Global Embedded Finance Market Size, Trends & Analysis - Forecasts to 2028 By Type (Embedded Banking, Embedded Payments {Digital Wallets/Mobile Wallets), In-App Payments, Contactless Payments/ NFC Payments, and Others}, Embedded Lending {Point-of-Sale (POS) Lending and Buy Now, Pay Later (BNPL)}, Embedded Insurance, Embedded Investments), By Business Model (B2B, B2C, B2B2B, and B2B2C), By End User (Retail & E-commerce, Healthcare, Logistics, Manufacturing, Travel & Entertainment, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

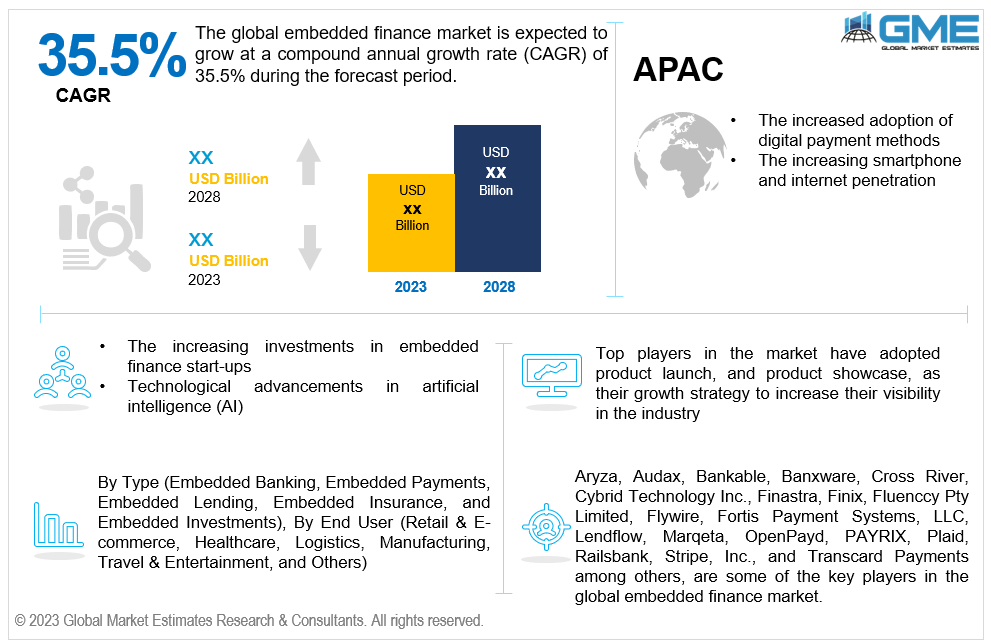

The global embedded finance market is estimated to exhibit a CAGR of 35.5% from 2023 to 2028.

The primary factors propelling the market growth are the increased adoption of digital payment methods and the increasing smartphone and internet penetration. Beyond simple payments, digital payment systems frequently provide peer-to-peer transfers, bill payments, financial management tools, and other services. These added services open opportunities for embedding other financial services into the same digital payment app, such as loans, insurance, investment choices, and savings accounts. Moreover, digital payment methods can reach a broader audience, including underserved or unbanked populations. People without access to traditional banking services are able to receive, transmit, and manage money due to the widespread use of digital wallets and mobile payments, which lays the groundwork for embedded financial services. For instance, according to the Press Information Bureau (India) January 2023 press release, BHIM UPI emerged as the preferred payment option for Indian residents, with an astounding 8,036.0 million digital payment transactions worth USD 165.2 billion.

The increasing investments in embedded finance start-ups and technological advancements in artificial intelligence (AI) are expected to support the market growth throughout the forecast period. Embedded finance start-ups are renowned for their creative approach to incorporating financial services into various sectors and uses. Increasing the investment enables start-ups to keep creating and improving their products, frequently resulting in developing more complex and user-friendly embedded finance products. Start-ups in embedded finance can extend their services beyond fundamental financial services like banking and payments through investment. They can expand into other markets, including financing, wealth management, insurance, and more, to build expansive ecosystems that serve a greater variety of customer requirements. For instance, a multinational embedded finance company, Railsr, formerly Railsbank, revealed in October 2022 that it had secured USD 46 million in its series C fundraising round.

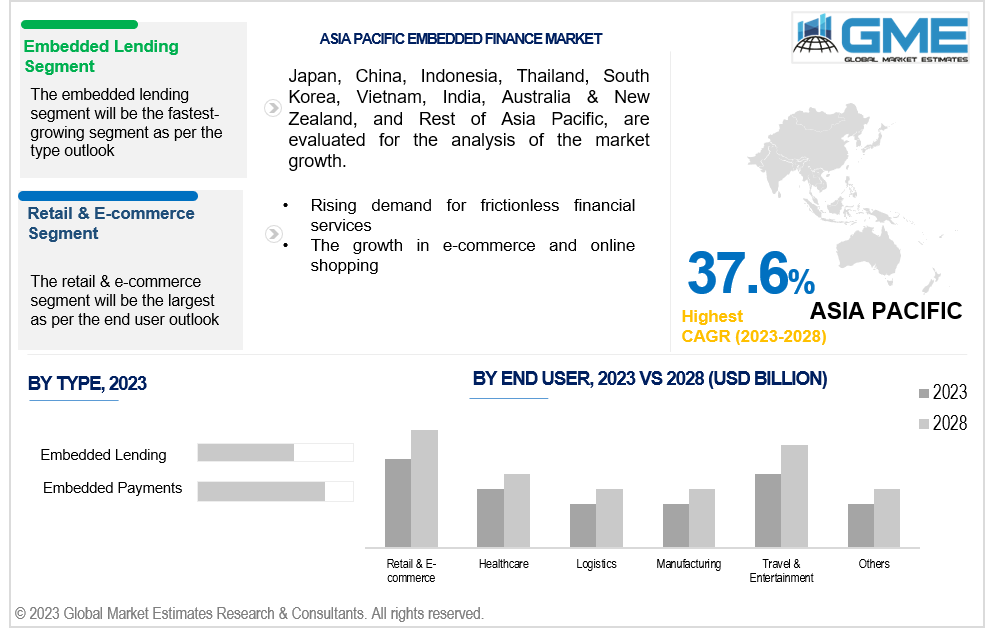

Rising demand for frictionless financial services and the growth in e-commerce and online shopping are propelling the market growth. E-commerce websites and apps have emerged as significant digital payment platforms, and many of them include a variety of payment methods, including digital wallets, credit cards, and buy now, pay later (BNPL) arrangements. This facilitates the embedding of financial services and payment solutions directly into the shopping experience. Moreover, e-commerce platforms frequently operate internationally. These platforms' consistent payment and financial services across several nations are made possible by embedded finance, giving customers worldwide a smooth shopping experience.

APIs (Application Programming Interfaces) are critical to embedded finance's growth. Building and providing APIs for financial services opens up opportunities for businesses to tap into the financial sector without becoming full-fledged financial institutions. Moreover, the integration of blockchain technology and cryptocurrencies with embedded finance opens up lucrative opportunities, including the emergence of stablecoins, the growth of decentralized finance (DeFi) services, and the development of blockchain-based financial products, among other innovative opportunities. However, data privacy concerns and the lack of standardized protocols are hampering the market growth.

The embedded payments segment is expected to hold the largest share of the market. Customers find it easier to finish transactions with embedded payments since they do not have to exit the platform or application they are using. This convenience is highly valued by consumers, leading to the widespread adoption of embedded payment options. Additionally, businesses, including retail, e-commerce, and service providers, can increase their revenue by embedding payment options into their systems. This enables them to boost client loyalty and conversion rates by streamlining the checkout process and lowering friction in the customer journey.

The embedded lending segment is expected to be the fastest-growing segment in the market from 2023-2028. Embedded lending simplifies the borrowing process. There is no need for users to visit a bank or other lending institution, as they can apply for loans or credit from within the application or platform they are using. This streamlined process appeals to borrowers, driving adoption. Moreover, artificial intelligence and data analytics are frequently used in embedded lending to make loan decisions in real time. Due to the ability to approve and distribute cash more quickly, this is a desirable alternative for people who need immediate access to money.

The retail & e-commerce segment is expected to hold the largest share of the market. From online purchases to in-store transactions, the retail and e-commerce sectors handle enormous volumes of customer transactions. The substantial need for embedded finance services, such as loan processing, payment processing, and other financial goods, is brought about by this high transaction volume. By providing embedded financing services, retailers and e-commerce companies can boost client retention and loyalty. These companies can entice users to use their platforms again for financial needs and shopping by offering a full range of financial services.

The travel & entertainment segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Ticketing services and booking systems can be easily integrated with embedded financing solutions. Customers can now book and pay for both their entertainment and travel experiences on the same platform owing to this integration, which improves user experience and lowers friction. With embedded finance, travellers and entertainment fans can quickly obtain loans or credit for their activities, along with real-time credit decisions. This speed is essential, especially for last-minute bookings and purchases.

North America is expected to be the largest region in the global market. Market players in North America have been receiving significant investments to develop and expand embedded finance solutions. They can develop and improve their offers due to this money infusion, which draws in new clients and partners. For instance, the U.S.-based embedded finance company Parafin, Inc. stated in August 2022 that it had secured USD 60 million in a series B fundraising round. The lead investor in the round was Singapore's national wealth fund, GIC. The company wanted to use the money to launch new goods intended for small enterprises.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific is host to a growing number of cutting-edge start-ups and well-established financial companies. These fintech companies are drawing funding to support their growth and are actively involved in creating integrated financial solutions. For instance, in October 2022, an audit, tax, and consulting services provider, KPMG Services Pte. Ltd., announced the launch of an embedded financial hub in Singapore. By assisting financial organizations and companies, the embedded finance hub's first aims to hasten the adoption of embedded finance services across the nation.

Aryza, Audax, Bankable, Banxware, Cross River, Cybrid Technology Inc., Finastra, Finix, Fluenccy Pty Limited, Flywire, Fortis Payment Systems, LLC, Lendflow, Marqeta, OpenPayd, PAYRIX, Plaid, Railsbank, Stripe, Inc., and Transcard Payments among others, are some of the key players in the global embedded finance market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2023, Embedded Finance Limited acquired Railsr, previously Railsbank. This acquisition was supported by a group of international investors, including Moneta VC, D Squared Capital, and Ventura Capital.

MyShubhLife, an embedded financial platform, and PayWorld, a fintech platform aimed at Indian retail merchants, collaborated in July 2023. Through its NBFC Ekagrata, MyShubhLife aims to provide PayWorld's shops with easy access to finance, meeting their needs for working capital.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL EMBEDDED FINANCE MARKET, BY TYPE

4.1 Introduction

4.2 Embedded Finance Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Embedded Banking

4.4.1 Embedded Banking Market Estimates and Forecast, 2020-2028 (USD Million)

4.4.1.1 Type Market Estimates and Forecast, 2020-2028 (USD Million)

4.4.1.1.1 By Retail Banking

4.4.1.1.2 By Corporate Banking

4.4.1.2 End User Market Estimates and Forecast, 2020-2028 (USD Million)

4.4.1.2.1 By Retail & E-commerce

4.4.1.2.2 By Healthcare

4.4.1.2.3 By Logistics

4.4.1.2.4 By Manufacturing

4.4.1.2.5 By Travel & Entertainment

4.4.1.2.6 By Others

4.4.1.3 Business Model Market Estimates and Forecast, 2020-2028 (USD Million)

4.4.1.3.1 By B2B

4.4.1.3.2 By B2C

4.4.1.3.3 By B2B2B

4.4.1.3.4 By B2B2C

4.5 Embedded Payment

4.5.1 Embedded Payment Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1.1 Type Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1.1.1 By Mobile Payments

4.5.1.1.2 By In-App Payments

4.5.1.1.3 By Contactless Payments/ NFC Payments

4.5.1.1.4 By Others

4.5.1.2 End User Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1.2.1 By Retail & E-commerce

4.5.1.2.2 By Healthcare

4.5.1.2.3 By Logistics

4.5.1.2.4 By Manufacturing

4.5.1.2.5 By Travel & Entertainment

4.5.1.2.6 By Others

4.5.1.3 Business Model Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1.3.1 By B2B

4.5.1.3.2 By B2C

4.5.1.3.3 By B2B2B

4.5.1.3.4 By B2B2C

4.6 Embedded Lending

4.6.1 Embedded Lending Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1.1 Type Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1.1.1 By Point-of-Sale (POS) Lending

4.6.1.1.2 By Buy Now, Pay Later (BNPL)

4.6.1.2 End User Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1.2.1 By Retail & E-commerce

4.6.1.2.2 By Healthcare

4.6.1.2.3 By Logistics

4.6.1.2.4 By Manufacturing

4.6.1.2.5 By Travel & Entertainment

4.6.1.2.6 By Others

4.6.1.3 Business Model Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1.3.1 By B2B

4.6.1.3.2 By B2C

4.6.1.3.3 By B2B2B

4.6.1.3.4 By B2B2C

4.7 Embedded Insurance

4.7.1 Embedded Insurance Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1.1 Type Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1.1.1 By Intrinsic Insurance

4.7.1.1.2 By Opt-out & Opt-in Bundled Insurance

4.7.1.1.3 By Billboard Insurance

4.7.1.2 End User Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1.2.1 By Retail & E-commerce

4.7.1.2.2 By Healthcare

4.7.1.2.3 By Logistics

4.7.1.2.4 By Manufacturing

4.7.1.2.5 By Travel & Entertainment

4.7.1.2.6 By Others

4.7.1.3 Business Model Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1.3.1 By B2B

4.7.1.3.2 By B2C

4.7.1.3.3 By B2B2B

4.7.1.3.4 By B2B2C

4.8 Embedded Investments

4.8.1 Embedded Investments Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1.1 Type Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1.1.1 By Stocks and ETFs

4.8.1.1.2 By Others

4.8.1.2 End User Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1.2.1 By Retail & E-commerce

4.8.1.2.2 By Healthcare

4.8.1.2.3 By Logistics

4.8.1.2.4 By Manufacturing

4.8.1.2.5 By Travel & Entertainment

4.8.1.2.6 By Others

4.8.1.3 Business Model Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1.3.1 By B2B

4.8.1.3.2 By B2C

4.8.1.3.3 By B2B2B

4.8.1.3.4 By B2B2C

5 GLOBAL EMBEDDED FINANCE MARKET, BY END USER

5.1 Introduction

5.2 Embedded Finance Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Retail & E-commerce

5.4.1 Retail & E-commerce Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Healthcare

5.5.1 Healthcare Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Logistics

5.6.1 Logistics Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Manufacturing

5.7.1 Manufacturing Market Estimates and Forecast, 2020-2028 (USD Million)

5.8 Travel & Entertainment

5.8.1 Travel & Entertainment Market Estimates and Forecast, 2020-2028 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL EMBEDDED FINANCE MARKET, BY REGION

6.1 Introduction

6.2 North America Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.1 By Type

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By End User

6.2.3.2 Canada Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By End User

6.2.3.3 Mexico Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By End User

6.3 Europe Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.1 By Type

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By End User

6.3.3.2 U.K. Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By End User

6.3.3.3 France Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By End User

6.3.3.4 Italy Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By End User

6.3.3.5 Spain Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By End User

6.3.3.6 Netherlands Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By End User

6.4 Asia Pacific Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.1 By Type

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By End User

6.4.3.2 Japan Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By End User

6.4.3.3 India Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By End User

6.4.3.4 South Korea Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By End User

6.4.3.5 Singapore Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By End User

6.4.3.6 Malaysia Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By End User

6.4.3.7 Thailand Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By End User

6.4.3.8 Indonesia Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By End User

6.4.3.9 Vietnam Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By End User

6.4.3.10 Taiwan Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By End User

6.5 Middle East and Africa Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 By Type

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By End User

6.5.3.3 Israel Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By End User

6.5.3.4 South Africa Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By End User

6.6 Central and South America Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 By Type

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By End User

6.6.3.2 Argentina Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By End User

6.6.3.3 Chile Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Embedded Finance Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Aryza

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Audax

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Bankable

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Banxware

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Cross River

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 CYBRID TECHNOLOGY INC.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Finastra

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Finix

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Fluenccy Pty Limited

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Flywire

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

2 Embedded Banking Market, By Region, 2020-2028 (USD Mllion)

3 Embedded Payment Market, By Region, 2020-2028 (USD Mllion)

4 Embedded Lending Market, By Region, 2020-2028 (USD Mllion)

5 Embedded Insurance Market, By Region, 2020-2028 (USD Mllion)

6 Embedded Investments Market, By Region, 2020-2028 (USD Mllion)

7 Global Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

8 Retail & E-commerce Market, By Region, 2020-2028 (USD Mllion)

9 Healthcare Market, By Region, 2020-2028 (USD Mllion)

10 Logistics Market, By Region, 2020-2028 (USD Mllion)

11 Manufacturing Market, By Region, 2020-2028 (USD Mllion)

12 Travel & Entertainment Market, By Region, 2020-2028 (USD Mllion)

13 Others Market, By Region, 2020-2028 (USD Mllion)

14 Regional Analysis, 2020-2028 (USD Mllion)

15 North America Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

16 North America Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

17 North America Embedded Finance Market, By COUNTRY, 2020-2028 (USD Mllion)

18 U.S. Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

19 U.S. Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

20 Canada Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

21 Canada Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

22 Mexico Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

23 Mexico Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

24 Europe Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

25 Europe Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

26 EUROPE Embedded Finance Market, By COUNTRY, 2020-2028 (USD Mllion)

27 Germany Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

28 Germany Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

29 U.K. Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

30 U.K. Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

31 France Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

32 France Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

33 Italy Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

34 Italy Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

35 Spain Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

36 Spain Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

37 Netherlands Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

38 Netherlands Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

39 Rest Of Europe Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

40 Rest Of Europe Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

41 Asia Pacific Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

42 Asia Pacific Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

43 ASIA PACIFIC Embedded Finance Market, By COUNTRY, 2020-2028 (USD Mllion)

44 China Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

45 China Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

46 Japan Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

47 Japan Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

48 India Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

49 India Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

50 South Korea Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

51 South Korea Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

52 Singapore Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

53 Singapore Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

54 Thailand Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

55 Thailand Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

56 Malaysia Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

57 Malaysia Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

58 Indonesia Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

59 Indonesia Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

60 Vietnam Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

61 Vietnam Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

62 Taiwan Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

63 Taiwan Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

64 Rest of APAC Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

65 Rest of APAC Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

66 Middle East and Africa Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

67 Middle East and Africa Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

68 MIDDLE EAST AND AFRICA Embedded Finance Market, By COUNTRY, 2020-2028 (USD Mllion)

69 Saudi Arabia Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

70 Saudi Arabia Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

71 UAE Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

72 UAE Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

73 Israel Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

74 Israel Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

75 South Africa Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

76 South Africa Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

77 Rest Of Middle East and Africa Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

78 Rest Of Middle East and Africa Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

79 Central and South America Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

80 Central and South America Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

81 CENTRAL AND SOUTH AMERICA Embedded Finance Market, By COUNTRY, 2020-2028 (USD Mllion)

82 Brazil Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

83 Brazil Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

84 Chile Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

85 Chile Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

86 Argentina Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

87 Argentina Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

88 Rest Of Central and South America Embedded Finance Market, By Type, 2020-2028 (USD Mllion)

89 Rest Of Central and South America Embedded Finance Market, By End User, 2020-2028 (USD Mllion)

90 Aryza: Products & Services Offering

91 Audax: Products & Services Offering

92 Bankable: Products & Services Offering

93 Banxware: Products & Services Offering

94 Cross River: Products & Services Offering

95 CYBRID TECHNOLOGY INC.: Products & Services Offering

96 Finastra : Products & Services Offering

97 Finix: Products & Services Offering

98 Fluenccy Pty Limited, Inc: Products & Services Offering

99 Flywire: Products & Services Offering

100 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Embedded Finance Market Overview

2 Global Embedded Finance Market Value From 2020-2028 (USD Mllion)

3 Global Embedded Finance Market Share, By Type (2022)

4 Global Embedded Finance Market Share, By End User (2022)

5 Global Embedded Finance Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Embedded Finance Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Embedded Finance Market

10 Impact Of Challenges On The Global Embedded Finance Market

11 Porter’s Five Forces Analysis

12 Global Embedded Finance Market: By Type Scope Key Takeaways

13 Global Embedded Finance Market, By Type Segment: Revenue Growth Analysis

14 Embedded Banking Market, By Region, 2020-2028 (USD Mllion)

15 Embedded Payment Market, By Region, 2020-2028 (USD Mllion)

16 Embedded Lending Market, By Region, 2020-2028 (USD Mllion)

17 Embedded Insurance Market, By Region, 2020-2028 (USD Mllion)

18 Embedded Investments Market, By Region, 2020-2028 (USD Mllion)

19 Global Embedded Finance Market: By End User Scope Key Takeaways

20 Global Embedded Finance Market, By End User Segment: Revenue Growth Analysis

21 Retail & E-commerce Market, By Region, 2020-2028 (USD Mllion)

22 Healthcare Market, By Region, 2020-2028 (USD Mllion)

23 Logistics Market, By Region, 2020-2028 (USD Mllion)

24 Manufacturing Market, By Region, 2020-2028 (USD Mllion)

25 Travel & Entertainment Market, By Region, 2020-2028 (USD Mllion)

26 Others Market, By Region, 2020-2028 (USD Mllion)

27 Regional Segment: Revenue Growth Analysis

28 Global Embedded Finance Market: Regional Analysis

29 North America Embedded Finance Market Overview

30 North America Embedded Finance Market, By Type

31 North America Embedded Finance Market, By End User

32 North America Embedded Finance Market, By Country

33 U.S. Embedded Finance Market, By Type

34 U.S. Embedded Finance Market, By End User

35 Canada Embedded Finance Market, By Type

36 Canada Embedded Finance Market, By End User

37 Mexico Embedded Finance Market, By Type

38 Mexico Embedded Finance Market, By End User

39 Four Quadrant Positioning Matrix

40 Company Market Share Analysis

41 Aryza: Company Snapshot

42 Aryza: SWOT Analysis

43 Aryza: Geographic Presence

44 Audax: Company Snapshot

45 Audax: SWOT Analysis

46 Audax: Geographic Presence

47 Bankable: Company Snapshot

48 Bankable: SWOT Analysis

49 Bankable: Geographic Presence

50 Banxware: Company Snapshot

51 Banxware: Swot Analysis

52 Banxware: Geographic Presence

53 Cross River: Company Snapshot

54 Cross River: SWOT Analysis

55 Cross River: Geographic Presence

56 CYBRID TECHNOLOGY INC.: Company Snapshot

57 CYBRID TECHNOLOGY INC.: SWOT Analysis

58 CYBRID TECHNOLOGY INC.: Geographic Presence

59 Finastra : Company Snapshot

60 Finastra : SWOT Analysis

61 Finastra : Geographic Presence

62 Finix: Company Snapshot

63 Finix: SWOT Analysis

64 Finix: Geographic Presence

65 Fluenccy Pty Limited, Inc.: Company Snapshot

66 Fluenccy Pty Limited, Inc.: SWOT Analysis

67 Fluenccy Pty Limited, Inc.: Geographic Presence

68 Flywire: Company Snapshot

69 Flywire: SWOT Analysis

70 Flywire: Geographic Presence

71 Other Companies: Company Snapshot

72 Other Companies: SWOT Analysis

73 Other Companies: Geographic Presence

The Global Embedded Finance Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Embedded Finance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS