licensing in order to protect intellectual property and ensure adequate remuneration.

The market’s growth is restrained by the growing number of counterfeit products available in the market. The lack of adequate legal recourse in many developing countries and regions has also limited the potential for licensing and threatened the market. The cost of acquiring licensing, stringent regulations, and extensive procedures to attain licenses are also expected to restrain the growth of the market during the forecast period.

The COVID-19 pandemic has resulted in supply chain restrictions, limited the launch of new products, and restrained the development of new products. The forced shutdown of manufacturing and limitations on production capacity has hampered growth during the pandemic. The market is expected to bounce back during the forecast period.

The electronics & electrical licensing market is largely driven by the growing demand for complex electronic products, increased outsourcing of component manufacturing, adoption of new technologies, and exploration of new revenue models by manufacturers.

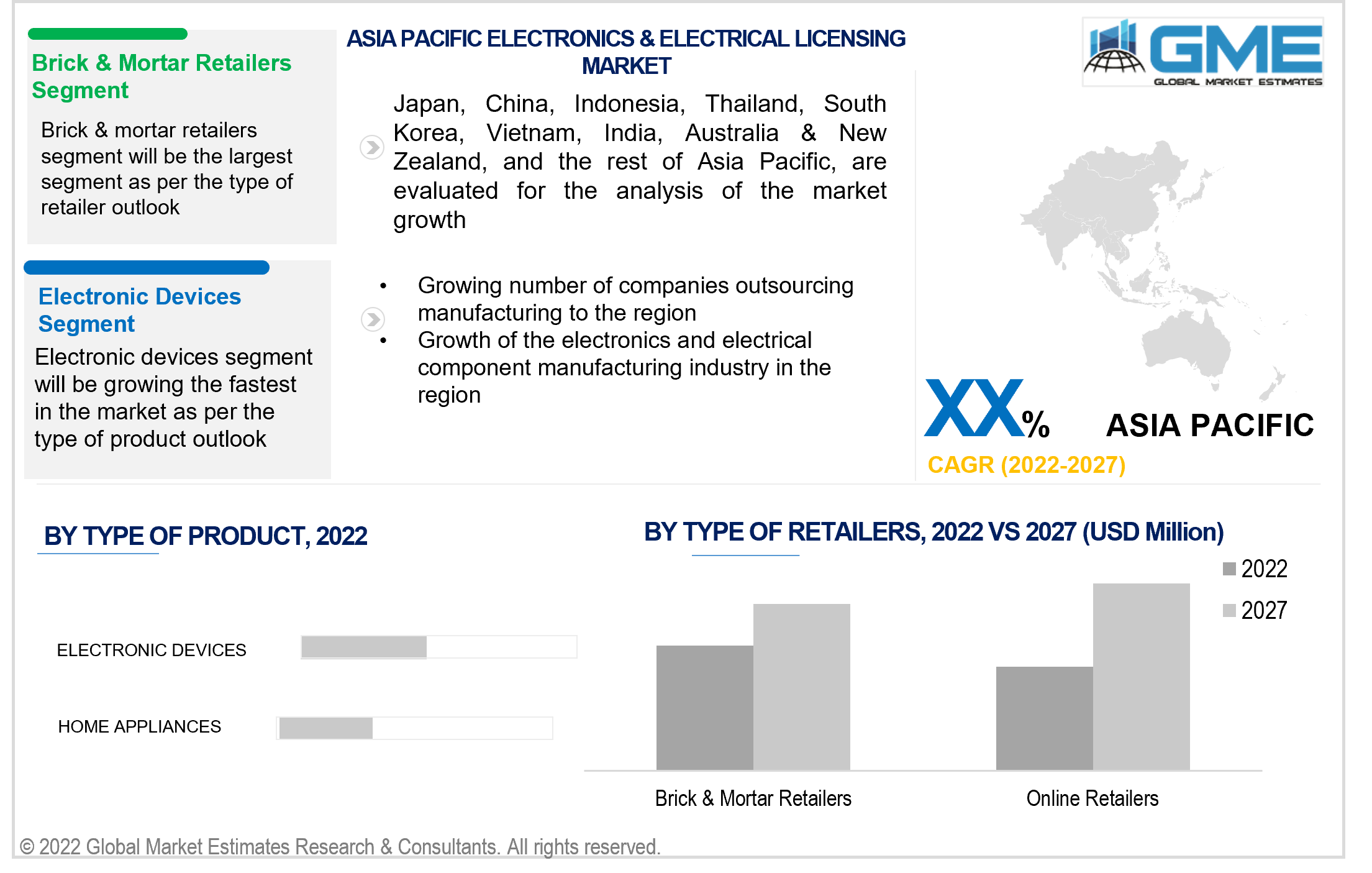

Based on the type of retailer, the electronics & electrical licensing market is segmented into online retailers and brick & mortar retailers. The brick & mortar retailer segment is expected to hold the largest piece of the market during the forecast period. The growing adoption of cloud technology, increasing usage of various software components in electronic devices, and the growth of subscription-based licensing models are expected to result in the online retailers segment growing faster during the forecast period.

Based on the various types of products in electronics & electrical licensing, the market is segmented into electronic devices and home appliances. The electronic devices segment held the lion’s share of the market. The growing number of electronic devices that are being developed, the growing number of vendors, and the increasing number of complex electronic devices are expected to result in the dominance of the electronic devices segment.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions.

The North American region is expected to be the dominant force in the market during the forecast period. The region’s strong licensing laws, greater spending on research and development of new products, a growing number of key electronics manufacturers, and the presence of major electronics manufacturers in the region have resulted in the dominance of the region.

The APAC region is expected to showcase the fastest growth rate among all regions. The growing number of electronics manufacturing, outsourcing of electronics and their components production to this region, and the growing number of regulations to protect intellectual property are the major factors of growth in the region.

TELEFUNKEN Licenses GmbH, Nalpeiron, Hasbro, Westinghouse, Cartoon Network Enterprises, Nascar, Hilco Consumer Capital, Jarden Corporation, Hewlett-Packard, The Lego Group, Plaroid, The Sharper Image, Hamilton Beach Brands, Global Icons, Moda Licensing, Technicolor, HDMI Licensing LLC, Orrick, DivX, PE Electronics Ltd, GitHub, KPPB LLP, Westinghouse Electric Private Limited, WiTricity, BBE Sound, MeitY, Clari-Fi, 3G, Muir Patent Law, VoltsUp Technologies Inc., HPO USA, and Avanci Licensing, among others are the key players in the electronics & electrical licensing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Electronics & Electrical Licensing Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type of Retailers Overview

2.1.3 Type of Product Overview

2.1.4 Regional Overview

Chapter 3 Electronics & Electrical Licensing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for electronics and electrical appliances

3.3.2 Industry Challenges

3.3.2.1 Growing number of counterfeit products available in the market

3.4 Prospective Growth Scenario

3.4.1 Type of Retailers Growth Scenario

3.4.2 Type of Product Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Electronics & Electrical Licensing Market, By Type of Retailers

4.1 Type of Retailers Outlook

4.2 Online Retailers

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Brick & Mortar Retailers

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Electronics & Electrical Licensing Market, By Type of Product

5.1 Type of Product Outlook

5.2 Electronic Devices

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Home Appliances

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Electronics & Electrical Licensing Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.2.3 Market Size, By Type of Product, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.3 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.4.3 Market Size, By Type of Product, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.4.7.2 Market size, By Type of Product, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.5.3 Market Size, By Type of Product, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.6.3 Market Size, By Type of Product, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Type of Product, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type of Retailers, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Type of Product, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 TELEFUNKEN Licenses GmbH

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Nalpeiron

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Hasbro

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Westinghouse

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Cartoon Network Enterprises

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Nascar

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Hilco Consumer Capital

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Jarden Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Electronics & Electrical Licensing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electronics & Electrical Licensing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS