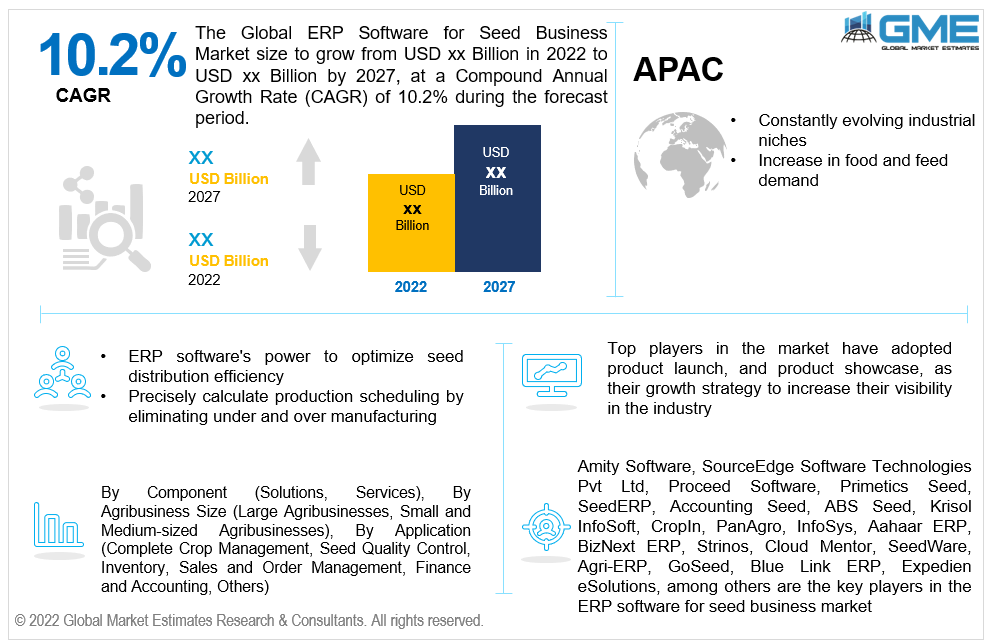

Global ERP Software for Seed Business Market Size, Trends & Analysis - Forecasts to 2027 By Component (Solutions, Services), By Agribusiness Size (Large Agribusinesses, Small and Medium-sized Agribusinesses), By Application (Complete Crop Management, Seed Quality Control, Inventory, Sales and Order Management, Finance and Accounting, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global ERP Software for Seed Business Market is projected to grow at a CAGR value of 10.2% from 2022 to 2027. Enterprise resource planning (ERP) is a relatively new technology that many businesses have adopted and it is a software package that combines all-important business operations into a unified system with a centralized database. These integrated and robust systems have the potential to be extremely strong, combining internal and external management information across an entire organization leading to market growth over the forecast period. As per Statista, the enterprise resource planning (ERP) software market is forecasted to grow to around 100.7 billion U.S. dollars by 2025 with SAP and Oracle being two of the leading vendors in the market.

The ability of ERP software to create a production budget and a step-by-step procedure each time a producer creates a seed product, ensuring inventory tracking and specifying a procedure in which the highest-quality seed products are made each time, is expected to drive demand for ERP software in the seed industry. Significant growth in corporate software solutions deployment across seed production for better strategic decision-making, stock cost reduction, profit margin enhancement, and enabling organizations to optimize their market dominance are also expected to drive market growth over the forecast period.

Market demand is also reefing due to ERP software's power to ensure continuous availability and optimize seed distribution efficiency, as well as precisely calculate production scheduling by eliminating under and over manufacturing. Additionally, ERP software offers comprehensive quality control and visibility into manufacturing costs, as well as improved inventory efficiency and preventing write-offs, all of which will considerably influence market expansion during the forecast period.

Seed demand has been steadily expanding in nations like China and India, which have the world's largest populations. An ever-increasing need for food grains also promotes the growth of the ERP software market. According to a study conducted by Research Gate, the entire value of purchased seeds (about 48.5 billion USD) equals nearly 1% of the overall value of acquired or self-produced food globally (approximately 5000 to 6000 billion USD). Furthermore, benefits such as the increased capacity to deliver new information system functionality, improved productivity and competitiveness, increased interaction between organizations with suppliers and customers in a long-term plan, and enhanced customer versatility by strapping customers to ERP systems are some of the variables influencing the market growth.

The impact of the COVID-19 pandemic on the market is predicted to be favourable. The normalization of the work-from-home paradigm has prompted front office personnel to remotely access ERP systems using an innovative cloud platform and operate the business dynamically, per an NTT Ltd. analysis conducted by International Data Group, Inc. (IDG). With manufacturers being forced to shut down and production capabilities being limited, ERP systems have aided in re-planning, rescheduling, and shifting stock-flow remotely.

ERP software implementations, despite their high prices and extended timelines, do not meet expectations, according to research findings. This is due to a lack of knowledge on how to deal with crucial issues during installations, which can result in project cancellation, major cost overruns, and catastrophe. International corporations, on the other hand, have the potential to boost ERP adoption success.

Based on the component, the ERP software for seed business market is segmented into solutions, and services. The solutions segment is expected to hold the largest piece of the market during the forecast period. The increased usage of software to handle all parts of a business, such as financial planning, human capital, supply chain, and making it simpler and effective for enterprises to gather data, is largely responsible for the segment's growth.

Furthermore, the widespread adoption of big data technologies, as well as the ever-changing customer-centric industry, are likely to generate massive opportunities for important players to invest in ERP software.

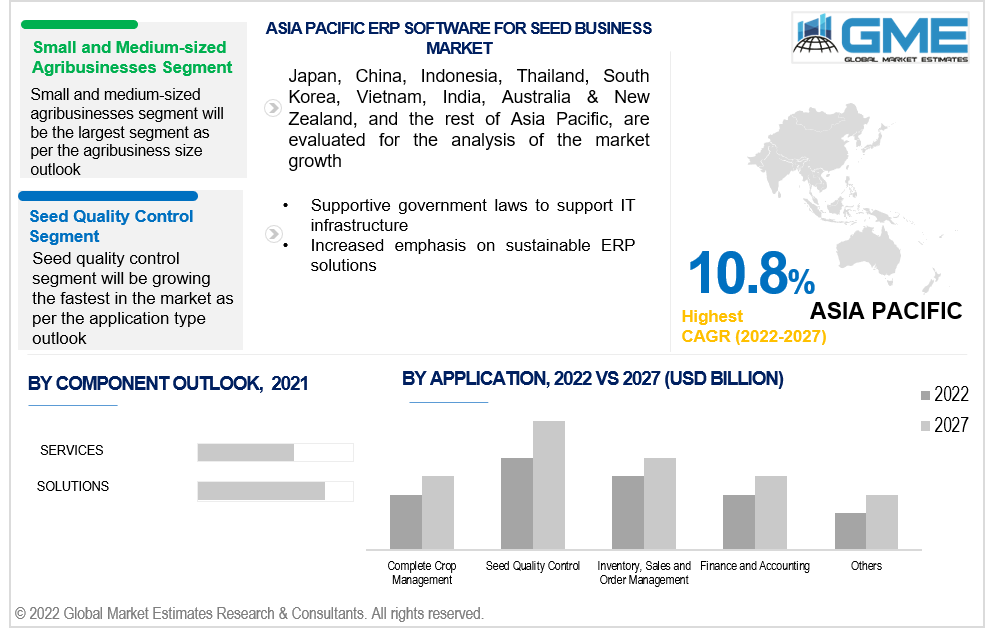

Based on the agribusiness size in ERP software for seed business, the market is segmented into large agribusinesses, small and medium-sized agribusinesses. The small and medium-sized agribusinesses segment held the lion’s share of the market. Small and medium-sized agribusinesses tend to adopt technological innovations faster owing to their greater revenue and spending powers. Other factors for the high tendency of technologies include better return on investment (ROI), versatility in the interconnection of software tools in hardware equipment, and a great investment in the cost of labor with the use of automated systems.

Based on the agribusiness application in ERP software for seed business, the market is segmented into complete crop management, seed quality control, inventory, sales and order management, finance and accounting, and others. The seed quality control segment is expected to grow the fastest in the ERP software for seed business market from 2022 to 2027. ERP software assures the quality of the seeds required by the client and that enough of them are produced, as well as recording and monitoring the seed's genetic potential for a wide range of yield and genetic capabilities. This system also monitors the quality of seed being delivered to distributors and provides an input timetable and schedule, all of which aids to the segment's growth.

As per the geographical analysis, the ERP software for seed business market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the ERP software for seed business market from 2022 to 2027. The region’s strong licensing laws, greater spending on research and development on innovative technologies, growing regional manufacturing industry, and rising technological advancements have resulted in the dominance of this region. As per the European Commission, in 2019, 30% of small businesses and 80% of large businesses implemented enterprise resource planning tools.

The APAC region is expected to showcase the fastest growth rate among all regions. The region's constantly evolving industrial niches, as well as an increase in food and feed demand, as well as government laws to support IT infrastructure and increased emphasis on sustainable ERP solutions, are all pushing their growth.

Amity Software, SourceEdge Software Technologies Pvt Ltd, Proceed Software, Primetics Seed, SeedERP, Accounting Seed, ABS Seed, Krisol InfoSoft, CropIn, PanAgro, InfoSys, Aahaar ERP, BizNext ERP, Strinos, Cloud Mentor, SeedWare, Agri-ERP, GoSeed, Blue Link ERP, Expedien eSolutions, among others are the key players in the ERP software for seed business market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Components

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 ERP Software for Seed Business Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Agribusiness Size Overview

2.1.3 Component Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 ERP Software for Seed Business Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 ERP software's power to ensure continuous availability and optimize seed distribution efficiency

3.3.2 Component Challenges

3.3.2.1 Lack of knowledge on how to deal with crucial issues during installations

3.4 Prospective Growth Scenario

3.4.1 Agribusiness Size Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Component Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 ERP Software for Seed Business Market, By Component

4.1 Component Outlook

4.2 Solutions

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Services

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 ERP Software for Seed Business Market, By Application

5.1 Application Outlook

5.2 Complete Crop Management

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Seed Quality Control

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Inventory

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Sales and Order Management

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Finance and Accounting

5.9.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 ERP Software for Seed Business Market, By Agribusiness Size

6.1 Large Agribusinesses

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Small and Medium-sized Agribusinesses

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Nuclear Imaging Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.2.3 Market Size, By Application, 2022-2027 (USD Billion)

7.2.4 Market Size, By Component, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By Application, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Component, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3.4 Market Size, By Component, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By Application, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Component, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By Application, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Component, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By Application, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Component, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By Application, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Component, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.4.3 Market Size, By Application, 2022-2027 (USD Billion)

7.4.4 Market Size, By Component, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By Application, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Component, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.4.9.2 Market size, By Application, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Component, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By Application, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Component, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.5.3 Market Size, By Application, 2022-2027 (USD Billion)

7.5.4 Market Size, By Component, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By Application, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Component, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.6.3 Market Size, By Application, 2022-2027 (USD Billion)

7.6.4 Market Size, By Component, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By Application, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Component, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Component, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Agribusiness Size, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Application, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Component, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2022

8.2 Amity Software

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 SourceEdge Software Technologies Pvt Ltd

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Proceed Software

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Primetics Seed

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 SeedERP

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Accounting Seed

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 ABS Seed

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Krisol InfoSoft

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 CropIn

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global ERP Software for Seed Business Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the ERP Software for Seed Business Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS