Global Emulsifying Machines Market Size, Trends & Analysis - Forecasts to 2026 By Operating Pressure [Vacuum (Up To -1 Bar), Atmospheric Pressure (Ambient Pressure), High Pressure (800-3100 Bar)], By Particle Size [Micro Emulsion (Particle Size Less Than 1 ?m), Nanoemulsion (Particle Size Between 100 And 500 Nm), Macro Emulsion (Particle Size Greater Than 1 ?m)], By Fluid Viscosities [High Viscosities (Over 5000cP), Medium Viscosities (2000 – 5000cP), Low Viscosities (Below 2000cP)], By Equipment Orientation (Horizontal Orientation, Vertical Orientation) By The Mode Of Operation (In-Tank Process, Inline Process) By End-User (Food And Beverage, Chemical, Pharmaceutical, Cosmetics/Toiletries, Academic & Analytical Research); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

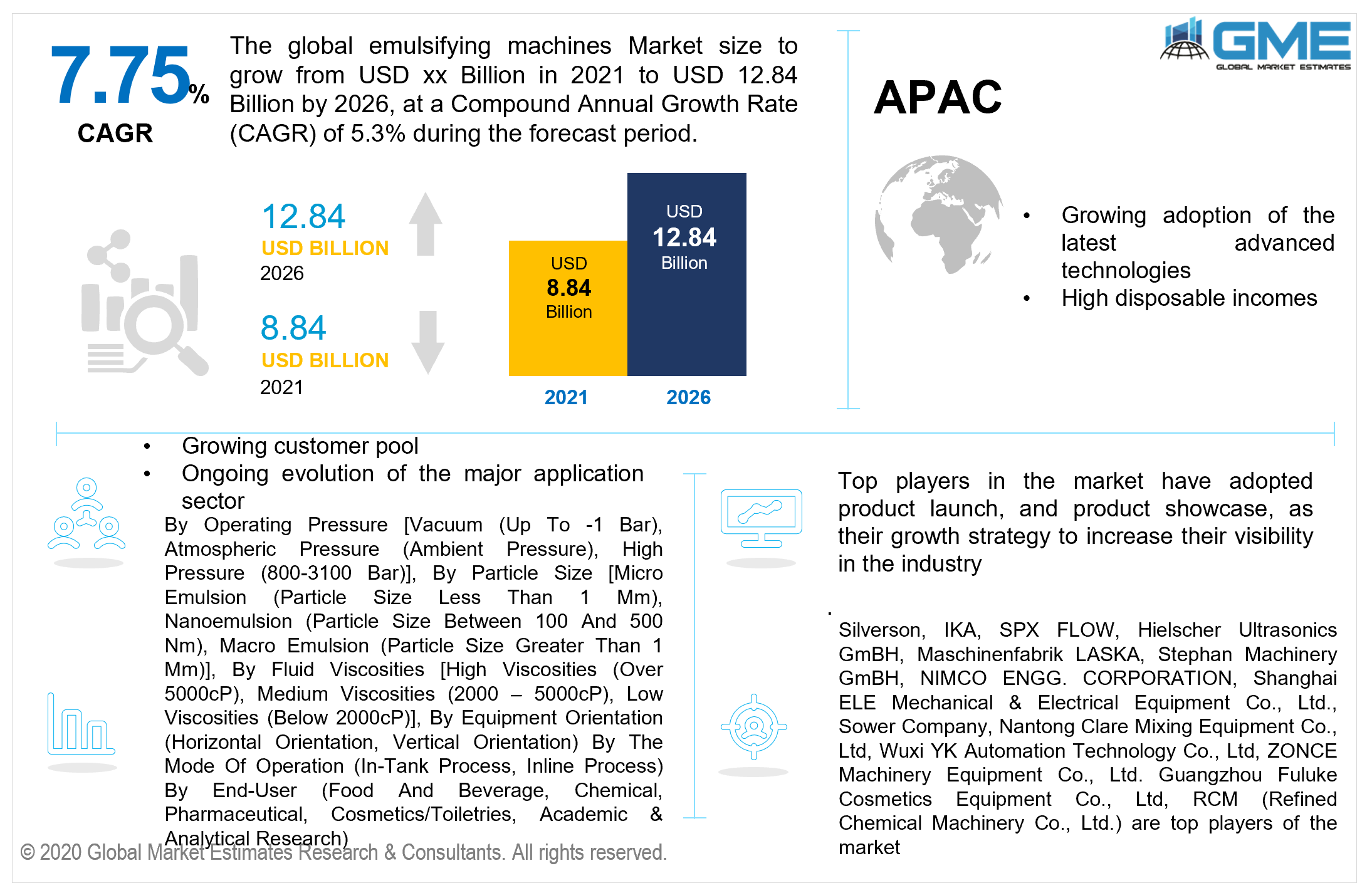

The global emulsifying machines market is estimated to be valued at USD 8.84 billion in 2021 and is projected to reach USD 12.84 billion by 2026 at a CAGR of 7.75%. The major market drivers that are contributing to the growth of the market are the cosmetic industry, pharmaceutical industry, and food & beverage industry.

Due to various improved healthcare awareness, the global populace's spending on medications and sanitation goods is steadily increasing in order to lead a healthier lifestyle. This might indicate the expansion of the pharmaceutical business. As a result, the pharmaceutical sector is increasing its demand for highly powerful equipment in order to meet the needs of the population. As a result, it is a significant contributor to the emulsifying machinery market.

Furthermore, because of the high demand for a variety of skincare products from end-users, such machines are extensively employed in the cosmetics sector. This constant need for beauty goods may lead to an increase in the demand for effective blending machines by cosmetics manufacturers, which may substantially influence the overall market.

Moreover, the growing demand for such machines in the food processing sector is set to propel market expansion. The processed food sector's demand is projected to rise. This will increase the number of applications for such machines, particularly in the paints, dairy, beverage, and distillery sectors. This increasing demand will also have a significant impact on the pharmaceutical and cosmetics industries, broadening the spectrum of potential for market participants. The packaged water and functional drinks product sector may be triggered by variables including rising discretionary income and demographic changes.

Nonetheless, emulsifying devices demand more power, which is deemed limited and is subject to severe government controls. China's Energy Conservation Law of 1997 and India's Energy Conservation Act of 2001 are two instances of such laws. These kinds of regulations might stymie such machines' promising future. Furthermore, developing sophisticated emulsifying equipment that requires trained manpower to deploy and run such machines may face a roadblock since prospective regional markets do not maintain such talents in sufficient quantities. Furthermore, the carbonated beverage industry is now progressing at a steady pace and will do so in the coming years.

Consequently, the emulsifying machinery required by companies has an extended lifespan. Emulsifying devices that require little to no administration are on the rise as a means of meeting rising demand. The majority of such machines on the market are reasonably priced without sacrificing quality or effectiveness. Furthermore, present demand from the commercial sector, such as hotels and breweries, is propelling the emulsifying machinery market to new dimensions.

Based on operating pressure, the market is divided into a vacuum (up to -1 bar), atmospheric pressure (ambient pressure), and high pressure (800-3100 bar). The demand for the category vacuum (up to-1 bar) is foreseen to be the highest. It is increasingly employed in the electronics and semiconductor industries. The producer constantly modifies the product or service to meet the unique specifications of its customers.

Based on particle size, the market is segmented into microemulsion (particle size less than 1 μm), nanoemulsion (particle size between 100 and 500 nm), macro emulsion (particle size greater than 1 μm). Nanoemulsion (particle sizes between 100 and 500 nm) is foreseen to be the leader. In pharmaceutical applications, nanoemulsions are frequently utilized. The formulation of nanoemulsions has numerous implications including the transport of medicines, biological agents, and diagnostic agents. The most common use of nanoemulsion is to conceal the unpleasant taste of greasy drinks. Drugs that are sensitive to hydrolysis and oxidation may also be protected by nanoemulsion. Nanoemulsions are being employed for targeted medication delivery of anticancer medicines, photosensitizers, and therapeutic agents. Nanoemulsions can also offer medications with a longer duration of action. Ultimately, all nanoemulsion formulations are efficacious, safe, and have improved bioavailability.

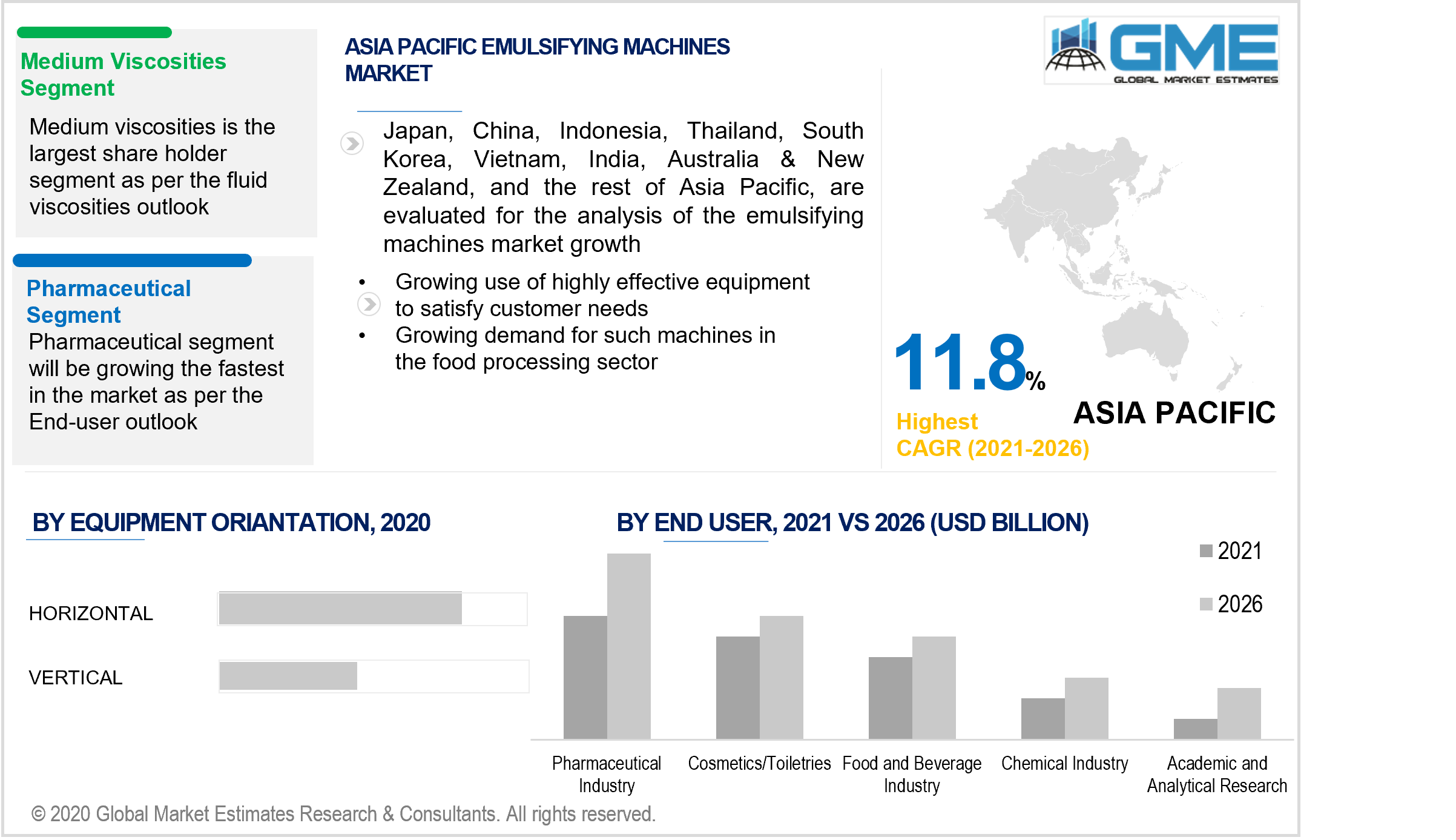

Based on fluid viscosities, the market is split into high viscosities (over 5000cP), medium viscosities (2000 – 5000cP), and low viscosities (below 2000cP). Medium viscosities are likely to predominate because they are extensively used in the pharmaceutical, cosmetics, and food processing sectors. Moreover, they get effectively mixed with other ingredients while producing the formulations and during the application provides better results.

Based on equipment orientation, the market can be classified into horizontal and vertical orientations. In the market, the category for horizontal orientation is expected to predominate. Due to its simpler loading and unloading capabilities relative to those of vertical devices, horizontal devices are rapidly used globally. In compliance with the product specifications, the use of certain devices varies. The use of this machine varies according to the specifications of the product.

Based on the mode of operation, the market is segmented into the in-tank and inline process. The leader for the emulsifying machinery market in this segment is considered to be the inline process. It increases return on investment by reducing manufacturing duration, increasing outputs, and increasing capacity. It also consumes less energy and saves money on production and administration. It enables continual raw material inflow and consistent final product production. A solitary, time-saving, extremely effective operation can often produce precise homogenization, emulsification, or deagglomeration.

Based on end-user, the market segment is divided into the food and beverage industry, chemical industry, pharmaceutical industry, cosmetics/toiletries, academic and analytical research. The pharmacy segment will be the largest market since investment in medicines and personal care goods rising in the global public interest to live a healthy life due to a range of health-enhancing alertness. Thus, the healthcare sector is increasing the need for highly efficient facilities to meet the needs of its consumers.

APAC is projected to be the major market shareholder region in the forecast period, as adoption of the latest advanced technologies, soaring core population, high disposable incomes, rapid urbanization, and the change of end-users to emulsified goods are factors that can lead to substantial growth in such machines on the market.

In the global market, Europe is expected to rise at a faster rate. This is owing to an influx of foreign investment in the area's largest application sector, which employs emulsifying equipment. Additional variables, including a large customer pool and the ongoing evolution of the major sector, are also moving the market forward.

Silverson, IKA, SPX FLOW, Hielscher Ultrasonics GmBH, Maschinenfabrik LASKA, Stephan Machinery GmBH, NIMCO ENGG. CORPORATION, Shanghai ELE Mechanical & Electrical Equipment Co., Ltd., Sower Company, Nantong Clare Mixing Equipment Co., Ltd, Wuxi YK Automation Technology Co., Ltd, ZONCE Machinery Equipment Co., Ltd., Guangzhou Fuluke Cosmetics Equipment Co., Ltd, RCM (Refined Chemical Machinery Co., Ltd.) are top players of the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Emulsifying Machines Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Operating Pressure Overview

2.1.3 Particle Size Overview

2.1.4 Fluid Viscosities Overview

2.1.5 Equipment Orientation Overview

2.1.6 Mode of Operation Overview

2.1.7 End-User Overview

2.1.8 Regional Overview

Chapter 3 Emulsifying Machines Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Consumption of Processed Food

3.3.1.2 Increasing Market Penetration of Emulsifiers

3.3.2 Industry Challenges

3.3.2.1 High Cost of Administration

3.4 Prospective Growth Scenario

3.4.1 Operating Pressure Growth Scenario

3.4.2 Particle Size Growth Scenario

3.4.3 Fluid Viscosities Growth Scenario

3.4.4 Equipment Orientation Growth Scenario

3.4.5 Mode of Operation Growth Scenario

3.4.6 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.10.1 Company Positioning Overview, 2020

Chapter 4 Emulsifying Machines Market, By Operating Pressure

4.1 Operating Pressure Outlook

4.2 Atmospheric Pressure (Ambient Pressure)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Vacuum (Up To -1 Bar)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 High Pressure (800-3100 Bar)

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Emulsifying Machines Market, By Particle Size

5.1 Particle Size Outlook

5.2 Micro Emulsion (Particle Size Less Than 1 Μm)

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Nanoemulsion (Particle Size Between 100 And 500 Nm)

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Macro Emulsion (Particle Size Greater Than 1 Μm)

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Emulsifying Machines Market, By Fluid Viscosities

6.1 Fluid Viscosities Outlook

6.2 High Viscosities (Over 5000cP)

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Medium Viscosities (2000 – 5000cP)

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Low Viscosities (Below 2000cP)

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Emulsifying Machines Market, By Equipment Orientation

7.1 Equipment Orientation Outlook

7.2 Horizontal Orientation

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Vertical Orientation

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Emulsifying Machines Market, By Mode Of Operation

8.1 Mode Of Operation Outlook

8.2 In-Tank Process

8.2.1 Market Size, By Region, 2019-2026 (USD Million)

8.3 Inline Process

8.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 9 Emulsifying Machines Market, By End-User

9.1 End-User Outlook

9.2 Food And Beverage

9.2.1 Market Size, By Region, 2019-2026 (USD Million)

9.3 Chemical

9.3.1 Market Size, By Region, 2019-2026 (USD Million)

9.4 Pharmaceutical

9.4.1 Market Size, By Region, 2019-2026 (USD Million)

9.5 Cosmetics/Toiletries

9.5.1 Market Size, By Region, 2019-2026 (USD Million)

9.6 Academic & Analytical Research

9.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 10 Emulsifying Machines Market, By Region

10.1 Regional outlook

10.2 North America

10.2.1 Market Size, By Country 2019-2026 (USD Million)

10.2.2 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.2.3 Market Size, By Particle Size, 2019-2026 (USD Million)

10.2.4 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.2.5 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.2.6 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.2.7 Market Size, By End-User, 2019-2026 (USD Million)

10.2.8 U.S.

10.2.8.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.2.8.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.2.8.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.2.8.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.2.8.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.2.8.6 Market Size, By End-User, 2019-2026 (USD Million)

10.2.9 Canada

10.2.9.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.2.9.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.2.9.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.2.9.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.2.9.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.2.9.6 Market Size, By End-User, 2019-2026 (USD Million)

10.3 Europe

10.3.1 Market Size, By Country 2019-2026 (USD Million)

10.3.2 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.3 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.4 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.5 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.6 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.7 Market Size, By End-User, 2019-2026 (USD Million)

10.3.8 Germany

10.3.8.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.8.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.8.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.8.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.8.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.8.6 Market Size, By End-User, 2019-2026 (USD Million)

10.3.9 UK

10.3.9.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.9.2 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.9.3 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.9.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.9.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.9.5 Market Size, By End-User, 2019-2026 (USD Million)

10.3.10 France

10.3.10.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.10.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.10.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.10.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.10.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.10.6 Market Size, By End-User, 2019-2026 (USD Million)

10.3.11 Italy

10.3.11.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.11.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.10.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.11.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.11.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.11.5 Market Size, By End-User, 2019-2026 (USD Million)

10.3.12 Spain

10.3.12.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.12.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.12.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.12.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.12.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.12.6 Market Size, By End-User, 2019-2026 (USD Million)

10.3.13 Russia

10.3.13.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.3.13.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.3.13.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.3.13.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.3.13.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.3.13.6 Market Size, By End-User, 2019-2026 (USD Million)

10.4 Asia Pacific

10.4.1 Market Size, By Country 2019-2026 (USD Million)

10.4.2 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.4.3 Market Size, By Particle Size, 2019-2026 (USD Million)

10.4.4 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.4.5 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.4.6 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.4.7 Market Size, By End-User, 2019-2026 (USD Million)

10.4.8 China

10.4.8.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.4.8.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.4.8.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.4.8.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.4.8.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.4.8.6 Market Size, By End-User, 2019-2026 (USD Million)

10.4.9 India

10.4.9.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.4.9.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.4.9.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.4.9.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.4.9.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.4.9.6 Market Size, By End-User, 2019-2026 (USD Million)

10.4.10 Japan

10.4.10.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.4.10.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.4.10.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.4.10.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.4.10.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.4.10.6 Market Size, By End-User, 2019-2026 (USD Million)

10.4.11 Australia

10.4.11.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.4.11.2 Market size, By Particle Size, 2019-2026 (USD Million)

10.4.11.3 Market size, By Fluid Viscosities, 2019-2026 (USD Million)

10.4.11.4 Market size, By Equipment Orientation, 2019-2026 (USD Million)

10.4.11.5 Market size, By Mode Of Operation, 2019-2026 (USD Million)

10.4.11.6 Market size, By End-User, 2019-2026 (USD Million)

10.4.12 South Korea

10.4.12.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.4.12.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.4.12.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.4.12.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.4.12.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.4.12.6 Market Size, By End-User, 2019-2026 (USD Million)

10.5 Latin America

10.5.1 Market Size, By Country 2019-2026 (USD Million)

10.5.2 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.5.3 Market Size, By Particle Size, 2019-2026 (USD Million)

10.5.4 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.5.5 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.5.6 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.5.7 Market Size, By End-User, 2019-2026 (USD Million)

10.5.8 Brazil

10.5.8.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.5.8.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.5.7.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.5.8.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.5.8.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.5.8.6 Market Size, By End-User, 2019-2026 (USD Million)

10.5.9 Mexico

10.5.9.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.5.9.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.5.9.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.5.9.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.5.9.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.5.9.6 Market Size, By End-User, 2019-2026 (USD Million)

10.5.10 Argentina

10.5.10.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.5.10.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.5.9.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.5.10.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.5.10.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.5.10.6 Market Size, By End-User, 2019-2026 (USD Million)

10.6 MEA

10.6.1 Market Size, By Country 2019-2026 (USD Million)

10.6.2 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.6.3 Market Size, By Particle Size, 2019-2026 (USD Million)

10.6.4 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.6.5 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.6.6 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.6.7 Market Size, By End-User, 2019-2026 (USD Million)

10.6.8 Saudi Arabia

10.6.8.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.6.8.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.6.8.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.6.8.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.6.8.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.6.8.6 Market Size, By End-User, 2019-2026 (USD Million)

10.6.9 UAE

10.6.9.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.6.9.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.6.9.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.6.9.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.6.9.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.6.9.6 Market Size, By End-User, 2019-2026 (USD Million)

10.6.10 South Africa

10.6.10.1 Market Size, By Operating Pressure, 2019-2026 (USD Million)

10.6.10.2 Market Size, By Particle Size, 2019-2026 (USD Million)

10.6.10.3 Market Size, By Fluid Viscosities, 2019-2026 (USD Million)

10.6.10.4 Market Size, By Equipment Orientation, 2019-2026 (USD Million)

10.6.10.5 Market Size, By Mode Of Operation, 2019-2026 (USD Million)

10.6.10.5 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 11 Company Landscape

11.1 Competitive Analysis, 2020

11.2 Silverson

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Strategic Positioning

11.2.4 Info Graphic Analysis

11.3 IKA

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Strategic Positioning

11.3.4 Info Graphic Analysis

11.4 SPX FLOW

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Strategic Positioning

11.4.4 Info Graphic Analysis

11.5 Hielscher Ultrasonics GmBH

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Strategic Positioning

11.5.4 Info Graphic Analysis

11.6 Maschinenfabrik LASKA

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Strategic Positioning

11.6.4 Info Graphic Analysis

11.7 Stephan Machinery GmBH

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Strategic Positioning

11.7.4 Info Graphic Analysis

11.8 Silverson

11.8.1 Company Overview

11.8.2 Financial Analysis

11.8.3 Strategic Positioning

11.8.4 Info Graphic Analysis

11.9 NIMCO ENGG. CORPORATION

11.9.1 Company Overview

11.9.2 Financial Analysis

11.9.3 Strategic Positioning

11.9.4 Info Graphic Analysis

11.10 Shanghai ELE Mechanical & Electrical Equipment Co., Ltd.

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Positioning

11.10.4 Info Graphic Analysis

11.11 Sower Company

11.11.1 Company Overview

11.11.2 Financial Analysis

11.11.3 Strategic Positioning

11.11.4 Info Graphic Analysis

11.12 Nantong Clare Mixing Equipment Co., Ltd.

11.12.1 Company Overview

11.12.2 Financial Analysis

11.12.3 Strategic Positioning

11.12.4 Info Graphic Analysis

11.13 Wuxi YK Automation Technology Co. Ltd.

11.13.1 Company Overview

11.13.2 Financial Analysis

11.13.3 Strategic Positioning

11.13.4 Info Graphic Analysis

11.14 ZONCE Machinery Equipment Co., Ltd.

11.14.1 Company Overview

11.14.2 Financial Analysis

11.14.3 Strategic Positioning

11.14.4 Info Graphic Analysis

11.15 Guangzhou Fuluke Cosmetics Equipment Co., Ltd.

11.15.1 Company Overview

11.15.2 Financial Analysis

11.15.3 Strategic Positioning

11.15.4 Info Graphic Analysis

11.16 RCM (Refined Chemical Machinery Co., Ltd.)

11.16.1 Company Overview

11.16.2 Financial Analysis

11.16.3 Strategic Positioning

11.16.4 Info Graphic Analysis

11.17 Other Companies

11.17.1 Company Overview

11.17.2 Financial Analysis

11.17.3 Strategic Positioning

11.17.4 Info Graphic Analysis

The Global Emulsifying Machines Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Emulsifying Machines Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS