Global Engineered Stone Market Size, Trends & Analysis - Forecasts to 2028 By Product (Tiles and Blocks & Slabs), By Application (Countertops, Flooring, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

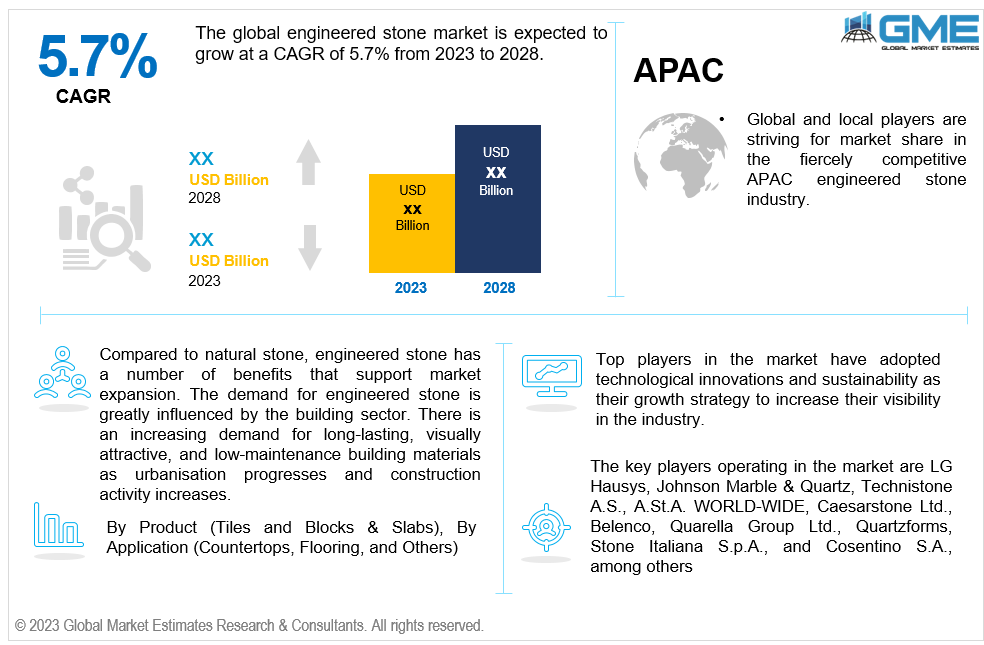

The global engineered stone market is expected to grow at a CAGR of 5.7% from 2023 to 2028. Engineered stone is a form of man-made stone material that is created by blending crushed stone particles with a resin binder. It is also known as quartz or composite stone. Compared to many forms of natural stone, engineered stone is tougher, more flexible, and non-porous. Its consistent internal structure prevents it from having the hidden defects or fissures that real stone may have, and it also ensures uniformity in colour and design from slab to slab. Binding agents for polyester resin provide some flexibility, avoiding breaking under the flexural strain. However, the binding substances frequently continue to harden, which over time results in a loss of flexural strength.

The main driver of the engineered stone market is increasing demand from construction industry and advantages over natural stone.

Compared to natural stone, engineered stone has a number of benefits that support market expansion. Engineered stone is very heat, stain, and scratch resistant since it is non-porous. Compared to natural stone, which needs frequent sealing, it requires less upkeep. Additionally, engineered stone offers similar patterns, hues, and dimensions, enhancing project consistency and design flexibility.

The demand for engineered stone is greatly influenced by the building sector. There is an increasing demand for long-lasting, visually attractive, and low-maintenance building materials as urbanisation progresses and construction activity increases. These characteristics make engineered stone a popular option for uses including worktops, flooring, and wall cladding in both residential and commercial structures.

Sustainability and environmental concerns are gaining prominence in the engineered stone business. To lessen the environmental effect of their products, several firms have made investments in environmentally friendly production techniques and recycled materials. Customers are gravitating more and more towards ecologically friendly and sustainable solutions, which might spur more industry innovation.

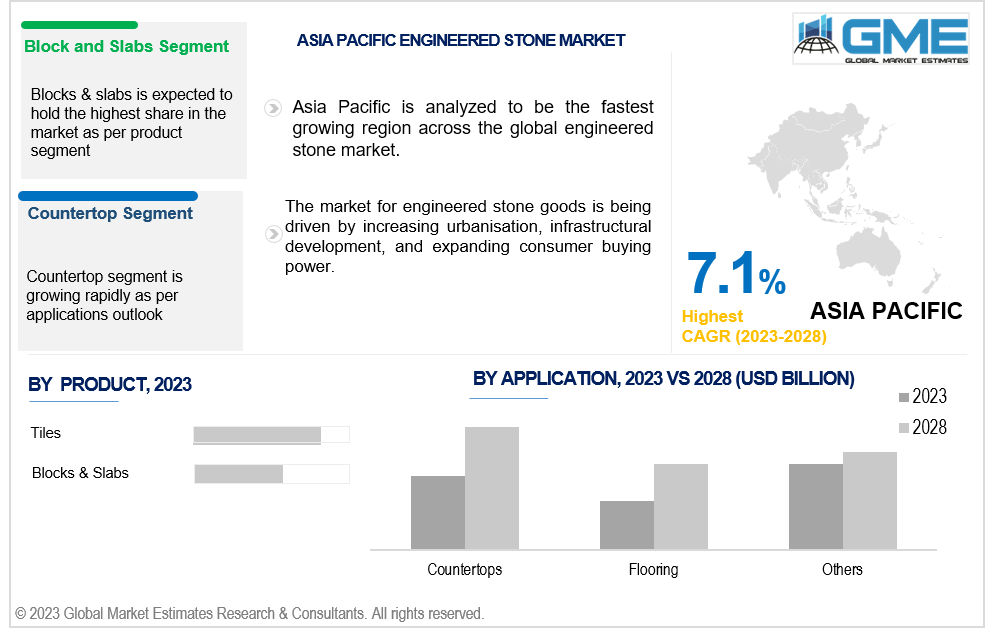

Based on product type, the market is segmented into tiles and blocks & slabs. Similar benefits of engineered stone, such as durability, consistency, resistance to stains and scratches, and simplicity of care, are offered by both tiles and blocks & slabs. In addition to being more affordable and more pleasing than actual stone, they also provide a variety of design alternatives to accommodate various architectural tastes and types. The blocks and slabs segment is one of the significant contributors to the global engineered stone market, particularly in the countertop application.

Based on application, the market is segmented into countertops, flooring, and others. Combined, countertops and floors make up a sizeable portion of the worldwide engineered stone business. The need for long-lasting, low-maintenance surfaces that are aesthetically pleasing and give design freedom is what drives demand for these applications. Because of its exceptional qualities, including durability and carefreeness, engineered stone is frequently chosen for worktops and floors in both residential and commercial settings. However,, countertop is expected to lead the application segment.

North America is analysed to be the largest region in the global engineered stone market during the forecast period. Because of its strength, variety in design, and resistance to stains and scratches, consumers are increasingly preferring engineered stone. The area also values environmentally friendly and sustainable materials, which has had an impact on the market.

Asia Pacific is analysed to be the fastest growing region across the global engineered stone market. The market for engineered stone goods is being driven by increasing urbanisation, infrastructural development, and expanding consumer buying power. The growing middle-class population and changing lifestyles contribute to the market's expansion.

The market in Europe is anticipated to expand over the forecast period, owing to the expanding mining restrictions and significant expenditures in the renovation of ancient building structures. The Middle East & Africa area is anticipated to grow at a substantial CAGR throughout the forecast period. The region's high governmental investment and growing FDI influx are driving the construction industry's expansion. However, engineered stone is only seen as a decorative material in many African nations, which might impede the expansion of the local market.

The key players operating in the market are LG Hausys, Johnson Marble & Quartz, Technistone A.S., A.St.A. WORLD-WIDE, Caesarstone Ltd., Belenco, Quarella Group Ltd., Quartzforms, Stone Italiana S.p.A., and Cosentino S.A., among others. To keep their market positions and adapt to changing client needs throughout the world, these businesses spend in R&D, marketing, and strategic partnerships.

Please note: This is not an exhaustive list of companies profiled in the report

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ENGINEERED STONE MARKET, BY PRODUCT

4.1 Introduction

4.2 Engineered Stone Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Tiles

4.4.1 Tiles Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Blocks & Slabs

4.5.1 Blocks & Slabs Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL ENGINEERED STONE MARKET, BY APPLICATION

5.1 Introduction

5.2 Engineered Stone Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Countertops

5.4.1 Countertops Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Flooring

5.5.1 Flooring Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL ENGINEERED STONE MARKET, BY REGION

6.1 Introduction

6.2 North America Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.1 By Product

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.1.1 By Product

6.2.3.1.2 By Application

6.2.3.2 Canada Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.2.1 By Product

6.2.3.2.2 By Application

6.2.3.3 Mexico Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.3.1 By Product

6.2.3.3.2 By Application

6.3 Europe Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.1 By Product

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.1.1 By Product

6.3.3.1.2 By Application

6.3.3.2 U.K. Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.2.1 By Product

6.3.3.2.2 By Application

6.3.3.3 France Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.3.1 By Product

6.3.3.3.2 By Application

6.3.3.4 Italy Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.4.1 By Product

6.3.3.4.2 By Application

6.3.3.5 Spain Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.5.1 By Product

6.3.3.5.2 By Application

6.3.3.6 Netherlands Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By Product

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By Product

6.3.3.6.2 By Application

6.4 Asia Pacific Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.1 By Product

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.1.1 By Product

6.4.3.1.2 By Application

6.4.3.2 Japan Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.2.1 By Product

6.4.3.2.2 By Application

6.4.3.3 India Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.3.1 By Product

6.4.3.3.2 By Application

6.4.3.4 South Korea Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.4.1 By Product

6.4.3.4.2 By Application

6.4.3.5 Singapore Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.5.1 By Product

6.4.3.5.2 By Application

6.4.3.6 Malaysia Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By Product

6.4.3.6.2 By Application

6.4.3.7 Thailand Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By Product

6.4.3.6.2 By Application

6.4.3.8 Indonesia Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.7.1 By Product

6.4.3.7.2 By Application

6.4.3.9 Vietnam Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.8.1 By Product

6.4.3.8.2 By Application

6.4.3.10 Taiwan Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.10.1 By Product

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.11.1 By Product

6.4.3.11.2 By Application

6.5 Middle East and Africa Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 By Product

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.1.1 By Product

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.2.1 By Product

6.5.3.2.2 By Application

6.5.3.3 Israel Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.3.1 By Product

6.5.3.3.2 By Application

6.5.3.4 South Africa Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.4.1 By Product

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.5.1 By Product

6.5.3.5.2 By Application

6.6 Central & South America Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 By Product

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.1.1 By Product

6.6.3.1.2 By Application

6.6.3.2 Argentina Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.2.1 By Product

6.6.3.2.2 By Application

6.6.3.3 Chile Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By Product

6.6.3.3.2 By Application

6.6.3.3 Rest of Central & South America Engineered Stone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By Product

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 LG Hausys

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Johnson Marble & Quartz

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Technistone A.S.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 A.St.A. WORLD-WIDE

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Caesarstone Ltd.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Belenco

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Quarella Group Ltd.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Quartzforms

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Stone Italiana S.p.A.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Cosentino S.A.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Engineered Stone Market, By Product, 2020-2028 (USD Billion)

2 Tiles Market, By Region, 2020-2028 (USD Billion)

3 Blocks & slabs Market, By Region, 2020-2028 (USD Billion)

4 Global Engineered Stone Market, By Application, 2020-2028 (USD Billion)

5 Countertops Market, By Region, 2020-2028 (USD Billion)

6 Flooring Market, By Region, 2020-2028 (USD Billion)

7 Others Market, By Region, 2020-2028 (USD Billion)

8 Regional Analysis, 2020-2028 (USD Billion)

9 North America Engineered Stone Market, By Product, 2020-2028 (USD Billion)

10 North America Engineered Stone Market, By Application, 2020-2028 (USD Billion)

11 U.S. Engineered Stone Market, By Product, 2020-2028 (USD Billion)

12 U.S. Engineered Stone Market, By Application, 2020-2028 (USD Billion)

13 Canada Engineered Stone Market, By Product, 2020-2028 (USD Billion)

14 Canada Engineered Stone Market, By Application, 2020-2028 (USD Billion)

15 Mexico Engineered Stone Market, By Product, 2020-2028 (USD Billion)

16 Mexico Engineered Stone Market, By Application, 2020-2028 (USD Billion)

17 Europe Engineered Stone Market, By Product, 2020-2028 (USD Billion)

18 Europe Engineered Stone Market, By Application, 2020-2028 (USD Billion)

19 Germany Engineered Stone Market, By Product, 2020-2028 (USD Billion)

20 Germany Engineered Stone Market, By Application, 2020-2028 (USD Billion)

21 U.K. Engineered Stone Market, By Product, 2020-2028 (USD Billion)

22 U.K. Engineered Stone Market, By Application, 2020-2028 (USD Billion)

23 France Engineered Stone Market, By Product, 2020-2028 (USD Billion)

24 France Engineered Stone Market, By Application, 2020-2028 (USD Billion)

25 Italy Engineered Stone Market, By Product, 2020-2028 (USD Billion)

26 Italy Engineered Stone Market, By Application, 2020-2028 (USD Billion)

27 Spain Engineered Stone Market, By Product, 2020-2028 (USD Billion)

28 Spain Engineered Stone Market, By Application, 2020-2028 (USD Billion)

29 Netherlands Engineered Stone Market, By Product, 2020-2028 (USD Billion)

30 Netherlands Engineered Stone Market, By Application, 2020-2028 (USD Billion)

31 Rest Of Europe Engineered Stone Market, By Product, 2020-2028 (USD Billion)

32 Rest Of Europe Engineered Stone Market, By Application, 2020-2028 (USD Billion)

33 Asia Pacific Engineered Stone Market, By Product, 2020-2028 (USD Billion)

34 Asia Pacific Engineered Stone Market, By Application, 2020-2028 (USD Billion)

35 China Engineered Stone Market, By Product, 2020-2028 (USD Billion)

36 China Engineered Stone Market, By Application, 2020-2028 (USD Billion)

37 Japan Engineered Stone Market, By Product, 2020-2028 (USD Billion)

38 Japan Engineered Stone Market, By Application, 2020-2028 (USD Billion)

39 India Engineered Stone Market, By Product, 2020-2028 (USD Billion)

40 India Engineered Stone Market, By Application, 2020-2028 (USD Billion)

41 South Korea Engineered Stone Market, By Product, 2020-2028 (USD Billion)

42 South Korea Engineered Stone Market, By Application, 2020-2028 (USD Billion)

43 Singapore Engineered Stone Market, By Product, 2020-2028 (USD Billion)

44 Singapore Engineered Stone Market, By Application, 2020-2028 (USD Billion)

45 Thailand Engineered Stone Market, By Product, 2020-2028 (USD Billion)

46 Thailand Engineered Stone Market, By Application, 2020-2028 (USD Billion)

47 Malaysia Engineered Stone Market, By Product, 2020-2028 (USD Billion)

48 Malaysia Engineered Stone Market, By Application, 2020-2028 (USD Billion)

49 Indonesia Engineered Stone Market, By Product, 2020-2028 (USD Billion)

50 Indonesia Engineered Stone Market, By Application, 2020-2028 (USD Billion)

51 Vietnam Engineered Stone Market, By Product, 2020-2028 (USD Billion)

52 Vietnam Engineered Stone Market, By Application, 2020-2028 (USD Billion)

53 Taiwan Engineered Stone Market, By Product, 2020-2028 (USD Billion)

54 Taiwan Engineered Stone Market, By Application, 2020-2028 (USD Billion)

55 Rest of APAC Engineered Stone Market, By Product, 2020-2028 (USD Billion)

56 Rest of APAC Engineered Stone Market, By Application, 2020-2028 (USD Billion)

57 Middle East and Africa Engineered Stone Market, By Product, 2020-2028 (USD Billion)

58 Middle East and Africa Engineered Stone Market, By Application, 2020-2028 (USD Billion)

59 Saudi Arabia Engineered Stone Market, By Product, 2020-2028 (USD Billion)

60 Saudi Arabia Engineered Stone Market, By Application, 2020-2028 (USD Billion)

61 UAE Engineered Stone Market, By Product, 2020-2028 (USD Billion)

62 UAE Engineered Stone Market, By Application, 2020-2028 (USD Billion)

63 Israel Engineered Stone Market, By Product, 2020-2028 (USD Billion)

64 Israel Engineered Stone Market, By Application, 2020-2028 (USD Billion)

65 South Africa Engineered Stone Market, By Product, 2020-2028 (USD Billion)

66 South Africa Engineered Stone Market, By Application, 2020-2028 (USD Billion)

67 Rest Of Middle East and Africa Engineered Stone Market, By Product, 2020-2028 (USD Billion)

68 Rest Of Middle East and Africa Engineered Stone Market, By Application, 2020-2028 (USD Billion)

69 Central & South America Engineered Stone Market, By Product, 2020-2028 (USD Billion)

70 Central & South America Engineered Stone Market, By Application, 2020-2028 (USD Billion)

71 Brazil Engineered Stone Market, By Product, 2020-2028 (USD Billion)

72 Brazil Engineered Stone Market, By Application, 2020-2028 (USD Billion)

73 Chile Engineered Stone Market, By Product, 2020-2028 (USD Billion)

74 Chile Engineered Stone Market, By Application, 2020-2028 (USD Billion)

75 Argentina Engineered Stone Market, By Product, 2020-2028 (USD Billion)

76 Argentina Engineered Stone Market, By Application, 2020-2028 (USD Billion)

77 Rest Of Central & South America Engineered Stone Market, By Product, 2020-2028 (USD Billion)

78 Rest Of Central & South America Engineered Stone Market, By Application, 2020-2028 (USD Billion)

79 LG Hausys: Products & Services Offering

80 Johnson Marble & Quartz: Products & Services Offering

81 Technistone A.S.: Products & Services Offering

82 A.St.A. WORLD-WIDE: Products & Services Offering

83 Caesarstone Ltd.: Products & Services Offering

84 BELENCO: Products & Services Offering

85 Quarella Group Ltd. : Products & Services Offering

86 Quartzforms: Products & Services Offering

87 Stone Italiana S.p.A.: Products & Services Offering

88 Cosentino S.A.: Products & Services Offering

89 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Engineered Stone Market Overview

2 Global Engineered Stone Market Value From 2020-2028 (USD Billion)

3 Global Engineered Stone Market Share, By Product (2022)

4 Global Engineered Stone Market Share, By Application (2022)

5 Global Engineered Stone Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Engineered Stone Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Engineered Stone Market

10 Impact Of Challenges On The Global Engineered Stone Market

11 Porter’s Five Forces Analysis

12 Global Engineered Stone Market: By Product Scope Key Takeaways

13 Global Engineered Stone Market, By Product Segment: Revenue Growth Analysis

14 Tiles Market, By Region, 2020-2028 (USD Billion)

15 Blocks & Slabs Market, By Region, 2020-2028 (USD Billion)

16 Global Engineered Stone Market: By Application Scope Key Takeaways

17 Global Engineered Stone Market, By Application Segment: Revenue Growth Analysis

18 Countertops Market, By Region, 2020-2028 (USD Billion)

19 Flooring Market, By Region, 2020-2028 (USD Billion)

20 Others Market, By Region, 2020-2028 (USD Billion)

21 Regional Segment: Revenue Growth Analysis

22 Global Engineered Stone Market: Regional Analysis

23 North America Engineered Stone Market Overview

24 North America Engineered Stone Market, By Product

25 North America Engineered Stone Market, By Application

26 North America Engineered Stone Market, By Country

27 U.S. Engineered Stone Market, By Product

28 U.S. Engineered Stone Market, By Application

29 Canada Engineered Stone Market, By Product

30 Canada Engineered Stone Market, By Application

31 Mexico Engineered Stone Market, By Product

32 Mexico Engineered Stone Market, By Application

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 LG Hausys: Company Snapshot

36 LG Hausys: SWOT Analysis

37 LG Hausys: Geographic Presence

38 Johnson Marble & Quartz: Company Snapshot

39 Johnson Marble & Quartz: SWOT Analysis

40 Johnson Marble & Quartz: Geographic Presence

41 Technistone A.S.: Company Snapshot

42 Technistone A.S.: SWOT Analysis

43 Technistone A.S.: Geographic Presence

44 A.St.A. WORLD-WIDE: Company Snapshot

45 A.St.A. WORLD-WIDE: Swot Analysis

46 A.St.A. WORLD-WIDE: Geographic Presence

47 Caesarstone Ltd.: Company Snapshot

48 Caesarstone Ltd.: SWOT Analysis

49 Caesarstone Ltd.: Geographic Presence

50 Belenco: Company Snapshot

51 Belenco: SWOT Analysis

52 Belenco: Geographic Presence

53 Quarella Group Ltd. : Company Snapshot

54 Quarella Group Ltd. : SWOT Analysis

55 Quarella Group Ltd. : Geographic Presence

56 Quartzforms: Company Snapshot

57 Quartzforms: SWOT Analysis

58 Quartzforms: Geographic Presence

59 Stone Italiana S.p.A..: Company Snapshot

60 Stone Italiana S.p.A..: SWOT Analysis

61 Stone Italiana S.p.A..: Geographic Presence

62 Cosentino S.A.: Company Snapshot

63 Cosentino S.A.: SWOT Analysis

64 Cosentino S.A.: Geographic Presence

65 Other Companies: Company Snapshot

66 Other Companies: SWOT Analysis

67 Other Companies: Geographic Presence

The Global Engineered Stone Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Engineered Stone Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS