Global Embedded Hypervisor Market Size, Trends & Analysis - Forecasts to 2026 By Component (Services, Software), By Technology (Desktop Virtualization, Server Virtualization, Data Center Virtualization), By Application (IT & Telecommunications, Automotive, Aerospace & Defense, Industrial, Transportation, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

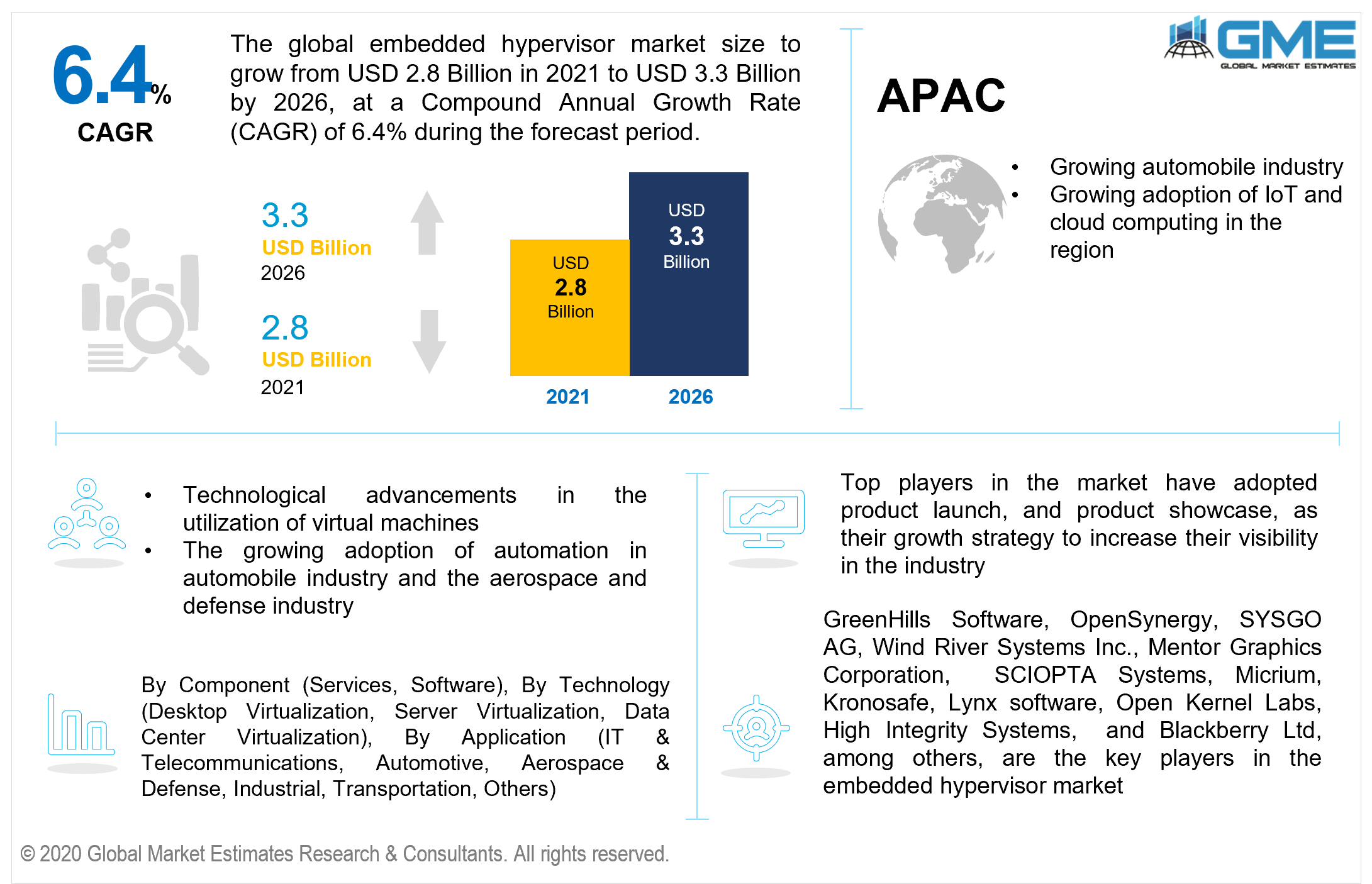

The global embedded hypervisor market is projected to grow from USD 2.8 billion in 2021 to USD 3.3 billion by 2026 at a CAGR value of 6.4% between 2021 to 2026. An embedded hypervisor is used to improve an embedded device’s flexibility and give the device higher levels of capabilities while providing better security features. Virtualization machines have become instrumental in the deployment of artificial intelligence in various industries. Artificial intelligence is being used in, manufacturing industries to facilitate the automatization of production functions.

The growing use of embedded hypervisor and hypervisor software in the automobile industry has been instrumental in the growth of the market. Embedded hypervisors are used in server virtualization as it reduces the required number of drivers, stores various virtual machines in single storage area network, and allows boot up from virtual machine images rather than a hard drive. These features allow for better utilization of server space and reduce the cost of hardware.

With the advent of cloud computing and IoT, the hypervisor in cloud computing applications is increasing which will be a major driver of the market. The growing number of applications for these hypervisors in the aerospace and defense industry for efficient machine learning capabilities are expected to further enhance the demand for these components. Embedded hypervisors provide greater cybersecurity compared to conventional hypervisors. This property has played an instrumental role in the use of these components in industries like the healthcare industry where data protection is crucial.

The current demand for embedded hypervisors largely stems from their increased adoption in the information and communications technology industry. The electronics industry is also expected to provide lucrative opportunities in the market as vendors of computers and servers begin to incorporate these components in their final products.

The market is restrained by the high cost of implementation of AI and IoT-driven processes for automation. The dearth of skilled employees for implementing such systems is also expected to restrain the growth of the market during the forecast period.

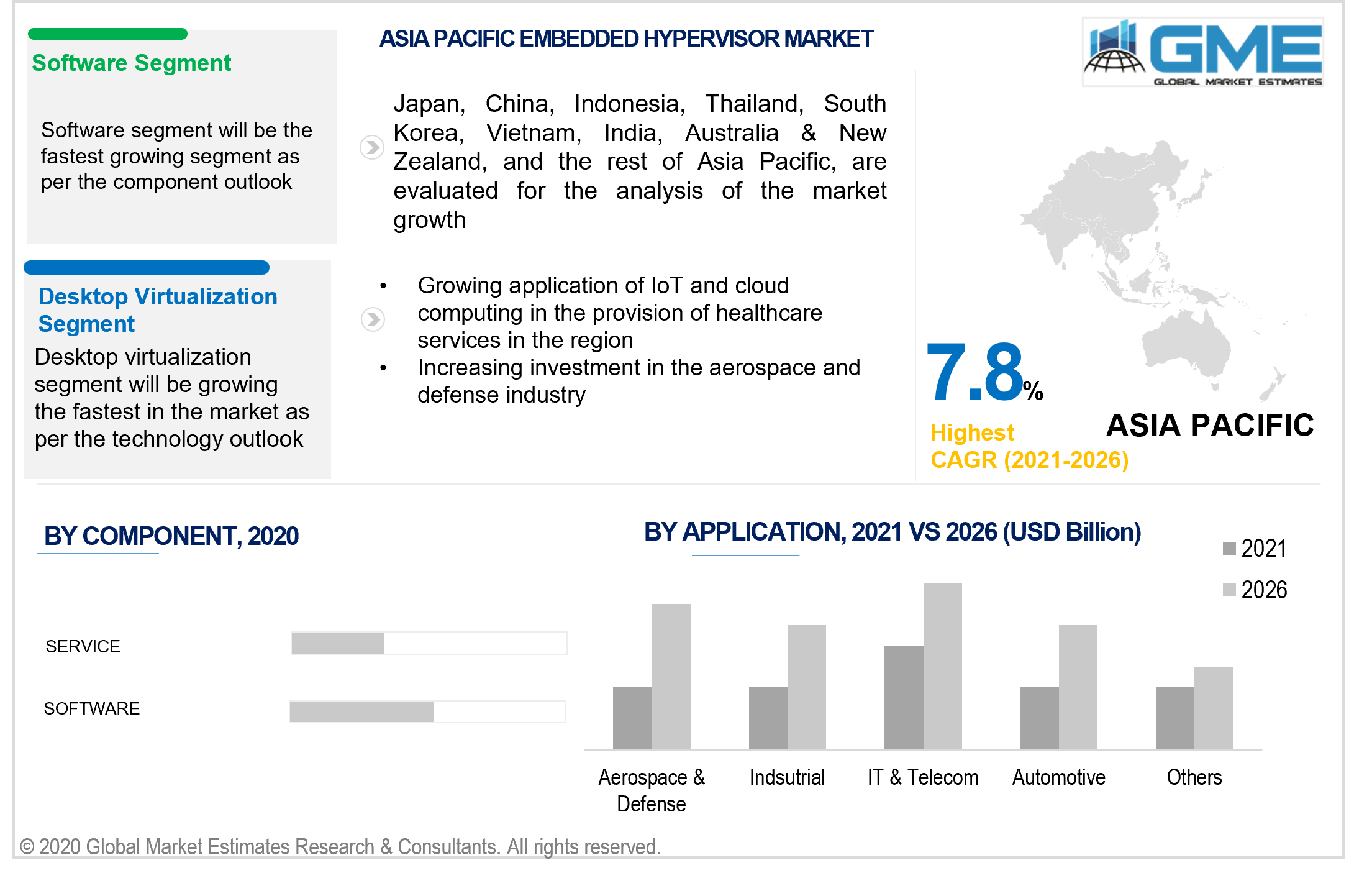

Based on the components employed, the market can be segmented into software and service. The software segment has been envisaged to clutch the largest quota of the market as well as registering better growth rates than the service segment during the forecast period.

Hypervisor software is crucial for most applications that utilize virtual machines. Most companies that require hypervisors often have in-house technicians who are capable of maintaining the system which has been a major factor for the dominance of the software segment. The high potential for growth of the software segment stems from the increased application of such hypervisors in the information and communications technology industry.

Based on the technology employed in the embedded hypervisors, the market can be segmented into desktop virtualization, server virtualization, and data center virtualization segments. The desktop virtualization segment is expected to grasp a bigger share of the market compared to the other segments. Desktop virtualization allows users to access their workstations from any remote location using any network-connected device. The growing number of companies implementing work-from-home policies have been a major driver of this segment. The security features offered by embedded hypervisors are envisaged to culminate in this segment to show better growth rates than the other two segments during the forecast period.

Based on the applications of embedded hypervisors, the market can be fragmented into IT & telecommunications, automotive, aerospace & defense, industrial, transportation, and others. The IT & telecommunications segment is surmised to have the largest share of the market compared to the other segments. The dominance of this segment over the market has been driven by the increased application of cloud computing and the use of virtual machines to improve remote working capabilities with better security features while saving on the cost of hardware.

The aerospace & defense segment has been analyzed to become the fastest-growing segment during the forecast period. Increased spending on aerospace & defense by governments has led to increased application of machine learning and cloud computing features in this industry.

Based on region, the market can be segmented into various regions such as North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The North American region is expected to hold the largest share of the market during the forecast period followed by the European market. The European market has been characterized by the growing adoption of cloud computing and IoT in various industries as automation ramps up in the region. The region’s heavy spending on defense applications has been instrumental to the dominance of this region in the market. A large number of key players in the aerospace sector in the region along with government agencies have culminated in the region’s large demand for embedded hypervisors in this industry.

The APAC region is envisaged to become the fastest-growing region during the forecast period. The growing automobile industry in the region will play a key role in the demand for embedded hypervisors as the industry turns to automation of production. The growing aerospace and defense industry in the region is also expected to have a positive impact on the market. The growing adoption of cloud computing and IoT is another significant factor in the growing demand for embedded hypervisors in the region.

GreenHills Software, OpenSynergy, SYSGO AG, Wind River Systems Inc., Mentor Graphics Corporation, SCIOPTA Systems, Micrium, Kronosafe, Lynx Software, Open Kernel Labs, High Integrity Systems, and Blackberry Ltd, among others, are the key players in the embedded hypervisor market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Embedded Hypervisor Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Embedded Hypervisor Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing adoption of IoT and cloud computing for automation in manufacturing industries

3.3.2 Industry Challenges

3.3.2.1 Large infrastructure and maintenance costs incurred through the implementation of cloud computing and IoT

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Embedded Hypervisor Market, By Component

4.1 Component Outlook

4.2 Service

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Software

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Embedded Hypervisor Market, By Technology

5.1 Technology Outlook

5.2 Desktop Virtualization

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Server Virtualization

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Data Center Virtualization

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Embedded Hypervisor Market, By Application

6.1 IT & Telecommunications

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Automotive

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Aerospace & Defense

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Industrial

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Transportation

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Others

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Embedded Hypervisor Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Component, 2020-2026 (USD Billion)

7.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Component, 2020-2026 (USD Billion)

7.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Component, 2020-2026 (USD Billion)

7.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Component, 2020-2026 (USD Billion)

7.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Component, 2020-2026 (USD Billion)

7.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 GreenHills Software

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 OpenSynergy

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 SYSGO AG

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Wind River Systems Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Mentor Graphics Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 SCIOPTA Systems

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Micrium

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Kronosafe

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Lynx Software

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Embedded Hypervisor Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Embedded Hypervisor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS